Determining the capital structure of a company is a very critical factor to consider while projecting corporate performance in any business environment. This decision becomes even more difficult in a country like Nigeria, where the business and economic environment is highly unstable. This leaves the firms in a dilemma about what capital structure to adopt in financing their operations: Furthermore, the choice made by the company on what capital structure to adopt in financing their operations has serious impact on the performance of the firm. This study used regression analysis to determine the effect of capital structure on corporate profitability for 10 selected manufacturing firms for the period studied 2002-2005. We found out that the ratio of long-term debt to total asset (debt financing) and the ratio of equity to total liability of the firm (equity financing) had negative impact on the return on capital employed (ROE), while the ratio of short term debt to total liability had insignificant effect on return on capital employed (ROE). Based on these findings, we made some recommendations, which includes that the firm management should ensure that they manage the composition of their capital structure well, most especially as it relates to long-term debts and equities as well as to the corporate reserves of the firm.

This study examines the effect of corporate capital structure on the profit of a firm. The capital structure of a firm is the relative amount of debt and equity the firm uses to finance its operations ( Abor & Biekpe, 2005). Capital structure is a sensitive component of the firm because it affects all other operations of the firm. This implies that the company may have a distorted operation as long it has a poor capital structure decision. A firm can choose among several capital portfolios, depending on the one that best soothes its operation and enhances its performance. A number of theories developed to explain the way the capital structures affect the firms' performance includes the pecking order theory and the trade off theory for emphasis.

However, no rigorous study have been undertaken to apply these theories to the Nigerian context. The instability of the Nigerian financial and economic environment (the instability of the capital market and difficulty in borrowing money from the money market) makes it difficult for the finance manager to make adequate decisions; hence, the capital structure decision becomes more critical. There is also a dearth of empirical studies of the effect of capital structure on firms' performance in developing economies like Nigeria unlike in developed economies ( Esperanc et al, 2003; Hall et al, 2004; Abor & Biekpe, 2005 ).

This speaks to the necessity of this study, whose purpose is to determine the relationship that exists between capital structure and the profit of manufacturing firms in Nigeria. In this light, the objective of this study is to determine the relationship existing between the capital structure and firm performance. Furthermore, the structure of the remainder of the paper is as follows: the first section provides a review of the extent literature, section two explains the methodology employed for the study, the empirical results and discussions are presented in the third section and finally concludes with the discussion.

Uremadu (2004) and Akinsulire (2002) view the capital structure as how the firm finances its operation and the relationship that exists between the different classes of capital in the firm. This includes both long-term and shortterm sources of capital such as debentures, preference share capital and equity share capital. Eugene and Joel (2001), Eugene, Gapenski & Ehrhardt (1999) and Jansen (2004) elaborate on the concept to imply the mix of debt, preferred stock and common equity depended on by the firm for their operation. Hovakimian, Hovakimian & Tehranian (2002), Myers (1984) and Frank & Goyal (2000) argues that the capital structure of firms', ranges from internal financing to external financing; the internal finance includes retained earnings, while the external finance includes debt financing and equity financing. Zoppa & McMahon (2002) posit that capital structure includes reinvested profits, short-term debt financing such as trade credit, long-term debt financing (debentures), new equity capital injections from existing owners and owner managers and new equity capital from uninvolved parties such as outside investors and venture capitalists.

Several studies have attempted to explain the extent to which capital structure affects the firm. The Modigliani and Miller's study on the relationship between the cost of capital and the value of the firm proposes that the capital structure of a firm does not have an effect on the firms' value ( Eugene, Gapenski & Ehrhardt, 1999). The theory was based on the following assumptions; there was perfect information flow between the activities of the firm and the investors, the capital market was perfect and there was no bankruptcy cost, there was no tax chargeable nor transaction cost in raising of capital fund and the cost of capital for an unlevered firm is the same as the cost of capital for a levered firm plus risk premium ( Modigliani & Miller, 1958).

Notably, though, there is a modification of this in a later publication of the authors. They stated that the capital structure affects the firms' value because debt would attract a tax-deductible expense on interest and hence, there is a distribution of the savings to the shareholders ( Eugene, Gapenski & Ehrhardt, 1999). Yonezawa et al (2006), Zoppa & McMahon (2002), Uremadu (2004) and Eugene, Gapenski & Ehrhardt (1999) disagree with the initial finding that the capital structure of the company has no effect on the value of the company.

Several factors can predict the value of the firm. Chief among these is profit. It is important to understand the relationship between capital structure and profit. Hovakimian, Hovakimian & Tehranian (2002) posit that the capital structure decision of a firm is not dependent on any other factor except the company market/book ratio. They argue that a less profitable firm will issue more equity to offset their debt level, on the flip side, a profitable firm will not issue equity nor debt to finance their operations because the firm will be most interested in internally generated funds. Coyle (2000) further posits that when a firms' only source of finance becomes equity finance, this implies that it is financially weak and has a low credit rating. Hence, equity finance has a negative correlation with profit.

In their study of capital structure and profitability, Valvona & Sloan (1988) found that investors primarily require high return on investment. This attracts them to commit their funds to the firm. As more investors are willing to commit their funds, the firms' value positively increases due to more funds available to them for operation, hence, causing the share price of the firms' stock to rise. The absorption of investors' fund in the operation of the firm would cause it to have more shareholders to be accountable to. These expectations would make the management of the firm to be conscious of their activities and may lead them to fabricate their financial statements to soothe the expectations of their numerous shareholders.

Eldomiaty, Choi & Cheng (2007), propose that the firm should take into consideration its profit as well as other factors in selecting its capital structure. This is to mitigate the signaling effect that the capital structure decision may have on the public perception of the firm (Eugene & Joel (2001). They posit that the public generally views a firm issuing new equity for funding their operation as unprofitable. Almeida & Campello (2007) and Myers & Majluf (1984), further argues that profitable firms' depend more on internal financing than on external financing due to information asymmetry in the market. This implies that profitable firms' depend less on external finance and more on internal finance, than the less profitable firms who depend more on external finance. The pecking order theory further underscore the argument by its proposition that as the profit of the firm increases, the firm depend less on external finance (debt and equity finance) and more on internal finance (retained earnings) ( Myers & Majluf, 1984 ; Abor & Biekpe, 2005).

In contrary to this, the trade off theory argues that the firm can maintain an optimal capital structure by trading off the cost of debt financing against the benefit from debt financing ( Diamond, 1994). Hovakimian, Hovakimian & Tehranian (2002) and Brealey & Myers (2000) posit that the target capital structure that balances the various costs and benefits from debt financing and equity financing is optimal. Hence, the trade off theory views the capital structure as having a positive linear relationship with profit, which implies that as the firms' profit increases, debt increases as well because of the tax saving effect of debt.

The size of the firm also has an effect on both the capital structure of the firm and its profit ( Esperanc et al, 2003; Hall et al, 2004 ). Titman & Wessels (1988), Esperanc et al (2003), Barclay & Smith (1996) and Cassar & Holmes (2003) found a positive relationship between the longterm debt and the size of the firm but a negative relationship between the size of the firm and short-term debt. They further emphasized that smaller firms are more likely to depend on equity finance and short-term debt unlike larger firms who will depend more on long-term debt. Cosh & Hughes (1994) further posit that smaller firm depend less on long-term debt because operational risk has an inverse relationship with the size of the firm. The more debt incurred, the higher the risk. Hence, smaller firm may be prone to having a higher operational risk if they utilise more of long-term debt. Finally, Abor & Biekpe (2005) further posit that bigger firms are much diversified and are perceived as having lower risk unlike smaller firms. This makes them capable of attracting more long-term debt financing than the smaller firms and this affects their profit positively.

This study uses an empirical research method to examine the impact of capital structure on firms' profit. To achieve the objective of this study, we used simple regression analysis to derive the relationship.

The study samples are firms listed on the Nigerian Stock Exchange. The sample was selected based on judgmental sampling from firms listed on the Nigerian Stock Exchange as of 31 December 2006. This is because of the difficulty in accessing the financial statements. Ten companies were selected; they include companies in the printing and publishing sector, the automobile sector, breweries and producers of building materials, chemical paints, food and beverages, packaging and textiles.

The data used in the empirical analysis was derived from the financial statements of these firms' during a five-year period, 2002-2006. This forms the secondary data for the study, which was generated from balance sheets and profit and loss accounts. This period was selected because of accessibility to the financial statements.

The validity of the source of data for this research is established by the fact that only published audited annual reports of quoted companies were used. These reports are published so as to comply with the statutory requirement, which carries with it a penalty if information contained therein is found to be materially misleading for use. The reliability of the source and data is also established by the fact that the consistency of the data can be assured due to its somewhat permanent state that can be repeated with little or no variation. Likewise, different researchers such as Abor (2005), Kumar (2003), Marcos, De Mesquita & Lara (2003), Xu & Wang (1997) and Chen & Hammes (1997) used similar sources of data. Return On capital Employed (ROE) is the dependent variable and it is used as a measure of profit after tax is divided by the total equity. Total equity includes the shareholders fund. The independent variables include the ratio of short-term debt to total asset (RSDTA), ratio of long-term debt to total asset (RLDTA) and the ratio of equity to total liability (RECTL). The short-term debt of the company includes those debts that are repayable within a short period of time e.g. a year. This includes bank loans, bank overdrafts, short-term creditors and other current liabilities. Long-term debts are the proportion of the company debt, repayable beyond a year. It includes long-term loans, long-term creditors, directors' loans, hire purchase and leasing obligations. The total assets of the company include the fixed assets and the current assets such as debtors, bank balance and cash balance. The measure used for equity is the value of ordinary shares used by the company to finance their operations.

In addition to the independent variables, the model includes the size of the firm (SIZE) as a control variable that may affect the capital structure of the firm and the profit of the firm ( Abor & Biekpe, 2005; Esperanc et al, 2003)

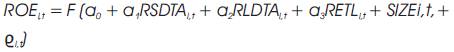

Therefore, the model adopted for this study is expressed thus

Where,

Y captures the dependent variable, which is the return on capital employed

X captures the list of independent variables, which includes ratio of short term debt to total asset, ratio of long term debt to total asset, ratio of equity to total liability and the size of the firm.

The equation above becomes

The explicit form of the equation above becomes;

Where,

1. ROEi,t (ratio of profit after tax before dividend divided by total equity) for firm i in period t

While the explanatory variables to be used for this study includes;

2. RSDTAi,t (ratio of short term debt to total asset) for firm i in period t

3. RLDTAi,t (ratio of long term debt to total asset) for firm i in period t

4. RETLi,t (ratio of equity to total liability) for firm i in period t

5. SIZEi,t (Log of total asset) for firm i in period t

6.e is the error term, which captures other explanatory variables not explicitly included in the model.

The parameters “a1 's” (i= 0,…,3) are the coefficients to be measured, which shows the nature of the relationship between the dependent variable and the explanatory variables, while a0 is the intercept of the regression line. The a priori expectations of the coefficients is such that a0 , a1 , a2 , a3 are < or > 0, which means that we expect either positive or negative relationships between the dependent variable and the explanatory variables.

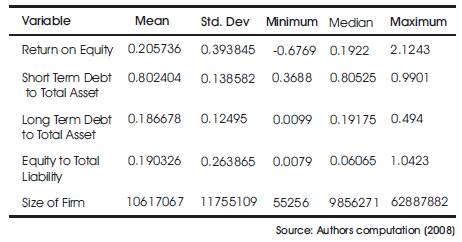

Table 1 provides a summary of the descriptive statistics of both the dependent and the independent variables. It shows the standard deviations, the mean, median, minimum and the maximum of the variables used. The mean (median) long term debt ratio of the firms is 0.186678 (0.19175). This suggests that long term debts are able to finance about 18.6678% of the total assets of the companies. The mean (median) value of the short term debt of the firms' is 0.802404 (0.80525), suggesting that the short term debt is able to finance 80.2404% of the firms' total asset. This suggests that the firms' utilize more short term debt in financing their total asset than long term debt. The average size of the firm studied is N10, 617, 067 (000). The average size is measured as the Log of total assets of the firms' studied which is N10, 617, 067 (000). The firms' equity to total liability ratio mean (median) value is 0.190326 (0.06065), which is suggesting that on the average, the firms' equity can finance only 19.0326% of its total liability. On the average, the firms' return on equity has a value of 0.205736% performance for the years studied and the median value of the return on equity is 0.1922.

Table 1. Descriptive Summary Statistics

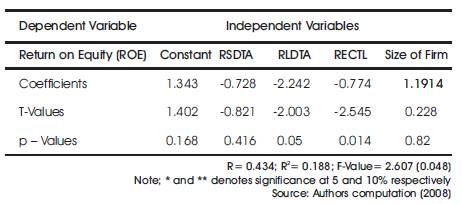

The result from Table 2 implies that the independent variable, which includes the short-term debt (RSDTA), the long term debt (RLDTA), the equity financing (RETL) and the size of the firm are all able to explain for 18.8% of positive variation of the profit of the firm (ROE). This has a significance level of 0.048. The overall model implies that the capital structure indices and the size of the firm are not able to explain for 91.2% of profit variations. This can be understood from the macro economic variables like government policies, competition, cost of production and unstable monetary policy, which is able to significantly affect the profit of firms.

Table 2. Regression Result for the Model

From the result above, when no capital structure decision is made and the size of the firm not considered, the firms would still make a profit of N1, 343, 000 (unit of measurement is in Millions of Naira). When variable X (capital structure variables and size) in the model is 0, variable Y (profit) would be N1, 343, 000.

Furthermore, the result above also implies that when there is a unit change in the short-term debt of the firm, there is a negative impact on the profit of the firm by (0.728) loss. This also implies that if the firm reduces its short-term debt by one, there would be a positive effect on the profit of the firm. This is not significant at 0.05 and 0.01 significance level. The long-term debt and the equity finance of the firm, has a negative significant effect of (2.242) and (0.774) on the profit of the company. These implies that a unit change in the long term debt and equity financing of the firm, has a significant negative effect of (2.242) and (0.774) loss on the firm. The result is significant at a 0.05 level of significance.

The result is consistent with the pecking order theory of Myers & Majluf (1984), which posit that as the profit of the firm increases, there is a detest for external financing like short term debt, long term debt and equity financing. This is because of the availability of retained earnings to depend on ( Abor & Biekpe, 2005). The result is also consistent with the work of Marcos, De Mesquita & Lara (2003), Hall et al (2004), Myers (1984) and Abor (2005), who posit that the long term debt and equity financing has a negative effect on corporate profit.

Finally, the size of the firm has a non-significant positive effect on the profit of the firm. This implies that the size of the firm has a positive effect of 1.1914 on the profit of the firm. The result is not significant at a 0.01 and a 0.05 significance level.

The capital structure decision and its effect on the profit of the firm is an ongoing research area and it is important to the performance of the firm. The issue is very important for firms in developing countries like Nigeria, with an unstable macroeconomic policies and business environment. This would imply having a flexible capital structure policy that could be adjusted for maximum benefit in the face of changing business and macroeconomic environment. This study specifically focuses on the effect of the capital structure on profit of listed manufacturing firms in Nigeria. The result of the study can be summarized as follows:

The results from this study have granted some insights on the corporate capital structure policy of Nigerian firms and its effect on profit. The issue of capital structure and the profit of the firm is a very critical one. However, the results have shown the effect the capital structure decision has on the profit of the firm. It is therefore essential for managers and financial director of firms to become more aware of the macro-economic environment and the unpredictable business environment their firms are operating in. as this may have very significant effect on the profit of the firm. More so, the financial directors and management of firms should also begin to build their retained earnings base and capital reserves, as this would aid expansion and other capitalintensive project. This would discourage depending more on external financing and a high cost of external financing and debt ratio.