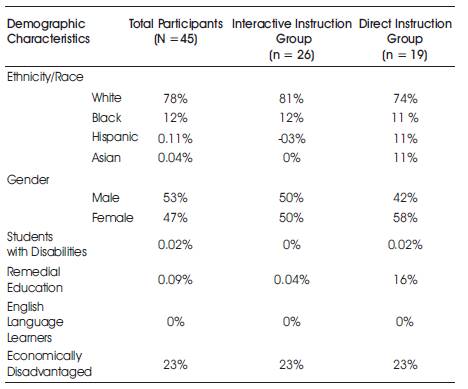

Table 1. Demographic Characteristics of All Participants of Interactive Instruction Group and Direct Instruction Group

The purpose of the current research study was to compare the use of interactive instruction to direct instruction on the acquisition of personal finance skills for high school students. Participants were 45 high school seniors who were divided into a Traditional and an Interactive Instruction group. The 9-week research study measured the impact that interactive instruction had on students' achievement in acquiring personal finance skills, students' attitudes toward personal finance instruction, and student's engagement in learning personal finance skills. The data collection instruments included a pre-test and post-test, a Likert-scaled attitude survey, an engagement checklist, and field notes detailing qualitative observations of students' behaviors. Results indicated no significant statistical difference on achievement test scores between the groups, but a medium effect for practical significance. Students' attitudes toward instruction changed as a result of the type of instruction they received and students' engagement was statistically higher for the interactive instruction group.

With the recent collapse of the housing market and record levels of inflation and unemployment, now more than ever, the importance of understanding economics and having financial literacy are essential for individuals to function in society. Individuals will be called upon to understand and participate in increasingly difficult levels of economic activity with little to no schooling or training in the subject matter. Principles of personal finance are not always taught in any detail, making it difficult for individuals to make sound decisions. It is important for individuals to learn the necessary financial skills now to better equip them to make smart financial decisions in the future.

Individuals must make economic decisions every day of their lives. A sound understanding of economics principles is critical and necessary. Mandell (2009) found the understanding of personal finance of great importance for all people. Finkelstein, Hanson, Huang, Hirschman, and Huang (2011) found programs that educate individuals in economics are primarily focused on seniors in high school. Finkelstein et al. (2011) found economic education programs are centered on the acquisition of micro and macroeconomics using state adopted guidelines, with little to no emphasis on consumer economics. Walstad (2001) found implementation of the economic curriculum is left up to individual teachers and their school districts leading to great variation from program to program. Teachers bear the responsibility to meet the requirements of content standards for the state and still provide meaningful education on the basic knowledge required for individuals to function as responsible members of society. McCormick (2009) stressed that educating individuals in consumer economics is a priority, that must occur on a large scale, and begin with the youth so that they are prepared to deal with the many economic situations that will occur, as they become adults.

On a National Level, Economic Education has been pushed into the forefront of attention due in large part to several active organizations. As reported by Finkelstein et al. (2011), the National Council of Economic Education stressed the importance of economic, education in a survey indicating that 48 out of the 50 states have curriculum standards for economics, while 22 states have mandatory economics courses required for graduation. Further, 23 of the 48 states have required state standardized testing in economics. The federal government has recognized the need for economic education for our nation's citizenry. A report by the Government Accounting Office (GAO) in 2011, stressed the importance of financial literacy for the well-being and security of families and the U.S. economy. The GAO report (2011) indicated that, surveys of individuals showed that, most did not have a grasp of basic economic concepts such as budgeting. In a Presidential Press Release, (The White House, 2011), President Barack Obama declared April 2011 as National Financial Literacy Month, urging Americans to find ways to improve their understanding of finances and the economy.

The Georgia Department of Education (GaDOE), (2014) requires students to take an economics course and pass a state standardized test for graduation. The End-of-Course Test (EOCT) in Economics is used as a benchmark to determine acquisition of the curriculum content. Personal finance knowledge is a portion of the EOCT in economics that students traditionally score lower on than other content sections. According to the GaDOE (2014), the most recent statistics indicate that, 78% of the students tested met or exceeded the standard for EOCT in economics on the winter 2013 administration of the exam. The GaDOE (2014) report indicated that, English Learner (EL) students improved achievement in Economics by one percentage point, and Students with Disabilities (SWD) improved achievement in Economics by two percentage points. The GaDOE (2014) report further indicated that, the achievement gap between Black and White students for meeting or exceeding on the EOCT in Economics has continued to narrow to a 21% point gap and for Hispanic and White students to a 16% point gap. The results showed a marked improvement in scores on the EOCT in Economics in the state among subgroups, but equitable achievement had not been attained.

In order to address the gaps in achievement and promote success for all students, the School Improvement Plan (SIP, 2014) proposed measurable goals and preferred outcomes for all groups. The School Improvement Plan disaggregated the data into subgroups and set percentage gains for meeting or exceeding standards on the EOCT in all subject matters. For the school as a whole, the School Improvement Plan set a yearly goal under the provision of the Post High School and Readiness (PHSR) and Graduation Rate to increase the percentages of students who exceed standards on the EOCT. Using research based strategies, the school established initiatives to increase content mastery. The School Improvement Plan outlined initiatives which included reviews for EOCTs, use of technology and software containing practice tests, information sharing sources, Bring Your Own Technology (BYOT), remediation programs, and reviews of best teaching practices and training for teachers.

There has been emphasis on a national, as well as a state level on educating students on the importance of economics and financial literacy. Mandell (2009) found that, school based financial education programs have a long-term beneficial impact on students, that carried over into adulthood. The data from the state, as measured by the EOCT, indicated improvements in educating students in economic literacy, but there is still a great deal of progress to be made. The School Improvement Plan (2014) outlined the need for increasing levels of students passing the EOCT test with a meets or exceeds. Given the importance and emphasis of mastery of content knowledge and improvement in scores on EOCTs, teacher methodology used in the classroom deserves a further examination to ensure best practices are being utilized. Specifically, understanding what methods work best for greater student understanding of the content is critical for student success. The teacher-researcher investigated the effects of teacher methodology on improving student understanding and academic achievement of financial literacy.

Personal finance skills are important and necessary for participation in a global economy. Robb and Woodyard (2011) explained that, there is a general lack of financial knowledge among United States citizens of all ages, and also suggested that the common answer to lack the publics' financial knowledge is Education. There is supporting evidence to suggest that, financial education is effective in individual's developing financial literacy, however, there is not clear consensus on the age at which financial education should begin. School age students often do not acquire those skills early enough in life to make sound financial decisions. McCormick's (2009) literature review examined studies conducted over a 4-year period and found that most programs that, educated youth on personal financial skills relied on strategies used to educate adults. McCormick reasoned that, in order for youth to acquire the necessary personal finance skills to make sound financial decisions, programs needed to be centered on education of youth and be more comprehensive in scope, incorporating more diverse expertise from the field. McCormick advocated education in personal finance begin earlier in a students' schooling as some students would face economic decision sooner than others. Mandell (2009) found that, a sound understanding of personal finance principles was critical for individuals to participate effectively in the society. Mandell indicated that, school-based financial education programs have a long-term beneficial impact on students that carried over into adulthood. Students benefit from exposure to financial literacy information, even though the positive effect may be latent, manifesting itself later in an individual's life.

Students often do not have the necessary financial skills that are required to function effectively in society. The problem for students is multifaceted with evidence to suggest that, students do not understand the basic personal finance skills that are required of them once they graduate. Studies that examined the phenomenon of lack of personal finance skills among youth demonstrated mixed results with many variables accounting for students' lack of financial literacy. Mandell (2009) found that, financial literacy did not provide benefits to students in the short run, but in the long term provided benefits to students through the emotional appeals of investing and saving. Upon graduation, students may not have the opportunity immediately to exhibit the skills that they learned and therefore may not demonstrate knowledge of personal finance. A later study by Mandell and Klein (2009) indicated that, the data between personal finance skills and subsequent financial behavior was inconsistent, with personal finance knowledge not always translating to responsible personal financial behavior. Students displayed behaviors, that were inconsistent with the personal finance information that they have received in their coursework.

In examining the California Mandate, a measure that requires students to take a one semester course in economics and pass a state standardized test for graduation, Gill and Gratton-Lavoie (2011) found that, students did not retain all the information that they had learned in economics class, but loss of information was small, especially for those students who were in Honors/AP economics courses. Students who remembered the material were able to demonstrate knowledge of the material yet this was essentially true for the students in higher-level classes, while on-level students did not display the same amount of retention of information.

In United states, where there is an economics' mandate, students in on-level classes, Students with Disabilities (SWD), and English Language Learners (ELL) are at a greater disadvantage. Typically, SWD and ELL students struggle with content areas in economics; particularly, the area of personal finance. The state data, reported by the Georgia Department of Education (GaDOE 2014), pointed to a need to increase scores on standardized tests such as the End of Course Test (EOCT) in economics to help narrow the gap that exists between ELL students, SWD students, Black students, and Hispanic students, and their White student counterparts.

Students face additional challenges in developing personal finance literacy skills. Schuchardt et al. (2009) pointed to the effects of socialization on financial literacy skills in youth. Parents, family, and peers were very influential in a youth's ideas about personal finance.

Students relied, to a greater degree, on others for information concerning personal finance. Students did not always have the appropriate background information through which they could filter the advice. Miller, Hite, Slocombe, and Railsback (2010) found that, students reported their own independent thought as their guiding influence in financial matters and their teacher's and radio programs as having the least influence in their personal finance matters. Students looked to other sources, often reflecting on their own thoughts and knowledge, to gain understanding of personal finance skills creating problems for students with inaccurate or biased information.

According to Finkelstein et al. (2011) as many as 23 states have state mandated economics courses with state standardized testing in economics as a requirement for graduation. Students in one of the 23 states with mandated economics courses must take a minimum one semester course in economics focusing on the major content areas of microeconomics and macroeconomics, with personal finance as a smaller less significant portion of the course. Time constraints in a one-semester course pose problems for teachers and students due to the need to complete all the material in time for the state exams. Students are taught the major content areas of micro and macroeconomics and personal finance is left to the teacher's discretion. The pace of instruction does not allow great flexibility in ensuring that, students are acquiring the necessary economic background they need, especially in the area of personal finance. Students struggle with the overall concept of economics and further with personal finance skills. The deficiency in skills is more pronounced in SWD, ELL, Black, and Hispanic students. Often, the pace of instruction is detrimental to students' learning, yet all students are tested at the end of the one-semester class.

Teachers face many problems in educating students in personal finance skills. Finkelstein et al. (2011) found most high school programs centered on micro and macroeconomics as indicated in the state adopted guidelines. Finkelstein et al. noted that, in the 23 states that require state standardized testing for graduation, teachers are left with the responsibility of dividing their time between the two major domain foci of micro and macroeconomics and fit the lesser domain of personal finance in the course as time permit. Many students were receiving little or insufficient education in personal finance skills, although they were required to know the skills on state standardized tests. In a foundational study, Walstad (2001) noted that, the issue is further complicated by the fact that curriculum standards vary from state to state, and teachers, working with their school districts, are responsible for implementing the curriculum in their own classrooms.

Individual states also vary in teacher education requirements needed to teach a high school level economics courses. There is also a confusion as to where personal finance classes should be placed in the curriculum. Many schools offered personal finance courses as part of the math curriculum while others placed the material within the business education curriculum. Offering the course outside of the economics' classroom placed an extra burden on the economics' teacher, as personal finance is part of the state standardized tests in economics.

Hahn and Jang (2010) found that, teachers were not necessarily formally trained in economics and that classroom instruction was often lecture driven and centered on the textbook. Textbook centered instruction was the preferred method of instruction by most teachers to educated students in economic principles. Few teacher education programs focused on different methodologies to teach economics other than lecture and paper and-pencil-driven instruction.

The research that exists concerning personal finance education pointed to a strong relationship to teacher training and effective use of strategies in the classroom. McCormick (2009) stressed the importance of focus on teacher training to ensure that, teachers are well versed in personal finance education. Haynes and Chinadle (2011, as cited in McCormick, 2009) emphasized the need for active learning and a multimodal model that addressed different levels of intelligence to help educators effectively in teaching personal finance. Miller, Hite, Slocombe and Railsback (2010) suggested that, further research was needed to understand the teaching strategies and content of material that has the most beneficial impact for learning financial skills. Mandell and Klein (2009) suggested the need to conduct research to determine teaching methods that help students understand the impact of financial decisions and information that would improve their financial skills.

Swinton, De Berry, Scafidi, and Woodard (2010) provided evidence that, when teachers improved their teaching skills and varied their instruction in the classroom in economics, student achievement is improved. Swinton et al. found that, teachers who attended an economics in-service workshop had a positive impact on their students' achievement. Teachers improved teaching methods had a positive effect on students' scores on the economics End of Course Test (EOCT). Swinton et al. further reported that, the workshops provided a cost-effective way to increase teacher content knowledge in economics. Pang (2010) compared the teacher instructional methodology used in the classroom to help improve students' financial literacy skills, and found that, variation theory was a significantly useful tool to help students improve their financial literacy skills. Pang further suggested that, for teachers to help students gain a greater understanding of financial literacy, it was important to help them develop a good grasp of the understanding of core economics principles, thereby providing students with the means to think conceptually about important financial decisions.

Finkelstein et al. (2011) studied the effects of problem based instruction and its impact on teacher preparation and understanding of curriculum content and subsequent student learning of high school economics. Finkelstein et al. found students in the teacher intervention groups that had received training in problem based instruction, outscored the students in the control group on average 2.6 test items. Students in the teacher intervention group indicated a greater degree of knowledge of problem solving skills and application of economic principles to real world problems. Teachers in the intervention groups reported greater satisfaction with curriculum materials employed in the classroom.

Mandell and Klein (2009) suggested that economic education also had a positive effect on students' attitudes about personal finance skills. On a national level, students indicated that, they recognize the importance of economic education. According to the U.S. Department of Education's National Center for Education Statistics and Educational Testing (2013) in the 2012 Nation's Report Card concerning economics, more than two-thirds of 12th grade students indicated that, economics-related courses help them understand three of the four topic domains: U.S. economy, news and current events, and how to manage personal finances. Further, two-thirds or more of students reported using various sources to gain information about economics, with the Internet and family and friends indicated as the most influential. The National Center for the Education Statistics and Educational Testing (NCEST, 2013) report indicated that, the data showed a race/ethnicity difference in students' attitudes toward economics course affecting their understanding of economic principles. The report indicated higher percentages of Black and Hispanic students than White and Asian students agreed that, economics courses helped them understand personal finance. The NCEST report noted that, students reported greater understanding of economic principles through economic course work in high school.

Little existing research has focused directly on teacher methodology used in the classroom to educate high school students concerning personal finance skills, although several researchers pointed to the need for teachers to examine their classroom practices. Previous research by Pang (2010) suggested that, examining teacher methodology and practice in the classroom was important. Walstad and Salemi (2011) found that, college faculty, who were trained in and employed interactive, multimodal teaching techniques in the classroom, reported improved student achievement and improved teaching methods. It is important to understand how these same teaching methods can be applied to younger students. Teachers, who are responsible for teaching students economics, need information on the best practices that can be used in the classroom to help students learn the material. Miller, Hite, Slocombe and Railsback (2010) suggested the use of more interactive types of lessons rather than traditional lecture as a way to help students engage in learning personal finance skills.

Miller and Watts (2011) pointed to instruction using new and novel ways to introduce economic concepts and personal finance in the classroom as a means to get students interested in and thinking about economics. Miller and Watts suggested the use of Dr. Seuss books in Economic Classes as a Way to Introduce Economic Concepts Make Them More Attainable for Students. The use of sources other than the textbook suggested that, students could gain economic knowledge from places that they did not anticipate or expect. Carlin and Robinson (2012) studied the effects of economic education on subsequent student financial behavior through student participation in a handson finance theme park, and found that, students who had received personal finance education were more likely to make sound financial decisions and demonstrate ability to use the information in preparing a budget and buying a car. Students who were taught personal finance skills and given hands-on tasks to complete demonstrated an ability to transfer the knowledge to real life situations.

Relevant studies on the impact of financial literacy education on students' financial decisions indicated a paradox. Mandell and Klein (2009) found that, personal finance training did not always lead to responsible financial behaviors. Students who had taken a high school economics class did not always indicate that they engaged in sound financial decision-making. Students often pointed to other factors that influenced their decisions with little regard to coursework. Mandell (2009) concluded that, previous studies did not find that high school economics classes in personal finance were beneficial for financial literacy, at least in the short term. Students seemed to benefit later in life from coursework, when they had encountered emotional appeals for saving and investing, and demonstrated a latency effect in the learning of personal finance skills, but only when they encountered situations that appealed to their emotions.

Mandell and Klein (2009) found that, earlier studies concerning acquisition of personal finance skills centered on what skills students know and do not know, through selfreporting, with little examination of how they acquired the skills or their attitude toward the way they learned the skills. The exception was the Gill and Gratton-Lavoie (2011) study of the California State Mandate. Here, Gill and Gratton- Lavoie studied the effect, the California state-mandated economics classes had on economic literacy and the extent of student retention of the material using the Test of Economic Literacy (TEL). Gill and Gratton-Lavoie reported that, students did not retain all of the information learned in high school economics courses, yet the information loss was small and less pronounced for higher-level students, Gill and Gratton-Lavoie also noted that, the difference in effect for students who had taken a state-mandated economics course and students who had not taken a state-mandated economics course, were negated after the first year of college. Students who had not been required to take the state-mandated course were able to make gains on students who had taken the course.

In order to determine why there is such a paradox in students learning of personal finance skills and students financial behavior, other factors need to be examined. As noted by Miller and Watts (2011), a little research has been focused on the most effective classroom strategies for teaching personal finance skills. Miller and Watts stressed the need for examination of teaching methods and practices and provisions for more interactive lessons rather than traditional lectures. Mandell and Klein (2009) stressed the importance of teaching practices in effective learning of personal finance skills. There is a need to focus on classroom instruction and the types of methods being used to determine the best way to help students grasp personal finance skills so they can make sound financial decisions in the future.

The purpose of the current research study was to compare the use of interactive instruction to direct instruction on the acquisition of personal finance skills for high school students. The current research study measured the impact that interactive instruction had on students' achievement in acquiring personal finance skills, students' attitudes toward instruction in personal finance skills, and student's engagement in learning personal finance skills. The existing literature indicated the necessity for teachers to examine current classroom practices to determine effectiveness of classroom methodology for student acquisition of personal finance skills. The findings of the current research study may be used to help teachers make decisions on how to effectively teach personal finance skills to students. The current research study outcomes may benefit schools where economics is a required course for graduation to prepare students for graduation requirements and standardized tests. The current research study outcomes may also benefit teachers who must help students learn personal finance skills and prepare students for state-mandated tests and real life experiences. Students may also benefit from gaining the information and skills to pass the course, state-mandated tests, and understand how to make sound financial decisions.

Research Question 1: Will achievement scores be different for 12th-grade students who participate in interactive instruction in personal finance skills when compared to 12th-grade students who do not participate in interactive instruction in personal finance skills?

Research Question 2: Will attitudes toward personal finance skills and instruction be different for 12th-grade students who participate in interactive instruction when compared to 12th-grade students who do not participate in interactive instruction in personal finance skills?

Research Question 3: Will engagement in lessons about personal finance skills be different for 12th-grade students who participate in interactive instruction when compared to 12th-grade students who do not participate in interactive instruction in personal finance skills?

Interactive Instruction: Interactive instruction is instruction that utilizes multimodal methods to deliver curriculum content. In the current research study, interactive instruction included hands-on activities, games, group activities, and computer-based instruction in personal finance skills.

Personal Finance Skills Achievement: Personal finance skills achievement refers to acquisition of personal finance skills. For the current research study, student achievement was defined by gains in personal finance skills as measured on pre-test and post-test scores on a personal finance exam. A pretest was administered prior to the intervention to assess initial personal finance knowledge and a post-test was administered at the conclusion of the intervention to assess personal finance knowledge acquisition.

Attitude Toward Personal Finance: Attitudes are the feelings and opinions that students have about a subject. In the current research study, attitudes refer to students' opinions about their personal finance skills, and the type of instruction students received in the classroom. Students' attitudes toward personal finance skills and the type of instruction they preferred was assessed prior to intervention and post intervention, using a Likert scale survey.

Engagement with Personal Finance: Engagement is referred to as the relevant in-class behaviors, that students demonstrate during classroom instruction. Students' engagement was measured using an engagement checklist to record on task behaviors during class instructional time. The engagement checklist was used during classroom instruction during the current research study.

The current research study was conducted in a rural county in west Georgia with an estimated 2013 county population of 133,180 residents. The U.S. Census Bureau (2013) reported that, the median household income in the years from 2008-2012 was $60,675 above the state median household average of $49,604. The poverty rates for the county was reported as 11%, and 23% of the county residents are considered economically disadvantaged. The U.S. Census Bureau cited that, 87% of the county residents 25 years or older reported having a high school diploma, whereas 26% of individuals who were 25 years or older reported having a bachelor's degree.

The current research study was conducted in a high school setting. The high school was 1 of 3 high schools in the county and served students in grades 9 through 12. According to the 2014 Governor's Office of Student Achievement (GOSA) report, the student body consisted of approximately 1777 students in the 2013-2014 school year encompassing all grades. The GOSA report cited the student demographics consisted of 77% White, 13% Black, 5% Hispanic, 3% Multi-racial, 2% Asian, and .06% Native American. The student population's gender make-up was 52% male and 48% female. The GOSA (2013) report indicated that, 10% of the students were Students with Disabilities (SWD), 8% of students were Remedial Education (RE), 0.2% students were English Language Learners (ELL), and 23% of the students were eligible for free or reduced price lunch.

The current research study participants numbered 45 and were enrolled in a senior level high school economics course. Students were assigned to classes through scheduling done by the guidance department prior to beginning of the school year and thus provided the teacher-researcher with a convenience sample for the current research study. Of the participants in the current research study, 0.09% were remedial education students, 0.02% were students with disabilities, and 23% were economically disadvantaged and qualified for free and reduced lunch. The gender make-up of the participants was 47% male and 53% female and reflected the gender composition of the overall school population.

In the current research study, 19 students were assigned to the Direct Instruction Group by the teacher-researcher. The student participants in the Direct Instruction Group consisted of 8 males and 11 females. One student in the Direct Instruction Group was classified as a student with disabilities, and three students were classified as remedial education students. The Direct Instruction Group received traditional instruction in personal finance skills.

In the current research study, 26 students were assigned to Interactive Instruction Group by the teacher-researcher. Of the student participants, 13 were male and 13 were female, and one student was classified as a remedial education student. The Interactive Instruction Group received multimodal instruction in personal finance skills. Table 1 displays the demographic characteristics of all study participants, and participants in the Interactive Instruction Group and Direct Instruction Group.

Table 1. Demographic Characteristics of All Participants of Interactive Instruction Group and Direct Instruction Group

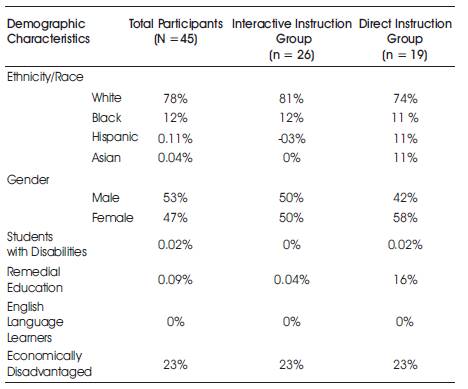

Student participants in the current research study were required to enroll in a one-semester economics class and a state-mandated End of Course Test (EOCT) as part of the graduation requirement. The course consisted of the major domain foci of micro and macroeconomics and the lesser domain of personal finance. All students participated in the lessons on the major domain foci and personal finance, while lessons on personal finance were changed for the Interactive Instruction Group as compared to the Direct Instruction Group. At the end of the semester, student participants were administered the EOCT which was scored at the county level. The EOCT counted for 20% of the students overall grade in the course. Table 2 shows the pass rate in percentages for students who scored “Meets or Exceeds” on the EOCT in economics for the Interactive Instruction Group, Direct Instruction Group, and the state of Georgia by demographic groups in 2013.

Table 2 Demographics for Interactive Instruction Group and Direct Instruction Group

The teacher-researcher was an economics teacher for 9 years at the high school level and a veteran teacher with 30 years experience at various levels of education. The teacher-researcher had been an instructor at the community college level prior to receiving a broad-field social studies certificate and entering the public school system. The teacher-researcher implemented all aspects of the curriculum and taught all lessons on the three economics subject domains.

During the 9 week period in which the current research study was implemented, all student participants in the Interactive Instruction Group and the Direct Instruction Group, engaged in economic instruction in micro - and macroeconomics for a 45 to 90 minute period, 5 days a week. All curriculum content materials were planned using the Common Core Georgia Performance Standards for Economics. The instruction in micro - and macro economics included lecture instruction, textbook-led reading and activities, and question and answer sessions. During the current research period, all student participants in the Interactive Instruction Group and the Direct Instruction Group engaged in personal finance instruction for 30 to 45 minutes, three days per week. The personal finance instruction includes lecture instruction, textbook-led reading and activities, and question and answer sessions. All lessons and activities were conducted by the teacher researcher and all students spent the same amount of time on task related activities. Lesson arrangement and pacing was planned according to the organization and importance of micro-and macroeconomics, and personal finance as indicated on the EOCT in economics. The difference in instruction between the Interactive Instruction Group and the Direct Instruction Group was the teacher methodology employed to teach personal finance skills. The Direct Instruction Group was given a pretest prior to the intervention to assess their knowledge of personal finance skills. Students in the Direct Instruction Group were informed that they would also receive a posttest following instruction in personal finance skills to determine how much they had learned over the course of 9 weeks. The Direct Instruction Group was taught personal finance skills using traditional methods used to teach students of economics. Traditional instruction includes lecture and note-taking, textbook book driven assignments and worksheets, followed by a large group discussion and question and answer session. Students in the Direct Instruction Group were given 15 minutes of lecture focused on the subject matter followed by 30 minutes of worksheet activity and discussion session. Post lesson, the teacher researcher encouraged the Direct Instruction Group to ask questions relevant to the lesson. The teacher-researcher provided further information on personal finance skills and resources for students to find the relevant information for self-study. The Interactive Instruction Group was given a pretest prior to the intervention to assess their knowledge of the personal finance skills. The Interactive Instruction Group was informed that, they would be given a post-test in personal finance skills at the end of the unit to determine how much they had learned over the course of the 9 weeks. The Interactive Instruction Group was taught personal finance skills using a multimodal approach that incorporated hands-on activities, games, computer simulations, puzzles, visuals and activities from Financial Fitness for Life, a publication by the National Council for Economic Education (2005) and the Financial Fitness for Life Teacher's guide by Morton and Schug (2012). Students in the Interactive Instruction Group were given 15 minutes of teacher directed set-up of the lesson followed by 30 minutes of a hands-on activity or game related to the subject matter. The teacher-researcher encouraged students in the Interactive Instruction Group to ask questions during the activity as needed for clarification of the lesson.

Prior to and at the conclusion of the intervention, the teacher-researcher administered a Likert-scaled questionnaire to students in the Interactive Instruction Group and the Direct Instruction Group. The survey assessed students' attitudes toward personal finance skills and the type of instruction they received during the semester.

The teacher-researcher recorded information on an engagement checklist, three times per week, of the Interactive Instruction Group and the Direct Instruction Group, during the intervention period. The teacher researcher assessed the students' engagement in lesson activities and class work, discussions related to the subject matter, participation in group activities, and completion of assignments.

During the intervention period, the teacher-researcher recorded the detailed descriptive and reflective fieldnotes, three times per week, of the Interactive Instruction Group and the Direct Instruction Group. The descriptive fieldnotes outlined the teacher-researcher's personal observations of students' behaviors and engagement during lesson activities. The reflective fieldnotes outlined the personal thoughts and reflections of the teacher-researcher of students' engagement in personal finance lessons during the intervention period.

The teacher-researcher utilized three different data collection instruments to measure the effects of multimodal instructional practices on students' acquisition of personal finance skills. The measurement instruments included a pre-test and post-test to determine achievement of personal finance skills knowledge, a survey to access students' attitudes about personal finance skills and instruction in the classroom, an engagement checklist to record students' behavior during instruction, and fieldnotes taken during the intervention period to determine reoccurring themes and differences in students' behaviors during classroom instruction. Measurements were used prior to intervention, during the intervention period, and post intervention to gain the relevant data.

The Personal Finance Pre-test and Post-test was utilized by the teacher-researcher to assess personal finance skills prior to intervention and post intervention. The pre-test and post-test were the same test with the question material deriving from “Financial Fitness for Life–High School” (FFL-HS, 2005) test bank that provides a multiple choice format exam covering five personal finance skills themes. According to the test examiners manual written by Walstad and Rebeck (2005), the FFL-HS test was field-tested on 859 students, primarily in the state of Texas, during the 2003- 2004 school year. The teacher-researcher selected the test-retest format to help increase reliability of test scores. The teacher-researcher selected the FFL-HS test bank questions, because the data provided in the FFL-HS examiners manual cited content validity for each theme was high and construct validity for test items was higher for students who engaged in the Financial Fitness for Life program as compared to students who did not engage in the program (p.20).

The pre-test and post-test was a 35-question multiple choice test assessing the five themes of personal finance: the economic way of thinking, earning income, saving, spending and using credit, and money management. The teacher-researcher administered the pre-test and the posttest and following the 30-minute time limit, the teacher researcher scored the tests using a Scantron Machine. For the Interactive Instruction Group and the Direct Instruction Group, pre-test and post-test scores were analyzed using descriptive statistics (M, SD) and a two-tailed, unpaired ttest. Scores on the pre-test and post-test measures were compared for the Interactive Instruction Group with scores for the Direct Instruction Group.

The Attitudes Toward Personal Finance Instruction Survey was developed by the teacher-researcher to assess the students' attitudes toward personal finance skills and instruction. The survey consisted of a 10-item Likert-scale with a 5-point rating scale ranging from 1 (strongly disagree) to 5 (strongly agree). The survey was pilot tested with 60 students and peer reviewed by two additional economic teachers in the department. The survey had students rate their attitudes toward personal finance instruction. The teacher-researcher administered the survey to the Interactive Instruction Group and the Direct Instruction Group prior to and post intervention. The teacher-researcher analyzed student responses for patterns and themes in attitudes about personal finance skills and instruction and calculated the scores in percentages for student responses to survey questions. The students' responses and scores on the survey, prior to intervention and at the conclusion of the intervention, were compared for the Interactive Instruction Group and the Direct Instruction Group.

Students' engagement in personal finance skills' lessons was assessed using a Student Engagement Checklist. The engagement checklist was developed and implemented by the teacher-researcher to record students' on-task behaviors and engagement in the lesson activities. The engagement checklist was peer reviewed for relevance by two economics' teachers in the department. The engagement checklist rated students on a scale from 1 (always) to 4 (never) demonstrating completion or engagement in the activity and was utilized 2 times per week during the intervention period. The teacher researcher utilized the checklist to assess students' engagement for the Interactive Instruction Group and the Direct Instruction Group following the initial lecture time while students were engaged in the post lecture activities. The scores for the engagement checklist were calculated weekly and analyzed for patterns and themes in students' engagement and compared for similarities and differences in engagement for the Interactive Instruction Group and the Direct Instruction Group.

The Fieldnotes Form was developed by the teacher researcher to record descriptive and reflective fieldnotes during classroom observation. The teacher-researcher recorded descriptive fieldnotes of observations of students' behaviors of the Interactive Instruction Group and the Direct Instruction Group 3 days per week during student engagement in lesson activities. The teacher-researcher also recorded reflective fieldnotes of personal thoughts and reflections of the students' engagement in personal finance lessons for the Interactive Instruction Group and the Direct Instruction Group. The fieldnotes were analyzed for patterns, themes, and inconsistencies in the observations, and were also analyzed to compare similarities and differences in observations between the Interactive Instruction Group and the Direct Instruction Group

Data collection instruments for the current research study provided timely and relevant information to the teacher researcher concerning the use of different instructional practices for student acquisition of personal finance skills. Two high school senior economics classes participated in the research project. The Interactive Instruction Group received a multimodal approach using hands-on lessons, games, computer simulations, puzzles, and activities to learn personal finance skills. The Direct Instruction Group received a traditional approach using lecture, worksheet activities, and discussion to learn personal finance skills. The quantitative data collection instruments used to assess personal finance skills included a pre-test and post-test to assess students' acquisition of personal finance skills, an attitude survey to assess students attitudes toward personal finance skills, a student engagement checklist to assess students' on-tasks behaviors and completion of assignments. The qualitative data collection instrument includes fieldnotes to record students' behaviors and the teacher-researcher's thoughts regarding instruction.

The pre-test scores from the beginning of the intervention and the post-test scores from the conclusion of the intervention were compared for the Direct Instruction Group and the Interactive Instruction Group. The means of the pretest and posttest scores for the Interactive Instruction Group were compared to the means of the pre-test and post-test scores, for the Direct Instruction Group to determine a statistical significance. The results indicated a negligible statistical difference (t(45) = 2.02, p= 0.143) in the post-test scores for the Interactive Instruction Group as compared to the Direct Instruction Group.

Cohen's ‘d’ was calculated to determine a practical significance in the difference between posttest scores for the Interactive and Direct Instruction Groups. The results indicated a medium effect (d = .55). The average student in the Interactive Instruction group generally was expected to score 16% higher than the average student in the Direct Instruction Group. The scores on the pretest and posttest for the Direct Instruction Group and the Interactive Instruction Group are displayed in Table 3.

Table 3. Comparison of Pretest and Posttest Results for Direct Instruction and Interactive Instruction

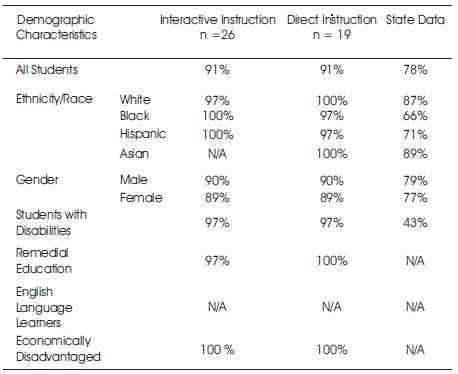

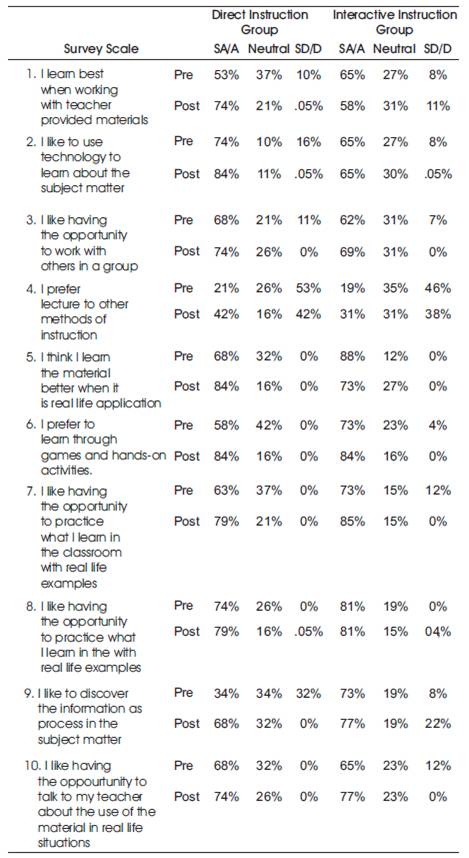

An attitude survey was given to the Interactive Instruction Group and the Direct Instruction Group prior to the intervention and post intervention to determine students' attitudes toward personal finance instruction. The survey consisted of a 10-item Likert-scale with a 5-point rating scale ranging from (strongly disagree) to 5 (strongly agree). Pre and post-intervention results are displayed in Table 4.

Table 4. Pre and Post-Intervention Survey Results for the Direct and Interactive Instruction Groups

In addition, students were asked several questions in reference to whether they had a checking or savings account and if they watched the news. In response to the survey question, “Do you have a savings and/or checking account? ” a slightly greater percentage of students in the Interactive Instruction Group, 81%, indicated having a savings account as compared to the Direct Instruction Group; 63% but a greater percentage of students in the Interactive Instruction Group; 73% indicated having a checking account as compared to, 58% in the Direct Instruction Group. No significance was found between the Interactive and Direct Instructions Groups in response to the question, “How often do you watch the news?” Students in the Interactive and Direct Instruction Groups indicated that, they never watched the news during the week.

The pre-intervention internal survey results indicated several differences between the Direct Instruction Group and the Interactive Instruction Group. The most significant differences occurred in response to the question indicating the preference to discover the information and the progression in the subject matter. The Interactive Instruction Group indicated to a greater percentage, the preference to learn as you progress through the subject matter. The Interactive Instruction Group also indicated a preference for greater acquisition of the material when it is linked to real life application. Post-intervention internal survey results indicated differences in attitudes towards instruction on different questions than pre-intervention surveys. Students in the Direct Instruction Group were more likely to indicate a stronger preference for learning best with teacher provided materials. Students in the Direct Instruction Group were also more likely to agree/strongly agree with the statement, “I like to use technology to learn the about the subject matter,” than students in the Interactive Instruction Group.

Comparison of the pre-intervention and post-intervention survey results indicated some sharp contrasts between preand post-intervention between the Direct Instruction Group and the Interactive Instruction Group. Following intervention, students in the Direct Instruction indicated that, they agreed or strongly agree that, they liked to use technology to learn the material, prefer real life application of the material and prefer to discover information as they progress. Pre and post-intervention, students in the Interactive Instruction Group indicated a greater degree of agree/strongly agree to the statement, “I like having the opportunity to talk to my teacher about the use of the material in real life situations, and a greater degree of dislike to the statement, I prefer lecture to other methods of instruction”. The Direct Instruction and Interactive Instruction Groups were more likely to indicate agreement with the statements regarding preferences for teacher provided material, real life application of the material, and the use of hands-on activities from pre- intervention to postintervention

The teacher-researcher utilized an engagement checklist to assess students' engagement and completion of lesson activities. The engagement checklist rated students on a scale from 1 (always) to 4 (never) according to completion and engagement in the activity and was utilized two times per week during the intervention period. Checklist results for the 9-week intervention period are displayed in Table 5.

Table 5. Engagement Checklist Results

Over the course of the 9-week intervention period, both groups generally showed an increase in engagement in, and completion of lesson activities. The Interactive Instruction group showed greater lesson engagement and completion over the 9-week intervention period as compared to the Direct Instruction Group.

The teacher-researcher recorded detailed descriptive and reflective fieldnotes, three times per week, of the Interactive Instruction Group and the Direct Instruction Group during the 9-week intervention period. The descriptive fieldnotes outlined the teacher-researcher's personal observations of students' behaviors and engagement during lesson activities. The reflective fieldnotes summarized the personal thoughts and reflections made by the teacher researcher of students' engagement in personal finance lessons during the intervention period. The descriptive fieldnotes showed a pattern of increased engagement and participation in lesson activities for the Interactive Instruction Group as compared to the Direct Instruction Group. Students in the Interactive Instruction Group were more likely to discuss the subject matter among themselves, remain on task, and engage the teacher with relevant conversations and questions. Students in the Interactive Instruction Group were more likely to inquire about additional information on the subject for future reference. Students in the Direct Instruction Group were more likely to be distracted during lessons and find the material “boring.” The teacher-researcher noted that, an average of seven students in the Direct Instruction Group were distracted during the lessons, either putting their head down, attempting to use cell phones, or engaging in irrelevant conversations.

The teacher-researcher used reflective fieldnotes to assess personal thoughts and feelings about students' engagement in personal finance instruction. The teacher researcher noted that, although the activities with the Interactive Instruction Group were more chaotic and harder to control, the lesson activities seemed more enjoyable and effective. The teacher-researcher also noted that, students in the Direct Instruction Group appeared to lack enthusiasm with lesson activities often asking, “Why do we need this?” The teacher-researcher identified that some activities were easier to engage students than others and that additional factors such as time of day and mixture of students need to be considered for certain activities.

In order to determine, if the type of instruction students received in personal finance skills would have a significant effect on student achievement, attitude toward instruction, and engagement in lessons, the teacher-researcher compared achievement test scores on pre-test and posttest measure, attitude survey results, and engagement checklist data over a 9-week intervention period.

To examine research question one, the teacher-researcher used pretest measures to assess initial understanding and post-test scores to assess student acquisition of the material. After the 9-week intervention period, post-test scores of the Direct and Interactive Instruction Groups were analyzed for any measurable statistical difference. Results indicated a negligible statistical difference (t(45) = 2.02, p = 0.143). Further, Cohen's ‘d’ was computed to analyze a practical significance. The results indicated a medium effect (d = .55) with a 16% greater likelihood that the average student in the Interactive Instruction Group would outperform the average student in the Direct Instruction Group. This finding is consistent with the Mandell's (2009) research, which indicated that financial literacy instruction and skills did not always translate into immediate and demonstrable results. Mandell (2009) concluded that, students learning of personal finance skills showed a latent effect, often showing up later in life.

In order to address research question two, the teacher researcher analyzed pre and post-intervention survey data for the Interactive and Direct Instruction Groups. Survey data indicated differences within groups from pre- to postintervention on several questions, but also differences between groups from pre to post-intervention. Within the Direct Instruction Group, students indicated that they agreed or strongly agreed that they liked to use technology to learn the material, preferred real life application of the material and preferred to discover information as they progress, from pre- to post-intervention. Likewise, within the Interactive Instruction Group, students indicated a greater degree of agree/strongly agree to the statement, “I like having the opportunity to talk to my teacher about the application of the material for real life situations, and a greater degree of dislike to the statement, I prefer lecture to other methods of instruction.” Between group comparisons indicated, the Direct Instruction and Interactive Instruction Groups were more likely to indicate agreement with the statements regarding preferences for teacher provided material, real life application of the material, and the use of hands-on activities from pre intervention to post intervention. The current findings of improvement of attitude are consistent with data provided by Mandell and Klein (2009) suggested that, economic education also had a positive effect on students' attitudes about personal finance skills.

In order to consider research question three, the teacher researcher analyzed the engagement checklist data for the 9-week intervention period. The results indicated that, students in the Interactive Instruction Group were significantly more engaged in the lesson activities and more likely to complete assignments as compared to the students in the Direct Instruction Group. No research was found comparing the type of instruction and engagement in lesson activities for personal finance skills.

Fieldnotes were analyzed for patterns and themes. Results indicated a difference in participation and engagement between the Direct Instruction Group and the Interactive Instruction Group. Students in the Interactive Instruction Group were more likely to discuss the subject matter among themselves, remain on task, and engage the teacher with relevant conversations and questions. The teacher-researcher also noted that, students in the Direct Instruction Group appeared to be less engaged with lesson activities. Existing research did not provide fieldnotes data on student engagement in personal finance lessons and activities.

Researchers such as Mandell (2009), McCormick (2009), Haynes and Chinadle (as cited in McCormick, 2011), and even President Obama (2011) have stressed the importance of financial literacy. Examining best practices is and should be a continued priority. School data supported the importance of state standardized tests in Economics. The findings of the current research study did not indicate a statistically significant improvement in achievement test scores among groups, but there was a medium effect on practical significance. The findings on the current research study pointed to a difference in attitudes toward instruction and engagement in lesson activities. The intervention revealed a need for further research into student acquisition of personal finance skills and type of instruction, as noted in the research by Pang (2010), and Miller and Watts (2011).

Several factors contributed to implementation of the intervention in the current research study. Unexpected occurrences continued during the intervention period. Unplanned senior meetings, fire drills, and testing that displaced the students and teacher from the research room were some of the challenges that affected implementation of the intervention.

Further, student absences, differing levels of abilities between research participants, prior knowledge of the subject matter, time of the day when class was conducted, and motivation levels created other difficulties in implementing the intervention in the classroom.

The results of the current research study had several limitations that need to be considered. The inability to control extraneous variables and the lack of a controlled environment make it difficult to create reliability and generalize the research findings. Classrooms are not science labs and therefore are not easily controlled nor are results as reliable under the circumstances. Flexibility in instruction and a teacher's ability to differentiate based upon students', and classrooms’ needs and abilities, must be considered. In addition, teacher training and subject matter expertise are factors worth investigating when understanding the nature of student' acquisition of personal finance skills. Further, site factors are also important. School systems vary not only across the country but, also across states and districts. Variance in school funding and support for economic education need to be examined when considering the efficacy of programs that seek to teach students personal finance skills.

The generalizability of the results in the current research study were limited and definable. The teacher-researcher was limited to the sample and other restraints such as time, students' prior knowledge of the subject matter, and varying levels of ability. However, inquiry into varying methods of instruction is warranted and required in the age of high stakes testing. Further, the idea that teachers are committed to student development necessitates a need to examine best practices to help ensure future student success.

The current research study findings provided valuable information to the teacher-researcher. The teacher researcher will continue to implement hands-on, interactive activities in the classroom, not only with personal finance skills, but also with other domains of Economics.

During the research study, student's consistently demonstrated a desire for interactive, hands-on activities as the preferred method of instruction. Although the research did not bear out a strong statistically significant difference between post-test scores among groups, the Cohen's ‘d’ data indicated a practical significance with a 16% improvement in achievement scores for the intervention group. Qualitative data suggested that, students often did not show an immediate effect in relation to test scores or evidence of learning, but in the long term, students had learned the material and were able to demonstrate an understanding of personal finance skills.

The current research study has implications for stakeholders in addition to the teacher-researcher. Colleagues could benefit from the knowledge gained from students' desire to learn in different ways and students' engagement in lessons. As educators strive to find new ways to engage and reach students, the current research practices could yield valuable information into more effective ways to help students learn personal finance skills. For administrators, the results are not as tangible or quantifiable, as there are many factors that contribute to students' acquisition of personal finance skills. In addition, the study of teaching methodology and student acquisition of personal finance skills has not been studied on a large scale level, further compounding the problem. Yet, overall student acquisition of information and achievement should be a concern of every administrator and stakeholder.

The teacher-researcher will continue to implement handson activities in the classroom during personal finance lessons. The research provided practical information for the teacher-researcher about how different teaching methods affect students' achievement and attitudes toward instruction that will be used in the classroom. The results of the study will be shared with other economics teachers in the high school.