9983 crores were registered and the overall transaction

volume has grown to

9983 crores were registered and the overall transaction

volume has grown to  22525 crores during FY14 as

against

22525 crores during FY14 as

against  13033 crores during FY13 through BC channel.

13033 crores during FY13 through BC channel.In India, focus of the financial inclusion at present is confined to ensure a bare minimum access to a saving bank account without frills to all. Financial Inclusion effort should offer at a minimum, access to a range of financial services including savings, long and short term credit, insurance, pensions, mortgages, and money transfer at a reasonable cost. The purpose of this paper is to assess the role of business to SBI and to evaluate the business correspondent's performance and an insight into financial inclusion in rural areas. The importance of financial Inclusion arises from the problem of financial exclusion of unbanked people from the formal financial services across the world. State Bank of India achieved 100% coverage of its allotted unbanked villages under the Financial Inclusion Programme of the RBI with the help of Business Correspondents, finally to give an appropriate suggestion.

In recent years India has witnessed a high rate of economic growth, which has resulted in greater personal wealth for many Indians. However, a vast section of the society is still financially excluded; that is what, in India an effort has been made to achieve FI by using information and communication technology through a Business Correspondent (BC's) model.

The policy makers focused on financial inclusion in rural and semi rural areas of India mainly for three important needs.

The Third party agent banking was launched in 2006 in India with the intent of increasing the ambit of the formal banking sector. A business correspondence is an entity that acts as a teller in the bank and carries out a full range of transactions on behalf of the bank. The objective of Bcs was to reach all villages with populations more than 2000 and they get communication from the bank for their rendering services. RBI allowed all the micro finance institutes, registered NBFC'S post offices and individual's local grocery shops to function as BCs.

The functions of Bcs are as given below (i) identification of borrowers; (ii) collection and preliminary processing of loan applications including verification of primary information/data; (iii) creating awareness about savings and other products and education and advice on managing money and debt counseling; (iv) processing and submission of applications to banks; (v) promoting, nurturing and monitoring of Self Help Groups/ Joint Liability Groups/Credit Groups/others; (vi) post-sanction monitoring; (vii) follow-up for recovery, (viii) disbursal of small value credit, (ix) recovery of principal / collection of interest (x) collection of small value deposits (xi) sale of micro insurance/ mutual fund products/ pension products/ other third party products and (xii) receipt and delivery of small value remittances/ other payment instruments (Ganeshkumar, 2013) .

The research had been undertaken to analyze the business correspondent's contribution regarding financial inclusion. The research is analytical research and the information is obtained through secondary data i.e., news papers, research journals, articles and bank annual reports.

The methodology is similar to other global indices, such as United Nations Development Programme (UNDP's) Human development Index, that measure financial inclusion on the three critical parameters of basic banking servicesbranch penetration, deposit penetration, credit penetration. 1. Banking and branch penetration is definitely the most critical parameter for measuring the depth of financial inclusion and is measured as the ratio of bank accounts and branches to the total population. The index uses parameters that focus only on the 'number of people' whose lives have been touched by various financial services, rather than on the 'amounts' deposited or loaned. 2. Credit penetration: it is measured as no of small borrower loan accounts and no of agriculture advances as defined by RBI to total population. Here, the micro credits are accessed by the small borrowers and the farmers are accessed the agriculture credit. 3. Deposit penetration: it measures the no. of savings deposit accounts to the population.

State Bank of India (SBI), with a 200 years history, is the largest commercial bank in India in terms of assets, deposits, profits, branches, customers and employees. The Government of India is the single largest shareholder of this Fortune 500 entity with 61.58% ownership. SBI is th ranked 60 in the list of the Top 1000 Banks in the world by "The Banker" in July 2012 and the bank plays lead bank role in 9 states and 1 union territory under financial inclusion plan. Apart from pursuing various goals under commercial banking and mandated priority sector lending activities, the Bank is also contributing to other CSR activities. The Government has allotted 1369 villages to the Bank all over Andhra Pradesh, having over 2,000 populations, for coverage under financial inclusion. Of these 1369 villages, 35 villages are getting the services under Brick and Motor branches, 162 villages will be covered under the Banks on the bikes / Branch model and the balance 1,157 villages will be covered by Business Correspondent (BC) model. Finally, 15 villages are covered by the Banks on wheels.

The banks are offering various technology enabled products through Business correspondent channel such as Savings bank, FlexiRD, STDR, Remittance& SB-OD facilities. Multiple IT enabled channels for Financial Inclusion include SBI-Tiny card, Kiosk banking, Mobile Rural Banking, Cell Phone Messaging Channels.

SBI-Tiny card is the one of the financial inclusion products for the unbanked people. Under Financial Inclusion, “A Little World” are actively involved in producing a mini banking system called “SBI Tiny “reaching beneficiaries at the door step. For this programme, SBI will tie up with NGOs who will play the role of (CSP) customer service providers or local branch. 14 lakhs of customers have been enrolled during FY2013 and the cumulative customers are more than 76 lakhs.

The Bank's own technology initiative operated at internet enabled PC (Kiosk) with bio-metric validation at 20,178 Customer Service Points (CSPs), covering 83 lakhs customer enrollments has been rolled out in 31 states and 479 districts during the Fy1.

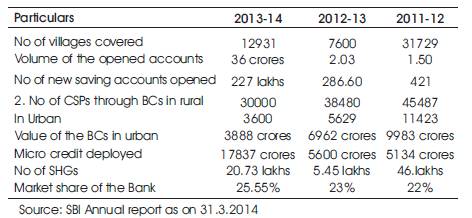

Table 1 clearly shows that, the bank has achieved the

100% coverage in 31729 villages during the FY14 and the

cumulative coverage has gone up to 52260 villages. The

bank opened new accounts under savings bank account

421lakhs which were 46.7% higher than 286.60 lakhs

accounts and the volume of the accounts are 1.50 crores

against 2.03 crores which simplified the KYC Norms.

During the FY14, 226 lakhs of remittance transactions for

9983 crores were registered and the overall transaction

volume has grown to

9983 crores were registered and the overall transaction

volume has grown to  22525 crores during FY14 as

against

22525 crores during FY14 as

against  13033 crores during FY13 through BC channel.

13033 crores during FY13 through BC channel.

The bank sets up 45487 Business Correspondents- Customer service Points through alliances both at

National and Regional level in rural areas, whereas in

urban 11,423 outlets have been set up which cater to the

requirements of migrant labourers and vendors. The

cumulative coverage has gone up to 1, 13,967 in rural

and 20652 in urban during the FY2011-14. 4.46 lakhs SHGs

credit linked to the credit deployment of  5134 crores

with the market share is 22%, while the cumulative SHGs

were 30.64 lakhs during the FY 2011-14.

5134 crores

with the market share is 22%, while the cumulative SHGs

were 30.64 lakhs during the FY 2011-14.

Table 1. Bank achieved 100% coverage during Fy14

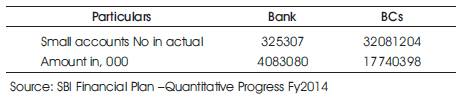

Table 2 depicts that the bank opened the number of saving accounts within one year in different modes. The BCs’ opened Basic Saving Bank Accounts (BSBDAs) have grown to 3,20,81,204 when compared to the bank opened accounts 32,25,307 and the amount was 17,740,398. BCs actively performed to increase the premier banking customers in the financial inclusion plan. OD Facility availed in Basic Saving Bank Accounts (BSBDAs) 6866 and the amount was 11316-51.85%.

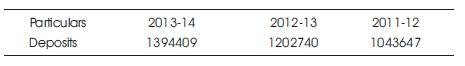

The bank deposits rose by 15.94% to 1394409 crores over the previous year's level of 1202740. Due to higher growth as compared to the industry in All Scheduled Commercial Bank (ASCB) deposits increased by 11BPS to 16.57% in March 2014.

SBI introduced the Mobile Platform based on the bank's

own technology and it is inexpensive mobile handset. The

bank is the market leader with the market share of 57%

transactions volume and 17% share in terms of value.

During the FY2013-14, financial transactions worth  3763

crores were executed through the mobile banking

services resulting in an income of

3763

crores were executed through the mobile banking

services resulting in an income of  6.43 crores.

6.43 crores.

Table 2. No. of savings account opened by the Bank

Table 3. Banks deposits

This is a cost effective model, working on simple phones and well secured through PIN/Signature. It covered 2025 CSPs outlets across 50 districts in 12 states during the FY2013.

The bank has established linkage with 69749 villages through 34064 CSPs in Hub and Smoke Model for scouting application from customers residing in remote unbanked areas and bringing them into the banking fold. A loan repayment facility has also been enabled at 31919 BCCustomer service point outlets.

SBI is the first bank to use National Payments Corporation of

India (NPCI) Aadhar Payment Bridge System(APBS) for

transferring LPG subsidies based on Aadhar Number and

as a sole sponsoring bank for LPG transactions which are

processed centrally for Oil Marketing Companies over

8.98 crore transactions amounting  5393 crores

processed. Therefore, overall 1.36 crore accounts are

linked with Aadhar across the country.

5393 crores

processed. Therefore, overall 1.36 crore accounts are

linked with Aadhar across the country.

With a view to facilitate transactions through alternate channels, the bank has issued 24 laks ATM Debit cards to FI Customers.

The main objective of FLCs was creating financial awareness, importance of savings and advantages of savings with banks, benefits of borrowings from banks. SBI sets up 169 FLCs across the country.

Leveraging wider reach achieved through its 762 branch network, SBI Life has systematically brought large rural areas under insurance. The company has sold 23.4% of the total policies in this segment during FY2013-14. A total of 79463 lives covered by SBILIFE are from the under privileged social sector.

Bank has entered into 14 new corporate tie-ups for driving growth, major being PepsiCo (KCC), Rallis India (KCC), ITC Ltd (KCC) and the National Bulk Handling Corporation (Warehousing receipt financing).

The bank received wider attention and appreciation in various fields and garnered highest no of awards in CSR Achievements during the FY13-14.

Other prominent awards conferred IPE BFSI Award 2013 for Best CSR Practices. India's Most Ethical Companies Awards 2013 for Ethical Companies in Banking. Asia Green Future Leadership Award 2013 for 'Best Green Service Innovation'. My FM Stars of the Industry Award for excellence in Banking Public Sector Unit (PSU) 2013. News Ink Legend PSU Shining Award 2013. ABP News BFSI 2013 for Best CSR Practices Award. ABP News Global CSR Excellence & Leadership Award for Organizations with best CSR Practices. Blue Dart – Global CSR Excellence & Leadership Award for Best use of CSR Practices in Banking and Financial Sector. Global CSR Excellence & Leadership Award 2013.

SBI has turned into the third-largest employer in India among the listed companies after Coal India Limited (383,347) and Tata Consultancy Services (226,751). More than 67 per cent of its 15,869 branch network is in rural and semi urban areas. In the last four years, the bank has set up more than 45487 Customer Service Points (CSPs) of Business Correspondents (BCs) to increase its outreach. The bank has already reached out to more than 1 lakh unbanked villages.

The bankers should focus more on the Business correspondents, as they can assist in providing the basic as well as other banking services to the vast section of the large rural poor.

Fund high quality BC entrepreneurs with soft loans and demand rapid outcomes which are large, sustainable and scalable. Allow performance based bonuses for employees of BCs in order to keep the talent level high. Allow BCs to pay employees a market competitive base salary.

Indian banks will have more opportunities in the area of financial inclusion, rural banking and mobile banking in their quest for a new banking paradigm. Financial inclusion is an ongoing process. It is a big project which requires team efforts of all the stake holders – the Government, financial institutions, Business correspondents and the regulators, the private sector and the community at large. Finally, this is a powerful channel and the countries have ensured that vast segment of the population has been covered in BCs and the country easily gets the capital formation and enhances the subsidies through BCs channel under financial inclusion plan. This is only possible by all the stake holders' commitment, dedication and passionate involvement. Financial inclusion can empower even the poorest person and bring about a dramatic change in his fate.