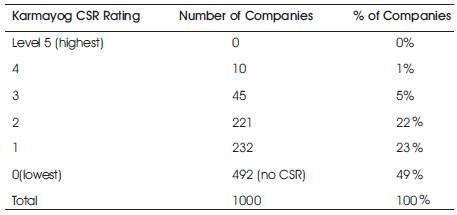

Table 1. Results of the Karmayog CSR Rating 2009 of the 1000 largest Indian companies

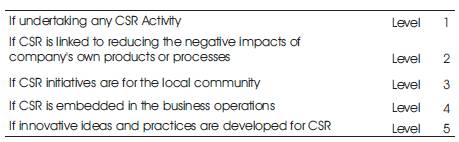

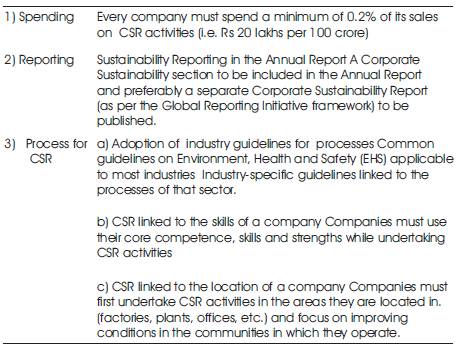

CSR contribution is set to come as a yardstick for the banks in their future ratings. Corporate Social Responsibility could potentially increase the clientele base of the financial institutions by helping to brighten up the image while acting as a potential branding instrument. In the future, a bank's performance may not be rated merely on conventional parameters but their credit disbursements in SME and agriculture as well as CSR contribution are also to come into play. These parameters are also likely to included in the next ratings and other similar performance evaluators to ensure more transparency and competitiveness in such activities. The paper gives a picture of the CSR activities taken up by the banks. It also highlights the decisive contribution that banks make to communities development thanks to their locally focused project policy, based on the relationship with stakeholders. The paper throws light on the various channels of delivery of CSR prevalent in Indian banks and various drivers of CSR. Furthermore, it highlights the areas of CSR addressed in corporate policies. The report also presents the latest ratings of public, private and MNC banks by the renowned networking platform Karmayog. Some of the notable suggestion formed in the paper are every company must spend a minimum of 0.2% of its sales on CSR activities (i.e. Rs 20 lakhs per 100 crore) A Corporate Sustainability section to be included in the Annual Report and preferably a separate Corporate Sustainability Report (as per the Global Reporting Initiative framework) to be published. Common guidelines on Environment, Health and Safety (EHS) applicable to most industries Industry-specific guidelines linked to the processes of that sector. Companies must use their core competence, skills and strengths while undertaking CSR activities. Create Inclusive Employment - for marginalized groups such as the physically-challenged, with a special emphasis on the local community.

Corporate Social Responsibility speaks of the doctrine where an entity whether it is Government, Private Corporation or Public Organization has a responsibility towards society.

“CSR is a concept whereby institutions not only consider their profitability and growth, but also the interests of society and the environment by taking responsibility for the impact of their activities on stakeholders, employees, shareholders, customers, suppliers, and civil society represented by NGOs. The economic globalization resulted in a demand for corporations to play a central role in efforts to eliminate poverty, achieve equitable and accountable systems of governance and ensure environmental security There was a need to make business a part of society and to maximize positive benefits that business endeavor can bring to human and environmental well being and to minimize the harmful effects of irresponsible business. The scheme which was developed from this concern is known as the “Corporate Social Responsibility”.

Corporate Social Responsibility (CSR), also known as corporate responsibility corporate citizenship, responsible business, Sustainable Responsible Business (SRB), or corporate social performance is a form of corporate self regulation integrated into a business model.(3) CSR policy basically works as a standard of built-in, self-regulating mechanism and ensure their harmony with law, ethical standards, and international norms. The three keys to an effective CSR policy are commitment, clarity and congruence with corporate values. Clarity is all-important because social responsibility is a broad term, and it needs to be debated and hammered out to meet each company's circumstances. Congruence is about ensuring that the company's attitude to its responsibilities towards society is consistent with the way in which it runs the whole business, i.e. its values and culture.

Corporate Social Responsibility (CSR) emerged in the late 1980s as a label for a philosophy of economic growth in business that values only those gains that can endure into future generations. Different organizations understand CSR in different ways. It used to be the sole preserve of socially progressive companies. Now, most multinationals have adopted some CSR principles. The World Business council for Sustainable development defines CSR as “the continuing commitment by businesses to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large.”

Traditionally, in the United States, CSR has been linked to philanthropy. Companies make profits, unhindered except by fulfilling their duty to pay taxes, then they donate a certain share of the profits to charitable causes. It is seen as tainting the act for the company to receive any benefit from the giving.

The European model is much more focused on operating the core business in a socially responsible way, complemented by investment in communities for solid business case reasons. As outlined in this article, CSR in Latin America is being influenced in addition by current social issues such as poverty and inequality, which challenge the continent.

CSR is closely linked with the imperative of ensuring that the companies” operations are “sustainable” i.e. it is recognized that it is necessary to take account not only of the financial/economic dimension in decision making but also of the ethical, social and environmental consequences. Environmental damage, improper treatment of workers, and faulty production leading to customers inconvenience or danger, are frequently highlighted in the media. In this current economic crisis, this media scrutiny is only increasing.

In some countries, government regulation regarding environmental and social issues have increased, and standards and laws are also often set at a supranational level (e.g. by the European Union). A number of stakeholders and investment fund managers have begun to take account of a corporation's CSR policy while making investment decisions. Likewise, some consumers have become increasingly sensitive to the CSR performance of the companies from which they buy their goods and services. These trends have contributed to the pressure on companies to operate in an economically, socially and environmentally sustainable way. This holistic approach to business regards organizations as being full partners in their communities, rather than seeing them more narrowly as being primarily in business to make profits and serve the needs of their shareholders.

Banks are generally large companies that have powerful impacts on the economic fabric. Their profession leads them to play a key role in managing the social and environmental impacts of the activities of the companies that benefit from their financing. For the past fifteen years, this unique responsibility has been gradually integrated into the Banks’ practices, particularly at the request of civil society and donors. This commitment takes different forms like improving in-house working conditions, reducing the ecological footprint of the company; sponsorships, philanthropy and/or company benefit schemes, partnerships with NGOs, clients, microfinance institution, a range of responsible products and services: green loans, socially responsible investments (SRI), solidarity savings, environmental and social risk management for investments.

The aim in promoting CSR to Banks is to help them strengthen their own CSR policy, and also to raise awareness amongst the Banks’ clients of the need to adopt best practices.

If one delves deep into the corporate history, Corporate Social Responsibility (CSR) is almost as old as that of companies. However, the second-half of Twentieth century witnessed increasing awareness about and commitment on inclusive growth and sustainable development through socially responsible business practices. For instance, the United Nations Environment Programme (1972) advocates that the financial sector has a role to play in protecting environment while maintaining profitability of their business. The concept of triple bottom – line espoused by John Elkington, encompasses social, environmental and financial accounting. Keeping these perspectives in view, the Reserve Bank of India has rightly issued, moral suasion policy for Banks on CSR. Recently, the Ministry of Corporate Affairs has also issued voluntary CSR guidelines for Indian corporate.

Banks are generally large companies that have powerful impacts on the economic fabric. Their profession leads them to play a key role in managing the social and environmental impacts of the activities of the companies that benefit from their financing. Improving in-house working conditions,

CSR policy in Banks is based on pillars of Sustainable Banking, Environment Protection, Social Commitment, Human Resource Development and Stakeholders Engagement. CSR strategies are built on core values, on sound risk management policies and sustainable business practices, which mean achieving profits for the Bank‟s shareholders underpinned by good governance, long-lasting customer relationships and highly committed staff delivering the corporate strategy and managing the social and environmental impact of its business.

CSR is the underlying philosophy of good corporate governance which guides to integrate environmental and social aspects with the Banks' working and functions and particularly, with promotional, financing and developmental support to the Micro, Small and Medium Enterprises (MSME) sector. In other words, CSR is based on commitment and furtherance of responsible banking through environment protection both within the Bank and outside, in the MSME sector, enhancement of social welfare, capacity building of human resources and engagement with various stakeholders. These are CSR pillars which not only guide to sustainable development, but also enable maintain relationships with the people that matter to the business most effectively – whether they are customers, communities or investors.

Sustainability banking is built on values, sound risk management and sustainable business which mean achieving profits for shareholders underpinned by good governance, long-lasting customer relationships, adherence of corporate strategy by highly committed staff. Various facets and key issues of CSR approach.

Milestones in sustainable development in the banking Sector

1992: Launch of UNEP-FI, following the UN Earth Summit in Rio: a public-private partnership between the United Nations Environment Programme (UNEP) and the private financial sector that aims to promote links between the environment, sustainability and financial performance and the adoption of improved environmental and social practices by financial institutions.

1998: “Performance standards” published by the International Finance Corporation (IFC) – World Bank Group.

2003: Equator Principles published: a series of common policies and indicators that commit signatory financial institutions to ensuring that the projects they finance are implemented in a socially responsible and environmental respectful manner.

2006: “Principles for socially responsible investment” (SRI) published by UN (UN-PRI).

2007: Rome Consensus adopted by European donors.

Banking practices are based on sustainability which places importance on the environmental and social consequences of projects and financial products, rather than just economic impact. The Banks try to understand the direct and indirect impacts, both positive and negative, that are created by their operations, products and services on the environment and society. With this in mind, they try to integrate environmental and social considerations into their day-to-day business decision making and operational practices. In nutshell, sustainable banking can be guided by some of the following commitment.

Commitment to Sustainability: under which the bank reiterates its commitment to stage of social and environmental sustainability.

Commitment to “Do no harm”: under which the bank minimizes the environmentally and socially detrimental impacts of its portfolios and operations.

Commitment to Responsibility: This emphasizes the Bank’s commitment to bear full responsibility for the environmental and social impacts of its transactions

Commitment to Accountability: under which, the Bank reiterates that it is accountable to its stakeholders, particularly those that are affected by the activities and side effects of policies and activities

Commitment to Transparency under which, the Bank ensures that it is not only transparent to stakeholders, in terms of its robust, regular and standardized disclosure, but also through being responsive to stakeholders,

While leveraging on opportunities and bracing the challenges the Banks orient their CSR activities towards holistic development of the sector they are involved with, they are also undertaken to meet growing public expectations, to build reputation, to use them as a tool for risk management, improve operational efficiency and productivity as well as to create an enabling environment for functioning effectively. They believe, this will add value to their business by reducing risk, improving operational efficiency, productivity, products and customer service as well as creating a great place to work.

The Banks believe in the principle of good environmental management which makes good business sense. Like any financial institution, the Banks have an influence on the environment, directly through consumption of natural resources, management of properties, use of paper, travel, etc. and indirectly through the environmental consequences of the products and services offered, especially those related to financing and management of the chain of suppliers.

Climate change involves both risks which need to be minimized and real opportunities which need to be seized. Governments across the globe on climate change may lead to capping of Greenhouse gas emission by various countries which, if it happens, is likely to have fallout on the various industrial sectors and may even lead to stipulation of new emission norms for entire industrial sector including Memes. This, in turn, would compel the enterprises in sectors like Foundry, Forging, Auto Parts, Rolling/Re-rolling mills, etc. to adopt more stringent norms for which the necessary technological up gradation and emission reduction methodology shall have to be undertaken.

Understanding this, Banks are pro-actively started offering various innovative financial products and capacity building measures to the sector. The same has also been documented in Loan Policy with a view to addressing the risks posed by climate change.

Main streaming environmental concerns with operations: Banks, being the principal lender to the industries from various sectors in the country, has committed itself to achieve sustainability by incorporating Environmental and Social (E&S) aspects in its core business.

For instance, a cautious approach is adopted in respect of certain industries, such as, chemical dye intermediates, industrial oxygen, distilleries, etc. Similarly, financial assistance is not provided to industries consuming / producing ozone depleting substances, viz. Chlorofluorocarbons (CFCs), Halon Carbon tetrachloride, Methyl chloroform, Hydrobromofluoro-carbons (HBFCs), hydro chlorofluorocarbons (HCFCs), Methyl bromide, Bromochloromethane (BCM), etc. Banks have stipulated a necessary pre-condition before sanctioning the credit, wherein the enterprise has to obtain No- Objection Certificate (NOC) of “Consent to Establish” from the respective State Pollution Control Board (PCB) concerned wherever required, before the enterprise takes up the implementation of the project. Further, it has also to obtain a NoC for “Consent to operate”, being the final Clearance from the PCB; before permitting the unit to commence commercial production.

The final clearance once granted is subject to review and renewal at periodic intervals based on monitoring/ inspection by the PCBs to ensure that the unit is actually meeting the prescribed norms and parameters. Besides, banks also provide credit (e.g. under the World Bank Line of Credit) to MSMEs conforming, among others, to E&S standards.

Efficient use of energy by enterprises is emerging as an area of critical importance as it is a potential tool for reducing costs. The Banks supports this by way of sensitizing and educating its stakeholders in adopting efficient means of energy consumption by way of booklets, and books, workshops, and energy audit services. Banks has also been actively involved in organizing awareness campaigns to create the awareness regarding the benefits of adopting energy saving equipments and technologies.

Following compliance towards World Bank's E&S norms, some Banks have integrated a similar system for carrying out environmental and social appraisals of projects funded through the micro credit route. These appraisals broadly identify environmental risks associated with some of the most relevant/ common activities funded through partner MFIs. During the appraisal, gender sensitization is also taken into account.

Optimal utilization of resources is one of the main objectives of banks. In order to achieve this objective, banks have undertaken certain measures. The main resource consumed at banks is paper and banks have undertaken the following measures to reduce its consumption:

All branches are computerized. Hence payments are done through software and authorized online in order to avoid taking printouts. As part of Bank”s initiatives to provide electronic inter face to speed up the communication with its borrowers, issuance of Demand Advice (DA) or payments done from borrowers are being sent through e-mail / SMS to the borrowers instead of dispatching printed version of it.

Banks has also taken up steps to save electricity within its premises. A practice of shutting down computers by the users and automatically shutdown of servers at the end of the day is being followed. Most of the new upcoming branches are retrofitted with CFL lighting in a phased manner. Installing the solar heater system in the bank”s office/residential building which could be used as an alternative source of energy to generate power; water conservation measures like rain water harvesting; use of recycled paper in official noting /records; double sided printing of all official notes/ memos, etc.

Banks involvement with the society has always been an integral part of mainstream work. It goes beyond the realm of finance and is oriented towards socio-economic empowerment of the bottom - of- the - pyramid sections of the society, besides capacity building of the respective sector, skill enhancement of employees, staff welfare, and more importantly, enterprise promotion without collaterals. A two-pronged approach for supporting communities through direct assistance and through social intermediation which includes capacity building is being pursued. Efforts are made to stimulate closer cooperation with governments, NGOs and clients, together with stronger employee engagement.

Way back in early nineties, when banks had commenced Micro Credit Programme, a commitment towards inclusive growth by making small loans available to the neglected sections of country was made. It includes women, minorities and the backward classes in the rural, unorganized and under-served regions. Banks have observed that these sectors have long remained excluded from the Formal Financial Institutions (FFIs) and were heavily dependent on local money lenders who used to charge usurious interest rates, leading to perpetual debt trap. In order to alleviate their problem, the banks formally institutionalized the microcredit programme by setting up specialized departments for Micro Credit as an “Institutional Answer” to the huge unmet demand for micro finance.

The primary objective of this to “create a national network of strong, viable, and sustainable Micro Finance Institutions (MFIs) for providing micro finance services to economically disadvantaged people of India, especially women”. The MFIs have the advantage over FFIs in terms of reaching out to the doorstep of rural people and also over local money lenders by charging lower interest rates than that charged by such money lenders.

However, these MFIs need strong capacity building support to effectively provide micro credit at affordable rates. MFIs were encouraged to promote women’s access to credit so as to help them acquire productive resources, thereby attempting to redress gender differences and inequalities in the social setup. Micro finance programmes, does not restrict itself to funding alone. Services include not only meeting the financial needs of MFIs with structured, value-added products, such as, Term Loans, Transformation Loans, and Equity Support, etc. but also provide capacity building grants as well.

Human Resource Development & Management Strengthening (e.g. a part of the salary of young professionals recruited by MFIs are borne by banks through various’ Programmes)

Business Development Services (e.g. IT / Automation- MIS Development and Software, hardware Support, use of innovative Information & Communication Technologies (ICTs) in credit delivery; Infrastructure, such as, vehicles)

Women Empowerment Reconciling the growth of the MSMEs with the economic and social upliftment of women has been one of the most sustainable solutions for women empowerment. 80% of micro finance beneficiaries are women.

Technical Assistance and infrastructure support: Strengthening infrastructural facilities is one of the foremost developmental activities of banks .This component intends to focus on improving the quality of products, services and systems to make them more efficient. The end goal of this activity is to enable each enterprise to scale up and graduate to a stage of operational and financial sustainability.

Banks not only strive to invest in their own human capital, but also develop and train the staff of their partner MFIs and SFCs. The motive behind nurturing minds not only aims at creating a cadre of trained manpower supply for the industry in the country, but also assisting people who otherwise do not have any economic opportunities to broaden their horizons at the same time.

Banks provide support to premier management institutes for course development on elective in micro finance. They regularly sponsor the management faculty at these institutions, staff of MFIs, consultants and service providers for international exposure visits, workshops, short duration and customized training programmes in various areas of micro finance.

Banks also encourage employees to undertake various community development services, such as, blood donation, volunteering, sports activities, etc. Banks has also been involved in organizing blood donation camps and for this purpose; employees are given eligible special leave on full pay basis. Employees have risen on many occasions to help the victims of natural disasters like, cyclone, tsunami, floods, earthquakes, etc. by way of monetary and kind support.

Banks professes the philosophy of a responsible corporate citizenship through continuous dialogue and engagement with its stakeholders. The stakeholders – both external and internal viz., Regulators, Shareholders, Customers, Employees, Society, International Partners, Suppliers, Media, MSME Business Member Organisations, Planning Commission, etc. with whom there is regular interaction.

Trust of stakeholders is the key reason that drives banks business and encourages them to deliver. Recognizing that an intensive dialogue and engagement with various stakeholders is sine qua non to ensure successful sustainable management, the stake holders ’ engagement and input is central to the entire strategic planning and deployment exercise. Hence, it is important to paper engagement with key stakeholders as a matter of priority of the stakeholders. This enables them to form long lasting relationship with stakeholders on a strong platform of mutual trust and cooperation, thereby ensuring sound business decisions.

The fiscal and monetary regulators of the Indian economy and the banking system, viz. the Government of India (GoI) and the Reserve Bank of India (RBI) are the regulators. Banks comply with all applicable regulations and guidelines, pay all relevant taxes and duties and report all relevant parameters/information to the Regulatory authorities/ agencies.

For instance, the Annual Accounts of the Bank are prepared by the RBI approved auditors, duly approved by the Board and submitted to the Ministry of Finance, Government of India every year in stipulated time; the Government Nominees on the Board ensure that they function as per the provisions of its Act. Bank officers proactively participate in Government, statutory and business for an on issues relating to regulatory and public policy framework.

Banks believe that it is their responsibility to protect and enhance the wealth of their shareholders and continue to enjoy their trust. They reward the shareholders by way of dividends and other monetary ways. The issues concerning the policies can be raised by the shareholders in the Annual General Meetings. The Bank also publishes its half-yearly and annual results/reports in the Banks' website and in the news papers to be transparent to its shareholders.

Apart from ensuring customer satisfaction banks ensures protection of Customer privacy and data by bringing these aspects under IT Security Policy: password policy, confidentiality agreement (non-disclosure agreement) and information system security agreement, restrictions of Privacy Rights, etc. Customer information is classified under Restricted Information category and treated as sensitive to external exposure. Customer data protection is ensured by having physical and logical access controls. Policy on restriction of disclosure of data ensures that the data are not exposed to unauthorized disclosure. Also, websites are established, maintained and administered in a secure environment and a legal statement is included in the website.

Endeavour to accord top priority to achieve customers‟ satisfaction and boost their confidence and trust in the banks is the primary motive behind the existence of banks us. A number of channels have been opened to satisfy customer needs and interests like faster credit decisions through Credit Appraisal and Ratings Tool (CART) and Risk Assessment Model (RAM) for loans. As a result, the average period being taken to sanction a long term loan proposal has come down. Banks hold regular customers meets to take macro view of the concerns of the clients and arrive at acceptable solutions to the utmost satisfaction of customers without sacrificing financial prudence.

EmployeesAt the core of banks' existence lie its diverse, vibrant and diligent human resources. Bank employees assimilate from across the country, function in a multi-cultural environment bringing valuable perspective that boost their performance. An open communication channel is maintained with the employees, besides soliciting their feedback through various mechanisms. For instance, a Grievance Redressal Management System is in place where an employee can submit and follow up for redressal of his /her complaint.

As per this policy, the complaints received are resolved in a systematic manner, starting from making a note of it with the appropriate authority, then forwarding it to the authority concerned and ensuring that the complaint is resolved within a specified time period. The Audit Committee of the Board also carries out periodic checking of such complaints and redressal thereof. Similarly, suggestion policy welcomes and rewards employees bringing solutions to serve the sector better.

The employees of the bank form associations. The Management holds meetings with the representatives of these associations on a regular basis and takes necessary steps for resolving the general issues concerning its employees.

SocietyBanks believe that the more they do for the society, the more banks get back from it. As a responsible sector, they have to actively engage with communities and contribute to their sustainable development. There priority groups should be the underser ved and the disadvantaged sections of the society, viz. the people from backward classes and minority groups, women and the poor.

International PartnersBanks enjoys confidence and close partnership with multilateral and bilateral institutions, such as, the World Bank; Japan International Cooperation Agency (JICA), Japan; Department for International Development (DFID), UK; International Fund for Agricultural Development (IFAD), Rome; KfW and GTZ Germany and Agence Française de Développement (AFD), France for resource support and technical cooperation on various capacity building programmes for industry in India. They value the rewarding relationship with these agencies for providing not only resources but also cooperation and commitment to facilitate increased turnover of the sector, thereby bolstering India's efforts for inclusive growth.

SuppliersBanks will have to remain committed to ensure that the suppliers are treated in a fair and reasonable manner and for this purpose, periodic meets are held with suppliers. As a principle to build a sustainable business relationship with suppliers, they have an elaborate written down manual for procurement guidelines which conform to the principles of Economy, Efficiency, Fairness and Transparency during procurement practices.

Methods/ Channels of Delivering CSR

Source: Corporate Social Responsibility Survey 2009 – India (United Nations Development Programme, British Council, CII, PriceWaterHouseCoopers.

Source: Corporate Social Responsibility Survey 2009 – India (United Nations Development Programme, British Council, CII, PriceWaterHouseCoopers.

Future of Corporate Social Responsibility in Banks

Shareholders put their risk capital in a Joint Stock Company (or business) and therefore, companies should be managed in the interest of the owners or the shareholders. This primacy of treatment given to the shareholders is being justified on the grounds of ownership and shareholding. It is felt that maximization of profits or the bottom line should be the ultimate objective of the management.

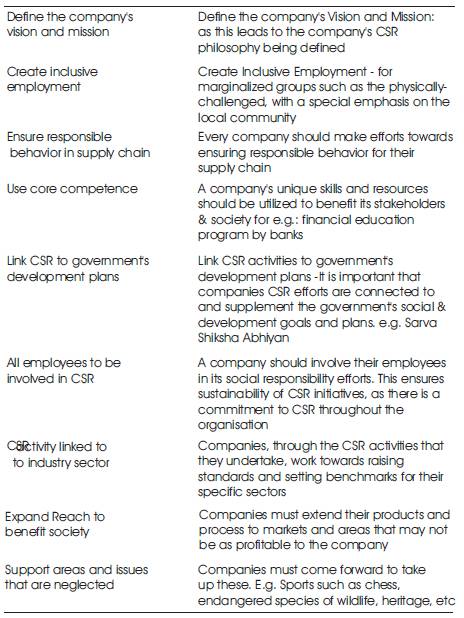

Developing corporations argue that practicing and following CSR is matter of concern for companies having big business with lot of resources at their disposal. It is argued that CSR is the responsibility of the politicians. It’s not business role to get involved. Business has traditionally been beyond morality and public policy. Sometimes CSR is also attached with the ulterior motive of the company following (Table 1).

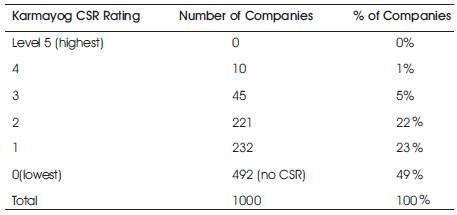

Parameters of the Karmayog CSR Ratings 2008 Karmayog CSR Ratings 0 % 1 % 5 % 22 % 23 % 49 % 0 % 10%20%30%40%50%60%Level 5Level 4Level 3Level 2Level 1Level 0Rating Levels% of Companies (Table 2).

Table 1. Results of the Karmayog CSR Rating 2009 of the 1000 largest Indian companies

Table 2. Parameters of the Karmayog CSR Ratings 2008

Mandatory Recommendation

Voluntary Recommendation

Banks are beginning to recognize that they have a social responsibility to fulfill as they emerge from the shadow of traditional banking. As per relatively indirect nature of their environmental and social impacts, banks need to examine the effects of their lending and investment decisions. Incorporating environmental and social criteria into business decision-making can reduce the impacts of operating activities Financial institutions can do a lot to assist efforts for corporate social responsibility and achieve sustainability. Financial institutions not only ensure that internal activity is sustainable, but they can also help financing itself become more sustainable.

Sustainable finance should be promoted. SRI (sustainable and responsible investment/socially responsible investment) is an investment strategy that identifies investment targets that not only provide financial growth but also takes explicit account of environmental, social & governance (ESG) issues in the investment process. Sound financing of sustainable economy can be promoted by the banks itself. A lot more can be done by bank so as to practice the corporate social responsibility. CSR supporting measures should be strictly dealt and implemented. Until and unless environmental authorities are serious and stricter about this, the financial institution will face a lot of problems. There can be general social and economic benefits that would accrue to society, if businesses recognized broader social goals in its decisions.