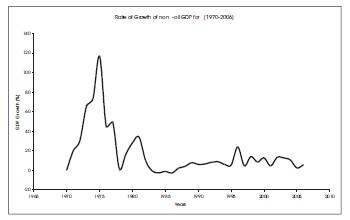

Figure 1. Development of non-oil GDP for (1970-2006)

UAE economy is going ahead in leaps and bounds, and it's one of the star performers of the Middle East. It keeps exceeding the most optimistic expectations, and even in times of political or economic crises, it was able to absorb all shocks and bounce back. This study aimed to identify the impact of the economic sectors in the UAE on the non-oil GDP. We used SPSS v.15.0 and Minitab v.14 heavily to analyze the statistical data depending on Arithmetic Means, Correlation Coefficients, and Regression Analysis to test the validity of the proposed statistical model, and to find the impact of independent variables (economic sectors) on the dependent variable (non-oil GDP). The findings of this study revealed that we were able to build a statistical model for the economic sectors and the non-oil GDP, to analyze the economic indicators of the UAE during (1970-2006). In addition, we found that the oil sector has a statistically significant impact on the UAE non-oil GDP. We strongly emphasize on the importance of this study, and that decision makers should use it when planning for future strategies.

The UAE since its establishment has witnessed a remarkable and fast economic development, which is very difficult to attain even in the most developed communities. The UAE has rapidly maximized the benefits obtained through its huge oil revenues to provide the basic requirements of society. The UAE has lived up to the expectation of the international community, and generously stood by its sister countries in the Arab world, and other developing countries in the rest of the world.

During the last three years, the UAE economy continued to grow rapidly, due both to high oil prices and to the success of other economic sectors, including manufacturing, construction, finance, services and tourism. Looking forward, we expect economic growth to achieve flying colors results in 2007. Growth for the UAE has been 23 per cent in nominal terms for 2006 and GDP was USD 163 billion for 2006. Oil sector is to record high growth, as oil production is expected increase steadily to 3.5million barrels per day by 2011. On the other hand, non-oil sector will gain more support from the diversification policy. We also expect manufacturing and trade to continue growing at high rates, in turn keeping the overall economic growth strong.

The time frame and the geographical scope for this study revolve around the different UAE economic sectors for the period (1970 to 2006).

"Economic Development in the UAE", by Mohamed Shihab.

In this study, Shihab tried to study the current situation of UAE in the late 1990s after 20 years of oil discovery. He concluded that huge structural changes in UAE economy and an enormous increase in quality of services offered by the government led to a fast development in fields of life. And UAE has achieved impressive improvements in many social and economic development indicators during the past three decades.

"The Status and Future of Economic Development in United Arab emirates", by Adel Al Qadhmani.

Al Qadhmani tried to figure out the current situation of UAE economy and compared it with the past since the establishment of the federation. His study was purely statistical without going through economic analysis process. He concentrated on the Gross Domestic Product development for the economic sectors indicators except the Mining Industry sector which includes Gas and Oil.

"Oil Development in Libya", by Fathi M. Othman.

The aim of this study was to understand the mechanism of generating data in different oil fields and to use this knowledge in predicting future production. Fathi's approach basically starts with developing models on the basis of the past behavior of the production data generated by each oil field under study. The researcher found that most of oil fields under study have been adequately and efficiently described by ARIMA(1,1,1).

"Trends in Human and Economic Development across Countries", by Edward Nissan.

Convergence of the Human Development Index (HDI) and per capita income were tested between 1975 and 1998 using a yearly adjustment model. The results indicated convergence for HDI and divergence for income. The aim was to make evident that examination by a one dimensional measure between and within countries, usually income, is not an accurate representation of quality of life. By use of a multimeasure such as the HDI, a better picture is produced.

"Forecasting Foreign Direct Investment Inflow in Jordan: Univariate ARIMA Model", by Al-Abdulrazag Bashier & Bataineh Talal.

This study was an attempt to build a univariate time series model to forecast the FDI inflows into Jordan in the future. The study employed Box-Jenkins methodology of building ARIMA (Autoregressive Integrated Moving Average) model to achieve the goals of the study. The forecasting results revealed an increasing pattern of FDI over the forecasted period. In light of the forecasted results, policy-makers should gain insight into more appropriate investment promotion strategy and meat the needs of such inflow in terms of infrastructure and skilled labor.

"Electricity Demand Management in Libya", by Mosbah Al-Ghariani

In this research, Mosbah studied the electricity consumption in Libya, and how to control it by using DSM (Demand Side Management). So based on the past and present electricity consumption rate, a theoretical model was created in order to forecast future consumption rates. His model was based on the time series data by using the “identification” stage of Box-Jenkins' methodology to briefly explore the data-generating processes of the electricity consumption.

In this section, we will try to shed the light on the major economic sectors that affect the development of UAE economy. The economic activities in United Arab Emirates are classified into ten main sectors, as follows: Agriculture Forestry and Fishing, Mining, Manufacturing, Electricity and Water, Construction and Building, Trade and Restaurants, Transport and Communication, Finance and Insurance, Real Estate and Public Services.

Agriculture in the UAE is confined to a few locations such as parts of Ras al-Khaimah, the Batinah coast, Al Dhaid and Al Ain. The country is self-sufficient in salad crops and poultry for much of the year and even exports crops to markets in Europe. The economy has seen a steady increase in investment in agriculture and fisheries, with the private sector playing an increasingly important role especially in the dairy, poultry and dates industries. As to 2005 statistics, this sector contribution to GDP is estimated to be 3%, where cultivated areas represent 3.1% of total territory, and the number of date palms is over 40 million. Products includes Dates, green fodder, vegetables and fruit; livestock, poultry, eggs, dairy products, and fish. UAE also possesses a fishing fleet of 5191 ships and boats, and there are more than 17,264 fishermen, and the estimated catch is 97,574 tons.

Figure 1. Development of non-oil GDP for (1970-2006)

With the fast development of domestic, industrial, and agricultural activities, conventional water resources have been seriously reduced. Recently, there has been an increasing concern about the development of the water sector and the best practices for conserving the available resources. In 2004, the total water production was 195 billion gallons. On the other hand, total installed electricity generating capacity in 2006 was 16,220 MW, and the projected installed electricity generating capacity in 2010 is 26,000 MW. In 2005, the annual electricity demand growth reached 12%. The services offered by the federal Ministry of Electricity and Water have grown very substantially over the years and now match those offered in developed countries.

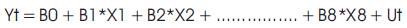

Figure 2. Rate of Growth of non-oil GDP for (1970-2006)

A state of the art facilities, competitive low labor and energy costs, favorable tax laws and political stability have all contributed to the growth of industry in UAE. Nowadays, you can find the label of "Made in UAE" on many products including cement, aluminum, building and construction materials, fertilizers, foodstuffs, garments, furniture, plastics, fiberglass, jewelries, pharmaceuticals, firefighting equipments, processed metals, and many other products. Non-oil manufacturing is concentrated in Dubai and Sharjah. Both emirates have large industrial areas, constructed by their respective governments, and free zones, which have attracted considerable foreign investment. The most successful free zone in the UAE is at Jebel Ali, which was established in 1985. Most companies use the free zone as a storage and distribution center for the Gulf and beyond.

For thousands of years, UAE has been a trade center for pearls, copper, and other materials which were being transferring from one region to another through UAE coasts. These days, trade continuous to be a cornerstone for UAE economy. The numerous free trade zones established in the country are also contributing enormously to the value of exports and UAE has become the third most important re-export center in the world (after Hong Kong and Singapore), and re-export trade provides an important one-third of the entire trading sector in the UAE. As of 2005, exports reached USD 116 billion, free-zone exports were USD 17.4 billion while reexports yielded a USD 38 billion. On the other hand, imports reached USD 71.1 billion.

With 41 airports, six of which are international airports, and more than 10 ports, the Federation plays a vital role in both regional and international trade, acting as the leading Trans-shipment hub for the Gulf and an important staging post for the Indian sub-continent, East Africa and Central Asia. Its position has been further enhanced by the rapid growth recorded by Dubai-based Emirates airline, and Abu Dhabi-based Etihad Airlines. The rapid development over the past two decades in airport infrastructure has been assisted by the UAE's open sky policy. Currently, Dubai is working on a state-of-art railway system that will change the way people used to transport for ever, with a cost of 4.1 billion USD. Providing an alternative mode of transport, the metro aims at easing traffic congestion, reducing the traveling time, this in effect will reduce traffic-borne pollution and improve air quality thereby creating a better environment.

The UAE has no restrictions or regulations on foreign exchange. Capital, profits, interest, and royalty payments may be repatriated freely. The local currency has been tied traditionally to the US dollar at the rate of US$ 1 to DH 3.67. Banks in the UAE are divided into two major categories: Locally Incorporated Banks which are public shareholding companies licensed by the Union Law, and Branches of Foreign Banks which have obtained Central Bank's licenses to operate in the country. The banking industry has a strong and stable funding base, mainly from individuals who place money with the banks on a short-term basis. There is no deposit insurance scheme, but this has not blocked the steady flow of funds into the local banking system.

There is now a race to offer a complete medial service throughout the federation, with equipped hospitals in all the larger centers of population The UAE has achieved the highest life expectancy of 75 years in the Arab world, according to a report by the United Nations Development Program (UNDP). The UN has also widely recognized an ongoing UAE campaign to ensure better services for children and secure the world record in cutting child mortality rate. In addition to that, Dubai government created the Dubai Healthcare City, which will become the internationally recognized location of choice for quality healthcare and an integrated centre of excellence for clinical and wellness services, medical education and research. The UAE is fast transforming itself into a top healthcare destination.

According to figures of the latest nation-wide census of 2005, the illiteracy rate in the country is 9%, which is approximately the same between nationals and non nationals. Nationals with only high school certificates are 31.5%. For the non nationals this percentage is around 23.8%. Nationals with university degree (Bachelor and above) are 11%, and for the non nationals this percentage is 18.4%. Although the UAE has achieved much in the field of education, there is a real awareness that constant updating of policy and continual investment in infrastructure is required to ensure that graduates are properly equipped to enter the workforce and assist in country's development. To this end, the Ministry of Education has released a draft policy document outlining a strategy for educational development in the UAE up to the year 2020 based on several five - year plans.

The UAE possesses nearly 10 percent of the world's total reserves, and there is no doubt that oil will continue to provide the income for both economic growth and the expansion of social services for several more decades at least. The oil and gas sector provides around a third of the UAE's GDP, and oil production is around 2 million barrels a day. Gas is increasingly important, both for export, and for meeting local demand, from domestic and industrial consumers and for power generation and water desalination plants. Over the years, the federation has been a strong supporter of OPEC and has generally adhered to its quota, even though the situation has meant that Abu Dhabi has had to produce well below its actual production capability.

A recent study conducted by the National Bank of Dubai (NBD) has said the UAE's construction sector output grew at an average annual rate of 11 per cent over the last decade, rising from USD 3.95 billion in 1996 to USD 6.92 billion in 2004. Given the wave of real estate development during the last few years, the average growth rate during 2002-2004 exceeded 16 percent per annum. The UAE has USD 35.6 billion worth of construction projects running, making up 63.7% of the total value of projects under development in the GCC, according to a report by Abu Dhabi National Exhibitions. There are other ambitious construction projects running in Dubai scheduled for the next 10 years, for example, Burj Dubai, Nakheel Islands, Dubai Land, Dubai Light Rail Transport (LRT) project and Deira Palm Island. In addition, the announcement of a $4.3 billion plan to redevelop Dubai's World Trade Center (DWTC) is another endorsement of Dubai's pursuit to maintain its reputation.

We shall study the non-oil industry representing the GDP cost prices of the Gross Domestic Product GDP during the period of time through the years from (1970-2006) including the contributions of the different sectors, excluding the oil industry.

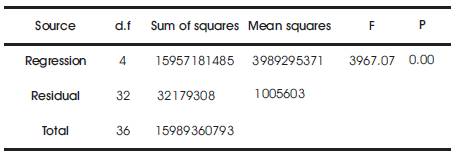

Table 1 declares primary data for the non-oil Gross Domestic Product in current prices, in addition to the average growth rates and the rises achieved during that period. We notice from the same table (column 2) that the base year (1970) is the lowest level of Gross Domestic Product which is (USD 343.6 million). It keeps rising until year 1982, where it starts to decline, because of the political crises of the Iraqi-Iranian war. Through that period, the GDP growth reached 116.5% at 1975 as a top level and 1.9% at 1978 as a low level.

Table 1. UAE's non-oil GDP for the period (1970-2006) at current income factor cost in million USD

Year 1983 represents the beginning of a new stage in GDP development, by showing a series of draw-backs in domestic production as a result of recession which covered the world in general. But when OPEC adopted an advertising budget policy, the stability returned back to the oil markets and oil sales rose again, and GDP resumed its development to reach its highest level at a percentage of 23.8% in year 1996.

Sources:

1-Ministry of planning.

2-National Accounts for UAE

3-Economic and Social Development in UAE.

4-Annual Economic Report.

5- The Arabian Monetary Fund Annual Report

In general, we can see that the average rate of growth of the GDP during this period is close to 18% per annum, achieving at the end of the period an average of 21538.8%, which means that the GDP has doubled 215 times during the last 37 years. Being more specific, the 1970s shows an average growth rate of 46.4% per annum, which is higher than the rate achieved in the 1980s which was 7.9% and even higher than the 1990s, 8.7%. So the 1970s showed the highest rate of growth and were the liveliest of the entire period. See Figures (1) and (2).

If we return back to the contribution of non-oil economic sectors that built up the UAE economy, we find that the year 1975 is the liveliest in domestic product growth in all sectors. The construction and building achieved an outstanding growth rate that reached 325%, followed by the financial sector with a growth rate of 138.1%, trade sector at a growth rate 90.5%, and by the public services at a growth rate 66%, which was the source of development increase in the service and distribution sector to give the answer for the needs of the growing population, by adding more social health and educational services. See Table 2.

Table 2. UAE's non-oil GDP by economic activity from (1970-2006) at a current income factor cost in million USD

As a general evaluation of the development of the economic sector, according to its contribution to gross domestic product, it appears to us, that the Public Services sector occupies the first place in growth power, an average growth rate that reached (25%) followed by Trade sector (19%), Constriction and Building sector (18%), in third place, Manufacturing Industries sector (14%) in fourth place, then Financial sector (9%). Agriculture and fishing occupied the last rank with a growth of (3.1%), due to low fertility and scarcity of water and bad weather. See Table 2.

Sources:

1-Ministry of planning.

2-National Accounts for UAE

3-Economic and Social Development in UAE.

4-Annual Economic Report.

5- The Arabian Monetary Fund Annual Report

We measured the mean value of all economic sectors for (1970-2006), through the four-part time periods which are the (1970s, 1980s, 1990s, and 2000s), and the results were recorded in the table 3. From the table we can see that the construction sector occupied the first rank in the (1970s) in accordance with the public services sector which occupied the first rank in the (1980s, 1990s, and 2000s).See Table 3.

The sectors of Public Service, Money, Insurance, Trade, Restaurants and Transport added together contributed more than 77 per cent to the GDP, and these sectors are considered distributive service ones, which emphasizes that the development of non-oil UAE economy is not centralized on goods trading, and that is why it's very important and necessary to emphasize more on this sector in order to complete the infrastructure development and carry on towards the continuous country development in the future.

The speed in which the UAE economy develops indicates an outstanding performance and strength, and help in predicting the economic direction of the economy, especially if the source of that acceleration is from the economic activities which contribute to the economic growth. For that purpose, we have studied the average or the mean of that acceleration, which have incurred from in the non-oil GDP at the current costs and prices. It shows that it had reached the peck in the 1970s and started declining in the 1980s, from a percentage of 372% to 1.1%. In the late 1980s the economic growth was decreased by 77%. It then increased rapidly in the 1990s by 340% which is considered to be a great improvement. All the above indicate that the UAE economy will succeed more in the future.

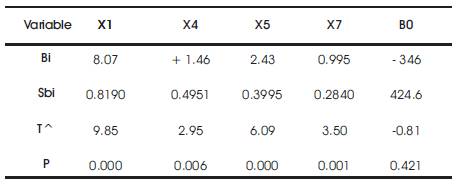

The goal of this analysis is to find whether the economic sectors affect the non-oil GDP, or not. We shall consider the average of growth for every economic sector as an independent variable. So we will have (8) independent variables, considering the average growth of non-oil production as a dependent variable by using Multiple Linear Regression Analysis.

Yt = Yearly growth rate of gross domestic production (non – oil)

B0 = First condition of the model

B1 = Slope coefficient regression

Ut = Random error

X1 = Agricultural sector

X2 = Manufacturing Industries

X3 = Electricity and water

X4 = Building

X5 = Trade

X6 = Shipping and transportation

X7 = Financial Institutions and Insurance

X8 = Public services

By using Least Square Method (LSM) that gives us B0, B1 which are calculating B0 + B1 with the least deviation to find the model that gathers all eight sectors and its effect on the dependent variable that expresses Gross Domestic production (GDP). It is impossible to do so due to result of hypothesis testing which is related to the independence for more than one variable. The continued series have been ignored for those, which have been accepted by Ho hypothesis to reach the final model, which consist of four independent variables.

We take the following model:

For the analysis of constants model, which we consider to be finally the relation between the economic sectors and the Gross Domestic Production (GDP), we shall see Table 4.

Table 4. Some statistical indicators necessary for analysis of sample factors

Below, we apply the Hypothesis Testing to determine the significance of our proposed model:

Now, we will use some statistical tests to find the significance of F measurement. See Table 5.

Table 5. Analysis of Variance

From the table above, it's clear that our model is convenient to test study hypotheses, based on the increment of the value of the calculated "F", when compared to "Fcritical ". We assumed that if (F=3967.07), and that F is greater than the Fcritical at probability of 95% and at freedom (4-32). So we ignored the hypothesis (H0 ) and accepted the proposed model based on the fact that it is convenient to represent the relation of the economic sectors in United Arab Emirates, and the nonoil GDP.

We say that coefficient (R²) is very important to increase confidence of accepted model. This solution shows adj. (R²=0.99952) .In this samples the Independent Variable explains the 99% a percentage from the variables of nonoil GDP. Hence this affected spread values of GDP and sequence forecasting.

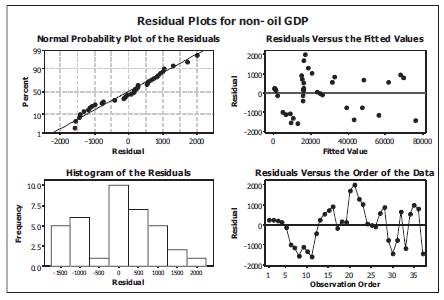

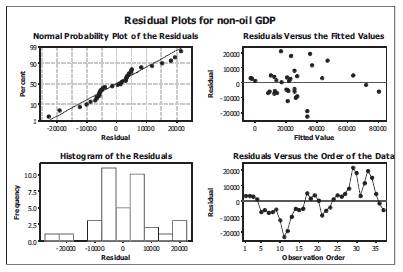

One of the main conditions to obtain perfect model is to reduce the errors between the UT and the normal distribution. Based on the above (X2 = 1.16), we have accepted the hypothesis which depends on the reduction of the distribution residual from the normal distribution. See Figure 3. The sample indicates the absence of the first order auto correlation.

Figure 3. Residual plots for non-oil GDP

From the results, it's clear that the economic sectors under study which form the UAE economy are convenient for our chosen model, after getting rid of all notices and defects which underestimate the importance our chosen model.

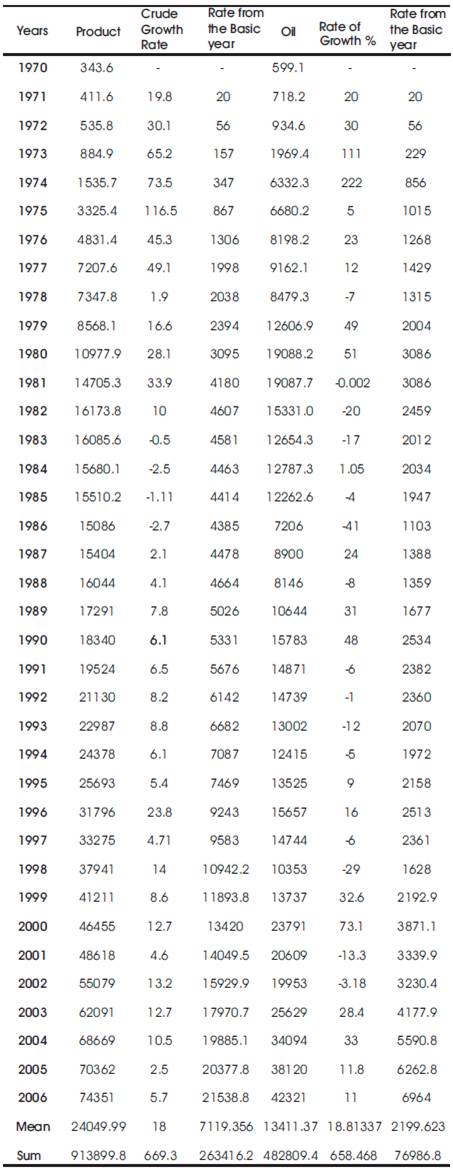

Table 6 shows us the strategic production in UAE economy during the period (1970-2006), where oil is considered to be in its main spire. We found that there are series of fluctuations and instability. The highest level was reached in year 1980 and the lowest was in year 1978, refer to Table 6.

Table 6. Non-oil GDP and Oil production from (1970-2006) at current income factor cost “In million USD”

What draws attention is that the contribution of this sector, starting from the year 1970 and till the year 1982, was exceeding the non-oil GDP. From there onwards a new stage started in the development of the UAE economy. This allowed the UAE non-oil GDP to exceed the revenue of the oil sector, hence continuing till the end of the period being studied.

This continued to 80% of the oil and non-oil GDP of year 1970. As known before, the oil sector is a factor that drives development in all sectors of economy by using the greater part of its returns to expand those sectors. We found that the person correlation coefficient R.y.x = 0.8 means that the relation is strongly positive for the analysis of constant sample on whose basis we found the relation between the gross domestic production (G.D.P) and strategic production (oil).

Sources:

1-Ministry of planning.

2-National Accounts for UAE

3-Economic and Social Development in UAE.

4-Annual Economic Report.

5- The Arabian Monetary Fund Annual Report.

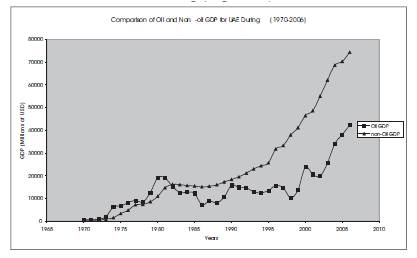

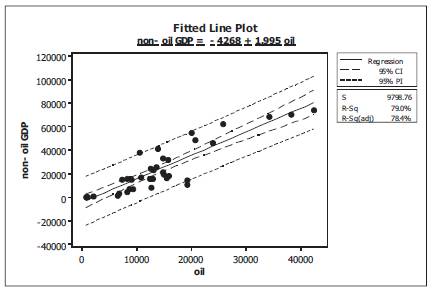

As we mentioned before, the Mining Industry sector (Oil and Gas) is considered the main player in UAE economic development, and as a result to our statistical modeling for the relation between oil development and non-oil GDP, we reached to the following (Figure 4)

The regression equation is:

This model is considered objective from (Figure 5) a statistical point of view.

In this sample, we found the value of t0 ^ = .012, t x^ =5.368 is greater than tcritical , in d. f = 36 and confidence X = 0.05 in addition to the value F = 131.53 which is greater, in d.F1=1, d.F2=35.

Figure 4. Comparison of oil and Non-oil GDP for UAE (1970-2006)

Figure 5. Fitted Line Plot

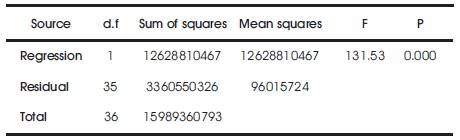

The analysis of variance: (Table 7)

Table 7. The analysis of variance

One of the main conditions to obtain perfect model is to reduce the errors between the UT and the normal distribution.

It means that Fcritical is less than F = 28.81807. As this we accept the model.

Hence: from the above model we conclude that any increase of one million dollar in the oil sector affects the non-oil GDP with an increase of (1,991,000 USD) at a probability of 95%.

Figure 6. Residual Plots for non-oil GDP

We have come up to a number of conclusions, which could be summed up as follows:

1. Growth rate in non-oil sectors during the period under study, from (1970-2006), reached about 18% per annum. At the end of the period it was up at 21538.8% against the start-year, which means that it has been doubled more than 215 times. In the 70s growth rate was up 41.8% per annum, while in the 80s it was 7.9 %, and the 90s it was up to 9.2%, while in the 2000s it reached 8.8% per annum.

2. Generally speaking, GDP suffered a number of setbacks in 1983, due to recession worldwide and in the Arab nation, because of the political crises. But it eventually resumed growth to reach a maximum of 23.8% in 1996.

3. The 70s were characterized by a record growth in GDP.

4. As a general evaluation of the development of the economic sector, according to its contribution to gross domestic product, it appears to us, that the Public Services sector occupies the first place in growth power, an average growth rate that reached (25%) followed by Trade sector (19%), Constriction and Building sector (18%), in third place, Manufacturing Industries sector (14%) in fourth place, then Financial sector (9%). Agriculture and fishing occupied the last rank with a growth of (3.1%), due to low fertility and scarcity of water and bad weather.

5. The contribution of service and distribution sectors during the periods under study was never less than 77%. Sectors other than the sector of goods dominate the UAE non-oil economy, as the country infrastructures are yet to be completed.

6. Non-oil GDP is mainly influenced by four sectors; Agricultural, Building & Construction, Financial Institutions and Insurance and Trade.

7. Mining (oil) sector, from 1970 up to 1982, surpassed non-oil GDP. But later on, a new era began, in which the equation was capsized, and as a consequence, non-oil GDP surpassed oil income (80% of GDP-oil and otherwise in 1995 against 40% in 1970.

8. According to our proposed statistical model we conclude that any increase of one million dollar in the oil sector affects the non-oil GDP with an increase of (1,991,000 USD) at a probability of 95%.