Project Appraisal at Durgapur Steel Plant

Abstract

This research paper studies the tools and techniques used in

investment appraisal in Steel Authority Of India Limited using

a live modernization project at SAIL “ the rebuilding of coke oven

battery # 4”. It is observed that Investment decisions are

the most important and crucial decisions of the corporate world owing to

the large amount of risk involved. They affect

the value of the firm and thus they need to be critically analyzed both

technically and financially. To investigate the

feasibility of a proposal, project appraisal techniques like Net Present

Value (NPV) method, Internal Rate of Return (IRR)

method and Sensitivity Analysis were employed. The authors opine that the

NPV comes out to be  .296.20

crores (posttax)

and IRR 26.81% and 33.75% for post- tax and pre- tax respectively which

is well above the hurdle rate, hence the

project is feasible and recommended for implementation.

.296.20

crores (posttax)

and IRR 26.81% and 33.75% for post- tax and pre- tax respectively which

is well above the hurdle rate, hence the

project is feasible and recommended for implementation.

Keywords :

- Investment Appraisal,

- Internal Rate of Return,

- Cash Flows,

- Techno-Economics Analysis.

Introduction

Global Steel Industry

The global steel industry employs more than two million

people worldwide, with further two million contractors and

four million people in supporting industries. It is at the

source of employment for more than 50 million people. In

2014, global demand for steel is forecast to grow at about

3.3%. Much of the demand growth is expected to come

from outside of China. Global demand and supply for

steel will be mostly from the developing economy and

also from recovering economies. As urbanization projects

continue, accompanied by a strong domestic economy

and a growing middle class, the demand for steel will

continue to stimulate. It will also shift the product range as

more sophisticated consumer products, such as

automobiles and home appliances, are sought after. This

will benefit steelmakers with high-end, value-added

products (Global steel 2014, Ernst & Young

Publications p.

6). World crude steel production increased from 28.3

mega tonnes (MT) in 1900 to 1,607 MT. in 2013 and

currently stands at 405677 thousand tonnes as on March

2014 (World Steel Association).

Global Supply and Demand

Global steel demand increased by an estimated 3.2% in 2013 as compared

to 2012, largely due to increased

infrastructure and construction activity, especially in

Asia.

China leads from the front, recording 6% growth in 2013

compared to 2.9% in 2012 in the global steel industry.

However, the rest of the world failed to meet expectations

and was lower than as forecasted in 2013. A larger portion

of the demand (+4.9%) came from emerging

economics; North America showed a slight increase in

demand of steel usage (+0.2%), whereas demand in EU

continues to decline for the apparent use of steel (-3.8%).

In 2013, global production of steel increased by 3.5% to

1,607 million tonnes despite low demand growth in most

parts of the world, lead by China, where at least 58 new

furnaces have come online, which increased the annual

capacity by 80 million tonnes. Japan also showed an

increase in steel production by 3.1% to 110.6 million

tonnes. Some countries show decline in the production,

with a 4.4%, 2%, 2% and 1% fall in South Korea, the US,

Europe and Brazil, respectively. Average capacity

utilization in the industry increased from 76.2% during

2012 to 78.1% in 2013 (Global steel 2014, Ernst &

Young

Publications p.4).

Domestic Scenario

India has become the second best in terms of growth

amongst the top ten steel producing countries in the world

and a net exporter of steel during 2013–14. Steel

production in India recorded a growth rate of 4.8 per cent

in February 2014 over February 2013. The cumulative

growth during April–February, 2013–14 stood at 4.2 per

cent over the corresponding period of the previous year

(India Brand Equity Foundation, updated May, 2014)

.

Market Size

India's real consumption of total finished steel grew by 0.6

per cent year-on-year in April–March 2013-14 to 73.93

million tonnes (MT), according to Joint Plant Committee

(JPC), Ministry of Steel. Construction sector accounts for

around 60 per cent of the country's total steel demand

while the automobile industry consumes 15 per cent

(Economic times, online article, March 2014). India

became net steel exporter in 2013–14 and is likely to

maintain the momentum in 2014-15 as producers are

looking to dock more overseas shipment to tide over

subdued domestic consumption. Total steel exports by

India during 2013–14 stood at 5.59 MT, as against imports

of 5.44 MT. (Indian steel industry facts and figures,

retrieved may 8 2014, from http://www.ibef.org/industry/

steel.aspx)

Figure 1 shows the consumption pattern of steel in the

Indian market, as can be seen the largest share is of

infrastructure 63%. Thus we can say that, as the

construction and real estate industry grows in India so will

the steel industry.

Figure 1. Indian Steel Consumption

Road Ahead

Indian steel industry has a bright future. Infrastructure

spending are projected to be increased from 5 per cent

to 10 per cent in 2017 and the country has a plan of

investing around US$ 1 lakh crore in infrastructure in its 12th five-year

plan. (Data Retrieved from working group report

on Indian steel industry, retrieved may 8 2014, from

http://planningcommission.gov.in/aboutus/committee/w

rkgrp12/wg_steel2212.pdf)

1. Objectives Methodology and Review of Literature

1.1Objective of the Study

Investment planning is a long term exercise and involves a

huge amount of time and money. It therefore involves

careful analysis of the proposal. SAIL (Steel Authority Of

India Limited) has specified procedures for such

modernization and replacement proposals and their

approval. Some of the objectives of the study are as

follows:

- To study the financial performance of Steel Authority

of India, its growth and profitability in the recent years.

- To study and understand the process of investment

appraisal at a big government undertaking with Steel

Authority of India as the platform.

- To learn and understand the tools and techniques

used in capital budgeting like NPV (Net Present Value

method) and IRR (Internal Rate of Return method),

Cost Benefit Analysis and Sensitivity Analysis.

1.2 Methodology

The study is mainly based on secondary data. In order to

study the global steel industry, the data is collected from

world steel association's website and for the domestic

steel industry, data from various sources like Ministry of

Steel publications is amassed. The company data is taken

from company's annual reports and official website. To

study the process of investment appraisal, details for the

same is studied from the company’s appraisal books and

for financial analysis part, a live project was studied and

the project was appraised with techniques like Net Present

Value method, Internal Rate of Return method, Gross

margin calculation and sensitivity analysis.

1.3 Literature Review

Singh Shveta, Jain P.K., Yadav Surendra S., Department of

Management Studies, Indian Institute of Technology

Delhi, New Delhi, India (2012) have studied “Capital

budgeting decisions: Evidence from India” for 10 years from 2001 to

2011. The authors found that, trends towards

sophisticated techniques and sound capital budgeting

decisions have continued in India. All sample respondent

firms used Discounted Cash Flow (DCF) techniques in

conjunction with non-DCF techniques. Internal Rate of

Return (IRR), used by more than three quarters of the

sample companies, is favoured over Net Present Value

(NPV), used by half of the sample companies. Real

options are used by half of the sample companies.

Permanent (long-term) capital has been used to finance

fixed assets (net) and working capital (net).

The authors highlight that, Capital budgeting practices in

India appear to have improved over the past decade or

so with an increasing number of companies using more

sophisticated DCF techniques. To assess risk, sensitivity

analysis is perceived to be the most important technique.

It is a matter of gratification to note that all the respondent

sample companies used DCF techniques in conjunction

with non-DCF techniques. There was a strong preference

for DCF with 50 per cent using NPV and 78.57 per cent

using IRR. The results also indicated that firms still relied on

simple capital budgeting techniques such as the

payback period and the ARR. Despite the

recommendations of the financial literature on using NPV

as the primary technique, this research too found that

respondent firms indicated a preference for IRR

compared to NPV. (Journal Retrieved May 13 2014, from

http://www.emeraldinsight.com/journals.htm?articleid=1

7035911)

Cooper William D., Morgan Robert G., Regman Alonzo,

Smith Margart (2001) have done a study to assess the

current level of capital budgeting sophistication in

Corporate America. A survey questionnaire was sent to

the CFOs of the Fortune 500 companies. They received

response from 113 companies having a response rate of

23%. As per the results of their study, the most commonly

used primary capital budgeting evaluation technique is

the IRR (57%). The second most popular technique is the

PBP (20%). The most popular backup technique is the PBP

(23%), which is slightly more popular than the IRR and the

NPV (21%). Many firms use a team approach to evaluate

capital projects. The largest number of their respondents believe that

project definition and cash flow estimation is

the most important and difficult stage of the capital

budgeting process. Majority of the firms used cut-off rate

between 10% and 15%. The most popular method of

handling risk in the capital budgeting process identified

by 33% of the respondents was to increase the required

rate of return of cost of capital.

Venkatesan T., Dr. Nagarajan S. K. (2012) had done a study

on the topic titled “An empirical study of profitability

analysis of selected steel companies in India” founded

that, profitability more or less depends upon better

utilization of resources, cut-off expenses and quality of

management function in the products, customer services

and to manpower and goodwill and market share. It is

worthwhile to increase production capacity and use

advance technology to cut down cost of production and

wage cost in order to increase profitability, not only

against the investment, but also for the investor's return

point of view. These programs are helpful to increase the

profitability of selected steel companies in India in future

prospects. If the management or government does not

look into it seriously, it can result in loss of jobs and the

company will become a sick unit. And founded in

numerical statement, the correlation of SAIL to Tata (0.56)

of NP and SAIL to Tata 0.64 of OP ratio was positive. It shows

that they maintained similar level in NP and OP ratio and

negative correlation was observed among bhushan to jsw (-0.12) of NP

ratio and bhushan to jsw of (-0.394) OP

ratio. Conclude by “t” test, there is no correlation among

SAIL to Tata and bhushan to jsw of NP ratio and SAIL to Tata

and sail to Tata and bhushan to jsw of OP ratio and in

ANOVA test, there is no significant difference in the ROI of

SAIL, Tata, bhushan, visa, & jsw.

1.4 Limitation

- Industry norms are defined.

- Full disclosure of the company information is not

allowed.

- Manufacturing expenses for the modernization of

battery are calculated by Engineers.

- Approval time is 30 months Therefore, it takes a long

time to pass on from one stage to another, thus appraisal may be

effected by macro forces.

2. Steel Authority of India Limited (SAIL)

Started with the name of Hindustan Steel Private Limited

set up on January 19, 1954, Steel Authority of India Limited

has grown immensely. The Government of India owns

about 80% of SAIL's equity and retains voting control of the

Company. However, SAIL, by virtue of its 'Maharatna'

status, enjoys significant operational and financial

autonomy. SAIL is India's largest steel producing

company, with a turnover of `. 49,350 crore. SAIL has five

integrated steel plants, three special plants, and one

subsidiary in different parts of the country. It holds a handsome

2nd position in the Indian steel industry and a

decent 24th position in the global arena. (Retrieved

April

10 2014, from http://sail.co.in/aboutus.php?tag=

company-aboutus)

2.1 Financial Highlights

SAIL achieved the saleable steel production of 12.385

Million Tonnes (MT) during the financial year 2012-13. The

profit after tax of Rs. 2170 crore was lower by Rs. 1373 crore

over the last year (Rs.3543 crore).

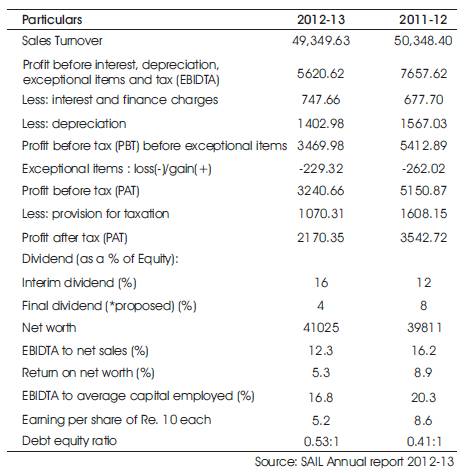

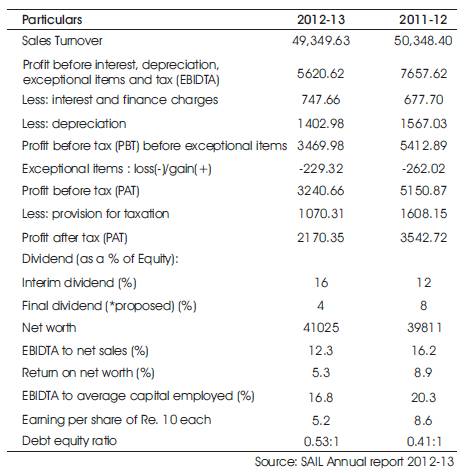

Table 1 shows the comparison between the financial

performance of 2012-13 and 2011-12 as it can be seen

that the company achieved a turnover of Rs. 49,350 crore

during the Financial Year 2012-13, which was almost at

the same level as that of last year ( . 50348 crore). The

profit after tax of the Company for the Financial Year 2012-

13 was

. 50348 crore). The

profit after tax of the Company for the Financial Year 2012-

13 was  . 2170.35 crore

compared to

. 2170.35 crore

compared to  . 3542.72 crore in

the previous Financial Year. Net profit was down largely

due to the lower Net Sales Realization resulting from a

subdued market. Higher usage of external inputs like BF

Coke & pellets and higher salary & wages were other key

factors impacting profitability adversely. The debt equity

ratio of the Company was 0.53:1 as on 31st March, 2013

as against 0.41:1 as on 31st March, 2012 which went up

on account of increase in borrowings during the year to

fund the ongoing capital expenditure. The net worth of the

Company improved from

. 3542.72 crore in

the previous Financial Year. Net profit was down largely

due to the lower Net Sales Realization resulting from a

subdued market. Higher usage of external inputs like BF

Coke & pellets and higher salary & wages were other key

factors impacting profitability adversely. The debt equity

ratio of the Company was 0.53:1 as on 31st March, 2013

as against 0.41:1 as on 31st March, 2012 which went up

on account of increase in borrowings during the year to

fund the ongoing capital expenditure. The net worth of the

Company improved from  . 39,811

crore as on 31st

March, 2012 to

. 39,811

crore as on 31st

March, 2012 to  . 41,025 crore

as on 31st March, 2013.

The Company paid interim dividend at 16% of the paidup

equity share capital during the year. The Board of Directors have further

recommended a final dividend at

4%, subject to approval of shareholders, thus making the

total dividend at 20% of the paid up equity share capital

for the Financial Year 2012-13. A sum of Rs. 163 crore has

been transferred to the general reserves during the

Financial Year 2012-13 (Steel Authority Of India Limited,

annual report 2013 p.6).

. 41,025 crore

as on 31st March, 2013.

The Company paid interim dividend at 16% of the paidup

equity share capital during the year. The Board of Directors have further

recommended a final dividend at

4%, subject to approval of shareholders, thus making the

total dividend at 20% of the paid up equity share capital

for the Financial Year 2012-13. A sum of Rs. 163 crore has

been transferred to the general reserves during the

Financial Year 2012-13 (Steel Authority Of India Limited,

annual report 2013 p.6).

Table 1. Comparative performance sheet

for the year 2012-13 and 2011-12

3. Investment Appraisal at Steel Authority of India Limited

3.1 Procedure of Investment Appraisal at SAIL

At SAIL, regular capital investments are necessary for

maintaining health of the plants and to face

technological obsolescence. Since such investment

decisions are quite critical owing to the risks involved, they

need to be critically analyzed both technically and

financially. SAIL has an effective investment appraisal

process which is mandatory for any investment decision

to pass through before it gets approved for execution.

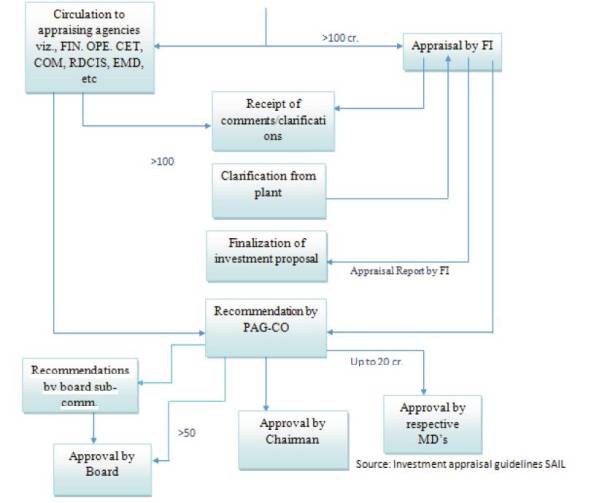

3.1.1 Appraisal Process Flow

Figure 2 shows the appraisal process at SAIL, where the

plan starts, how it flows through various departments,

and who approves it. (Retrieved on April 10, 2014

Guidelines for Formulation of Investment Proposals for

Appraisal, SAIL)

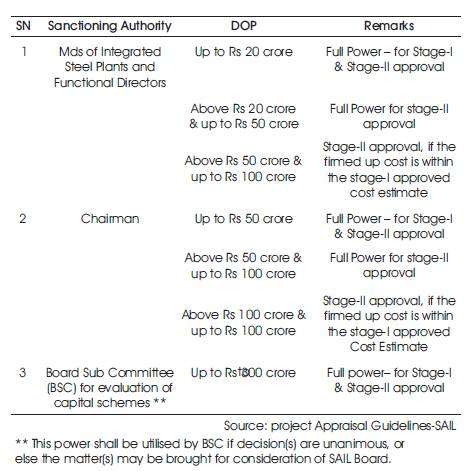

3.1.2 Present Delegating Powers

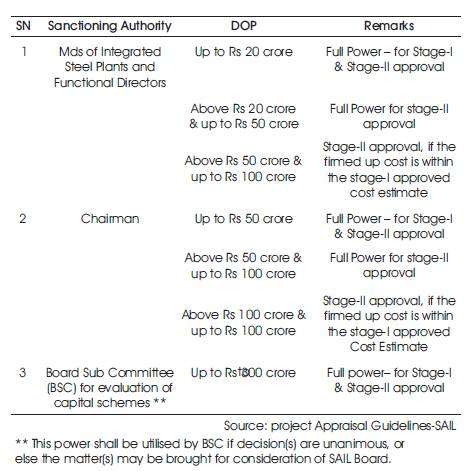

Table 2 shows the present delegation of powers for

sanction of investment proposals for SAIL plants/units,

including Enabling /Auxiliary Package sunder

Modernization & Expansion Plan of SAIL, as approved by

SAIL Board in its 359th meeting held on 17.03.10.

Table 2. Delegation Power for Sanction of Investment

Proposal

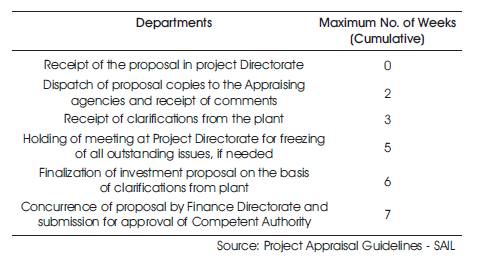

3.1.3 Time Schedule for Appraisal of Proposals

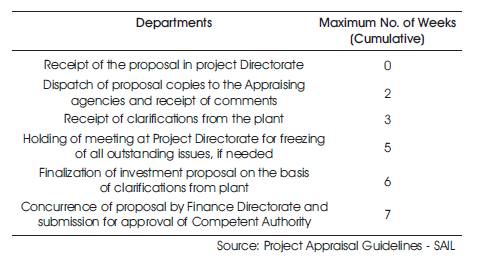

Table 3 outlines a time schedule for scrutiny, appraisal and

sanction of Investment Proposals from the date of its

submission by Plants / Units to Projects Directorate.

Table 3. Time Schedule for Appraisal

If the Proposal is required to be appraised by an

Independent Institution, then the activity will commence

in Week 1 and will get complete by Week 5. This activity will

be carried out in parallel with above listed activity.

3.1.4 Procedure of Financial Appraisal at SAIL

At SAIL, regular capital investments are necessary for maintaining

health of the plants and to face

technological obsolescence. Since such investment

decisions are quite critical owing to the risks involved, they

need to be analyzed financially. SAIL has an effective

financial appraisal process which is mandatory for any

investment decision to go through.

Once the investment proposal is received by the finance

department for financial appraisal to assess the

investment viability, it is assessed through the following

step-by-step method :-

3.1.4.1 Capital Cost

The Capital Cost of the Project should be based on

Budgetary Quotation / Engineering Estimate. Basis of

Capital Cost should include FE parity, base date, taxes &

duties and Interest During Construction (IDC). The Capital

Cost should be indicated on net of CENVAT basis indicating the CENVAT

amount specially.

3.1.4.2 Financing & Financial Closure

The Project shall be financed through the following

- Equity / Internal Resources

- Loans from …. @.. p.a.

Ratio of Loan to Equity and the Interest Rate on the loan

portion are to be considered based on the guidelines

issued from time to time.

3.1.4.3 Phasing Of Capital Expenditure

The phasing of Capital Expenditure should be estimated

according to the Bar-Chart for Project implementation for

each of the Project activity. Based on the construction

schedule and the financing pattern, the Interest During Construction

(IDC) should be calculated.

Table 4 shows the format for phasing of expenditure

including Interest During Construction (IDC).

Table 4. Phasing of Expenditure Including IDC -

Format

3.1.5 Benefits Envisaged

The benefits envisaged for the selected alternative should

be clearly brought out in quantitative as well as qualitative

terms. While working out the benefits, selling price of the

product along with the Net Sales Realization and the

quantities with quality / size that the market can absorb

should be vetted by Central Marketing Organisation only

for New Products in writing which shall form a part of the

Proposal. Concession benefits include Section 80 I (A),

and all other assumptions for calculating benefits.

3.1.6 Techno-Economics Analysis

The Techno-economics should be done on realistic basis

and should be calculated based on:

- Considering Technical Parameters of previous year if

the Investment Proposal (IP) is prepared during the

period April-September and considering technical

parameters of first Half Year (H1), if FR/ IP is prepared

during the period October-March.

- Standard Cost for the current year should be

considered for working out the Production Cost/

Manufacturing Cost/ Additional Expenditure.

- Simple average of Net Sales Realization (NSR) of last 3

years as per CMO price circulars OR as supplied by

the Plants or current NSR whichever is lower.

- Salvage/ Residual value of the Project should be

considered at 5% at the end of economic life of

Project.

- In the Cash Flow Statement, Depreciation, in general,

to be calculated on WDV basis and Capital Cost on

net of CENVAT basis for green field/brown field units of SAIL.

However, in case of Projects executed under new

Joint Venture and Projects with 80 I benefits

Depreciation under straight line method also needs to

be calculated to arrive at Book Profit to determine

applicability of MAT (Minimum Alternate Tax) flows in

the Cash Flow Statement.

- CENVAT Benefit should be considered while

calculating the Techno-Economics.

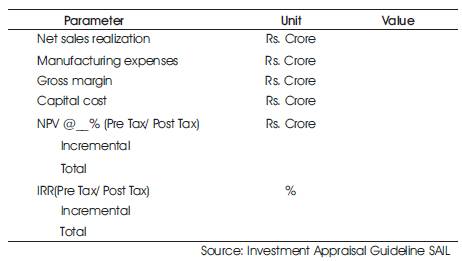

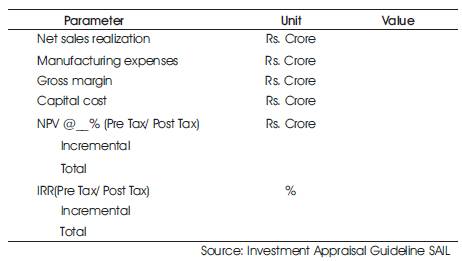

Table 5 outlines the financial indices that should be given

along with the proposal.

Table 5. Financial Indices

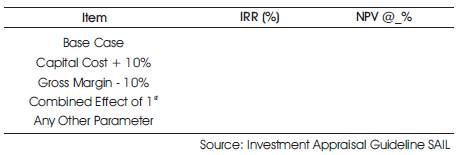

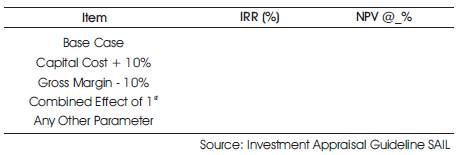

3.1.7 Sensitivity Analysis

Sensitivity of Financial Indices for selected parameters

should be indicated which are given in Table 6.

Table 6. Sensitivity Analysis - Format

4. Analysis of a Live Project

Durgapur Steel Plant (DSP) has embarked upon expansion

plan to achieve hot metal production of 3.3 MT p.a. in

2016-17. To take care of the hot metal production, Battery

No. 2 is being rebuilt which is scheduled for

commissioning in November 2012. Battery No.4 is the

oldest battery which is more than 24 years old followed by

Battery No.1 which is more than 20 years old. Next in line

for rebuilding is Battery No.3 which is also more than 15

years old. Bunching of rebuilding is foreseen if timely

action for rebuilding is not taken. This will lead to coke

shortages in future. To meet the future demand of BF coke,

DSP gave an assignment to CET (Civil Engineering

Technician) for rebuilding of Coke Oven Battery No. 4.

As per present Repair/Rebuilding plan, Battery No.5 will be

taken up for construction first followed by rebuilding of

Battery No.4, which will be taken up for rebuilding after

Battery No.2 is commissioned. With commissioning of Battery No.5, Battery

No.1 will be taken down for

rebuilding. With rebuilding of Battery No.4, DSP will have

three healthy batteries with pollution control facilities in

operation i.e. Batteries Nos. 2, 4 & 5 which will also avoid

bunching of rebuilding of batteries. Therefore, immediate

action for rebuilding of Battery No.4 is being taken for

obtaining approval of SAIL Board Sub-Committee. (Data

retrieved from http://www.sail.co.in/pnu.php?tag=

durgapur)

4.1 Financial Analysis of the Proposal

4.1.1 Capital Cost Estimates

The capital cost of the project “Rebuilding of Coke Oven

Battery # 4, DSP” is estimated at  .304.87 crore net of

CENVAT of

.304.87 crore net of

CENVAT of  . 25.39 crore

including IDC of

. 25.39 crore

including IDC of  .18.76 crore.

There is no FE component in it.

.18.76 crore.

There is no FE component in it.

4.1.2 Mode of Financing

The total capital requirement of the project is proposed to

be provided from debt equity in the ratio of 1:1 with an

interest rate @ 11% per annum on loan.

The total capital required for the project is 330.26 which

includes plant cost of 311.50 and IDC of 18.76, out of

which 50%, that is 155.75, will be financed by equity and

the rest 155.75 from market loan at 11%.

Debt-equity ratio = 1:1, which is said to be a good

measure as it shows a balance between debt and equity.

4.1.3 Cost-Benefit Analysis

Gross margin calculation for the project is based on the assumption

that, in case the Coke Oven Battery is not

rebuilt, the entire requirement of coke (456887t) would

be met from purchased coke. Considering DSP average

price of purchased coke at  .23,300/t, savings on

account of purchased coke works out to be Rs. 1064.55

crore per annum. Other operational benefits in the form

of Coke Oven Gas as well as other by products have also been considered.

The total benefit on account of rebuilt

battery works out to be Rs. 1194.37 crore per annum.

Production cost of equivalent coke considering at

Rs.24,046/t (Standard cost 2011-12 H-1, DSP) works out

to be Rs.1089.03 crore per annum. Based on the above,

Gross Margin works out to be Rs.104.78 crore per

annum.

.23,300/t, savings on

account of purchased coke works out to be Rs. 1064.55

crore per annum. Other operational benefits in the form

of Coke Oven Gas as well as other by products have also been considered.

The total benefit on account of rebuilt

battery works out to be Rs. 1194.37 crore per annum.

Production cost of equivalent coke considering at

Rs.24,046/t (Standard cost 2011-12 H-1, DSP) works out

to be Rs.1089.03 crore per annum. Based on the above,

Gross Margin works out to be Rs.104.78 crore per

annum.

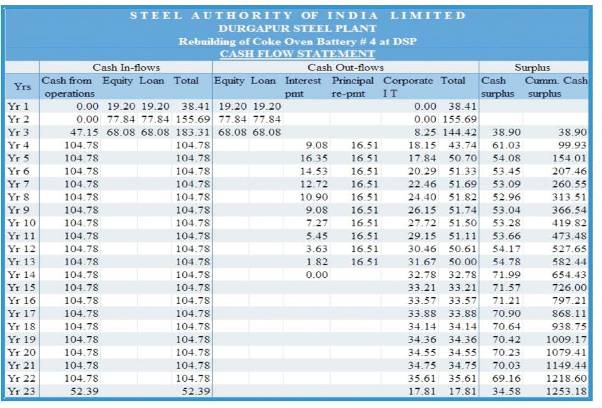

4.1.4 Cash Flow Statement

Cash flow analysis is simply the process of identifying the

categories of cash flows associated with a project or

proposed course of action, and making estimates of their

values.

In the research work, cash flow has been calculated for

the period of 20 years.

Table 7 summarises the cash flow statement of the project

and this shows that the project will generate surplus cash

for almost all the years expect the first 2 beginning years of the life

of the project.

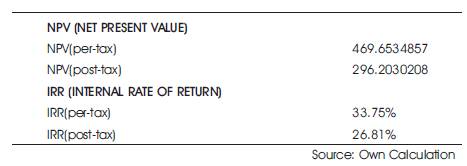

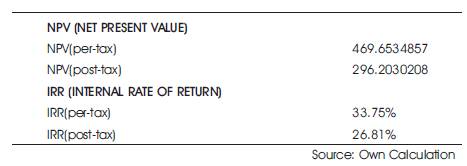

4.1.5 NPV and IRR of the Proposal

Table 8 shows the Net Present Value (NPV) and Internal

Rate of Return (IRR) for both pre-tax and post-tax of the

proposal. The proposal, as can be seen, is a clear go for

the financial part as NPV is very high and the IRR is well

above the hurdle rate.

Table 8. NPV & IRR

4.2 Sensitivity Analysis

Sensitivity analysis involves evaluating proposals over a

range of assumptions about key factors (e.g. prices, costs,

interest rates on any borrowed funds). If an option yields

acceptable results only with particular combinations of

circumstances, and the results are very sensitive to

variations in these circumstances, then it should probably

not be undertaken. If the relative merits of options change

with variations in the assumed values of variables, those

values should be examined to see whether they can be made more

reliable.

The following factors have been taken into account for

measuring the sensitivity of the profitability of the project:

- Increase in Capital Cost by 10 percent;

- Fall in Operating Margin by 10 percent;

- Combined Effect of above two factors;

- Debt Equity ratio changes to 1:1 from 3:2;

- Project is all Debt Financed;

- Project is all Equity Financed

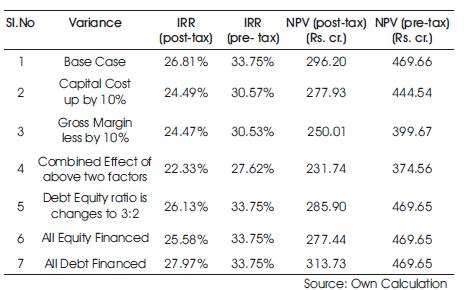

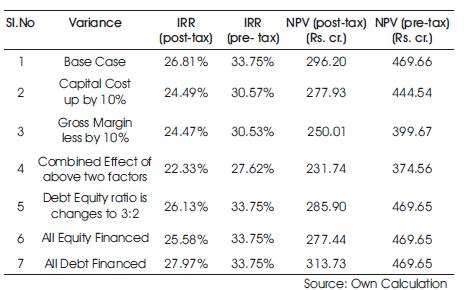

Table 9 shows the effect of various changes on the NPV

and IRR of the proposal and as can be seen, none of the

alternates have an adverse effect on the proposal. Thus,

we can say the proposal is not at all sensitive.

Table 9. Sensitivity Analyses

5. Analysis and Interpretation

- If the Capital Cost increases by 10% (due to any

reason like increase in the cost of equipment or

structure etc.) then both NPV and IRR decreases, but

IRR is still greater than 10% and NPV is still positive. Thus,

the project, though sensitive to the increase in Capital

Cost, is still acceptable.

- If the gross margin decreases by 10% (due to any

reason like increase in the cost of production), then

both NPV and IRR decreases, but are still within the

acceptable range and the proposal can be

accepted.

- The combined effect of increase in capital cost by

10% and decrease in gross margin by 10%, yields

greater decrease in NPV and IRR values, but still

doesn't produce a significant change in NPV and IRR

values.

- If the debt-equity mix is changed from 1:1 to3:2, the

NPV and IRR values do not change significantly and

the proposal is still acceptable.

- As the leverage decreases, the post tax IRR and NPV

values decreases, thus giving lower returns. Hence,

the project should not be 100% equity financed.

- As the leverage increases, the post tax IRR and NPV

values increase due to tax deductibility of interest

cost thus giving higher returns.

6. Findings and Recommendations

Steel Authority of India (SAIL) is a very well established

company and holds a strong position in the industry. The

financial position of SAIL is very strong. It had turnover of

49,350 crores in the last financial year. Though it has seen

a continuous decline in its profits, but they are only due to

the various expansion and modernization plans taken up

by the company. Findings made during the appraisal of

the givenproject “Rebuilding of Coke Oven Battery # 4 at

Durgapur Steel Plant” are as follows:

- Plant cost estimation is 330.26 cr. including Interest

During Construction (IDC) of Rs. 18.76 cr., which is

calculated by taking care of all the necessary

equipments and tools required.

- Gross margin is found out to be Rs.104.78 crs.

- Phasing of expenditure is considered in three years

which is divided in a certain ratio of 12%, 48%, 30%

and 10% respectively. (10% is considered for the post

commission)

- Cenvat credit is considered to be Rs. 25.39 cr.

- NPV and IRR both satisfy their acceptance criteria,

hence the proposal is acceptable.

- The project is not very sensitive to environmental changes.

Conclusion

Steel Authority of India (SAIL) is a well established

company and is a very strong pillar of the Indian

economy. SAIL has a bright future ahead, as both the

Global and Domestic Steel Industry have shown signs of

high growth in future and the market promised a rise in

the demand for steel.

SAIL achieved a turnover of Rs.49,350 crore during the

Financial Year 2012-13 and the profit after tax was

Rs.2170.35 crore compared to Rs. 3542.72 crore in the

previous Financial Year. Net profit was down largely due

to many modernization projects going throughout the

company and higher usage of external inputs like BF

Coke & pellets are other key factors impacting

profitability.

Having analyzed the project dynamics in details and

keeping in view the technical/ technological/

commercial parameters assumed by Durgapur Steel

Plant, SAIL, it is clear that SAIL follows a well developed

procedure for investment appraisal. It has predefined

rules and procedure for handing various parameters and

the process follows a set of series of steps.

Recommendation

- Steel Authority of India (SAIL) can even rise to new

heights if it adopts new and latest technology and

exploits the export market by increasing its operations

in the global market.

- During the financial analysis of investment plan, some

grey areas have been encountered. It is seen that,

while estimating the gross margin and capital costs,

current prices are used and there is no provision for

any escalation in prices of the raw material or capital

costs. In the light of an inflation prone country like

India, this can be a major setback on profitability in

later years of operation. Hence for a more pragmatic

estimation, it is recommended that the effect of

inflation be accounted on the prices by applying

appropriate models.

References

[1]. About Durgapur Steel Plant, April 12 2014, Retrieved

from Steel Authority of India ltd . Website

:http://www.sail.co.in/pnu.php?tag=durgapur

[2]. SAIL's Company Details, April 10 2014, Retrieved

from

Steel Authority of India ltd.Website:

http://sail.co.in/aboutus.php?tag=company-aboutus

[3]. SAIL, Guidelines for Formulation of Investment

Proposals for Appraisal, SAIL

[4]. Indian steel industry facts and figures, May 8 2014,

Retrieved from India Brand Equity Foundation, Website:

http://www.ibef.org/industry/steel.aspx

[5]. Data from working group report on Indian steel

industry, May 8 2014, retrieved from Report of the working

group on steel industry for the twelfth five year plan (2012 –

2017)Website:http://planningcommission.gov.in/aboutus

/committee/wrkgrp12/wg_steel2212.pdf

[6]. Global steel industry report, (2014). Retrieved from

Global Steel 2014, Planning To Profit From Opportunity:

Preparing For Future Demand ,Website:

http:// www.ey.com / Publication /vw LUAs sets / EY _-

_Global_steel_2014/$FILE/EY-Global-steel-2014.pdf

[7]. Global steel data and facts, (2014). retrieved from

World Steel Association Website :

http://www.worldsteel.org/

[8]. Pandey I.M., (2011). Financial Management 10th

edition (Vikas Publishing House Reprint 2011), Chapter No.

8, In text reference: Project Appraisal Techniques.

[9]. Pamela P. Peterson, Frank J. Fabozzi, (2002). Capital

Budgeting: Theory and Practice volume 10 (Wiley, 2002),

in text reference : Capital Budgeting.

[10]. Pandey I.M., (2011). Financial Management 10th

edition (Vikas Publishing House) Reprint 2011, In text

reference: Sensitivity Analysis.

[11]. SAIL's Directors, (6th August 2012). SAIL's

Annual

Report 2011-12, and SAIL's Directors, 22nd July 2013, SAIL's

Annual Report 2012-13, retrieved May 11 2014, from

Website: http://sail.co.in/financial-list/103.

[12]. Singh Shveta, Jain P.K., Yadav Surendra S., (2014).

Department of Management Studies, Indian Institute of

Technology Delhi, New Delhi, India (2012), Capital

Budgeting Techniques, (publisher: Emerald Group Publishing Limited )

retrieved May 132014,

http://www.emeraldinsight.com/journals.htm?articleid=1

7035911

.296.20

crores (posttax)

and IRR 26.81% and 33.75% for post- tax and pre- tax respectively which

is well above the hurdle rate, hence the

project is feasible and recommended for implementation.

.296.20

crores (posttax)

and IRR 26.81% and 33.75% for post- tax and pre- tax respectively which

is well above the hurdle rate, hence the

project is feasible and recommended for implementation.