With growing concerns about climate change on agricultural yields and prices, the authors studied and designed the agricultural profit insurance as risk management tool in this paper. They identified the key issues and concerns that arise in the design and rating of agricultural yield insurance plans, with particular emphasis on yield risk modeling. They showed how the availability of data shapes the insurance scheme and the ratemaking procedures. Relying on Taiwan’s experience and recent developments in Statistics and Econometrics, the authors review some risk modeling concepts and provide technical guidelines in the development of agricultural insurance plans. Yield randomness varies regionally. Price randomness differs among commodities and changes over time. Yields and prices tend to move in opposite directions. Finally, they showed how these risk modeling techniques can be extended to price risk in order to develop agricultural profit insurance schemes.

Farming is a financially risky occupation. On a daily basis, farmers are confronted with an ever-changing landscape of possible price, yield, and other outcomes that affect their financial returns and overall welfare. The consequences of decisions or events are often not known with certainty until long after those decisions or events occur, so outcomes may be better or worse than expected. When aggregate crop output or export demand changes sharply, for example, farm prices can fluctuate substantially and farmers may realize returns that differ greatly from their expectations. Understanding risk is a key element in helping producers make better decisions in risky situations, and also provides useful information to policymakers in assessing the effectiveness of different types of risk protection tools.

Risk is an important aspect of the farming business. The uncertainties of weather, yields, prices, government policies, global markets, and other factors can cause wide swings in farm income. Risk management involves choosing among alternatives that reduce the financial effects of such uncertainties.

Five general types of risk are described here: production risk, price or market risk, institutional risk, human or personal risk, and financial risk.

The management of crop production risks is an issue of fundamental importance to agricultural economies. Because of the random nature of production conditions (e.g., weather, pests, diseases), agricultural producers face an array of risks that may influence their level of output per acre from year to year. Management of such yield risks has long been an important issue for producers as well as for policy makers.

Crop insurance is one mechanism for the management of the risks associated with random yield shocks. Wide swings in farm income can result from variances of weather, yields, prices, government policies, global markets, and other factors. Managing risk is an important aspect of the farming business, and crop yield and revenue insurance is one of the tools used to manage risk. Producers of specific crops can purchase insurance policies at a subsidized rate, under Federal crop insurance programs. These insurance policies make indemnity payments to producers based on current losses related to either below-average yields (crop yield insurance) or below-average revenue (revenue insurance). Farmers sign up for insurance before planting, but usually pay premiums after harvest.

Several types of crop yield and revenue insurance are available. Each has some unique features.

Yield coverage levels are based on a producer's expected yield, which is calculated from the farm's actual production history (average yields over the last 4 to 10 years). The farmer selects a yield coverage level, ranging from 50 to 75 percent of average yield (up to 85 percent in some areas), and an indemnity price, ranging from 55 to 100 percent of the crop price established annually by RMA. If the harvested yield is less than the insured yield (i.e., less than the yield coverage level), the farmer receives an indemnity based on the difference between the actual yield and the insured yield. The total indemnity equals these yield shortfall times and the indemnity price times acres are insured.

Revenue Assurance (RA) coverage is similar to CRC, with two differences:

Income Protection (IP) provides protection similar to RA with the base price option, but requires producers to use "enterprise units." This means that the policyholder must insure all acreage for one crop in a county under a single policy (rather than having separate policies for different landlords, land sections, etc.). Premiums are lower, but IP requires that losses be across a wider area before an indemnity is paid.

Taiwan's local climate is greatly influenced by the East Asian monsoon. Massive Rainfall and strong wind are mostly from tropical cyclones (typhoons) in summer and cause serious losses in the agricultural sector. Although the Council of Agriculture has provided natural disaster loss subsidies to the farmers, the subsidies are hardly enough to satisfy the farmers.

In its most fundamental form, a Crop Insurance Plan will pay producers an indemnity in the event that their yields fall below a pre-determined level. Construction of such a seemingly simple contract requires representation of a number of important parameters. Accurate measurement of such parameters may be quite complex, especially in cases where limited knowledge of the risks or levels of protection being provided are available. The challenges associated with accurately measuring the parameters that determine liability, premiums, indemnities and other components of a crop insurance plan are often complicated and may require the application of rather complex actuarial methods, models, and assumptions in order to design and rate viable insurance contracts.

The purpose of this paper is to provide Bank staff and policy makers involved in crop insurance programs in developing countries with an overview of the latest developments in the modeling of crop yield risk and, to some extent, crop revenue risk, and to discuss how these modeling concepts affect the design and the rating of crop insurance.

This study used the data of rice yield from the Council of Agriculture in Taiwan. This paper focuses on the yield loss from typhoon. Meanwhile, the authors also considered the correlation of transaction price and yield in this model.

In contrast to traditional insurance, agricultural profit insurance seeks to protect the expected income. On the application of Bull call spread, this paper utilized Monte Carlo method to simulate premiums of agricultural profit insurance on different limit levels of claims. The results of our study indicate that the estimated premiums decrease with higher lower limit and increase with higher upper limit. The increase of relationship between price and cost will lead to a decrease of premiums.

Moreover, one factor in determining the amount of the disaster payment is the level at which the producer is participating in crop insurance: the higher the crop insurance coverage level, the greater the disaster payment. Whether potential disaster program payments create sufficient incentives to purchase higher, and more expensive, crop insurance coverage will depend on producers' individual situations. Based on the latest developments in agricultural risk modeling and on the U.S. experience, this paper reviews each of these concerns and identifies possible solutions and recommendations that may be commonly used to address each issue.

This paper is organized as follows. Crop insurance references are presented in Section 1 Section 2 examines the research data and methodology. Section 3 examines the empirical analysis. Finally, the key issues are summarized in the conclusion.

A considerable amount of past work has examined the demand for crop insurance, with emphasis on understanding how differences in farmer characteristics and risk positions impact the use of, and willingness to pay for, specific forms of crop insurance (e.g., Goodwin, Wang et al.) Goodwin and Smith (1995) reviewed the history and operation of the U.S. Crop Insurance Program. The European Commission (2001) provides a description of Crop Insurance Programs in European countries, Canada and Japan. FAO (1991) describes several Crop Insurance Programs in developing countries (e.g., Chile, Cyprus, Mauritius, Philippines). Stokes et al., (1997) make use of a fundamental paradigm of asset valuation and stochastic calculus to develop a theoretical model to value crop insurance. Duncan and Myers (2000) developed a new insurance model that shows how catastrophic risk affects the nature and existence of agricultural insurance market equilibrium. Catastrophic risk is shown to increase premiums, reduce farmer coverage levels and, under some conditions, lead to a complete breakdown of the agricultural insurance market. Optimal protection is not provided by available U.S. agricultural insurance contracts and may include combinations of profit insurance, yield insurance, futures, and options contracts (Mahul and Wtight, 2003). Sherrick et al. (2004) analyzed farmers' decisions to purchase agricultural insurance and their choices among alternative products. The influences of risk perceptions, competing risk management options as well structural and demographic differences are evaluated. Chambers (2007) proposed a method for estimating a farmer's stochastic discount factor that is independent of his or her risk preferences, and shows that that stochastic discount factor is appropriate for calculating a farmer's willingness to pay for an agricultural insurance product. Agricultural insurance is important for most commercial scale agricultural producers to protect against the consequences of poor agricultural performance or price declines. There is no complete program and implementation of agricultural insurance in Taiwan yet. Many countries in the world have implemented agricultural insurance to a considerable degree. Protection against climate changes has been an important issue in agriculture. Traditionally, the commercial insurance market provides protection against insurable risk. However, the agricultural risks may not be completely insurable (Ozaki, Goodwin and Shirota, 2008). Turvey (2009) presented an option model to estimate livestock insurance premium.

On the behavioral side, moral hazard and adverse selection have also been incorporated into explanations of the performance of insurance products and into empirical and theoretical studies of crop insurance demand (Goodwin and Smith, 1996). These studies have mainly addressed the impacts of farmer risks on participation and coverage election decisions, and have identified the implications of asymmetric information on participations and performance of Federal Crop Insurance Corporation (FCIC) programs. The study examined factors that influence product selection, but still focus on measures of farmer-level risk characteristics as the variables to explain choices among competing products. Farmers' preferences for insurance product attributes remain largely unaddressed.

Data sources are divided into two parts, one for the farm price per kilogram and cost per hundred kilograms of riceyield from 1987 to 2011 and the other for the typhoon related yield loss. There are two types of yield costs, which are the direct yield costs plus indirect costs and the above costs with farmland rent and capital cost. Direct costs include seed, fertilizer, chemicals, energy, and labor (human and animal labor charges or mechanic fees). Indirect costs comprise farm facilities, machines and taxes. The second data source is for agricultural disaster (typhoon) loss from 2003 to 2011. The authors collect data from Agricultural Statistics Yearbook and Investigation report of Taiwan agricultural yield cost, which are published by the Council of Agriculture.

In this paper, the authors use financial model to design agricultural profit insurance as a risk management tool against price and yield risk for the sake of domestic agricultural producer.

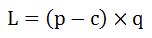

It is first assumed that the farm level operations involve the yield of rice. The net profits of per kilogram rice are given by

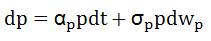

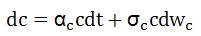

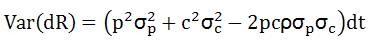

Where p is farm price and c is the yield cost per kilogram rice. Assume the change of p and c follows geometric Brownian motion as shown in equation (2) and (3).

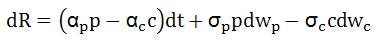

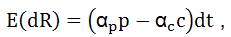

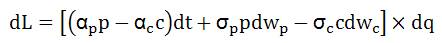

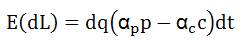

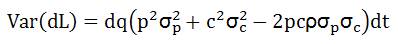

αp and αc are the drift rates and σp and σc are volatilities of price and cost. The terms dwp and dwc are Wiener processes. According to Ito's lemma the total possible change in net profits from price risk is shown in equation (4).

Insurance coverage should be offered at the whole farm level in order to stabilize the farmer's overall agricultural revenue. This global coverage focuses on losses that cannot be mitigated through diversification and avoids fraudulent claims.

The yield loss caused by typhoon is

Where q represents annual yield loss from typhoon. The change of yield loss can be written as,

Where dq is the change of yield loss that the typhoon causes.

The authors use aggregate loss model (collective loss model) to estimate the change of typhoon causeyield loss (dq). The frequency model is based on poisson process and the severity model is based on selecting appropriate distribution to describe the size of loss.

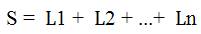

The aggregate loss, S, is defined by the sum of these losses:

If n, L1, L2,.... are the individual claims. L1, L2,.... are i.i.d., then S has a compound distribution.

n: frequency of claims; L: the severity of claims

The critical component to the analysis is the generation of the crop revenues Rj,i . Five thousand possible revenue outcomes were generated using Monte Carlo simulation. The venues are based on joint price and yield correlations and are net of any price, yield or revenue indemnities and the net cost of the indemnities.

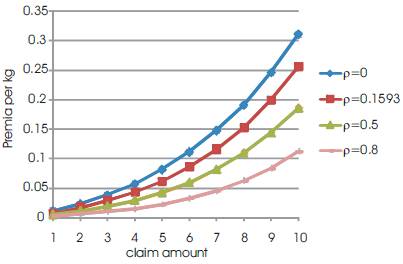

On the application of Bull call spread, this study utilized Monte Carlo method to simulate premiums of agricultural profit insurance on different limit levels of claims.

Bull Call spread

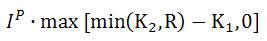

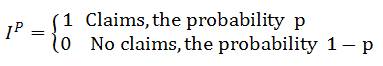

A bull call spread defines:

Where K1 is lower limit and K2 the upper limit.

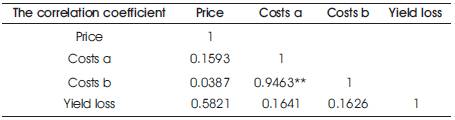

The insurance premium will be the expected discounted value of a bull call spread at maturity (T):

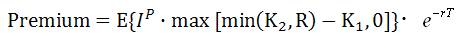

Table 1 shows the statistics of collected data about price, cost and yield loss under typhoon.

Table 2 shows the average typhoon caused loss of rice yield from the year 2003 to 2011.

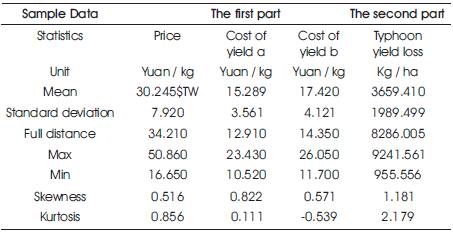

Table 3 shows the relationships among main variables and finds that there exist no significant correlation except two yield costs.

Under different risk scenarios, the authors establish 4 models to estimate agricultural profit insurance premiums. The statistics of simulated rice yield are provided in Table 4.

The results of premiums assessment using the models are presented in Appendix 1.

Table 1. Sample Data Statistics

Table 2. Average typhoon loss situations from 2003 to 2011

Table 3. Sample Correlation Coefficient

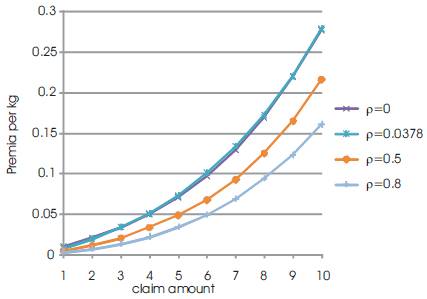

Figure 1 provides the trend of estimated insurance premiums of model I by bull call spread approach under different correlation coefficients. The figure shows that the premiums decrease with higher correlation coefficient and with lower claim amounts.

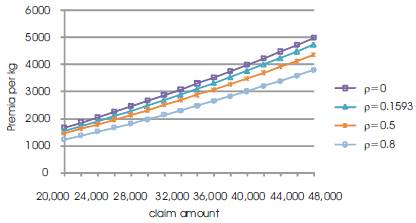

Figure 2 provides that model II has the same movement like model I.

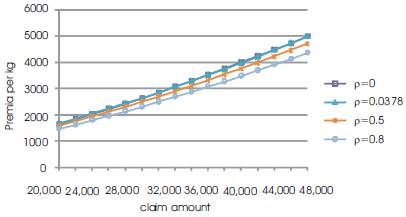

Figure 3 provides the trend of estimated insurance premiums per hectare of model III by bull call spread approach under different correlation coefficients. The figure shows that the premiums decrease with higher correlation coefficient and with lower claim amounts. Figure 4 provides that model IV has the same movement like model III.

Figure 1. Premiums of Model I by call spread approach with upper limit of 25

Figure 2. Premiums of Model II by call spread approach with upper limit of 25

Figure 3. Premiums of Model III by call spread approach with upper limit of 150000

Figure 4. Premiums of Model IV by call spread approach with upper limit of 150000

Managing agricultural profit risk is of critical importance for financial success by agricultural producers and a central theme of many government commodity and insurance programs. In this paper, the authors tried to establish agricultural profit insurance models as risk management tool against agricultural price risk and yield risk. Using available data from the Council of Agriculture in Taiwan, the models have been designed by bull call spread strategy to simulate profit insurance premiums with different claims limit. The results of our study indicate that the estimated premiums decrease with higher lower limit and increase with higher upper limit. The increase of correlation coefficients will lead to a decrease of premiums.

Finally, prior to any considerations regarding the contract design, one must investigate the demand for the insurance plan, i.e., willingness and ability to pay on the part of those targeted by the insurance plan. This issue has not been addressed in this paper and is left to subsequent work. An actuarially sound crop insurance scheme will fail if farmers have limited interest (e.g., because of risk management alternatives) and/or limited financial resources. This raises the tradeoff between actuarial soundness and effectiveness of the insurance plan for protecting against individual risks.

Future work should also address the complex relationships between farmers' preferences for crop insurance products, and their subjective beliefs about the risks faced. How well their beliefs correspond to actual yield risk could also be an important explanation of the use of crop insurance.