Assessing the Impact of Economic and Environmental Factors on Educational Outcomes in Some Selected African Societies

Quantitative Analysis of Disaster Impact on Hotel Recovery: A Case Study of the Nilgiris

Adopting Digital Transformation: An Empirical Study on How Digital Transformation Shapes Organizational Success

Performance Management Systems and Faculty Effectiveness in Indian Higher Education: A Structural Equation Modeling Approach

Financial Innovations in Indian Banking Industry: An Evaluation of Innovativeness and Financial Performance of Selected Banks

Notions of Ethics in Technology and Design Education

Efficiency Analysis of Commercial Banks in India: An Application of Data Envelopment Analysis

A Study on Factors Influencing Youngsters’ Perceptions towards Choice of Investment Avenues

A Study of Generic Intertextuality in Corporate Press Releases

A Study on Factors Affecting Purchase Decision of Young Adults after GST Implementation in India – With Special Reference to FMCG Products

Soft Systems Modelling of the New Product Development Process - A Case Study

An Emerging Training Model for Successful Lean Manufacturing – An Empirical Study

A Qualitative Performance Measurement Approach to New Product Development

Brand Power Through Effective Design

Intellectual Venture Capitalists: An Emerging Breed of Knowledge Entrepreneurs

Because an organization's visibility and decision-making abilities in a supply network is limited by its embeddedness, managing the embedded activities may be affected by non-contractual forms of governance and capability. Whatever the organization cannot see, it can't efficiently control. In this paper, the authors have studied non-contractual governance, dependence, and reliance in a manufacturer-vendor dyad in light of logistics, spill-over customer-centric service, and performance. Relational norms (information sharing and flexibility), trust, commitment, and bilateral dependence were hypothesized to explain manufacturers' logistics capability and customer-centric services. Using SEM-PLS (Structural Equation Modeling using Partial Least Squares) approach, all the hypothesized paths were proven with adequate R2 explained for each construct; R2 for financial performance was low.

In today's rapidly changing world, managing a local government or municipality has become extremely challenging. Municipalities are competing with local organizations to recruit the best talent and face many of the same issues, particularly managing and leading a diverse workforce. This study involved two very important aspects in the field of organizational behavior: leadership styles and organizational commitment. The main purpose of this study was to describe the employees' perception of the Mayor's leadership style, identify the employees' demographic profile (age, gender, race, education, and length of service), and determine its impact on the employees' level of organizational commitment within their municipal department. This study examined the relationship between the independent variables (leadership style and demographic profile) and the dependent variable (organizational commitment).

In this paper, the authors have conceptualized that effective financial system regulations and efficient financial intermediation will increase financial deepening thereby leading to real GDP growth. This paper examines the effect of financial intermediation and government regulations on financial deepening and growth in Nigeria using time series data and OLS (Ordinary Least Squares) regression methodology. In particular, macroeconomic data covering 24 years were used to conduct these investigations and analysis. Their findings showed that government bank regulations proxied by total balances with the central bank lead financial deepening in Nigeria. It is then followed by another surrogate of a financial intermediation variable (i.e. total demand deposit liabilities) as 2nd ; cash reserve ratio representing another surrogate of a regulatory variable ranked 3rd , while total bank credit to domestic economy that represents another surrogate of financial intermediation ranked 4th in their descending order of magnitude. The negative influence of cash reserve ratio and total bank credit on financial deepening and growth were also found. It is therefore recommended that monetary authorities should step up their bank regulation efforts so as to persuade Nigerian banks to efficiently perform their financial intermediation roles in order to positively engender adequate financial deepening in the financial system that will lead to desired real GDP growth.

Jel Classification: G21, G28, 016, E41, E43, E44, F31.

Hospitality industry is a vibrant and dynamic industry which has already been started using E-Learning as a training tool. In spite of being one of the most important industries in India, research in the usage of E-Learning in hospitality industry is extremely limited in India. This study seeks to partially fill this gap in through the review, by investigating the demand, effectiveness and evaluation of E- Learning in the corporate training process in the hospitality industry. The data are collected from both employees and managers in the four and five star corporate group hotels in Tamil Nadu, India .This study shows that demand and effective training through E-Learning is one of the robust technologies which will definitely enhance the quality in a faster pace of learning and training the employees in the hospitality sector. This study also reveals that, E-learning was provided by the hotels, by evaluating the training programs, identifies that the training content can be modified and organized in a proper planning for a successful outcome of the future training. The outcome of the results indicated that, some of the hotels were ready to accept by conducting a survey feedback, doing cost benefit analysis, and customer feedback. Few properties and managers mentioned that they didn't have much time to conduct a thorough evaluation process. This transformation will bring mobility of the corporate managers to be positioned in a centralized location to facilitate and incorporate the best training practices that the hospitality industry is lacking in the proposed region of the study.

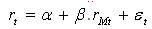

At the heart of the Capital Asset Pricing Model (CAPM) lies the concept of systematic risk. The systematic risk of a security is that component of the total risk of the security that is explained by market risk. This is captured through the regression of security returns rt on market returns rMt , viz

The regression coefficient β(r) measures the sensitivity of returns of the security to changes in market returns.

From an econometric perspective, two concepts become relevant in this context. Firstly, in order for the above regression to be meaningful, the time series {rt} and {rMt} should be stationary. In particular, the presence of a unit root would undermine the significance of β(r), and therefore threaten the entire basis of the CAPM. Secondly, there should be some form of causality from changes in market returns to changes in security returns. In particular, Granger causality from market returns to security returns must hold.

It is in this context that stationarity and Granger causality should be examined for the security line, as represented by the above regression. As Soufian (2001) has pointed out, in order for the regression analyses used for CAPM and APT (Arbitrage Pricing Theory) tests to be meaningful, it is essential to identify the processes that generate the series. In particular, Granger causality may offer an approach to determining the macroeconomic variables that influence asset returns in general.