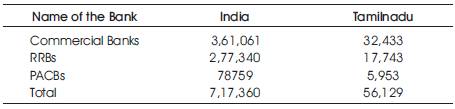

Table 1. SHG'S Linkage With Banks The Scene In Tamilnadu (2008)

The ultimate motto of every SHG is to create the habit of savings among the members who belong to really poor community. In every weekly meeting the members are encouraged to save to the possible extent. The members may be having the practice of saving weekly (or) monthly. The possibility of increasing the savings is usually discussed in their meetings mostly in consultation with the member. Instead of saving a particular amount only, some members may prefer to save more amount as they prefer. But it may be resolved that no interest will be given on the additional savings. The members who have failed to pay savings amount in the group meeting regularly, may be charged a fine from the fourth year of forming the group. The members may like to get a part of the interest earned by the group annually. The interest may be to the member in proportion to their savings. This study shows an overview of the savings and lending pattern of self-help groups in Coimbatore district.

Women are now seen as economic actors with a particularly important role to play in the efforts to reduce poverty. It is accepted that their poverty and non access to various productive resources is related to their gender. It is necessary for programmes specially targeted for women to be emphasized. As a result of the poverty alleviation scheme, such Integrated Rural Development Programme (IRDP), Training of Rural Youth for Self- employment (TRYSEM) and Development of Women and Children in Rural Areas (DWCRA) have been initiated [Abbas Manthiri, 2004].

Empowerment programmes for women have been found to be successful in improving their status in family and society, while giving a feeling of self - worth and esteem. The Tamilnadu Women Development project (TNWDP) taken up for implementation under the name of “Mahalir Thittam” covered about Ten lakhs poor women of the state in the year 1997- 98 (Abbas Manthiri, 2004). This scheme is intended to promote economic development and social empowerment of poor women through network of Self Help Groups (SHGs) formed with active support of NGOs ( Non Government Offices).

Self Help Groups are voluntary associations for the poor who come together to improve their socio- economic conditions. They are informal groups, which operate based on the principles of Self Help mutual trust and Co-operation.

NABARD defines SHG “as a homogeneous group of rural poor, voluntarily formed to save whatever amount they can conveniently, as funds of the group to be lent to the members for meeting productive and emergent credit needs.” In order to achieve the independent movement of Rural people, with reference to improve their socio-economic status, the self help groups have been formed. The main purposes for starting Self Help group are,

The SHGs collect from its members a savings amount weekly (sometimes monthly). Weekly savings are encouraged as it is easier for an SHG member to save during the week and pay the amount. The Animator has to enter the details regarding the savings in the cash book, savings ledger, and individual savings Accounts, from time to time. The amount collected from the members is to be deposited in the bank on the same day or on the next day. All the members are encouraged to go to bank for depositing the savings on rotational basis. Every group has to fix the maximum amount of cash in hand and to whom the cash is to be given. The cash also has to be kept on rotational basis.

The following are the objectives of the study.

This study is made from the point of view of the SHGs regarding savings pattern, internal and external lending pattern of SHGs, problem faced while making savings, and also in getting internal and external loan from banks.

It is an empirical study based on survey method. The data have been collected both from primary and secondary sources. Primary data were collected from the Animators and Members of SHGs through interview schedule. Secondary data were collected from Journals, magazines, Annual reports etc.,

The present study is based on random sampling, and 150 respondents were selected. This study have been considered to be effective to analyze the savings and lending pattern of SHGs.

'Savings First, Credit Later' should be the ultimate motto of every SHG member. The SHGs collect from its members a savings amount weekly/monthly. Weekly savings are encouraged as it is easier for an SHG member to save during the week and pay the amount. Six months time is the minimum time required to have the savings, and SHGs can lend the savings internally to its members. The savings amount available for internal lending will be about Rs.5000/- Rs.6000/- or Rs.12000/- respectively. At the time of formation of the first SHG, the members were not able believe that they being so poor could save at all. Women have proved that they could actually save, from the expenditures they make every day.

The savings habit of SHGs eliminates dependence on moneylenders and enhances confidence. The success of the MATHI is the promptness with which the women pay their weekly savings, despite the difficulties associated with it. Savings have not been without problems and difficulties. Although it is voluntary in theory, each member must pay weekly or monthly , the amount that the group has decided on. Initially, the women found it difficult to pay as they paid it from their income. If women did not have an income of their own, then it was more difficult. slowly they learnt to pay it from their expenditures. Recurring drought in Tamilnadu has made it difficult for those who depend exclusively upon farming for their livelihood to pay in their savings weekly. This proves the commitment the women have developed towards SHG.

The SHG lends its members from the amount saved and deposited by its members with the SHG, which is known as internal lending's, and commences after six month of savings. The saved amount is collected on a weekly basis from the members and is deposited the next day in an account opened by the group in a nationalized bank. The installment repayment of the loan along with interest is collected on a monthly basis and this is also deposited in the bank. The group, after estimating the loan requirement from its members, passes a resolution, withdraws the amount to the members. The loan is required by the SHG members to pay and be relieved from ' kandhu vatti,' to pay school fees for children, to pay for medical expenses due to sickness, to take back the farm land under mortgage, to meet household food expenses or other family expenses, to do business on vegetables, dry fish, petty shop, contract work, cycle shop, growing mushrooms, to purchase goat, cow carts, to deepen well etc., (Chitra.G, 2005).

The amount borrowed under internal lending system ranges from Rs. 500/-to 2000/-. A few borrowings are even more than Rs. 5000/-. The repayment is according to the amount borrowed, and it is generally five to ten monthly installments, (Gariyali. G.K., Vettivel S.K., 2006). The repayment capacity is assessed first before lending. The internal lending carries interest. The interest charged by the SHGs varies for different purposes and between districts. The interest charged ranges from 24 to 36 percent per annum i.e., double or treble the rates charged by the regular bank, which will make the borrowers return the loan back to the group quickly. Broadly, the interest charged is as follows:-

Some groups do not differentiate between economic and non economic activities and charge 36% on all advances other than for the purposes of education or health. The interest is charged on a reducing balance. (Komala. K, Aiyanna K.V. and Chikkarangaswamy, 2010) The SHGs also earn interest when they relent to the members the loans, they take from the banks. The SHGs take the loans from the banks at 12% interest and lend to the members at 24 or 36% so they make a profit of 12 or 24%p.a. The interest earned out of internal lending is used in different ways. Primarily, it is added to the savings and lent. The groups' unexpected expenses are paid from this amount. The amount is used to pay for the annual excursions, that the group undertakes annually. It pays for the uniforms for the group members. In respect of a few groups the interest has been divided among the members, according to the savings of the members. The activity of savings and credit makes an SHG function as a mini-bank.

The linkage with the bank commences when the SHG opens an account with the bank and deposits the weekly savings. The SHGs are on probation for months to prove themselves before they can become eligible to get a loan from the bank. During this time, the SHGs make weekly deposits of their savings. The SHGs become eligible for a loan after they are rated or graded about their performance. The banks have sanctioned direct credit linkage in the ratio of 1:2 or 1:4 to the savings amount.

A review of the development of SHGs in India reveals that the existing formal financial institutions have raised to provide finances to landless marginalized and disadvantaged groups. The experiences available in the country and elsewhere suggest that the SHGs are sustainable, have reliability, stimulate savings and in the process, help borrowers to come out of the vicious circle of poverty (Lakshmi.R, 2010).

The Indian micro - finance is dominated by Self Help Groups and their linkage to banks, with the launching of NABARD pilot scheme, and gained concepts like self-reliance, self-sufficiency, and self help at its core loans, under micro-finance programmes with over two million women. (Madhusudan Ghosh, 2012).

The following are the review of literature which is based on the previous weeks on the same title.

Sen Manab, (2002), in his work “Self-Help Groups and Micro Finance: An alternative socio-economic option for the poor” has undertaken a study in Noida district and has found that individual loans are mostly used for productive and consumption purposes, and the interest rate charged on individual loans are generally high to cover expenses of SHGs including the risk premium. The rate of recovery is also found to be very high, compared to the rate of recovery of formal institution system, and group development has been an instrument for change in quality of life of the poor people.

Annual Report of NABARD, (2005), studied the impact of microfinance on the living standards of the SHG members with the objective of analyzing the betterment of household by gaining access to microfinance and to find out how for the SHG bank linkage programs has lightened the burden of life for the average member of a SHG. The study covered 223 SHGs spread over 11 states with 560 respondents. The positive results identified by the researcher were, wholesome changes in the SHG member's standard of living, in terms of ownership of assets, increase in savings, income generating activities and income level. The study concluded that the involvement of members in the group have significantly improved their self confidence. The feeling of self worth and communication with others, improved through SHG formation. Group members were assertive in confronting social evils and problem situation, resulting in reduction of family violence.

Malaisamy, and Srinivasan, R., (2007), in their study “An economic appraisal of repayment and overdue position of self-help groups and PACB beneficiaries in Madurai district, Tamil Nadu”, have analyzed the repayment and transaction cost in self-help groups(SHGs) in rural areas vis-à-vis the co-operatives functioning in Madurai district of Tamilnadu. The results have found that majority of the members of PACBs availing loans have been willful defaulters which has not only denied them future loans but also affected the regular repayers. This tendency has not been observed in SHGs. A comparison of overdues of SHG beneficiaries with those of co-operatives shows that the latter had a high level of overdues (Rs.4,884) per household as compared to the former (Rs.1,012). The regression analysis reveals that 53 per cent of the variation overdues as the position has been explained by debt-asset ratio, educational level of the beneficiaries and membership of SHGs due to high interest charges as compared to the co-operatives.

Sarker, Debnarayan, (2010), in their study, “A study of SHG-NGO and SHG-Non-NGO models of rural micro financing in West Bengal”, studied the working of SHGs financed by a SHG-NGO, the Tajmahal Gram Bikash Kendra (TGBK), an agency of Rastriya Mahila Kosh in Howrab district of the state. In a comparative study of SHG-PACs model which points out that 50 per cent of the SHGs are credit linked, 92 percent of the total members are women and about 89 percent of the members belong to the Schedule Castes and Scheduled tribes. He said that micro financing of SHG-NGO model is not only more popular but productive, in terms of mobilization of savings and disbursement of credit. He suggests that there should be a change in the strategy of SHG-non-NGO model of micro financing to bridge the gap between savings-linked SHG and credit-linked SHG, and to increase the supply of credit substantially with the increase of SHGs in the state.

From Table 1 it is clear that in TamilNadu 56,129 SHGs have linkage with banks as at the end of March 2008. The SHGs had linkage with all the three sectors namely, commercial banks, the private and public sector, the Regional Rural through the District Central Co- operative Banks of the districts. In TamilNadu out of 56,129 SHGs, 32,433 are assisted by commercial banks, 17,743 and 5,953 SHGs are assisted by RRBs and PACBs (through respective CCBs) respectively. Figure 1 shows the SHG'S Linkage With Banks In Tamilnadu (2008).

Table 1. SHG'S Linkage With Banks The Scene In Tamilnadu (2008)

Figure 1. SHG'S Linkage With Banks The Scene In Tamilnadu (2008)

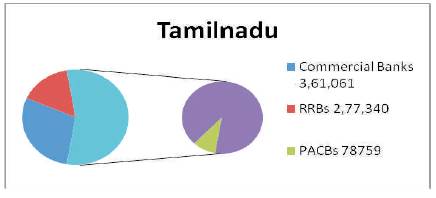

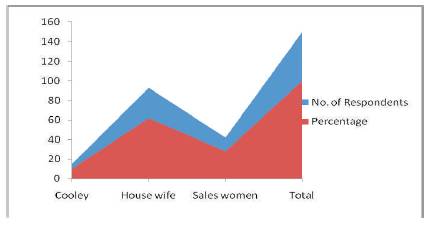

It is observed from Table 2 that before forming a Self Help Group, more than half of the respondents (62 percent) belonged to saleswomen category and the remaining belonged to Cooley category. Many housewives are willing to form SHGs, since they are the real sufferers in the family. They started to realize that they could earn efficiently through SHGs. Figure 2 shows the Status of Members Before Forming SHGs.

Table 2. Status of Members Before Forming SHGs

Figure 2. Status of Members Before Forming SHGs

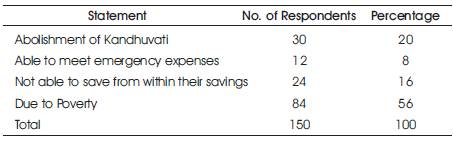

Table 3 shows that out of 150 respondents, 8 percent of respondents opined that they are able to meet emergency expenses. And 56 percent of respondents opined that due to poverty, they have become members of Self Help Groups. It is clear that a person may not only have a single reason, but may have varied reasons to be an SHG member. Figure 3 shows the Reasons for Joining As Self Help Group Member.

Table 3. Reasons for Joining As Self Help Group Member

Figure 3. Reasons for Joining As Self Help Group Member

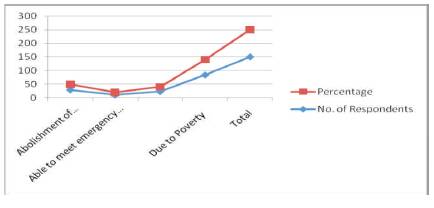

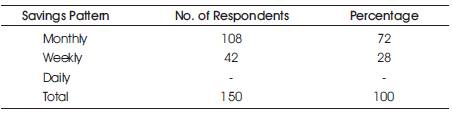

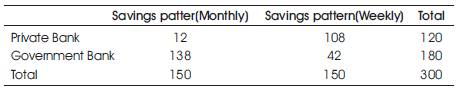

From Table 4 it is clear that nearly three-fourth of the respondents have been following monthly saving pattern, where as, 28 per cent follow the weekly savings pattern. Most of the respondents prefer to have monthly savings, since it will be a convenient one for them to save. But at the same time the members should be encouraged to have weekly savings in order to avoid unnecessary expenses by them. Figure 4 shows the Savings Pattern of SHG Respondents.

Table 4. Savings Pattern of SHG Respondents

Figure 4. Savings Pattern of SHG Respondents

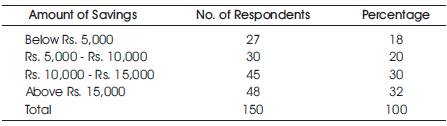

Table 5 shows that majority of the respondents ( 32 percent) have saved earlier. 30 percent of the respondents are able to save from Rs 5,000 to Rs. 10,000 and 18 percent of the respondents are coming under below Rs. 5,000. Figure 5 shows the Amount of Savings made by SHG Members.

Table 5. Amount of Savings made by SHG Members

Figure 5. Amount of Savings made by SHG Members

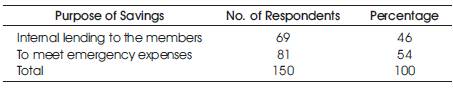

It may be observed from Table 6 that more than half of the respondents (54percent) collect savings in order to meet the emergency expenses, because some respondents expressed their view that Internal Lending may lead to quarrel among the group members. 46 percent of (69 respondents) felt that the main purpose of savings is to have internal lending with the members to safeguard them from the money lenders especially Kandhuvatti groups. Figure 6 shows the Purpose of Group Savings By SHG Respondents.

Table 6. Purpose of Group Savings By SHG Respondents

Figure 6. Purpose of Group Savings By SHG Respondents

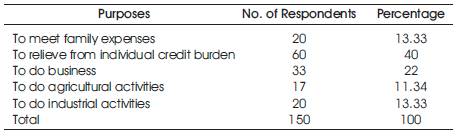

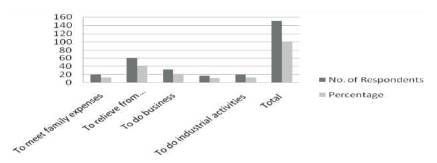

Table 7 shows that, out of 150 respondents 60 respondents (40 percent) were getting relieve from individual credit burden and 17 respondents(11.34 percent) were to do agricultural activities. From that we can clear those other purposes also. Figure 7 shows the Purpose of Internal Lending to SHG Members.

Table 7. Purpose of Internal Lending to SHG Members

Figure 7. Purpose of Internal Lending to SHG Members

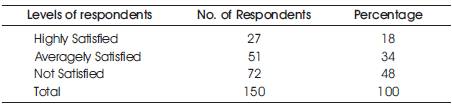

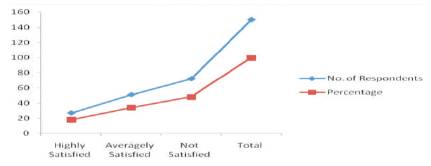

It is clear from Table 8 that only 18 percent of the respondents fall in the category of Highly Satisfied and 34 percent of respondents fall in the Averagely Satisfied category and the remaining 48 percent of the respondents fall under Not Satisfied category. Figure 8 shows the Opinions Regarding Benefits of SHGs.

Table 8. Opinions Regarding Benefits of SHGs

Figure 8. Opinions Regarding Benefits of SHGs

Chi-square is a statistical test commonly used to compare observed data with data we would expect to obtain according to a specific hypothesis. The chi-square test is used to test what scientists call the null hypothesis, which states that there is no significant difference between the expected and observed result (Kothari, C. R. 2002).

Chi – Square Test = (0-E)2/E

H0 – There is no significant relationship between Banks and Savings pattern of SHGs.

Degrees of freedom = (C-1)(R-1)

= (2-1)(2-1) = 1

Table 9 shows the Chi – Square for 1 degree of freedom at 5% level of significance is 3.841. The calculated value is more than the table value. Therefore the null Hypothesis is rejected and hence we can conclude that there is significant relationship between savings pattern and linkage with banks.

Table 9. Chi – Square Test of association between Savings pattern and Linkage with banks

The wealthy persons should come forward to donate enough fund to SHGs to strengthen their equity fund. This will help them not only to meet their emergency expenses but also to start their own ventures. Thus they may become small entrepreneurs. As “Unity is Strength”, the SHG members should have co-operation among themselves. Only the coordinated effort will make the members succeed in their life. By getting these qualities the women can be empowered. Definitely it will lead to an empowered society for an economically successful and challengeable life.