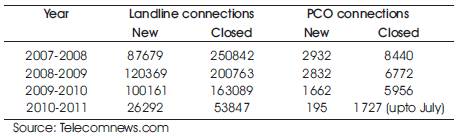

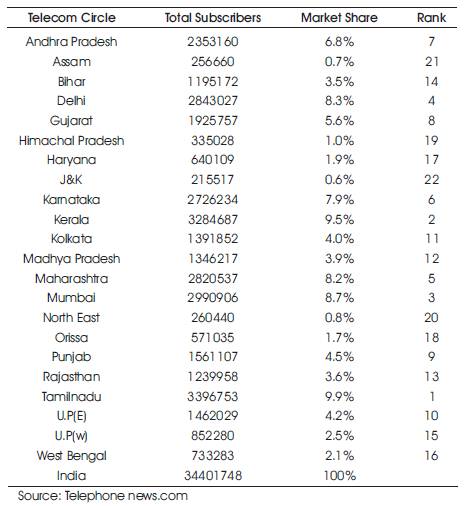

Table 1. New and closed BSNL landline connections in India during 2007-2011.

The Indian Telecommunications network with 203 million connections is the third largest in the world and the second largest among the emerging economies of Asia. Today, it is the fastest growing market in the world. The telecommunication sector continued to register significant success during the year and has emerged as one of the key sectors responsible for India's resurgent India's economic growth. Telecom sector accounts for 1 percent of India's GDP (Kashyap and Raut 2005). On opening up of telecom sector to private sector, private investment started coming in and it changed the entire paradigm of communication landscape in India in a matter of decade. Perhaps BSNL and its mentor central government could never anticipate that the change would be so fast and so radical that it caught BSNL unprepared. BSNL failed to keep pace with both changing customer demography and emerging technology. BSNL's forte landline has become a history within short span of time (John Wiley 1998). The mobile service providers have aggressively captured the urban and even penetrated into the rural market luring customers with attractive tariff packages targeting different strata of the society. An individual's perception of boosting his personality when he can associate himself with a branded mobile instrument with facilities starting from camera to radio has made many customers surrender their land line connections.

In the present scenario, the telecommunication is lifeblood for every business activity. The development of telecommunication infrastructure is likely to play a greater role in meeting the diverse needs of people and improving their quality of life through inter-linked development of many other sectors. Even in this industry there prevails a stiff competition between the service providers and tremendous popularity of mobile handsets in India, state own provider BSNL is now been faltered in its landline phones business with a steady decline in revenues, owing to the steep fall in its landline user base. It's the need for the hour to identify the reason for steep decline and to maintain sustenance market for the services (Rajamanickam, 2011).

Telephony was introduced in India in 1882. The total number of telephone subscribers in the country was 846.32 million as of March 2011. Total landlines customers was 34.73 million in March 2011 and Teledensity was 2.95. (TRAI Quarterly Report, 2011) 5The country is divided into several zones, called circles (roughly along state boundaries). In India landline service was firstly run by BSNL/MTNL and after there are several other private players too, such as Airtel, Reliance Infocomm, Tata Teleservices and Touchtel. Landlines are facing stiff competition from mobile telephones. The competition has forced the landline services for a steep decline (Gurusamy et. al 2012).

Bharat Sanchar Nigam Ltd. (BSNL) formed in October, 2000, is the seventh largest telecommunications company in the world providing comprehensive range of telecom services in India: Wireline, CDMA mobile, GSM Mobile, Internet, Broadband, Carrier service, MPLS-VPN,VSAT, VoIP services, IN Services etc. Presently it is one of the largest and leading public sector units in India. 7 The BSNL is the only service provider, making focused efforts and planned initiatives to bridge the Rural-Urban Digital Divide ICT sector. In fact, there is no telecom operator in the country to beat its reach with its wide network giving services in every nook and corner of country and operates across India (Muttur Ranganathan Narayana 2008).

Table 1. New and closed BSNL landline connections in India during 2007-2011.

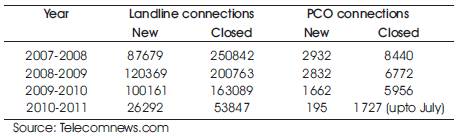

Indian landline telecom market ends May 2011 with subscriber base of 34.40 million. Due to cord-cutting trend about 0.15 million users disconnected their wireline connections resulting into negative monthly growth rate of -0.44% .Overall wireline teledensity stands at 2.88% (Urban: 7.19%, Rural: 1.02%). Urban to rural subscriber ratio is 75.19% to 24.81%. Going forward, wireline telephony is unlikely to witness any positive momentum mainly driven by increasing adoption of mobile phones among Indian consumers. Landline market is most likely to restrict in corporate & government offices and affluent households.10 BSNL leads Indian wireline telecom market with 72.3% share of overall subscriber base. MTNL which is another PSU focusing on metro markets of Delhi and Mumbai has 10.0% share. Bharti Airtel is the largest private wireline telecom operator with 9.6% market share followed by Tata (3.8%) and Reliance (3.6%) (Figure 1).

Figure 1. India Wireline Telecom Market Share May 2011.

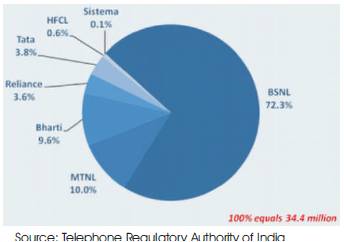

Tamil Nadu has highest number of wireline telecom subscribers with 9.9% share in India.12 Another South Indian state Kerala comes close second with 9.5% share followed by financial capital of India, Mumbai with 8.7%. Delhi ranks 4th with 8.3% share followed by Maharashtra at 5thposition with 8.2% wireline users. Top 5 markets accounts for 44.6% of total Indian wireline subscriber base indicating high degree of imbalance as far as penetration levels are concern (Table 2).

Table 2. Indian Landline subscriber base by circle during May 2011.

From Table 2, it is inferred that Tamilnadu has the majority of land line services and nearly 2.5 percent found in Kanyakumari district which is comparatively less. In order to maintain sustenance market and continue holding the first position in market share, customer retaining strategies should be developed for sustenance market.

Kathuria (2003) analyses that Indian telecom sector presents a picture of 'managed competition'. While the traditional public monopoly is ending, effective competition has been hard to achieve for a number of reasons. Under the given market-based approach and the current regulator y framework in place, the telecommunications industry has contributed to establish a 'new' sector in the economy driven by the IT/Software and IT enabled services.

Rajesh (2007) have investigated the rural telecom of Indian scenario. According to his views, till now it is government which was trying to reach the villages through various initiates, but the rural tele-density is very poor and can be improved only through the introduction of modern and suitable technology along with participation from the private operators. To address the issue of the urban and rural gap and reaching to the rural masses can be addressed by falling back on the Bottom of the Pyramid (BOP) marketing strategies as advocated by Prahalad (2004) and the 4 A's i.e., Availability, Affordability, Acceptability and Awareness (Anderson and Biliou, 2007, Kashyap and Raut, 2005). The BOP marketing strategies talk about aggregating the demand of consumers who have low purchasing power. The basic commercial infrastructure suggested by Prahalad and Hart (2002) for the bottom of the pyramid markets constitutes of four things, viz., creating buying power, improving access, tailoring local solutions and shaping aspirations. To overcome the difficulties wherein bigger villages can be targeted first, then the ones, which are near a small town and connected and last would be the remote villages.

Ravi Kumar et al (2008) stats that telecom industry is the most active and attractive in the service sector. Though the telecom industry is growing rapidly, India's telecom density is less than the world's average telecom density.This attracts private operators to enter into the Indian telecom industry, which makes the Bharat Sanchar Nigam Limited (BSNL) more alert to run its business and survive in the market.

Manjappa 2008 found out a positive relationship between concentration and pricing, whereas more competition of telecom service is associated with lower prices, which in turn, stimulated market demand. It is found out that concentration combined with an independent regulator is negatively correlated with telecom price performance, i.e., competition couples with independent regulation leads to more prices.

Sridev (1996) insist that the first step in customer analysis in the telecom sector is to identify the organization's customer segment and how well they are being served. In the telecom industry, the cream of the clientele is restricted to the top 10-20% of the subscriber base. The battle will be to gain control over this segment, which makes the maximum number of out-going calls and avails of specialized services. Other aspects of customer analysis involve the customer motivation and identification of unmet needs.

Rengarajan (2000) decides the pressure for the consolidation of the telecom industry is driven by the increasing customer demands, falling tariffs, fast changing technologies and shift in competitive strengths. According to his observation, the global telecom market is undergoing a paradigm shift and the market is expected to be dominated by agile players that can capture and retain customer base and run business profitably after catering to a ever increasing demand for higher bandwidths from the heavy usage segment. The telecom companies benefit their loyal customers and that too in terms of money to make it complete customer benefit strategy.

Pawar (2008) calls it Desirable Monetary Benefit Strategy. In his view, the customer may not in a position to command any strategy or decision making, but is the sense of gratitude that the telecom companies should possess and think from the point of view of the customers.

In the past three years, BSNL has lost six lakhs landline customers all over India and this reverse trend is not only restricted to home and office users only but the PCOs too. According to statistics, revenue collection from land line connections in the year 2008-09 was Rs.433.14 crores and it came down by 16 per cent in year 2009-10 to Rs.365.58 in the last fiscal. In fact, there is no telecom operator in the country to beat its reach with worldwide network providing services in every nook and corner of the country. Now the BSNL is crossing a crucial situation because of the technical advancement in the telecommunication sector and its survival is subject to some transformations. But, surrenders of land line and getting mobile connections are increasing every month. The BSNL cannot close its traditional tele services because it has a huge amount of investment on this line. So, the company has to retain its customers by offering concessions and introducing new liberalized schemes to the existing customers.

Descriptive type of research is used to find out the problems and challenges on BSNL landline services in Kanyakumari District. Stratified Random sampling technique is used for selecting the sample size of the BSNL landline users. The total population of existing BSNL users in Kanyakumari district is 81,894. Out of this a sample of 0. 2 percent ie. 164 samples is taken as representative sample of Kanyakumari district. Four taluks of Kanyakumari district viz. Vilavancode, Kalkulam, Agasteeswaram and Thovalai were identified as the representative regions of the study. Both Primary and secondary data collection methods is used for collecting data. Primary data is collected through questionnaire and personal interview from the BSNL landline users and BSNL officials and secondary data is through magazines, Journals, websites etc. The tools used for analysis are: Percentage Method, Weighted Average Method and Chi Square Method.

On opening up of telecom sector to private sector, private investment started coming in and it changed the entire paradigm of communication landscape in India in a matter of decade. Perhaps BSNL and its mentor central government could never anticipate that the change would be so fast and so radical that it caught BSNL unprepared. BSNL failed to keep pace with both changing customer demography and emerging technology. BSNL's forte landline has become a history within short span of time.

Demography of the 164 sample BSNL landline users:

They are classified into different features such as gender,

age, income etc. The sample customers represent each

group as follows:. Gender (male – 60%, female – 40%);

Age group – in years (30 – 35 is 2%, 36 – 40 is 8%, 41- 45 is

23 %, 46 – 50 is 19%, 51-55 is 26%, 56 to 60 is 13%, Above

61 is 9%); Marital status – (married 80%, single- 20%);

Educational status (Upto school final – 20.4%, Degree/

Diploma – 30.6%, P.G Degree -24.5%, Professional

Degree – 24.5%), Occupation (Employee -20.2%,

Business – 40%, Profession – 15.1%, Agriculture – 19.8%,

Household – 4.9%), Annual income (in Rs.) (Upto 1 lakh –

30.4%, 1-2 lakhs – 20.3%, 2-3 lakhs – 29.6%, Above 3 lakhs

-19.7%), years of experience in usage (Below 1 year –

20%, 2 to 5 years – 25%, 5 to 10 years – 12%, 7 to 10 years

– 28%, Above 10 yrs. – 13%)

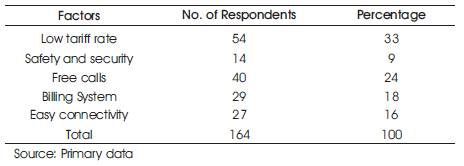

There are certain factors that influence the customers to use BSNL land line services other than broad band service. Here, an attempt is made to find out the other factors that influence to possess BSNL land line connection.

Majority 33 percent of the respondents are influenced by low tariff rate and 24 per cent of respondents are influenced by free calls of BSNL landline services and 18 per cent are influenced by billing system of BSNL landline connections. As 50 and 75 free calls per month are allowed for urban as well as rural in BSNL landline, majority of the customers are influenced by this scheme (Table 3).

Table 3. Factors influencing BSNL landline connection.

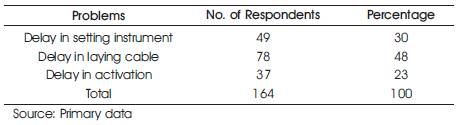

At the time of getting landline phone connection, there may be lot of problems encountered by the customers. An attempt is made here to find out the problems faced by the customers at the time of getting connection.

Most of the customers faced the difficulty of delay in laying cable and 14 per cent of respondents face the difficulty of delay in activation of BSNL landline connections. It is inferred from the study that after paying the requisite amount for connection, the connection is delayed because of the officials negligence in work and also the non availability of components (Table 4).

Table 4. Problems faced in installing landline connection.

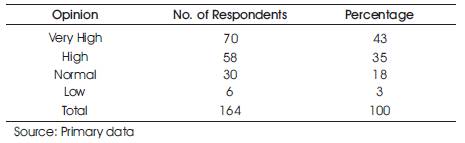

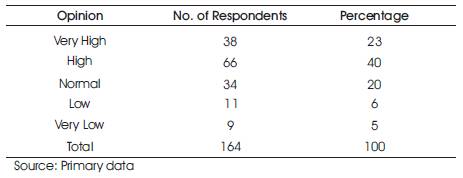

According to the different schemes of BSNL landline connection different amount of monthly rent is charged. An attempt is made here to find out the opinion regarding monthly rent for BSNL landline connection.

Most of the respondents opinion regarding the rent charged is high and only 03 per cent opines the rental value as low. While compared to the mobile rental charges and top up charges BSNL land line rent is high (Table 5).

Table 5. Opinion regarding the monthly rent charged by BSNL landline connection.

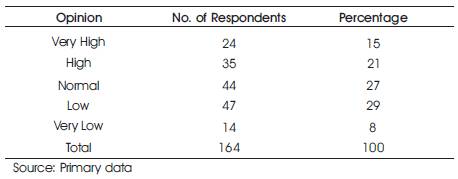

Different offers has been announced by BSNL landline connection to attract more BSNL users. Accordingly the rates has been slashed between BSNL to BSNL landline connection. Here an attempt is made to know the opinion of call rates charged between BSNL to BSNL.

Majority, 29 percent of the respondents are not even satisfied by the call rates between BSNL to BSNL and 27 percent of respondents states the rate as normal. BSNL has to take steps to slash call rates to the satisfaction of the customers atleast between the same network (Table 6).

Table 6. Opinion regarding call rates between BSNL to BSNL.

With regard to communication with various people, there is a possibility of calling people using other networks. So the opinion on call rates charged between BSNL and other networks is need to be known necessary. Here an attempt on that regard is made to enquire about the opinion of customers.

Majority 40 percent of the respondents felt that the call rate is high between BSNL to other networks. And 23 percent of respondents are highly not satisfied by the BSNL landline connection. The call rate charged by BSNL is high when compared to mobile and other landline services (Table 7).

Table 7. Opinion regarding call rates between BSNL to other net work.

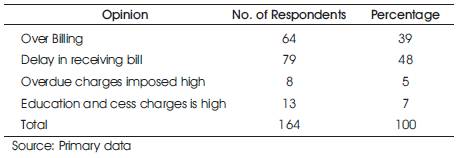

There may be lot of difficulties encountered by the customers due to the improper billing system. An attempt is made here to find out the problems faced by the customers during the payment of BSNL land phone bills.

Majority 48 per cent of the respondents states that there is delay in receiving bill and 39 per cent of the respondents state that sometimes overbilling takes place. This shows that BSNL is not following a prompt billing system to the satisfaction of the customers (Table 8).

Table 8. Opinion regarding billing system followed in BSNL landline.

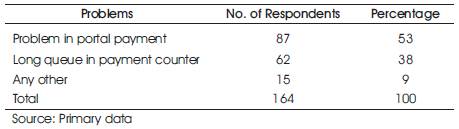

At the time of paying bills the customers has to encounter lot of difficulties. An analysis is made here to find out the difficulties faced by the customers in paying bills.

Majority 53 per cent of the respondents faced the difficulty in portal payment and 38 percent of the respondents faced difficulty in payment counter. Advanced software should be developed to overcome such portal payment difficulties (Table 9).

Table 9. Difficulties faced while paying BSNL landline bill.

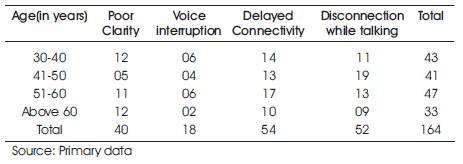

There is lot of difference between the opinion of the aged and young users and the problems they encounter while using BSNL land phone connection. An attempt is made here to test whether there is any relationship exist between the age and their opinion about various variables (Table 10).

Table 10. Age Vs problem encountered in BSNL land line connections.

| Null Hypothesis: | There is no significant association between Age and problem encountered by customers in BSNL land line connections. |

| Alt. Hypothesis: | There is significant association between Age and problem encountered by customers in BSNL land line connections. |

| The calculated value is = 8.146 | |

| The table value at (0.05, 9) = 16.919 | |

Since the calculated value is lesser than table value, the null hypothesis is accepted. Therefore it is evident that, there is no significant association exist between Age and problem encountered by customers in BSNL land line connections.

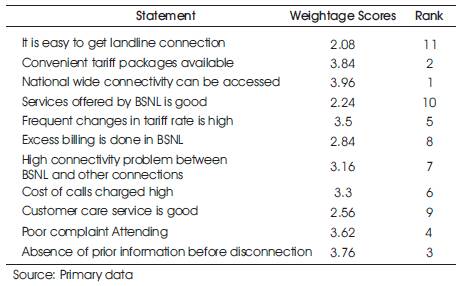

Ranking of opinion of customers done through the application of weighted average method. Few statements regarding BSNL land line connections has been framed by the researcher and the opinion from the customers were collected and they were ranked according to their preferences to know which factor affects them the more.

It is inferred from the Table 11 that the access is world wide and its service is not up to the mark. Connectivity problem seems to be in the IV rank, and it is not that easy to get a new land line connection and the customer care service holds only IX th rank. Lot of effort and convincing strategies should be developed for the effective sustenance market of BSNL landline connections (Table 11).

Table 11. Ranking of Opinions

The three primary reasons identified for decline of landline customer base may be poor customer service, uneconomical landline tariff and increased mobile penetration. On the other hand, decline in access cost, necessity of internet surfing in day to day life and government promotion for broadband have resulted in significant growth in broadband industry.

Various reasons for the surrender of Wire Line connections are as following:

The mobile service providers have aggressively captured the urban and even penetrated into the rural market luring customers with attractive tariff packages targeting different strata of the society. An individual's perception of boosting his personality when he can associate himself with a branded mobile instrument with facilities starting from camera to radio has made many customers surrender their land line connections.

To retain the existing land line customers and to compete with the other service providers, BSNL should have innovative tariff packages, prepaid landline, same tariff regime for rural and urban customers etc. suitable for different income levels. Create awareness among common public about the unmatchable latest quality services like IPTV, Video conferencing, broad band via copper cable. Introduce various schemes linked to landline like insurance policy to hook the customers for long time. BSNL should focus to provide good network and customer services.

For example, Bharti Airtel, the leading telecom operator is not only focusing the GSM segment but also trying to sustain its Fixed-line Subscribers by attractive offers. After Unlimited Free Sunday offer now Airtel has introduced free unlimited night calling offer for fixed line users. Most of the time only GSM customers gets such offers due to increased competition but Airtel is giving due attention to its fixedline customers and more reasons of having a landline.

Upkeeping landline connections by BSNL is not up to the mark and customers often complaint of high fault rate. BSNL is only having nearly 50% of its lines converted to underground cables. With ageing of existing cable network , the faults rates are going up and on the top of it, very slow pace of repair and maintenance work is further affecting the quality of network and hence customer satisfaction. Jointing of cable is of inferior quality and does not stand up the quality and performance that is desired in these days. Emergence of WLL and cannibalization of landline by WLL needs to be arrested and value proposition for the both needs to be clearly communicated to customers. Poor availability of attractive value added services is another area of improvement. Proper communication of value proposition and positioning of landline in the market is very essential.

Rampant civil work often damage BSNL's cables which need to be protected. Poor quality of materials (EPBTs/drop wire/jointing materials) results frequent faults and it affects the image of land line. Often the services are being rendered through contract labours who have no commitment for BSNL and service rendered is not up to the mark creating a wrong image for land line. Certain applications can be a “smart home “service where we can provide data, voice, entertainment (TV) and remote access to a household through a single OFC connection, Broadband WiFi combination along with converged ip based services such as IPTV, Video phone, Multi-media conferencing, Converged network (MPLS-IMS NGN) –device convergence (smart phone-LL with broadband including WiFi- –Tablet PC etc). Fixed mobile convergence with fixed phone migrated to NGN and WiFi enabled devices is an attractive option. Being a customer/service oriented organization BSNL is not having a clear cut policy to do all the front end customer oriented jobs resulting in loss of morality among employees.

The key priorities for increasing fixed access business in BSNL will be better marketing and product management, efficient sales & distributions mechanisms, faster service provisioning and grievance redressal and wider coverage. Since the customer experience of a product or a service is the sum of all encounters with the company, it is very important to understand the customer expectations and his emotional requirements for sustenance market. However, all the activities should be oriented towards not only for making customer satisfied but to win the heart of the customers by giving a “BSNL touch”, creating loyal customers and that will be the greatest asset for BSNL.