Table 1. Prior Communality Estimates Initial Communalities is always considered one in PCA method

The present study focuses on the current scenario of the frozen chain management system of Amul Ice Creams in Andhra Pradesh. This study focuses on all dimensions involved in the frozen chain management system like the company support, distribution network, relationship between distributors and retailers, promotional activities and many more. The concept of HADF (Humara Apna Deep Freezer) is also a part of the project which includes performing a purity check and analyzing the importance of HADF as a promotional tool in encouraging impulse buying at retail outlets.

The retailers and wholesalers of Amul in twin city of Hyderabad & Secunderabad has been taken as sampling unit. Convenience sampling method has been used for the sample size of 198. The collected information has been used for factor analysis followed by regression analysis using spss 13.0. There are five factors considered important for studying the frozen chain management system like HADF concept, Distributor & Retailer relationship, Promotional Activities, Company Support and association with Amul found from the analysis. Out of these five factors the first four have direct impact on the weekly sales of retailers.

With the help of research and technology development successful production of skimmed milk powder of buffalo milk was made possible for the first time in the world at such a large scale under the leadership of Dr V. Kurien in Anand. With the establishment of the Gujarat's Dairy Cooperatives there has been a significant social and economic change in the rural areas of our country especially farmers (Staal et al, 2006). Its main objective is to provide profitable returns to the farmers and side by side serving the interest of the consumers by providing quality products at affordable prices. Presently it is the largest food products marketing organization in India.

Amul's range of products include fresh milk, milk powder, ghee, curd, paneer, ice cream, cream, cheese, chocolate, Yoghurt, Shrikhand, sports health drink 'Stamina, Amul Pro and butter and many more. Beginning with fresh liquid milk, Amul has diversified its product portfolio from milk products to pizzas and desserts. The company made a successful entry in the ice cream sector as it was able to capture a major portion of the market share in short span of time targeting different segment of public. The Amul model comprises of three levels of the cooperative structure comprises of a dairy society, operates at the village level further affiliated to a milk union at district level which is in turn federated to a Milk federation at State level (Birthal,2008). This structure was formed in order to ensure smooth delegation of various functions like milk collection at village level, procurement and processing at the district level and finally marketing and selling at the state level (As told in U.S Department of Agriculture, Economic Research Service (ERS). 2007). Such a structure ensured elimination of internal competition as well as helped in achieving economies of scale, bringing about the White Revolution in India and played a major role in poverty reduction as well as generating employment.

Being a cooperative society they have always believed in maintaining a healthy relationship with its distributors and retailers. The company provides deep freezers to its retailers to store frozen products following certain schemes referred as Humara Apna Deep Freezers (HADF). manufactured by companies like Western, BlueStar, Voltas, Carrier etc .The HADFs differ in size, cooling, model as well as servicing facilities.

Primary objective of this study is to determine the factors related to supplies, distribution, storage and promotional activities of frozen chain management system and thereby analyzes their affect on the sales of Amul Ice Creams in Andhra Pradesh followed by Secondary Objective to analyze the efficiency of HADF (Humara Apna Deep Freezer) being used as a promotional tool in encouraging impulse buying at retail outlets.

The success of White revolution has helped India in a big way to achieve the position of largest milk producers in the world and glory of become 'DOODH KA SAGAR'. Being one of the most economical producers, the dairy industry forms an important sector of the country contributing close to one fourth of the Country's National Income (Balagtas & Kim 2007). Inspired by the success achieved in India by adopting this co-operative route, various other countries have also implemented the model of India's White Revolution. India tops the list of milk producers.

Currently growing at around 5% per annum in volume terms the market has been expanding in a very impressive way. The level of processing has increased to 22% in organized sector (Kumar, and Staal, 2010). Also the dairy exports have increased two fold against the last fiscal. India ranks first in respect of buffalo having around 57% of the world's buffalo population and ranking second in cattle and goats. The milk production has increased three times to over 80 million tonnes between a period of 1970-71 and 2000-01 showing an average annual increase of 4.5%. Inspite of being the largest producer of milk our country lags behind in terms of per capita availability. The present level of per capita availability is 214 grams per day which is much below the world average of 285 grams (Mishra and Shekhar,2011). The dairy cooperative societies are formed and controlled by the government in different parts of the country helping the farmers and small land holders to increase and improve their dairy production. Presently there are around 70,000 villages having dairy cooperatives incorporated within and these societies are federated into 170 district milk producers unions, gives employment to more than 72mn dairy farmers. Over the years, certain brands created by such cooperatives have become synonymous with quality, value and trust. In India the dairy market is quite huge and according to an estimate the unorganized market is around INR 470 billion whereas the processed organized market is only INR 10000 crores.

Indian summers are quite synonymous with ice creams. With the very onset of summer found numbers of colorful pushcarts on streets all ready to crunch thirst and heat with different variety, colors and flavors of ice creams. As per the Prevention of Food Adulteration (PFA) Rules of 1955, ice cream is defined as “a frozen product that contains not less than 10% milk fat, 3.5% protein, 36% total solids, and 0.5% of permitted stabilizer and emulsifier.” Ice cream market in India can be segmented into 3 different ways such as on the basis of flavors, stock keeping units (SKU)/ packaging, and consumer segments (Staal et al.,2006).

The market today has many flavors like Vanilla, Strawberry, Chocolate, Butterscotch, Mango, dry fruit flavors, fruity flavors, and some traditional flavors include kesar-pista etc. Inspite of so many flavors the Indian market is dominated by Vanilla, chocolate and strawberry constitute together share of around 70% followed by butterscotch. The ice cream sector growing at a healthy rate of 12%, due to strong distribution network and cold chain infrastructures and mobile vending units. Coming down to India, the industry is estimated to be of INR 2,000 crores The Indian market can be divided into the branded and the grey market where the first one is presently 100 million liters per annum being valued at INR 800 crores and the grey market is made up of small local players along with cottage industry players. As per a survey on the branded ice cream market in 2008-09, Amul ranked number one with a market share of 38%, and Kwality walls stood second with a share of 14%. However, Inspite of a decent growth rate, the industry is having a tough time due to low per capita consumption of approximately 300ml per annum which quite below the world annual average of 2.3 liters. Due to low consumption level of ice creams in India there is huge opportunity to attract a greater consumers segment. With the improving distribution channel there is a greater scope to reach remained untapped market so far.

Exploring the various possible opportunities the company has left no stones unturned to reach the masses. Communities on orkut, facebook and Sponsoring events like Amul Voice of India are some of the examples. The umbrella branding strategy of Amul has paid off really well. Because of such strong brand equity the company's advertising and marketing expenses never exceeded 1% of Amul's revenue. Company's creative billboards or campaigns like 'The Taste of India' have fairly managed to keep the brand feel alive and consistent along with the spirit of Indian culture in its contemporary manner. A chubby butter girl dressed up in a polka dotted dress is recognized as the Amul girl since 1967. This mascot was first used for butter only but in recent years the Amul girl is used in ad campaigns of different Amul products as well.

Being the largest food brand in India the company has a turnover of around US $1700 million (2009-10). Globally, Amul has also entered overseas markets like USA, Mauritius, UAE, Bangladesh, Australia, Singapore, China, Hong Kong etc. A creative but inexpensive advertisement is always capable of achieving its purpose of attracting customers, this is what Amul has always believed in. Since the brand has already developed a feeling of trust and positioned itself as a brand of high quality, the consumers don't hesitate to try different products launched under the umbrella brand (Brisbane et.al 2004). Amul has turned towards consumer advertising to target the middle class emphasizing on amul brand more rather than a single product also using institutional advertising. Amul is using different platforms such as Outdoor media: Billboards/Hoardings, Broadcast media: Television, Non-Broadcast media: Cinema, Print Media: Newspapers, Magazines and Internet for public advertisements of its products. The ads displayed on the hoardings are very creative, attractive and humorous. Apparently a new ad is created every week revolving around the latest things happening around in the country (Kumar & Staal, 2010).

The research concentrates on studying the relationship between retailers and distributors along with the HADF concept and their impact on sales. The parameters that help in determining their distributor relationship found from focus group discussion from AMUL retailers at twin city Hyderabad and Secunderabad. The research focus on Humara Apna Deep Freezers (HADF), provided by AMUL to distributors as well as to retailers for storage of AMUL products. These deep freezers are supposed to be 100 % pure which means that only Amul products should be stored in it. Some parameters included in the HADF study are Number of HADFs in each retail outlet, HADF Company, Model type, Filling Rate or Usage, Capacity, Servicing, Promotional Stickers, Schemes through open ended questions.

With the help of primary and secondary sources the research process of data collection has been carried out. Primary data collection is done by survey through a carefully designed questionnaire incorporating suitable scales of measurement of the variables identified for analysis. Before forming the final Questionnaire a pre-test study is done in order to determine which variables are to be included in the final questionnaire. Since the study aims at analyzing the relationships, so 'attitude' of respondents was measured on various dimensions. With the Likert scale, respondents indicate their attitudes by 5-point Likert Scale wherein individuals choose 1 from 5 alternatives: Conducting Personal Interview with distributors along with some retailers. Framing questionnaire using the data collected through interviews. Primary Data collection with an estimated sample size of 198 retailers covering both Hyderabad as well as Secunderabad city in Andhra Pradesh. Convenient sampling method has been used for the study. The collected data were coded into suitable format then Factor Analysis was done followed by Multiple Regression analysis.

The collected information are processed by editing and coding procedures, transforming raw data into information by applying required kinds of descriptive statistics in SPSS 13.0. Before proceeding towards factor analysis the co-relation among the variables has been measured through.

From the correlation matrix it has seen, none of the variables are very highly correlated. They are all moderately correlated. Variables HADF capacity and usage are moderately correlated (0.47) whereas Good quality product and new posters are not at all correlated (0.02).

It signifies that the variables are ready for factor analysis. The KMO value is 0.7588 which is greater than 0.5 so this it can be concluded that it is a successful and meaningful factor analysis (Boyd et al.,2002).

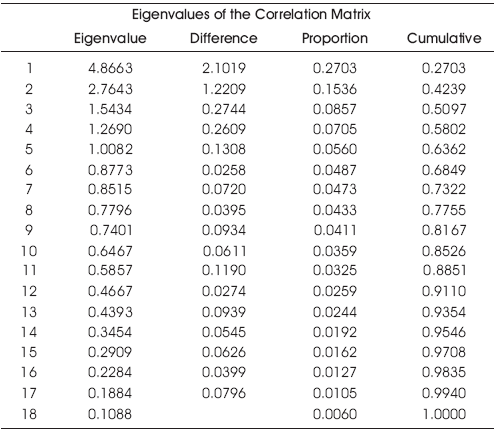

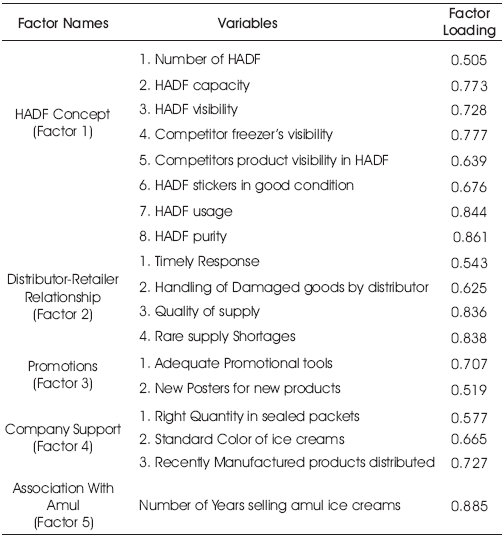

From the Communalities Table 1, it is observed out of 18 variables, 5 factors can be chosen as the eigenvalues are greater than 1. All of them together explain 63.62 percentage of total shared variance from the 18 independent variables. It was observed that there is high correlation between Factor 1 and HADF capacity (0.803). This table would only show the variance represented by the short listed factors.

Table 1. Prior Communality Estimates Initial Communalities is always considered one in PCA method

The majority of the other variables have values greater than 0.5. Thus, it can be said that the factors have substantially extracted the variance in all variables, therefore no variable needs to be dropped and the factor model is working well for them.

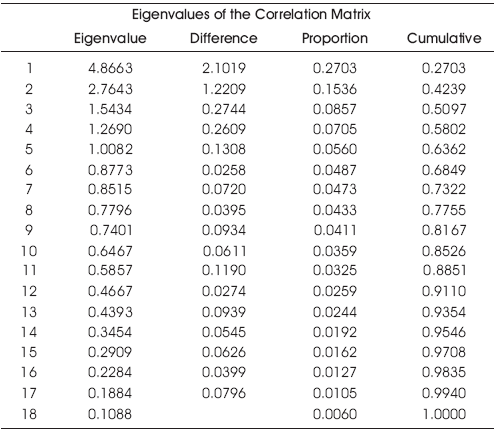

These 5 factors cumulatively explain 63.62 percent of the total variance. Therefore we limit the No. of factors to be 5 at this stage. The variables whose loadings are greater than 0.5 for a factor (in the rotated component matrix) are clubbed into that factor and are given a common name for identification. Here, the following are the various factors and the variables that constitute each based on this rule:

Table 2 shows five factors are important while studying the frozen chain management system of Amul's Ice creams. After doing factor analysis, the impact of these 5 factors on the weekly sales of retail outlets was analyzed through Multiple Regression by taking the same 198 observations.

Table 2. Factor Loadings with naming of the factors

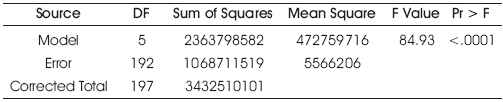

In the Table 3, ANOVA output has been explained with the F statistics is significant and as such the regression model that has been used is significant at a level of significance of 5% as Pr>F <.0001. This highlights the fact that a regression model can be run.

Table 3. Analysis of Variance

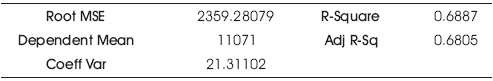

Table 4 shows R square value that indicates the variance explained by the model (i.e. including all the independent variables which are significant) in the dependent variable is 68.87%. Besides the adjusted R square is also very close to the R Square indicating that the number of irrelevant variables considered for the study is very few in number Boyd, et al., 2002).

Table 4. R Square Value

From the parameter estimate Table 5 and specifically from the Pr>|t| values it is clear that factor 1, 2, 3 and 4 are all significant at 5% level of significance. However factor 5 that is association with Amul is not a significant factor at 5% level of significance. Thus we can write the regression equation as follows-

Weekly Sales = .69871 Factor1 (HADF concept) + 0.09081 Factor2 (Distributor-Retailer Relationship) + 0.15497 Factor3 (Promotions) + 0.17552 Factor4 (Company Support) (standardized regression equation).

For a unit change in Factor1 there is a .69871 increase in the weekly sales. Thus HADF concept is definitely required for maintaining the sales of Amul retail outlets.

Also from the above regression it is clear that all of the factors are indicating towards a low multicollinearity as the VIF (Variance Inflation) values for these variables are less than the cut off value 5 and the tolerance values are also greater than the minimum cut off limit of 0.1.

From the summarized Table 6 it signifies Most Kirana stores go for keeping Amul ice creams. The left out stock is usually thrown away or used by the retailers themselves. Mostly retailers prefer opaque models and 17% of the retail outlets do not prefer to have HADF. Almost Every alternate day supplies are delivered to these retailers. Most of the retailers have not received their free ice creams as per the HADF scheme.

Mostly retailers prefer to have Western company's deep freezers. The retailers mostly complain about irregular servicing by the deep freezer manufacturers. Mostly retailers don't go for keeping competitors deep freezers except that of Kwality Walls. Amul lags behind its competitors mainly in the impulse range that is cone, sticks and cups. While considering the impulse range consumers usually prefer to for cup ice creams .Vanilla and Butterscotch are the most preferred flavors. The least preferred flavor is sitafal and coffee. Mostly retailers maintain safety stock for flavors like vanilla rather than for sitafal and coffee flavors. Retailers stock Amul's ice cream because they have trust in the company and also due high quality and good taste. The retailers who don't prefer to keep Amul products is due to less supply of varieties as well as due to low promotional activities.

From Factor Analysis, 5 factors were obtained from 18 variables, namely HADF concept, Distributor – Retailer relationship, Promotional Activities, Company Support and Association with Amul. Thus these 5 factors are important while studying the frozen chain management system of Amul. Again from Multiple Regression it was found that out of the 5 factors only 4 of them has an impact on sale of Amul ice creams. For every one unit change in promotional activity there is 0.15497 unit changes in Weekly Sales of retailers, for every one unit change in HADF concept there is 0.69871 unit change in weekly sales of retailers. Similarly Company support and Distributor-Retailer relationship also has an impact on the sales. Thus the company should give importance to these factors to improve their sales level.

Depending upon the type of store, different types of Amul ice creams should be stocked as per the target consumer. Mostly students drop down at Xerox store for short period of time so such stores should keep the impulse range of Amul ice creams. Impulse range is best suited for places like Cyber cafes. Ice cream parlors, Kirana Stores with whole range of Amul ice creams.

The company should try to capture untapped areas as well by bring up scooping parlors with adequate promotions (Juttner, 2005). Around 78% of the retailers prefer to keep Amul Ice creams because they trust the brand and customer feeling of faith in the shop. Even though ice creams are consumed mostly in summers, Amul keeps its sales up in the winter season as well. In the old city area of Hyderabad most of the retailers are very loyal to the company, even if they have a competitor's deep freezer still they stock Amul's product in it. During the field work it was observed that there were well educated retailers as well who after retirement from their actual job chose to start this business just to keep them engage. The company should attract such retired old people to open up small ice cream shops to boost its sales as well as benefit old people as well, can boost the company social marketing. So far there are only 5-10% of ice cream parlors out of all the retail outlets, so company should open up more joints to boost its sales.

The distribution vans don't always use refrigerators or deep freezers. Thus the shops receiving ice creams by the evening mostly get melted ones. Thus the distributors should make sure that deep freezers are used in delivery vans else the every single trip is of not more than 4 hours. Sometimes even the sealed boxes have less number of items as it is suppose to be. The company as well as the distributors should take care of this as this develops a feeling of distrust in the minds of retailers. They do not have timely delivery to retailers. Necessary steps should be followed in order to avoid damaging in first place. The Company should provide posters to the distributors on time and go for aggressive promotion for new products.

Due to variation in color, consumers doubt the quality of the product and avoid purchasing it. This should be kept in mind and the products should be manufactured with standard color and texture. The products should be packaged properly to avoid spilling. The products delivered are mostly half their shelf life. This kind of situation should be avoided by immediately delivering the recently manufactured products (Juttner, 2005). Flavors like vanilla and butterscotch have very high demand but the supply level are low comparatively. Almost 67% and 53% of consumers prefer to have vanilla and butterscotch flavors respectively. Necessary steps should be taken in this regard to meet the demand levels like increasing the production level of such products. Also increasing the varieties of ice creams will help in boosting the sales up. Retailer usually keep local cones which degrade the quality of the ice creams. The company can provide Amul cones to add taste and quality to its products. Around 51% retailers believe that Amul Ice creams lags behind its competitors in the impulse range that is cups, cones and sticks. The company should bring up this range in order to give a tough competition to other players.

Around 64% of retailers go for opaque models of HADF. The company should bring up schemes in order to encourage retailers to keep glass top models as Such freezers help customers see through top and get a better idea as well as create point of purchase (Balagtas and Kim, 2007). Since HADF is not for free, retailers often prefer to keep Kwality Walls deep freezers as they are for free. There are around 17% retail outlets that don't have HADF. The company should come up with attractive policies or schemes to make retailers keep HADF. Around 32% of retailers having HADF complain about irregular servicing by the HADF manufacturers, Company should improve on its service facility. The best way to tap the potential of HADF as promotional tool is to place it in such a manner that it attracts consumers. Around 28% retailers have complained about not receiving free ice creams at all as per the HADF policy and 26% have received only partially. The company should look into this matter and the schemes which have not yet been fulfilled should be made complete. This study helped measure the effectiveness of the vast distribution system the company owns and determined the important factors to be considered while analyzing the frozen chain system.

The research has helped in deciding the various important factors to be considered while analyzing frozen chain management of Amul. Also to what extent these factors have an impact on the weekly sales of the company was computed. This will help in making appropriate decisions keeping all the factors in mind. Various insights mentioned earlier were obtained through extensive field work which will help the company improve its distribution network and bring up better management. Also helps to analyze the various supplies, distribution, storage and promotion related factors affecting the sales of Amul Ice Creams in Hyderabad and Secunderabad. Studying the concept of HADF (Humara Apna Deep Freezer) is also a part of the study which includes performing a purity check and analyzing the importance of HADF as a promotional tool in encouraging impulse buying at retail outlets. Apart from this the study also helps to get an insight about the perception that a retailer holds for its distributor and what are the factors that affects his perception. The extensive field work helped in understanding the reasons behind the loyalty shown by the retailers towards the company. The survey will also help in identifying potential retailers who wish to stock Amul products.

No doubt the survey followed by some limitations ,absolute sales figures obtained from the survey through retailers may be inflated. Due to time constraint covering all retail outlets in the twin cities was not possible. HADF purity check has been done on the basis of the Interviewer's judgment level. An error may creep in because of unresponsive nature of certain retailers or tendency of people to answer the socially desired replies.

Even though the consumer eating habits have been changing drastically but still ice creams are considered as desserts or a side dish for Indian consumer. Increasing disposable income in the hands of the consumers as well as rise in the number of buyers preferring impulse segment is also encouraging market players to perform better. There are several challenges being faced the ice cream industry in India. Poor infrastructure, lack of proper cold storage and power supply issues in semi urban and rural areas are also of great concern to players who want to go for expansion. The players face competition not only from their immediate competitors but also from the other food industries.