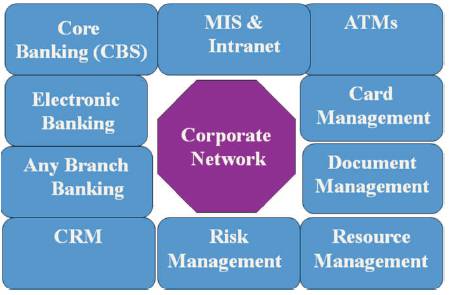

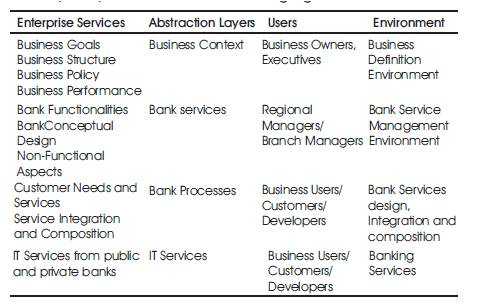

Figure 1. Commercial Banking Services (Source: www.idrbt.ac.in).

The fundamental way of banking undergoes a rapid transformation in the world of today in response to the forces of competition, productivity and efficiency of operations, reduced operating margins, better asset/liability management, risk management and Anytime and Anywhere banking. The technology has changed the face of banking by increasing high level of competition in the market together with increased awareness and quality consciousness among the customers by increasing the transparency in service. It is due to rapid development in technology that there is a sea change in both retail and investment banking. During 1980s the Rangarajan Committee report gave the first blue print for computerization of banks in the country. The Banks have been equipped with variety of platforms related to hardware, operating system, software and application software has implemented with different platforms. It is essential to have interface with different systems and other bank network environment. The cloud computing in banking sector aims to provide better and more innovative services to customers. The advancement of Service Oriented Architecture (SOA) has brought all the banks to come closer to establish and run a virtual business with online services. Cloud computing implements SOA in which IT resources are offered as a service that is more affordable, flexible and attractive to banking sector. This article discusses the benefits and challenges of cloud technology in banking sector and conceptual architecture for a bank operation environment.

Banking Sector has the first in exploiting the electronic network capabilities to conduct business-to-business (B2B) and business-to-consumer (B2C) interactions through technologies such as EDI. With the Implementation of the Web and the rapid increase of Internet users in the early 2000s, Banks such as ICICI, SBI, Bank of Baroda and HSBC Bank were among the early entrants to the business-to-consumer (B2C) model of ecommerce. The Internet has been a fast, easy-to-use and cheap medium which attracts millions of users online at any time.

Web Technology has moved from static content delivery to dynamics update of page content. The introduction of XML is the first evolution in web technology and it leads to efficient and interoperable running of electronic businesses. In the Web 1.O evolution, the backend IT systems have been created, owned and maintained by the business owners. The business needs more agility, operational efficiency, cost reduction and improved competitiveness. So the business has taken the advantage of Business Process Outsourcing (BPO). In the BPO, the company's non-core business functionality such as IT Operation is carried out by third-party external agencies that specialize in those functions. The Web 2.O technologies become more attractive for online business with the advent of service oriented computing (M.P Papazoglou, P. Traverso, S. Dustdar, F. Leymann, 2007). Service Oriented Architecture enables the business process functions as online web services and actively engaging customer via online.

The latest evolution in the Web Services is cloud computing. Cloud computing refers to the offering of hardware and software resources as service across the distributed environment. Cloud computing is the technology which allows the business owners to create and run a business using services over the internet.

Over the last 20 years, the banking sector has emerged as increasing in the size, spread and activities in the Banking Sector. The number of bank branches rose considerably during this period. The business profile of banks has transformed dramatically to include non-traditional activities like merchant banking, mutual funds, new financial services and products, and personal investment counseling. The banks intensified the competition to attract and retain customers. Introducing Technology was inevitable both in the interest of customer service and operational efficiency. The banks have travelled a long way through various phases from Automatic Ledger Posting Machines (ALPMs) to Total Branch Automation to ATMs, Mobile Banking, and Internet Banking. The banks are providing services not just Anytime Banking but Anywhere Anytime Banking. The Reserve bank of India (RBI) established INFINET (Indian Financial Network) by providing communication not only between branches of banks or across different banks, but also with the constituents of banks [Figure1(Source: www.idrbt.ac.in)].

The INFINET is cost effective and efficient communication backbone for the banking and financial sector and it offers exclusive, safe and secure communication network for the use of the banking sector. The payments in India are largely cash and non-cash payments. The Electronic Clearing Services (ECS) – both debit clearing and credits clearing have helped to eliminate paper work in respect of large volume. The Electronic Fund Transfer (EFT) system has facilitated remittance of funds from one bank branch to an account in another bank branch at a different centre quickly and securely. Reserve Bank of India introduced Structured Financial Messaging Solution (SFMS) – an application which would be incorporated on the INFINET communication to have adequate security measures by including PKI-Public Key Infrastructure in the software. It will be used for a number of intra-bank and inter-bank applications. The Centralized Management System (CFMS) and the Centralized Public Dept Office (PDO) consist of Negotiated Dealing System (NDS), Securities Settlement System (SSS), and the Real Time Gross Settlement System (RTGS) are enriching the service provided by the banking sector.

Figure 1. Commercial Banking Services (Source: www.idrbt.ac.in).

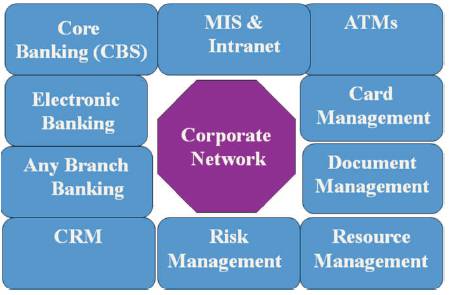

Cloud Computing is combination of advanced fields including utility computing, distributed computing, grid computing, web services, and service oriented architecture. Cloud computing is promoted by vision of “Everything as a Service” and offering as service under one umbrella. Cloud Computing consists of four services: Infrastructure as a Service, Hardware as a Service, Software as a Service and Database as a Service Table 1.

Table 1. Evolution of Grid Service System (J.K. Halvey, B.M. Melby, 2007)

Hardware resources and computing power (CPU and Memory) are offered as service to the Customers. Infrastructure as a Service enables the banks to rent their ATM resources to other bank customers rather than spending money to buy dedicated servers and networking equipment. The banks are billed for their usage following a utility computing model, where usage of resources is metered. The findings show that 80% of computing power and 70% of storage capacity are not efficiently utilized, where a single bank owns dedicated machines and servers.

It is a more specialized type of storage offering database capability as a service. DaaS on the cloud often adopts a multi-tenant architecture, where the data of the customers are kept in the same physical table. In cloud computing, the database structure is not relational and it adopts hierarchical data model, and data items are stored as property values or binary large objects (Blobs).

The Software applications are offered as a service on the internet rather than as software packages to be purchased as license by individual users. The examples include Google web-based office applications, Salesforce.com's CRM applications, Microsoft's online SharePoint, Adobe Photoshop and Adobe premiere on the web. The customer is free from applying patches or updates and data are kept in the cloud, based on DaaS.

It supports the entire business application development lifecycle including design, implementation, debugging, test, deployment, operation and support of rich Web applications and services on the Internet. The vendor lock-in limits the platform interoperability and not supporting some other language features or capabilities in current platforms.

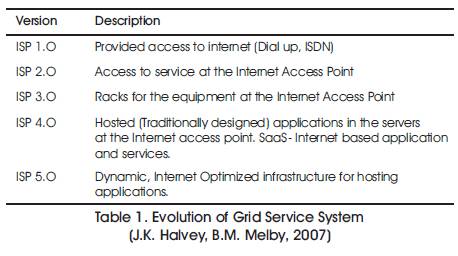

Multi-tenancy refers to sharing resources among users and/or applications and leads to higher utilization and cost reduction. In the Banking Industry, thousands of customers operate/ use a variety of software environment and banking applications. Multi-tenancy is about sharing resources among millions of users (e.g., keeping ATM operations common for all the bank customers) Figure 2.

Figure 2. Cloud Computing Architecture (Source: Forrester Research, Inc

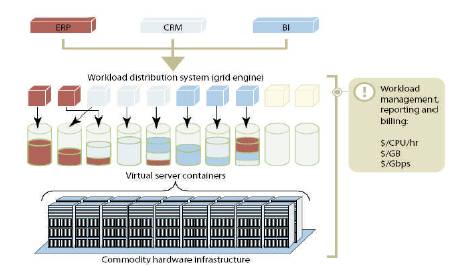

Let us consider a public sector bank like SBI which has 2, 000, 00 employees employed in different branches across the country. The Bank design and sells insurance, mutual funds and other banking operations. The Bank runs software in-house for its daily business operations and functions such as ATM, Mobile Banking, Online Banking, Core Banking Solution and call center. The Bank is having IT department which maintains the IT infrastructure inside the company. This IT infrastructure has grown more complex and expensive to maintain as it has grown with more customers. The Bank has installed more servers, specialized storage and network equipment, and list of software to ensure smooth and secure operations/transactions. The Bank invested heavily on Web site hardware and network bandwidth to prepare for customer services during the day-to-day transactions. Now the bank wants to reduce operational costs and enhance the focus on their core competencies by benefiting from the advancement in technology. The Cloud Technology is transforming the skill structure in banking sector by incorporating changing competencies which includes (Table 2)

Table 2. Banking Service Architecture and Environment (www.hpl.hp.com)

1.Avoiding huge capital and initial investment in hardware, servers, ATM and software resources by reducing ongoing operational, upgradation and maintenance cost.

2.Giving Permission to access a variety of software applications as SaaS and scaling up and down sizing hardware, network capacity by consumption based cost tracking.

3.Equipped with dynamic infrastructure cost and free of long term contract.

4.Free of software, hardware installation by providing web based collaborative services.

1.Loss of direct control of resources and software (e.g., Website Infrastructure, transaction and operations, carried out by third party or developers).

2.Increased liability risk due to security breaches and data leaks as a result of using shared external resources.

3.Decreased reliability, due to the service providers may going out of business, causing business continuity and data recovery issues.

4.SaaS solutions, built as one-size-fits all customers as enterprise unfriendly and difficult capacity planning, with concern for security and trustability.

5.Ensure smooth migration and transaction of data between the bank interoperation services.

The leading banks have built their business based on IT infrastructure that maximize data centre management and efficiency–investments. It gives a distinct advantage over competitors that came to web services / cloud services from a traditional IT environment. Most cloud services change by actual use of the resources in CPU utilization hours, the storage size in terms of gigabits (Gbs) consumed and gigabits per second transferred, rather than by the servers or via a monthly rental fees.

The Banking sector/customers benefit from the economies of scale and the highly optimized IT operations of cloud service providers. The opportunity to avoid capital costs, incurring predictable expenses which scale up and down with the current needs of the business is very attractive (J.A. Zachman, 1987) . The customers get benefit by only paying for resources when they are using them. The best service to the customer is achieved by exploiting the advantage of technology, increasing volumes at higher levels of efficiency and enhancing customer relationship. There is an important need of technology upgradation and integration with general way of functioning of banks to give them an edge in respect of services provided to their customers. Indian banks have always proved beyond their adaptability to change in the agile environment by adopting cloud technologies. Cloud Services is indeed a differentiator not only in terms of competitive advantage, but also in administrative and back-end processes.