The Relationship Between Value, Net Income, And Book Values

Chao-Hui Yeh * Ti-Ling Wang **

*Department of Business Administration, I-Shou University, Taiwan, Roc.

** Department of International Business, Kao Yuan University, Taiwan, Roc.

Abstract

The central variables of this paper are value, net income (wealth creation), book values (wealth accumulated), and dividends (wealth distribution). This paper provides a conceptually useful foundation for the study of net income, book values, and dividends as to how these variables relate to equity value. The discussion makes the case that the analysis is also of empirical interest. This paper systemized overview of the Ohlson 1995(O95) literatures. The paper considers situations in which price equal capitalized forward net income add growth in net income and book values. Accounting, or the financial reporting model, has its own rules, and these make their presence felt all the time. The CSR has a role to interlock the book values and net income. Book values differ from net income because the latter need a capitalization factor to be of the same order of scale as book values. Dividends decrease market value on a dollar-for-dollar basis as dividends (i) decrease book value similarly on a dollar-for-dollar basis but (ii) do not affect the expected residual income series. This paper shows further that the value replacement property tangles closely with the idea that dividends decrease subsequent periods' expected earnings. That is, the more the dividends today pay out; the less the book values accumulate today. The less the book values accumulate today; the less the future net income will come tomorrow. Finally, this paper studies two simple ideas. First, one can use residual income valuation model to predict stock value. Second, mathematical zero-sum series equality provides the analytical starting point and ensures analytical simplicity. These two ideas combine to yield many closed- form valuation models. Without violating the PVED precept, one obtains explicit and basic models relating market value to book value and income.

Keywords :

- Price,

- Earnings,

- Book Values,

- Dividends

Introduction

After Ohlson 1995(O95) and Yeh (2001), literature has been published numerous papers on accounting data and value. A review of this literature reveals that many themes and insights recur across the papers. This paper addresses the essence of O95 and tries to integrate the O95 literatures, and thereby making the O95 literatures more accessible to the average reader. Only with a systemized overview of the O95 literatures can a reader compare how models differ in their key characteristics (like their reliance on certain measures of growth). The paper considers situations in which price equal capitalized forward net income add growth in net income and book values.

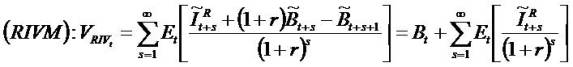

As a preliminary to deal with growth, the paper lays out the framework for (i) Book Value plus Residual Income (BVRI) valuation model and (ii) Capitalized Earning & Increments in Residual Income (CE&IRI) valuation model. The derivations of the (i) and the (ii) are from present value of expected dividends (PVED), but the (i) emphasizes book values while the (ii) emphasizes earning (earning also called net income). The (I) represents PVED via book value plus the present value (PV) of residual net income. Residual net income can be thought of as simply the change in book values with an adjustment for dividends. This manner of treating at residual net income causes an emphasis of growth of book values. On the other hand, the (II) formula derivation does not introduce book values. The (II) formula represents PVED via capitalized both forward earning and the PV of capitalized increments in residual net income. Both (I) and (II) are valuation tools; the goal of this paper is to show how growth influences valuation.

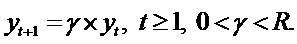

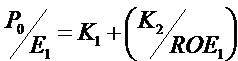

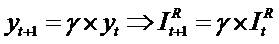

The more detailed study of growth assumes that the residual net income variable satisfies a standard growth/decay dynamic  The parameter γ identifies the long-term growth rate. The (I) formula then causes the market-to-book(P/B)1 model familiar from many textbooks (e.g. Penman 2006), and the (II) formula causes the so-called OJ model (Ohlson and Jeuttner-Nauroth 2005). Both (I) and (II) models can explain the price-to- forward-earning (P/E)2 ratio, but they do so with different dependent variables. In case of (I) formula, the return on equity (ROE)3 explains the P/E ratio

The parameter γ identifies the long-term growth rate. The (I) formula then causes the market-to-book(P/B)1 model familiar from many textbooks (e.g. Penman 2006), and the (II) formula causes the so-called OJ model (Ohlson and Jeuttner-Nauroth 2005). Both (I) and (II) models can explain the price-to- forward-earning (P/E)2 ratio, but they do so with different dependent variables. In case of (I) formula, the return on equity (ROE)3 explains the P/E ratio

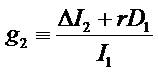

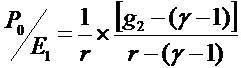

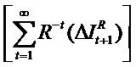

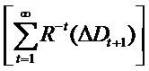

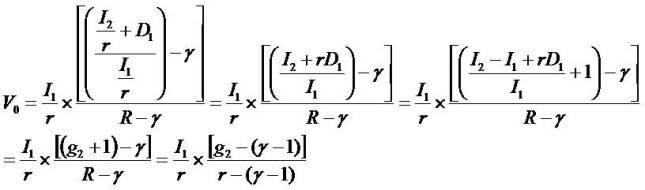

In case of (II) formula, the growth in expected net income explains the P/E ratio

The g2 defines the short-term growth (STG) in expected net income). Therefore one obtains two distinct ways of explaining the P/E ratio with transforming the mathematics. With growth being expected, it follows that the firm's price equates book values (or capitalized forward net income) add growth.

The central variables of this paper are value, earnings (wealth creation), book values (wealth accumulated) and dividends (wealth distribution).

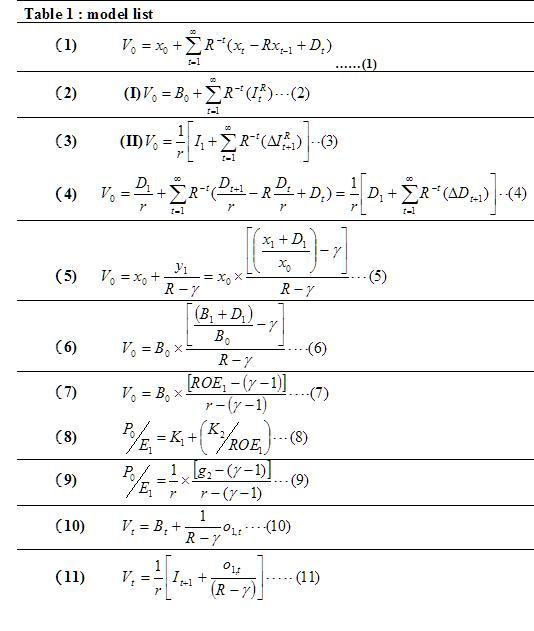

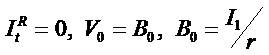

1. The models

This paper uses the following notation:

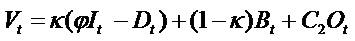

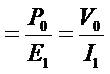

Vt= Value (price) of equity, V = P

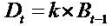

Dt = (net) Dividends

Bt= Book value

It = (net) Income (NI=EAT=earning after tax), I = EPS, the P/E ratio

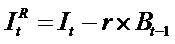

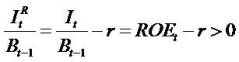

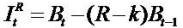

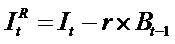

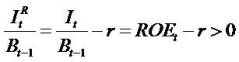

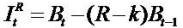

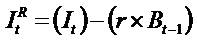

= Residual (abnormal) Income (RI), R = 1+ r= the discount factor, an exogenous constant equals the risk-free rate. RI is defined as current earnings minus the risk-free rate times the beginning of period book value, that is, earnings minus a charge for the use of capital. (RI =earning after tax and cost of capital (cc),

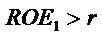

= Residual (abnormal) Income (RI), R = 1+ r= the discount factor, an exogenous constant equals the risk-free rate. RI is defined as current earnings minus the risk-free rate times the beginning of period book value, that is, earnings minus a charge for the use of capital. (RI =earning after tax and cost of capital (cc),  . If the ROE > r (

. If the ROE > r ( ) then the firm has the positive RI.

) then the firm has the positive RI.

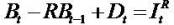

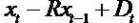

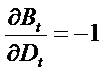

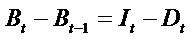

Clean surplus relation (CSR), Bt - Bt-1= It - Dt. Regardless one considers growth in expected Income or book values, such growth depends on dividends and the retention of earning. The more the retention, the more the firm will grow.

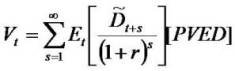

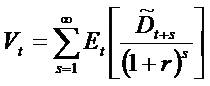

As is normal, this paper assumes that PVED determines value:

The Et [] is an expectation operator.

We build on the dividend discount model (PVED) using the following unified valuation framework. The framework emphasizes that from a mathematical point of view, one can use dividends, earnings, residual earnings, or free cash flows for valuation. To simplify the mathematical expressions, hereafter date 0 (NOT t) specifies the valuation date.

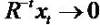

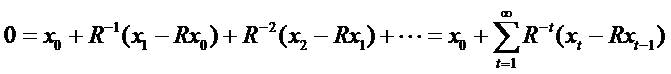

Mathematical zero-sum series equality provides the analytical starting point. For any series of numbers x0,x1…

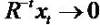

If x (numerator) grows slower than R-t (denomenator), then

That  makes sense, due to no firm will grow forever.

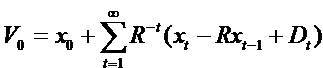

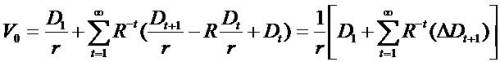

Adding PVED to zero-sum series produces the first

equation

makes sense, due to no firm will grow forever.

Adding PVED to zero-sum series produces the first

equation

Certainly, the analysis is valid for any x-series. The idea is

that one can represent value in respect of two parts: a

starting point, x0 and a complement defined by the present value of a generic series,  which

implants the series of dividends.

which

implants the series of dividends.

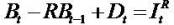

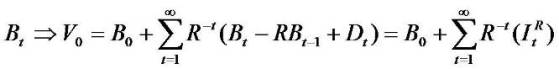

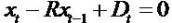

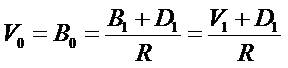

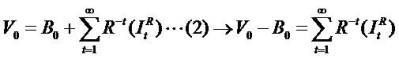

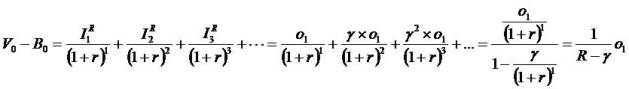

One starts with the book value of equity as follows.

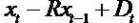

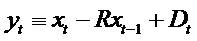

By putting xt = Bt and combining it with residual income (RI) and clean surplus relation (C.S.R.).

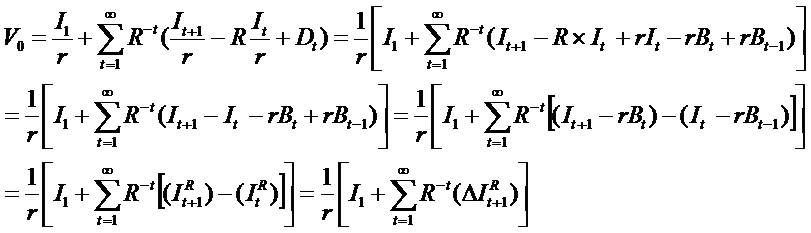

We get  and the second equation (2) and call it as

and the second equation (2) and call it as

(I) Book Value plus Residual Income (BVRI) valuation

model.

The price (V0) is explained by the initial book value (B0) and the subsequent growth in book value. If the firm has no

growth (R.I.), then price (V0) equate the initial book value (B0). The model fastens value on book value and plus a premium for the present value of residual income (super

growth in book value). The super growth is the growth

beyond what could be achieved by making the normal

rate of return on book value. Book value growth is

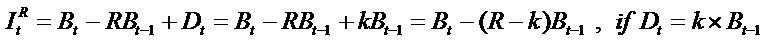

explained by the ItR due to the subsequent book value t

increase in ItR ( ).

).

The subsequent book value increase in ItR, due to

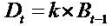

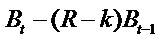

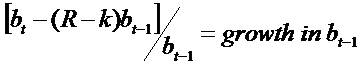

The  means fixed dividends policy and k = 0 means zero dividends policy and the

means fixed dividends policy and k = 0 means zero dividends policy and the  means growth in book value.

means growth in book value.

The market-to-book ratio ( ) increases as subsequent ItR

increases

) increases as subsequent ItR

increases

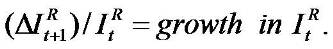

Proof of (2):

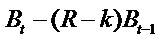

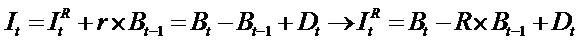

Replace It in R.I. with  in C.S.R., we get

in C.S.R., we get

If xt is book value,  is residual income

is residual income

Replace xt in (1) with

Q. E. D.

Book value and its growth are famous valuation models

only in banking industries. Analysts in many other industries

focus on earnings and earnings growth. In the following,

we show that instead of starting the valuation with book

value, one can start with capitalized forward earnings and

then plus a premium for abnormal earnings growth. We

call this model the Capitalized Earning & Increments in

Residual Income (CE&IRI) valuation model.

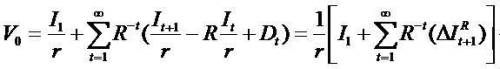

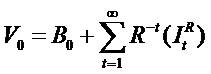

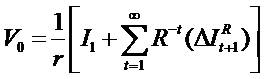

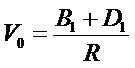

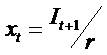

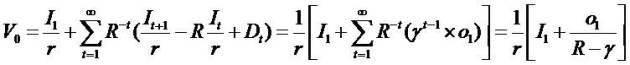

Instead of starting with book value of equity, one can start

with the Capitalized earning as follows. In a similar spirit, by

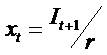

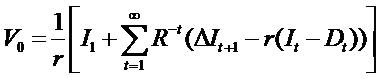

putting  we get the third equation (3) and call it as

(II) Capitalized Earning & Increments in Residual Income

(CE&IRI) valuation model.

we get the third equation (3) and call it as

(II) Capitalized Earning & Increments in Residual Income

(CE&IRI) valuation model.

The price (V0) is explained by capitalization of next period's expected earning ( ) and the subsequent growth

(increments) in residual net income.

) and the subsequent growth

(increments) in residual net income.

Residual earning (income) growth is explained by the

Due to

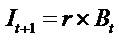

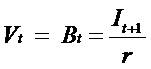

If the firm has no growth ( ), then price (Vo) equate the

capitalization of next period's expected earning (

), then price (Vo) equate the

capitalization of next period's expected earning ( ). That

). That

means time value of money. The V0 is the beginning investment, the I1 is income. Each dollar of stock price (V0) forecasts r dollars of next period earnings. In a certainty setting (referred to as the "savings

account"), where Vt is the amount deposited in the savings account; x, is earnings (the dollar amount of the

interest on the savings account deposit) for period t; r is

the rate of interest on the savings account deposit; and

Dt is the dividend paid to the owner of the savings account (the amount that the depositor chooses to

withdraw) at time t.

means time value of money. The V0 is the beginning investment, the I1 is income. Each dollar of stock price (V0) forecasts r dollars of next period earnings. In a certainty setting (referred to as the "savings

account"), where Vt is the amount deposited in the savings account; x, is earnings (the dollar amount of the

interest on the savings account deposit) for period t; r is

the rate of interest on the savings account deposit; and

Dt is the dividend paid to the owner of the savings account (the amount that the depositor chooses to

withdraw) at time t.

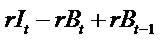

Proof of (3)

In CSR we replace  with

with  and get

and get

Q. E. D.

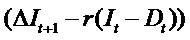

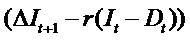

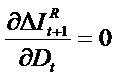

In the third equation

One interprets the item  as the increase in

expected earnings in excess of the increase due to

reinvestment of wealth (

as the increase in

expected earnings in excess of the increase due to

reinvestment of wealth ( ) during the period. The equity value equals capitalized forthcoming earnings add a

premium for growth in expected earnings in excess of the

growth that could be realized by simply retaining the

wealth generated in a fixed return (

) during the period. The equity value equals capitalized forthcoming earnings add a

premium for growth in expected earnings in excess of the

growth that could be realized by simply retaining the

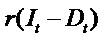

wealth generated in a fixed return ( ) instead of paying dividends. In a fixed rate savings account, the item

(-Dt) is the withdrawal and remaining amount (It - Dt) increases the savings account balance and yields

additional interest income: r (It - Dt). For a savings account, the item r (It - Dt) equates ΔIt+1 and the item (

) instead of paying dividends. In a fixed rate savings account, the item

(-Dt) is the withdrawal and remaining amount (It - Dt) increases the savings account balance and yields

additional interest income: r (It - Dt). For a savings account, the item r (It - Dt) equates ΔIt+1 and the item ( ) is

zero. Thus, there is no premium over capitalized

forthcoming earnings. That is, the marginal investment in a

savings account has zero NPV.

) is

zero. Thus, there is no premium over capitalized

forthcoming earnings. That is, the marginal investment in a

savings account has zero NPV.

In a similar spirit, by putting  we get the fourth

equation (4) and call it as capitalized dividends&

increments in dividends valuation model (CD&IDVM).

we get the fourth

equation (4) and call it as capitalized dividends&

increments in dividends valuation model (CD&IDVM).

The price (V0) is explained by capitalization of next period's expected dividends  and the subsequent growth

(increments) in dividends.

and the subsequent growth

(increments) in dividends.

Dividends growth is explained by the

due to

Those derivations (equations (2), (3) and (4)) do not

depend on any conceptual restrictions on accounting

data. There is, for example, no clear distinction between

the distribution (D) and creation (I) of wealth.

If net income means creation of wealth, then dividends

mean distribution of wealth.

After those derivations (equation (2), (3) and (4)), the

reader will see why the author want to introduce equation

(1). Because equation (1) has item  then

then  mean growth.

mean growth.

If  in the

in the  then

then  means

growth in book value.

means

growth in book value.

If  in the

in the  then

then  means

growth in earning.

means

growth in earning.

If  in the

in the  then

then  means

growth in dividend.

means

growth in dividend.

That  in equation (1) means zero growth

in all accounting variables.

in equation (1) means zero growth

in all accounting variables.

Moreover, this growth item  goes beyond

the call of duty due to retained net income. In other words,

this growth item

goes beyond

the call of duty due to retained net income. In other words,

this growth item  is, in fact, a dividend-adjusted

growth. Now the question arises whether one can find

some useful, additional assumption that parameterizes

this growth item

is, in fact, a dividend-adjusted

growth. Now the question arises whether one can find

some useful, additional assumption that parameterizes

this growth item  . All parameterizes are known.

. All parameterizes are known.

1.1 Comparisons of model (I) BVRIVM and model (II)

CE&IRIVM

Model (I) BVRIVM develop market value as book value plus

a premium above book value for expected growth in

book value, model (I) anchors valuation on book values.

Such focus on book values is justified when book values

near market values, for example, financial instruments

are marked to market. So, model (I) is good to value

financial institutions. But, the emphasis on book values is

lost when firms are conservative accounting rules. E.g.,

the most important assets of knowledge intensive

corporations are not shown on their books as

investments in intellectual assets are not shown on their

financial statements. Thus, their book values are underestimated

and the ROE is over-estimated. Analysts

valuing these firms usually do not use book value of

equity as the starting point in their valuation. Thus, model

(II) CE&IRIVM focus on the earnings and earnings growth

expected from these “off-balance sheet” properties.

Analysts focus on capitalized earning & increments in

residual income (CE&IRIVM) because future earnings

and earnings growth are less affected by conservatism

than are book values. Thus, model (II) are heavily used for

valuation.

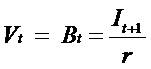

In model (I) BVRIVM

if the item  i.e.,

ROE=r, then model (I) reduce to Vt = Bt. Similarly, in model

(II) CE&IRIVM

i.e.,

ROE=r, then model (I) reduce to Vt = Bt. Similarly, in model

(II) CE&IRIVM

if the item  then model (II) reduce to

then model (II) reduce to  . In a fixed rate savings

account, the interest income expected from a savings

account equals

. In a fixed rate savings

account, the interest income expected from a savings

account equals  , which implies

, which implies  . For a savings account, the model (I) and model (II) are

equivalent. Real firms, however, are not savings accounts.

. For a savings account, the model (I) and model (II) are

equivalent. Real firms, however, are not savings accounts.

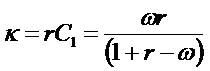

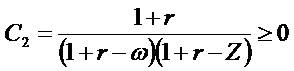

2. Parameterized models explaining the P/E ratio

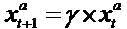

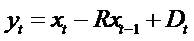

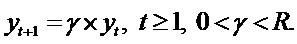

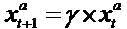

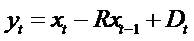

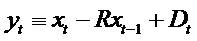

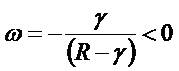

In what follows the authors do not initially attach any

economic interpretation to this growth item  . One can derive V0 as a function of x0 and x0 + x1 alone, given suitable assumptions on the x-series. Unsurprisingly, the

assumption requires the yt -series

. One can derive V0 as a function of x0 and x0 + x1 alone, given suitable assumptions on the x-series. Unsurprisingly, the

assumption requires the yt -series  to grow (or decay) geometrically. By imposing some structure on the

pattern on yt we get a short formula. To make the model

more realistic yet simple we do not restrict on one-year

ahead yt allowing y1 being any positive number. After year 1

we assume yt grows at a constant rate. Specifically,

to grow (or decay) geometrically. By imposing some structure on the

pattern on yt we get a short formula. To make the model

more realistic yet simple we do not restrict on one-year

ahead yt allowing y1 being any positive number. After year 1

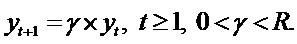

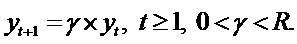

we assume yt grows at a constant rate. Specifically,  . Where 0 < γ is some presumed growth t

parameter and 0 < yt. If yt = 0, then

. Where 0 < γ is some presumed growth t

parameter and 0 < yt. If yt = 0, then  .

.

Given PVED and consider any series  satisfying

satisfying  and a related series

and a related series  such that

such that

Then

And

Where all parameterizes (ω, γ) are constants.

Proof of (5):

Given(1),

Armed with these analytical results, I next identify the two

cases that explain the P/E ratio. The first approach, (a),

refers to the growth in book value, and the second, (b),

refers to the growth in net income.

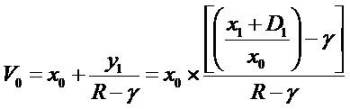

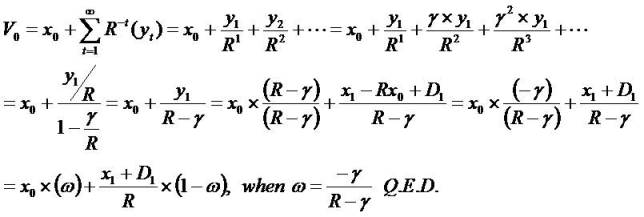

(I) Setting x = B in (5) simply changes the notation and the (5) decreases to (6)

One reads  in (6) as the forthcoming growth in the

expected book value, adjusted for dividends. The

numerator adjustment for dividends is important: it reflects

dividend policy irrelevancy (DPI). That is, the numerator

does not depend on the next period's dividend decision

since the cum-dividend book value,

in (6) as the forthcoming growth in the

expected book value, adjusted for dividends. The

numerator adjustment for dividends is important: it reflects

dividend policy irrelevancy (DPI). That is, the numerator

does not depend on the next period's dividend decision

since the cum-dividend book value,  , does not depend on the dividend. Thus the choice of date-one

dividends does not affect V0.

, does not depend on the dividend. Thus the choice of date-one

dividends does not affect V0.

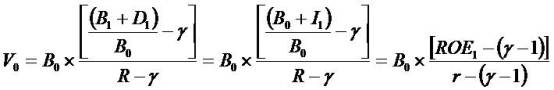

In CSR we replace  with

with

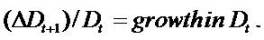

Standard derivations of the model assume CSR. It causes

the textbook expression:

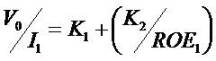

Given (6),

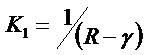

Where

equals the forthcoming expected return

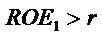

on equity. It follows that  increases as ROE1 increases. With respect to γ - where now

increases as ROE1 increases. With respect to γ - where now

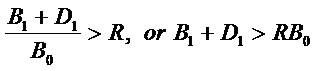

The market-to-book ratio ( ) increases as γ increases when

) increases as γ increases when  . These conclusions are reasonable because they decrease to the idea that "growth in residual net income is

good assuming they are initially positive". Relating the

. These conclusions are reasonable because they decrease to the idea that "growth in residual net income is

good assuming they are initially positive". Relating the

ratio to ROE has some attraction, certainly. But it needs a convincing real-world (For real-world reference

purpose, we put a sample in endnote 4) motivation.

Investors tend to ask "What factors explain the P/E ratio?"

rather than "What factors explain the

ratio to ROE has some attraction, certainly. But it needs a convincing real-world (For real-world reference

purpose, we put a sample in endnote 4) motivation.

Investors tend to ask "What factors explain the P/E ratio?"

rather than "What factors explain the  ratio?" More

important for our purposes, the last question is of interest

because it has already been established that

ratio?" More

important for our purposes, the last question is of interest

because it has already been established that  is valid

for time value of money

is valid

for time value of money

A model

resting on book values ought not to rule out an

explanation of the P/E ratio ( ).

).

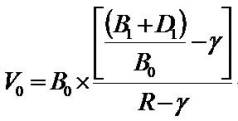

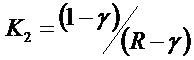

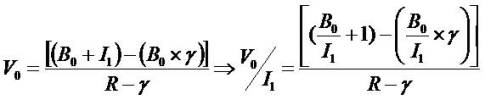

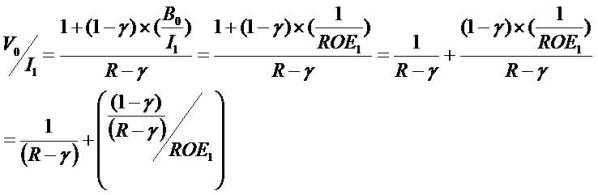

Shifting the focus to the P/E ratio, simple manipulations of

the last equation causes

Where

Proof of (8):

Given (7),

Q.E.D.

The left-hand-side variable of interest, the P/E ratio ( ),

depends only on the right-hand-side variable ROE1 in addition to the parameters γ and R.

),

depends only on the right-hand-side variable ROE1 in addition to the parameters γ and R.

An evaluation of how ROE1 influences the P/E ratio ( ), depends on the sign of K2. Signing K2 sequentially lays the duty on the sign of 1 - γ. Is γ greater or less than one? It

makes sense to require γ to exceed 1 if residual net

income (ItR) is positive (i.e., ROE1 > r), just as γ should be less than one if ItR is negative (ROE1 < r). The first claim is based on the idea that if the firm is profitable, then, in

expectation, the dollar amount of ItR should expand with time. Such an expected situation occurs if conservative

accounting is combined with growth in the firm (if ROE1 > r but γ < 1, then ItR and Vt - Bt decline with t and both go to zero, which is conflicting with conservative accounting).

As the second possibility, if the firm is unprofitable (ROE1 < r), then one should expect that the gap, ROE versus r, to be slowly closed in the future. And given ROE1 < r (or ItR < 0), ItR goes to zero as t → ∞ if and only if γ < 1. Thus ROE1 < r causes the condition y < 1.

), depends on the sign of K2. Signing K2 sequentially lays the duty on the sign of 1 - γ. Is γ greater or less than one? It

makes sense to require γ to exceed 1 if residual net

income (ItR) is positive (i.e., ROE1 > r), just as γ should be less than one if ItR is negative (ROE1 < r). The first claim is based on the idea that if the firm is profitable, then, in

expectation, the dollar amount of ItR should expand with time. Such an expected situation occurs if conservative

accounting is combined with growth in the firm (if ROE1 > r but γ < 1, then ItR and Vt - Bt decline with t and both go to zero, which is conflicting with conservative accounting).

As the second possibility, if the firm is unprofitable (ROE1 < r), then one should expect that the gap, ROE versus r, to be slowly closed in the future. And given ROE1 < r (or ItR < 0), ItR goes to zero as t → ∞ if and only if γ < 1. Thus ROE1 < r causes the condition y < 1.

Given the above restrictions — summarized by ItR (γ - 1) > 0 - it follows that if ROE1 is less than r, and then the price-to-

forward net income ratio, the P/E ratio ( ) decreases as

ROE1 increases. For ROE1 greater than r, the P/E ratio now increases as ROE1 increases. In other words, as an empirical matter one should expect the function

) decreases as

ROE1 increases. For ROE1 greater than r, the P/E ratio now increases as ROE1 increases. In other words, as an empirical matter one should expect the function  on

ROE1 to be U-shaped.

on

ROE1 to be U-shaped.

Despite the fact that the analysis may seem somewhat

self-important and mechanical, it makes more intuitive

sense than one might think initially. Consider a firm with

ROE1 of, say, 20 percent when r = 10 percent. Such a firm is profitable, and the setting corresponds to γ > 1. Now it is

clear that if the firm remains about equally profitable

some day, then a computation shows that the growth in

expected net income will be superior. Hence the P/E ratio

ought to show a premium (exceed 1/r). Next consider

when ROE1 is poor, say, 5 percent, which is the setting when y < 1. Now there is reason to expect that ROE improves with

the passage of time. A computation now shows that even

a modest improvement in ROE to, say, 6 percent implies a

considerable growth, in expected net income. Again, the

growth principle causes the conclusion that the P/E ratio

reflects a premium. (As an empirical matter, it is easily

verified, looking at real-world data, that the huge firms with

subpar ROE1 such as than 7 percent, indeed have relatively large P/E ratios. Yet, as any textbook will note,

such firms will also have below-average  ratios.)

ratios.)

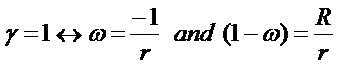

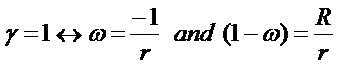

The modeling allows for the case when the capitalized

forward net income alone decides value: γ = 1 or ROE1 = r

give the necessary and sufficient conditions. The case

ROE1 = r is rather stale since now . The idea behind γ = 1 is more clever; now the conclusion

follows even though V0 - B0 ≠ 0 (the sign depends on the sign of ItR, of course). However, γ = 1 implies V0 - B0 = V1 - B1 (γ = 0 implies Vt = Bt) and hence the expected balance

sheet valuation "error" in the next year cancels with the

one in the current year. And such canceling of error

causes a perfect measure of expected net income so

that

. The idea behind γ = 1 is more clever; now the conclusion

follows even though V0 - B0 ≠ 0 (the sign depends on the sign of ItR, of course). However, γ = 1 implies V0 - B0 = V1 - B1 (γ = 0 implies Vt = Bt) and hence the expected balance

sheet valuation "error" in the next year cancels with the

one in the current year. And such canceling of error

causes a perfect measure of expected net income so

that  . That

. That  means no growth. Profitability,

as a concept, refers to the dividend-adjusted growth in

book value, and

means no growth. Profitability,

as a concept, refers to the dividend-adjusted growth in

book value, and  explains

explains whether one believes

CSR or not.

whether one believes

CSR or not.

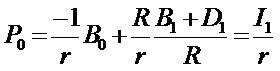

In x = B setting and also  that means no

growth and price decay to

that means no

growth and price decay to

The equation

implies

Hence the more general model

admits for a growth in book values

to explain the  ratio less than . In the equation (5.2)

that P0 increases as B0 decreases, holding (B1 + D1) fixed.

ratio less than . In the equation (5.2)

that P0 increases as B0 decreases, holding (B1 + D1) fixed.

In xt = Bt setting and also  . Thus

. Thus

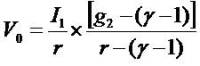

this setting thereby interlock between xt = Bt and

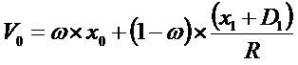

(II) Set  . This setting interlocks with the (CE&IRIVM:

. This setting interlocks with the (CE&IRIVM:

model framework. A

geometric growth (decay) assumption now causes the

equation (9).

Where

Proof of (9):

Given (5),

Put  In(5), get

In(5), get

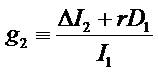

The item  defines the short-term growth (STG)

in expected net income, adjusted for dividends (For realworld

reference purpose, we put a sample in endnote 5).

Like the book value model, DPI constructs in an

adjustment for dividends. In the present case, the idea is

that

defines the short-term growth (STG)

in expected net income, adjusted for dividends (For realworld

reference purpose, we put a sample in endnote 5).

Like the book value model, DPI constructs in an

adjustment for dividends. In the present case, the idea is

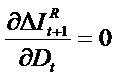

that  does not depend on dividends because I2 depends directly on D1. A savings account illuminates the idea as it shows that D1 gives up net income in the subsequent period such that

does not depend on dividends because I2 depends directly on D1. A savings account illuminates the idea as it shows that D1 gives up net income in the subsequent period such that  is independent of D1.

is independent of D1.

Thus the dependent variable (V0) increases as g2 (STG) increases, as ought to be the case. With respect to γ, the

dependent variable increases in γ if one assumes that g2

exceeds the level of cost-of-capital ( r). It, too, makes

sense as γ represents long-term growth (LTG). For g2 equal cost-of-capital, LTG is now immaterial as the current

growth is neutral to value. If the item g2 < r, a case of inferior growth, then it makes sense to think that γ is less than one.

Now the P/E ratio ( ) decreases as γ increases. But this limit does not affect whether the P/E ratio (

) decreases as γ increases. But this limit does not affect whether the P/E ratio ( ) increases as STG

increases (given fixed γ and r): it forever increases as g2

increases.

) increases as STG

increases (given fixed γ and r): it forever increases as g2

increases.

The special case when the P/E ratio ( ) suffice to decide

value occurs if and only if g2 =r (equally, y1 = 0). The pricing (V0) reflects no premium unless there is growth in expected net income. The g2 measures the short-term growth in earnings (adjusted for earnings foregone in period t+2

due to next-year dividends). Hence, the model has two

measures of growth in earnings, g2 and γ, explain the price to forward-earnings ratio.

) suffice to decide

value occurs if and only if g2 =r (equally, y1 = 0). The pricing (V0) reflects no premium unless there is growth in expected net income. The g2 measures the short-term growth in earnings (adjusted for earnings foregone in period t+2

due to next-year dividends). Hence, the model has two

measures of growth in earnings, g2 and γ, explain the price to forward-earnings ratio.

Simple as the analysis is, one gets the following

conclusion: the idea that the growth in net income

explains the P/E ratio is a principle of generality.

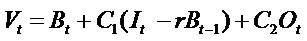

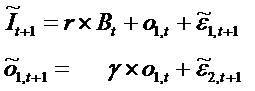

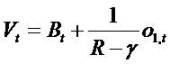

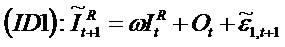

3. The sustaining information dynamics (dynamics

means time series)

This section affirms the two information dynamics that

support the parameterized the (I) model and the (II) model

framework, thus the modeling extends the benchmarks

by growth. This generality implies that the P/E ratio exceeds

1/r. Simplicity and symmetry will be piece of the modeling:

having thanked one of the dynamics, it becomes more or

less repeated what the second must be. Each of the two

dynamic have two parts: (a) a starting point as decided by

either book value or net income, and (b) information that

allows on the coming growth. With those concepts in

mind, one can next expand the dynamic via periodidiosyncratic

information, which makes the practical

content of the model more realistic. Finally, I show the

ways in which the modeling explains accounting

conservatism.

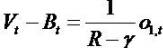

The first case extends the (I) Book Value plus Residual

Income (BVRI) valuation model such that it causes the

parameterized the BVRIVM. Consider the dynamic

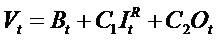

equations

The disturbance terms have zero mean in the usual

fashion. With respect to the incremental notation, one

thinks of 01,t as general "other" information. It can depend on almost anything inside and outside the financial statements.

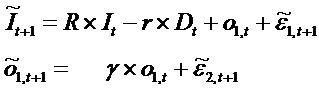

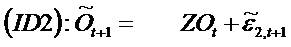

The second case generalizes (II) Capitalized earning&

increments in residual income valuation model

(CE&IRIVM) framework. Consider the dynamic equations

Each of the two dynamics implies a valuation answer

which expresses how the price depends on the

information and the parameters γ.

Assume PVED and consider two information dynamics. For

ID1 value equals

Proof of (10)

Given (2)

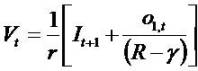

For ID2 value equals

The equation (11) tells us that next period expected

earnings, scaled by the inverse of the risk-free rate, decide

value, if other information is zero.

Proof of (11)

Given (3)

Q. E. D.

For real-world reference purpose, we put a sample in

endnote 6 about equation 11.

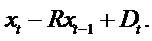

It is obvious that ID1 implies the  model. ID2, on the

other hand, gives a more robust valuation setting. This

watching suggests, speaking in broad terms, that an

earnings point of view provides greater flexibility than a book

value view. That said, for both models one easily explains

the value via a growth construct. When the setting is certain,

one put money a savings account. The dynamic (ID2) can

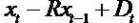

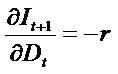

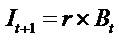

be decreased to (ID2.1), like It+1 = R x It - r x Dt ... (ID2.1).

model. ID2, on the

other hand, gives a more robust valuation setting. This

watching suggests, speaking in broad terms, that an

earnings point of view provides greater flexibility than a book

value view. That said, for both models one easily explains

the value via a growth construct. When the setting is certain,

one put money a savings account. The dynamic (ID2) can

be decreased to (ID2.1), like It+1 = R x It - r x Dt ... (ID2.1).

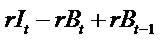

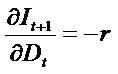

Expressing the dynamic this way makes it apparent that

the change in earnings, It+1 - It, depends only on the earnings r x (It - Dt) retained in the current period. t t

Accordingly, the dividend policy alone explains the

growth in earnings. Zero growth corresponds to a 100

percent payout; a growth that equals the discount factor

corresponds to a zero payout. Common sense suggests

that this growth effect due to retained earnings should

influence any model of earnings and dividends. More

general models, however, ought to also allow for growth

that goes beyond this dividend policy effect, unlike a

savings account. The more the retention holds, the more it

grow.

The dynamic (ID2) deals with "superior" growth, which goes

beyond the growth due to retained earnings in the

dynamic (ID2.1).

O95 suggest that conservatism arises from two different

sources. First, there exist positive net present value (NPV)

projects. Second, the accounting rules can be basically

conservative.

As to the first point, a firm may be observed to have the

opportunity to undertake positive NPV projects. Such

projects do not affect the accounting today, however the

same is not true for today's value. Thus it goes without

saying that the market value today can exceed both

book value and next period's expected net income

capitalized. (A general analysis exploits the (I) model and

the (II) model).

Even so, equation (10) and (11) make it clear that this

source of conservatism can happen only in the context of

growth. .jpg) will not exist

with a positive NPV setting.

will not exist

with a positive NPV setting.

It is seen that the import of growth asserts any introduction

of positive NPV projects. It may seem that positive NPV is

not only sufficient but also necessary for the conservatism.

Such is not the case, however. O95 provide a second

point: the accounting rules themselves can be

conservative besides not recognizing positive NPV

opportunities. The accelerated depreciation, R&D and

excess write-offs cases. Hence one can easily obtain an

inequity where price exceeds book value only as a result of a downward bias in the balance-sheet valuation

model. If in addition there is firm growth, then net income

will also be relatively discouraged because they will be

effectively "deferred".

For reference purpose, we put Yeh (2001) Residual

Income valuation mode (RIVM) in endnote 7.

Conclusion

The paper proceeds in three steps. First it presents and

critiques the extant valuation approaches namely the

present value of expected dividends (PVED) and the

residual income valuation model (RIVM). Second, it

presents a framework to unify these extant models and to

derive a model based on residual income and growth on

residual income, which are the two most heavily watched

metrics in the real world. Third, it presents a parsimonious

parameterization of the net income-based model that is

easy to implement and yet gives powerful insights into a

firm's value and its perceived risk.

This paper provides a conceptually useful foundation for

the study of net income, book values, and dividends as to

how these variables relate to equity value. The discussion

makes the case that the analysis is also of empirical

interest.

Accounting, or the financial reporting model, has its own

rules, and these make their presence felt all the time. The

CSR has a role to interlock the book values and net

income. Book values differ from net income because the

latter need a capitalization factor to be of the same order

of scale as book values. With respect to dividend, this

paper discriminates the creation of wealth from its

distribution and its accumulation: the dividend does

indeed differ from the net income and book values, and

the shift from PVED to various expressions that incorporate

net income and book values implants the simple but

important idea that the distribution of value must bring

together and be in agreement with its creation and its

accumulation. Wealth creation takes on fame insofar that

the dividend policy itself cannot create any value — that

is, DPI applies. Performance of this concept depends

critically — and attractively — on the five accounting

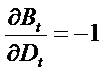

concepts: (i) dividends do not influence same-date net income ( ), (ii) dividends decrease book value (

), (ii) dividends decrease book value ( )

(iii) dividends decrease subsequent net income (

)

(iii) dividends decrease subsequent net income ( )

since the decreased book value represents fewer resources

essential to generate future net income, An increase in

dividends at any given date decrease the subsequent

period's expected earnings. Because risk neutrality obtains,

the marginal effect of a dollar of dividends on next period's

foregone expected earnings equals the risk-free rate. (iv)

Dividends do not influence residual net income (

)

since the decreased book value represents fewer resources

essential to generate future net income, An increase in

dividends at any given date decrease the subsequent

period's expected earnings. Because risk neutrality obtains,

the marginal effect of a dollar of dividends on next period's

foregone expected earnings equals the risk-free rate. (iv)

Dividends do not influence residual net income ( ),

and (v) dividends do not influence increment (

),

and (v) dividends do not influence increment ( ) in residual net income (

) in residual net income ( ).

).

Does the analysis result in useful empirical implications? I

think so, for the simple reason that investor starts from the

principle that the growth of expected net income should

justify the P/E ratio. And this is the principle that the analysis

elaborates on, including "why net income" and the nature

of the growth shapes. It certainly improves on the

traditional, textbook, so-called constant growth model.

The popularity of this model has been more dependent

on the importance of the empirical issues that it can

manage than on its intrinsic attraction.

Endnotes

- The market-to-book (V/B) also called price-to-book

(P/B), a ratio used to find the value of a company by

comparing market value of a firm to its book value. Market

value is determined in the stock market through its market

capitalization. Book value is calculated by looking at the

firm's historical cost, or accounting value. The market-tobook

ratio attempts to identify undervalued or overvalued

securities by taking the market value and dividing it by

book value. In basic terms, if the ratio is above 1 then the

stock is overvalued (growth stocks); if it is less than 1, the

stock is undervalued (value stocks). Growth stocks

returned 6.41% per year compared with value stocks

which returned 23.28%.

- A measure of the price-to-earnings ratio (P/E) using

forecasted earnings for the P/E calculation. While the

earnings used are just an estimate and are not as reliable

as current earnings data, there is still benefit in estimated

P/E analysis. The forecasted earnings used in the formula

can either be for the next 12 months or for the next full-year fiscal period. Long-term investors—investors who commit

their money to an investment for ten full years—did do well

when prices were low relative to earnings at the beginning

of the ten years. The lower P/E ratio stock you buy the

higher return you earn. Note that at the height of the Dotcom

bubble P/E had raised to 32. The collapse in earnings

caused P/E to rise to 46.50 in 2001. It has declined to a

more sustainable region of 17. Its decline in recent years

has been due to higher earnings growth.

- Return on Equity (ROE) between 15% and 20% are

considered desirable. High ROE yields no immediate

benefit. Since stock prices are most strongly determined

by earnings per share (EPS), you will be paying twice as

much (in Price/Book terms) for a 20% ROE company as for

a 10% ROE company. The benefit comes from the

earnings reinvested in the company at a high ROE rate,

which in turn gives the company a high growth rate. ROE is

presumably irrelevant if the earnings are not reinvested.

The sustainable growth model shows us that when firms

pay dividends, earnings growth lowers. If the dividend

payout is 20%, the growth expected will be only 80% of

the ROE rate.

What Does ROE Mean? The amount of net income

returned as a percentage of shareholders equity. Return

on equity measures a corporation's profitability by

revealing how much profit a company generates with the

money shareholders have invested. ROE is expressed as

a percentage and calculated as: Return on Equity = Net

Income/Shareholder's Equity.

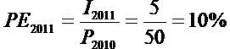

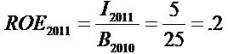

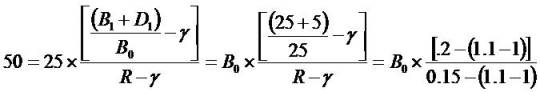

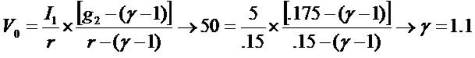

- (I) Setting xt = Bt, The firm in our example is Taiwan

Semiconductor Manufacturing Company (TSMC). TSMC

shares were trading at $50 at the end of 2010 and the

book value per share was $25. Market-to-book ratio = 2.

Bloomberg's estimate of the cost of capital on TSMC was

15 percent. Value Line forecasted earnings for 2011 of $5.

The implied long-term growth in residual income g, is 10

percent.

The relations between

prices, book value, and growth in book value are

illustrated in equation (7.1)

Notice that the price-to-book ratio of 2 is greater than one

— That is, the balance sheet is conservative. This

conservative accounting is associated with short-term

growth in (dividend-adjusted) book value (20 percent)

and long-term growth in residual income of 10 percent;

The observation that the expected short- term rate of

growth in dividend-adjusted book value (i.e., the

expected return on equity) of 20 percent is greater than

the cost of capital (15 percent) shows that the 2011

accounting is beginning to "correct" for the conservatism

in the 2011 balance sheet. The long-term growth rate in

residual income of 10 percent shows that more growth is

expected in future accounting earnings to complete the

"correction" for conservatism.

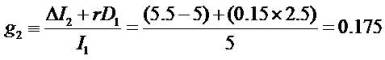

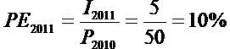

- (II) If

, is capitalized earnings, y is capitalized t

abnormal earnings growth, g is (one plus) change in

abnormal earnings growth, and the abnormal earnings

growth model may be written as

, is capitalized earnings, y is capitalized t

abnormal earnings growth, g is (one plus) change in

abnormal earnings growth, and the abnormal earnings

growth model may be written as

Where,

The adjustment to capitalized earnings in this form of the

model is additive in (II); the alternate form differs in that the

adjustment is multiplicative in (I). This form highlights

growth in earnings — both short-term and long-term. The

relations between TSMC's prices, earnings, and growth in

earnings are illustrated in equation (9.1) and (9.2). (In

addition to data seen before we now note that Value

Line's forecast of TSMC's 2012 earnings will be $5.5 and

TSMC's 2011dividends will be $2.50). Notice that the

forward-earnings-to-price ratio of  is

less than r (the cost of capital on TSMC was 15 percent) —

that is, the income statement is conservative. This

conservative accounting is associated with short-term

growth in (dividend-adjusted) earnings of 20 percent and

long-term growth/decay from this high base-level of

abnormal earnings growth, 10 percent (γ = 1.10).

is

less than r (the cost of capital on TSMC was 15 percent) —

that is, the income statement is conservative. This

conservative accounting is associated with short-term

growth in (dividend-adjusted) earnings of 20 percent and

long-term growth/decay from this high base-level of

abnormal earnings growth, 10 percent (γ = 1.10).

- The firm in our example is TSMC. Data same as above,

other information is close to zero (01 = 0.1).

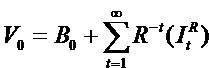

- Residual Income (Residual-Income, I R).

It : Net Income=NI, Earnings After Tax=EAT=EPS

r = denotes the nominal cost of capital and

Discounted Dividend Valuation Model (DDVM)

Under the clean surplus rule (CSR), dividend-adjusted

incomes are added to shareholder's book value.

Combine (A1) 、 (A2) 、 (A3), we get (A4) :

Linear Information Models, LIM

Combine (A4) 、 (A5) 、 (A6), we get (A7) :

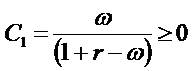

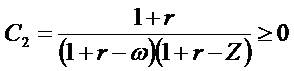

Where

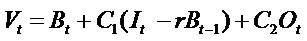

A restatement of the model (A7)

Using the definition of ItR, the model (1.7) also equals  . If one further replace Bt-1 with

CSR, then, we get

. If one further replace Bt-1 with

CSR, then, we get

Where

These valuation weights are purely functions of the cost of

equity and the persistence of residual income.

References

[1]. Ohlson, J. A. (1995). Earnings, book values, and

dividends in equity valuation. Contemporary Accounting

Research 11 (2): 661-87.

[2]. Ohlson, J. A., and B. Jeuttner-Nauroth. (2005).

Expected EPS and EPS growth as determinants of value.

Review of Accounting Studies 10 (2-3): 349-65.

[3]. Penman, S. (2006). Financial statement analysis and

security valuation, 3rd ed. New York: McGraw-Hill.

[4]. Yeh, chao-hui. (2001). A study on non-linear residual

income valuation model, doctoral dissertation, National

Sun Yat-sen University.

The parameter γ identifies the long-term growth rate. The (I) formula then causes the market-to-book(P/B)1 model familiar from many textbooks (e.g. Penman 2006), and the (II) formula causes the so-called OJ model (Ohlson and Jeuttner-Nauroth 2005). Both (I) and (II) models can explain the price-to- forward-earning (P/E)2 ratio, but they do so with different dependent variables. In case of (I) formula, the return on equity (ROE)3 explains the P/E ratio

The parameter γ identifies the long-term growth rate. The (I) formula then causes the market-to-book(P/B)1 model familiar from many textbooks (e.g. Penman 2006), and the (II) formula causes the so-called OJ model (Ohlson and Jeuttner-Nauroth 2005). Both (I) and (II) models can explain the price-to- forward-earning (P/E)2 ratio, but they do so with different dependent variables. In case of (I) formula, the return on equity (ROE)3 explains the P/E ratio

= Residual (abnormal) Income (RI), R = 1+ r= the discount factor, an exogenous constant equals the risk-free rate. RI is defined as current earnings minus the risk-free rate times the beginning of period book value, that is, earnings minus a charge for the use of capital. (RI =earning after tax and cost of capital (cc),

= Residual (abnormal) Income (RI), R = 1+ r= the discount factor, an exogenous constant equals the risk-free rate. RI is defined as current earnings minus the risk-free rate times the beginning of period book value, that is, earnings minus a charge for the use of capital. (RI =earning after tax and cost of capital (cc),  . If the ROE > r (

. If the ROE > r ( ) then the firm has the positive RI.

) then the firm has the positive RI.

makes sense, due to no firm will grow forever.

Adding PVED to zero-sum series produces the first

equation

makes sense, due to no firm will grow forever.

Adding PVED to zero-sum series produces the first

equation

which

implants the series of dividends.

which

implants the series of dividends. and the second equation (2) and call it as

and the second equation (2) and call it as

).

).

means fixed dividends policy and k = 0 means zero dividends policy and the

means fixed dividends policy and k = 0 means zero dividends policy and the  means growth in book value.

means growth in book value.

) increases as subsequent ItR

increases

) increases as subsequent ItR

increases in C.S.R., we get

in C.S.R., we get

is residual income

is residual income

we get the third equation (3) and call it as

(II) Capitalized Earning & Increments in Residual Income

(CE&IRI) valuation model.

we get the third equation (3) and call it as

(II) Capitalized Earning & Increments in Residual Income

(CE&IRI) valuation model.

) and the subsequent growth

(increments) in residual net income.

) and the subsequent growth

(increments) in residual net income.

), then price (Vo) equate the

capitalization of next period's expected earning (

), then price (Vo) equate the

capitalization of next period's expected earning ( means time value of money. The V0 is the beginning investment, the I1 is income. Each dollar of stock price (V0) forecasts r dollars of next period earnings. In a certainty setting (referred to as the "savings

account"), where Vt is the amount deposited in the savings account; x, is earnings (the dollar amount of the

interest on the savings account deposit) for period t; r is

the rate of interest on the savings account deposit; and

Dt is the dividend paid to the owner of the savings account (the amount that the depositor chooses to

withdraw) at time t.

means time value of money. The V0 is the beginning investment, the I1 is income. Each dollar of stock price (V0) forecasts r dollars of next period earnings. In a certainty setting (referred to as the "savings

account"), where Vt is the amount deposited in the savings account; x, is earnings (the dollar amount of the

interest on the savings account deposit) for period t; r is

the rate of interest on the savings account deposit; and

Dt is the dividend paid to the owner of the savings account (the amount that the depositor chooses to

withdraw) at time t. with

with  and get

and get

as the increase in

expected earnings in excess of the increase due to

reinvestment of wealth (

as the increase in

expected earnings in excess of the increase due to

reinvestment of wealth ( ) during the period. The equity value equals capitalized forthcoming earnings add a

premium for growth in expected earnings in excess of the

growth that could be realized by simply retaining the

wealth generated in a fixed return (

) during the period. The equity value equals capitalized forthcoming earnings add a

premium for growth in expected earnings in excess of the

growth that could be realized by simply retaining the

wealth generated in a fixed return ( ) instead of paying dividends. In a fixed rate savings account, the item

(-Dt) is the withdrawal and remaining amount (It - Dt) increases the savings account balance and yields

additional interest income: r (It - Dt). For a savings account, the item r (It - Dt) equates ΔIt+1 and the item (

) instead of paying dividends. In a fixed rate savings account, the item

(-Dt) is the withdrawal and remaining amount (It - Dt) increases the savings account balance and yields

additional interest income: r (It - Dt). For a savings account, the item r (It - Dt) equates ΔIt+1 and the item ( ) is

zero. Thus, there is no premium over capitalized

forthcoming earnings. That is, the marginal investment in a

savings account has zero NPV.

) is

zero. Thus, there is no premium over capitalized

forthcoming earnings. That is, the marginal investment in a

savings account has zero NPV. we get the fourth

equation (4) and call it as capitalized dividends&

increments in dividends valuation model (CD&IDVM).

we get the fourth

equation (4) and call it as capitalized dividends&

increments in dividends valuation model (CD&IDVM).

and the subsequent growth

(increments) in dividends.

and the subsequent growth

(increments) in dividends.

then

then  mean growth.

mean growth. in the

in the  means

growth in book value.

means

growth in book value. in the

in the  in the

in the  in equation (1) means zero growth

in all accounting variables.

in equation (1) means zero growth

in all accounting variables.

i.e.,

ROE=r, then model (I) reduce to Vt = Bt. Similarly, in model

(II) CE&IRIVM

i.e.,

ROE=r, then model (I) reduce to Vt = Bt. Similarly, in model

(II) CE&IRIVM

then model (II) reduce to

then model (II) reduce to  . In a fixed rate savings

account, the interest income expected from a savings

account equals

. In a fixed rate savings

account, the interest income expected from a savings

account equals  , which implies

, which implies  . For a savings account, the model (I) and model (II) are

equivalent. Real firms, however, are not savings accounts.

. For a savings account, the model (I) and model (II) are

equivalent. Real firms, however, are not savings accounts.

to grow (or decay) geometrically. By imposing some structure on the

pattern on yt we get a short formula. To make the model

more realistic yet simple we do not restrict on one-year

ahead yt allowing y1 being any positive number. After year 1

we assume yt grows at a constant rate. Specifically,

to grow (or decay) geometrically. By imposing some structure on the

pattern on yt we get a short formula. To make the model

more realistic yet simple we do not restrict on one-year

ahead yt allowing y1 being any positive number. After year 1

we assume yt grows at a constant rate. Specifically,  . Where 0 < γ is some presumed growth t

parameter and 0 < yt. If yt = 0, then

. Where 0 < γ is some presumed growth t

parameter and 0 < yt. If yt = 0, then  .

. satisfying

satisfying  and a related series

and a related series  such that

such that

in (6) as the forthcoming growth in the

expected book value, adjusted for dividends. The

numerator adjustment for dividends is important: it reflects

dividend policy irrelevancy (DPI). That is, the numerator

does not depend on the next period's dividend decision

since the cum-dividend book value,

in (6) as the forthcoming growth in the

expected book value, adjusted for dividends. The

numerator adjustment for dividends is important: it reflects

dividend policy irrelevancy (DPI). That is, the numerator

does not depend on the next period's dividend decision

since the cum-dividend book value,  , does not depend on the dividend. Thus the choice of date-one

dividends does not affect V0.

, does not depend on the dividend. Thus the choice of date-one

dividends does not affect V0.

. These conclusions are reasonable because they decrease to the idea that "growth in residual net income is

good assuming they are initially positive". Relating the

. These conclusions are reasonable because they decrease to the idea that "growth in residual net income is

good assuming they are initially positive". Relating the

is valid

for time value of money

is valid

for time value of money

).

).

. The idea behind γ = 1 is more clever; now the conclusion

follows even though V0 - B0 ≠ 0 (the sign depends on the sign of ItR, of course). However, γ = 1 implies V0 - B0 = V1 - B1 (γ = 0 implies Vt = Bt) and hence the expected balance

sheet valuation "error" in the next year cancels with the

one in the current year. And such canceling of error

causes a perfect measure of expected net income so

that

. The idea behind γ = 1 is more clever; now the conclusion

follows even though V0 - B0 ≠ 0 (the sign depends on the sign of ItR, of course). However, γ = 1 implies V0 - B0 = V1 - B1 (γ = 0 implies Vt = Bt) and hence the expected balance

sheet valuation "error" in the next year cancels with the

one in the current year. And such canceling of error

causes a perfect measure of expected net income so

that  . That

. That  explains

explains that means no

growth and price decay to

that means no

growth and price decay to

.jpg)

ratio less than . In the equation (5.2)

that P0 increases as B0 decreases, holding (B1 + D1) fixed.

ratio less than . In the equation (5.2)

that P0 increases as B0 decreases, holding (B1 + D1) fixed. . Thus

. Thus

.jpg)

.jpg)

In(5), get

In(5), get

does not depend on dividends because I2 depends directly on D1. A savings account illuminates the idea as it shows that D1 gives up net income in the subsequent period such that

does not depend on dividends because I2 depends directly on D1. A savings account illuminates the idea as it shows that D1 gives up net income in the subsequent period such that

.jpg) will not exist

with a positive NPV setting.

will not exist

with a positive NPV setting. ), (ii) dividends decrease book value (

), (ii) dividends decrease book value ( )

(iii) dividends decrease subsequent net income (

)

(iii) dividends decrease subsequent net income ( )

since the decreased book value represents fewer resources

essential to generate future net income, An increase in

dividends at any given date decrease the subsequent

period's expected earnings. Because risk neutrality obtains,

the marginal effect of a dollar of dividends on next period's

foregone expected earnings equals the risk-free rate. (iv)

Dividends do not influence residual net income (

)

since the decreased book value represents fewer resources

essential to generate future net income, An increase in

dividends at any given date decrease the subsequent

period's expected earnings. Because risk neutrality obtains,

the marginal effect of a dollar of dividends on next period's

foregone expected earnings equals the risk-free rate. (iv)

Dividends do not influence residual net income ( ),

and (v) dividends do not influence increment (

),

and (v) dividends do not influence increment ( ) in residual net income (

) in residual net income ( ).

).

is

less than r (the cost of capital on TSMC was 15 percent) —

that is, the income statement is conservative. This

conservative accounting is associated with short-term

growth in (dividend-adjusted) earnings of 20 percent and

long-term growth/decay from this high base-level of

abnormal earnings growth, 10 percent (γ = 1.10).

is

less than r (the cost of capital on TSMC was 15 percent) —

that is, the income statement is conservative. This

conservative accounting is associated with short-term

growth in (dividend-adjusted) earnings of 20 percent and

long-term growth/decay from this high base-level of

abnormal earnings growth, 10 percent (γ = 1.10)..jpg)

. If one further replace Bt-1 with

CSR, then, we get

. If one further replace Bt-1 with

CSR, then, we get