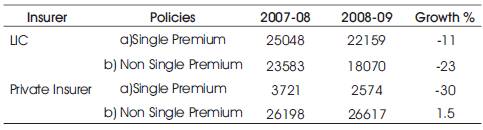

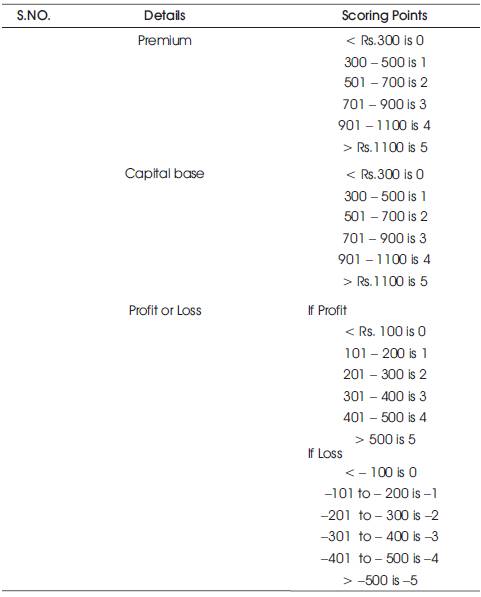

Table 1. New Premium income detail

This study is focusing on the comparison of private and public life insurance companies with respect to their capacity in performing life insurance business. The potential has been checked based on three criteria namely premium income, capital base and profit or loss in the past two years recession time. The finding is that Public sector insurance companies namely Life insurance Corporation of India and SBI are faring better than other private sector companies. The above mentioned insurance companies are more competitive in terms of low premium charge and high claims ratio.

Total value of the Indian insurance market (2004-05) is estimated at Rs. 450 billion (US$10 billion). According to the government sources, the insurance and banking services' contribution to the country's Gross Domestic Product (GDP) is 7% out of which the gross premium collection forms a significant part. The funds available with the state-owned Life Insurance Corporation (LIC) for investments are 8% of GDP. Till date, only 20% of the total insurable population of India is covered under various life insurance schemes, the penetration rates of health and other non-life insurances in India is also well below the international level. These facts indicate that there is a immense market growth potential for the insurance sector.

The year 1999 saw a revolution in the Indian insurance sector, as major structural changes took place with the ending of government monopoly and the passage of the Insurance Regulatory and Development Authority (IRDA) Bill, lifting all entry restrictions for private players and allowing foreign players to enter the market with some limits on direct foreign ownership. Though, the existing rule says that a foreign partner can hold 26% equity in an insurance company, a proposal to increase this limit to 49% is pending with the government. Since opening up of the insurance sector in 1999, foreign investments of Rs. 8.7 billion have poured into the Indian market and 21 private companies have been granted licenses.

Insurance is one sector that witnessed continuous growth owing to these reforms. The upward growth in this sector started in 2000. The year saw the opening up of the insurance sector, wherein foreign direct investment up to 26 percent was permitted in Indian ventures. This marked the entry of several global insurance giants in the market. From one state-owned insurance player in 1999, today there are 43 players in the market(including life and non-life players). The insurance sector is likely to attain a size of Rs.200,000 crore ($51.2 billion) in 2009-10. In life insurance, the business grew by 23.3 per cent to Rs.93,000 crore in 2007-08 (source: Assocham). This sector alone employs close to 30 lakh people (including agents and direct employees). If the proposed hike in the FDI cap to 49 per cent comes through, it will further strengthen the sector. It will help increase the penetration level in the country. Larger FDI will also help provide customers with better products, more options and better service levels.

Source: http//irda.org/scope/lifeinsurance

According to Sec.(2)(11) of the Insurance Act, Life Insurance business means “ the business of effecting contracts upon human life. It includes:

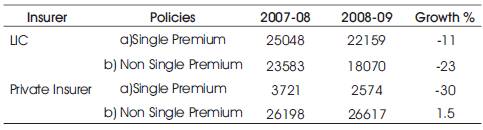

The Life Insurance sector in the country is in the red, going by the figures released by the Insurance Regulatory and Development Authority in its annual report for 2007 – 08. The losses posted by the private sector life insurance companies more than doubled to Rs. 4487 crore in 2007-08 compared with Rs.1934 crore in 2006 -07. Only four private insurers among the 17 in the fray were able to report profits in 2007 – 08. But this gloomy trend has spared public sector insurance companies namely SBI Life and Life insurance Corporation of India posting an improved performance with significant profits in the past years even during the recession time.

The largest losses were posted by ICICI – Prudential Life Insurance at Rs. 1395 crore and followed by this, Reliance Life at Rs. 768 Crore during 2007-08. The Public sector giant, LIC managed to post a moderate growth in profits at Rs.845 crore in 2008-09 compared with Rs. 774 Crore in 2007 -08.

Source: http//irda.org/outlook/life insurance

If the company is capable of earning consistent profit and minimizing both operative and non operative expenses, it is called as financially potential company.

To study the efficiency of Life Insurance Companies in terms of Premium income, Capital base and Profit and Loss.

Financial Statement Analysis was used from April 2007 to March 2009.The financial data will be taken from income statement sample of Life insurance companies. Sample type is Judgment sampling. It is because, of the total twenty one insurance companies, whichever company is having a minimum capital base of Rs.300 crore or the minimum premium of Rs.300 crore has been chosen for the study. There are three parameters namely Capital, New business premium and Net profit growth as on 2008-09 have been taken in to account to check out the financial potentiality. Under judgment sampling criteria only eleven life insurance companies had been chosen for the study. Financial patentability of sample companies has been explained in this study by way of processing scoring analysis.

This study divulges the financial performance of both private and public sector insurance companies in the year 2007-08, 2008-09. It focuses only on companies' financial potentials but it does not include market or technical potential of the insurance companies. The comprehensive approach is present in this study, because it does take in to account both life insurance companies capital and premium income. This study intends to reflect only the current trend in the insurance industry. It may change in future course of time. The future change prediction has not been incorporated in this study.

Public Sector Domination Continues In Life Insurance Segment

The public sector insurance industry recorded praiseworthy performance in the study periods. The remarkable performance of public sector insurance year after year since the opening up of the industry has surprised its critics. The LIC achieved a moderate growth over the unprecedented growth it had registered in the previous financial year. It secured first premium income of Rs. 43,813 crore through the sale of 3.76 crore policies under individual assurances. The LIC has also procured new premium of Rs. 9260 crore through its group portfolio. It is expected that the total premium income would touch Rs. 1,50,000 crore. With the total assets in excess of Rs 7,00,000 crore, LIC has retained the status of being the biggest financial institution in the country. It is this splendid performance of LIC that has raised the levels of life insurance premium penetration to 4.1 per cent of the GDP. This level of penetration is higher than those achieved in many developed countries including the United States.

The IRDA has released the un audited new business statistics for the year 2007-08. As per the IRDA, the LIC has underwritten new premium of Rs. 59182.20 crore (on the basis of annualised premium), which translates to a market share of 63.64 per cent. The seventeen private companies together have a market share of 36.36 per cent. The ICICI prudential with a market share of 8.93 per cent is a distant second to LIC. Eleven companies have a market share of less than 2 per cent. In the total premium mobilized in the country, the share of LIC is in excess of 80 per cent. This clearly demonstrates the total domination of LIC in the life insurance industry in India.

Today, the opponents of public sector are greatly surprised over the resilience and ability of LIC to innovate and raise its servicing standards. The LIC has been able to offer innovative products, better returns to its policyholders and has created unsurpassable records in claim settlements. The LIC has been settling over one crore claims each of these years. It has maintained a consistent record of settling over 99.86 percent of the reported claims. It tops in conservation of business with the lowest lapsing ratio in the industry. In contrast, the private companies have settled only around 72 per cent of the reported claims and large number of these companies have more than 25 per cent lapsing ratio as against 4 percent of LIC according to the annual report 2006-07 of the IRDA. The operating expenses of LIC are also the lowest in the industry at 5.54 per cent. It is this sound track record that has earned LIC the trust of the insuring public. Naturally over 230 million policyholders have placed their unflinching faith and trust in this great institution.

Source: The Hindu, “Business Review Column”

As there is no structural damage to Indian economy due to the above mentioned US and UK crisis, there is a slow down which is experienced in all industrial and service sector. It is obviously the impact of negative vibration across the globe. Due to the result of slow down, the life insurance policies industries' new premium income from regular policies reported a negative growth (Table 1).

Table 1. New Premium income detail

From this Table 1 it is understood that negative growth in single premium of Private insurers together is much lower than LIC. This trend is attributed to the loss in the investor confidence due to the economic scenario; uncertainty about job and income levels. Since the investor confidence is low the ability to save has come down drastically. When LIC was seeing negative growth in Non single premium as well, Private insurers on an average were able to show profits. With regard to the Non single premium earning, a number of companies such as SBI Life, Birla Sun Life, Reliance, TATA AIG and HDFC Standard have managed to post positive results, the industry average was pulled down by some big companies such as ICICI Prudential and Bajaj Allaince which reported decline of 22% and 33% respectively, on their non single premium earnings.

Source : Business Line “ Corporate column”

For group policies, Private sector companies had 3.93%. While at the same time LIC had 0.24%. The claim average pendency ratio of 22 private sector Life insurance companies is higher than LIC, but it has come down due to intervention of Insurance Regulatory and Development Authority. The pendency ratio of Private firms is 13.32% in 2006, which came down to 10.88% in 2007 and to 7.75% in 2008-09.

Source : Business Line, “Money/banking column”

Indian life insurers are subject to solvency requirements, which stipulate them to maintain a minimum solvency ratio of 150 per cent. This ensures that Life Insurance Company remain well capitalized at all points of time. As against the required minimum solvency ratio, the actual solvency available with almost all the insurers is much higher. As a prudent measure, IRDA also requires life insurance companies to set aside reserves to meet future claims and these reserves are monitored by IRDA regularly.

In addition to solvency, IRDA has stringent guidelines for the investment of policy holders' funds. These cover a gamut of risk management issues including defining the acceptable quality of investment, and set limits on permissible exposure to any single asset class, security, company or industry.

The investment guidelines laid down by IRDA also restrict life insurance companies from investing in overseas assets or international markets. Thus, the industry does not have any exposure to international credit instruments. All life insurance companies invest strictly in accordance with these regulations, thereby ensuring no risks to policy holders' investments, during these turbulent times in the global markets. SEBI's recent circular has now impeded the growth of new private sector insurance companies which are hoping to do business on ULIPS. As per the circular private insurance companies should float any new ULIP scheme with out the permission of SEBI. This order is currently in court hearing (Table 2).

Table 2. Showing the Net Profit or Loss position of Private Sector and Public sector Insurance companies- LIFE Insurance Segment

From the above mentioned data, it is well known that only public sector companies namely LIC of India and SBI LIFE had shown much more significant positive result. In private sector insurance only three companies 1) SAHARA ( +3). 2) Shri ram Life ( +5), 3) Met Life( 21) were showing positive result. It is quite evident that only LIC is showing its domination every now and then. It is followed by SBI LIFE. Of the total loss making private companies, particularly ICICI Prudential Life and Reliance Life made a major loss.

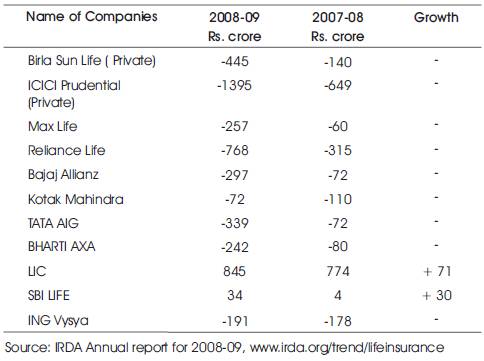

It is only at the will of researcher; the scoring norms had been decided. It is completely a subjective calculation, which is based on the observation of the researcher (Table 3).

Table 3. Scoring analysis framework for Life insurance companies

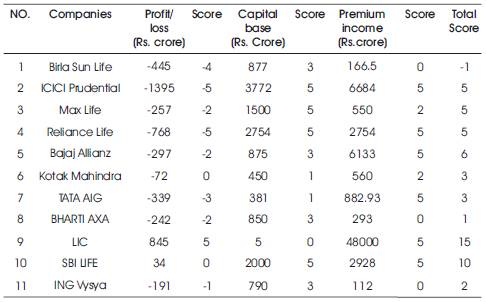

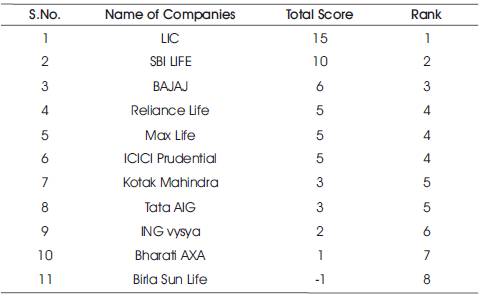

In Table 4 researcher had mapped the items namely Profit or loss, Capital Base and Premium income to different scores as per the norms mentioned in the scoring analysis framework. It is evident that only LIC remains top among the top ten insurance companies. Followed by this, SBI Life insurance stood in the second place. Bajaj Allianz stood in the third place (Table 5).

Table 4. Showing Scoring analysis as on March 2009

Table 5. Showing Finance Potential Wise Ranking of Life insurance Companies

This study has brought in the successful strategy of Public sector life insurance companies and weaknesses of Private sector life insurance companies. It is obviously proved that cheap premium charge and good capital base together with high claims ratio can determine the successes of Life insurance business. The down trend is partly because of the attitude of the people. Due to the global recession, people lost the faith in private sector life Insurance companies. So the only option left to private sector life insurance companies is that they need to bring in their policies to the market with cost competitiveness. More over if there is the public Private partnership model, surely private counter parts can raise their level on par with public sector life insurance companies.