Abstract

Mutual funds are one of the important financial instruments for the financial sector. Mutual funds provide an opportunity for investors to invest in a variety of diversified portfolio investments and also help to achieve their financial objectives. The mutual fund industry has been responding veritably fast in the Indian financial market in the last ten years as it provides further promising results to investors. The Indian mutual fund industry has over the last year seen a dramatic improvement in terms of volume as well as the quality of the product and service offerings in recent times. The study measures the performance of Mutual Fund (MF) schemes in India with special reference to public and private debt mutual fund schemes. A total of 16 schemes were selected from the four asset management companies. The evaluation was attained by applying various financial tools like Rate of Return, Standard Deviation, Beta, Sharpe Ratio, Jenson Ratio, and Treynor Ratio. The data contained comes from the various authorized websites and factsheets of funds. When public and private mutual funds were analogized, the private mutual fund companies were commencing much better than public mutual fund companies for the investors to invest in.

Keywords:

- Mutual Funds

- Financial Sectors

- Investors

- Portfolio

- Financial Markets

Introduction

A mutual fund is mostly a pool of investors' investments, which are collected by fund managers and invested in stock exchanges(Nimalathasan & Gandhi, 2012). Mutual funds are considered to be one of the important segments of the Indian capital and financial markets(Pathak, 2008). The government of India introduced economic reforms in the fields of trade, industry, and commerce so as to bring about the integration of the Indian economy with the global economy. With the growth of the economy and the capital market in India, the size of investors has also increased rapidly. The stock market in India has experienced remarkable developments in the past few years. New innovative instruments and institutions have emerged that have been playing the role of financial intermediaries. A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund's assets and attempt to produce capital gains or income for the fund's investors (Sapar & Madava, 2003). A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus. Mutual funds are governed under the Securities and Exchange Act of 1934. They must be enrolled with the SEC and must give investors a prospectus that addresses the expenditure a shareholder will have to remunerate as well as the performance of the fund as of a distinct date. Mutual funds may be offered by brokers. Mutual funds provide a more feasible way for numerous individuals to invest in the market. Mostly, there are three types of investments. Various types of mutual fund schemes are designed to cater to the distinct needs of distinct people.

1. Equity or Growth Funds

These invest generally in equities, i.e., shares of companies. The primary goal is wealth creation, also known as capital appreciation. They've the implicit ability to induce an advanced return and are suitable for long-term investments. Examples would be "Large Cap" funds, which invest predominantly in companies that run established large businesses, and "Mid Cap" funds, which invest in mid-sized companies. "Small Cap" funds that invest in small-sized companies, "Multi Cap" funds that invest in a mix of large, mid-sized and small-sized companies, "Sector" funds that invest in companies that are related to one kind of business. For example, technology funds that invest only in technology companies, and "thematic" funds that invest in a common theme. For example, infrastructure funds that invests in companies that will benefit from the growth in the infrastructure segment.

2. Income or Bond or Fixed Income funds

These invest in fixed income securities like government securities or bonds, commercial papers and debentures, bank certificates of deposit, and money market instruments like Treasury Bills, Commercial Paper, etc. These are relatively safer investments and are suitable for income generation. Examples would be liquid funds, short term, floating rate, corporate debt, dynamic bonds, gilt funds, etc.

3. Hybrid Funds

These invest in both Equities and Fixed Income, therefore offering the best of both, Growth implicit as well as yield Generation. Examples would be Aggressive Balanced Funds, Conservative Balanced Funds, Pension Plans, Child Plans and Monthly Income Plans, etc.

4. Review of Literature

Adhav and Chauhan (2015) exacted the explanation of mutual fund schemes of named Indian companies in terms of risk-return relationship to analogize the performance of mutual fund schemes of named Indian companies based on benchmark index and concluded that the illustration of mutual fund schemes of named Indian companies has been superior over the last 5 years. Suneetha and Latha (2020) made an attempt to study the performance of select balanced funds in India, to measure the risk-return relationship and market volatility of the select mutual funds and to compare the performance of select balanced funds with the BSE Index. The analysis was achieved by using various financial tests like Rate of Return, Standard Deviation, Beta, Sharpe Ratio, and Treyner Ratio. The data was collected from various websites of mutual fund schemes and from AMFI India. The analysis depicts that the majority of funds selected for the study have out-performed under Sharpe Ratio. An attempt was made to study the performance of select balanced funds in India, to measure the risk-return relationship, market volatility of the select mutual funds and to compare the performance of select balanced funds with the BSE Index.

Dhume and Ramesh (2011) estimated the interpretation of the sector mutual fund in dealings with the market and performance, exercising distinct avenues of performance measurement and studying the risk-return analysis of the sector fund, and concluded that all the sector funds have outperformed the market according to Sharpe and Treynor, barring the infrastructure sector.

Sharma(2020) estimated the performance of named debt mutual fund schemes and examined the risk and return elements among these mutual funds with the help of standard deviation, Sharpe, and Jenson's ratio. According to the findings of this study, all of the funds fared well in the highly unpredictable market movement of two funds. Investors need to look at statistical parameters while investing in mutual funds apart from looking at the NAV and total return to ensure harmonious performance of mutual funds.

Uppily & Meenakshisundaram (2018), studies on the knowledge of debt mutual funds. The study was conducted to analyze the financial knowledge position with respect to debt mutual funds. The research says that there are various alternatives available in debt mutual funds and the investor has to study and select the appropriate fund based on his risk and time frame of the investment.

Jensen (1968) studied the disciplining effect of debt, as the “control hypothesis” of debt creation, which arises from the fact that debt can constrain directorial appropriation in a situation where corporations have more internally generated funds than investment opportunities in terms of the availability of projects with positive net present value.

Sushilkumar et.al. (2010) estimated the performance of mutual fund players in India based on their resource mobilization during the past decade. The study found that the players are highly categorized into public and private participants. The study discovered that there is a significant contribution by all the participants to the growth of the mutual fund industry in India.

Bobade et. al (2020) found that most investors are aware of mutual funds. Investors who have high liquidity invest their money in mutual funds. Investors are investing their money in mutual funds for a regular return in the future, tax saving and minimizing financial risk. The mutual fund industry is growing at a large level in India.

Treynor(1965) believed that exacting a portfolio's return in comparison with its systematized risk is increasingly sensible. In his endeavor, he'd estimated the exhibition of mutual funds on a quality line graphically. The more efficient risk or unpredictability a reserve has, the more risky a fund becomes. By incorporating an assortment of concepts, he created a single line indicator called the Treynor index.

Kaur (2014) examined the risk and return elements among these mutual fund schemes and the relationship between NAV and market portfolio return with the aid of various measures like standard deviation, beta, R-square, Sharpe, Treynor, and Fama's measure and found that open-ended debt mutual funds did not perform better than the benchmark indicator.

5. Objectives of the Study

- To assess the performance of selected debt mutual fund schemes in India.

- To examine the risk and return component among these mutual funds.

- To exact the performance of selected schemes using risk adjusted performance measures namely Standard deviation, Beta, Sharpe, Treynor and Jenson's Alpha ratios.

6. Research Methodology

6. 1 Sampling

To probe the performance of mutual funds in India, a total of 16 public and private mutual fund schemes have been selected as samples. The study measured the performance of 16 public and private debt mutual fund schemes (Tripathi & Japee, 2020).

6. 2 Period of Study

For the aim of the present study, performances of 16 sample schemes for the period of 3 years from 2019 to 2021 have been proposed to be analyzed.

6. 3 Data Sources

This study is based on secondary data and the relevant sources of data are books, journals, magazines, newspapers, brochures, and websites of selected mutual funds. Monthly NAV data on each sampling scheme is collected from www.mutualfundsindia.com and www.moneycontrol.com. The CRISIL 10 year gilt index was used as a benchmark for the analysis, and monthly BSE Sensex data were obtained from www.bseindia.com.

6. 4 Tools and Techniques

To analyze the data, simple statistical tools like arithmetic mean, percentages and standard deviation have been used. The financial tools like portfolio beta, Sharpe ratio, Treynor ratio and Jensen ratio have been selected (Pandey, 1995).

6. 5 Statistical Tools

Tools used for the present study are Rate of Return, Standard Deviation, Beta, Sharpe Ratio, Treynor Ratio and Jenson Ratio.

6. 5.1 Standard Deviation

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the friction. The standard deviation is computed as the square root of friction by deciding each data point's deviation comparative to the mean. Value gives an ideal about how unpredictable fund returns has been in the past years. A lesser value indicates further predictable performance. When seen in mutual fund standard deviation, it tells that how broadly the return from a mutual fund portfolio is sinking from the anticipated return.

Formula - √Σ(R¯R)2/N(Measure variance and risk.)

6. 5.2 Beta

Beta is also known as the Beta co-efficient. Beta valuation gives a concept about how changeable fund performance has been for analogous funds in the market. Lesser beta implies that the fund gives a further predictable interpretation assimilated to analogous funds in the market. A more useful understanding of risk is in relation to the market or rather the applicable market benchmark. The beta of a mutual fund scheme is the volatility of the scheme relative to its market benchmark. If the beta of a scheme is greater than 1, then the scheme is more volatile than its benchmark. If beta is lower than 1, the scheme is less unpredictable than the benchmark.

Covariance/σm×σm (Measure the level of volatility associated with the fund compared to the bench mark.)

6.5.3 Sharpe Ratio

It indicates how much important risk was taken to get the returns. Advanced valuation means the fund has been able to offer better returns for the amount of risk taken. It is computed by deducting the risk-free return, outlined as an Indian Government Bond, from the fund's returns and also dividing them by the standard deviation of returns.

Formula-[(return from the fund-risk free rate of return)/total risk of the fund] (Measures the excess return earned on fund per unit of total risk.)

6.5.4 Treynor's Ratio

It indicates how much important redundant return was generated for each unit of risk taken. Advanced value means the fund has been suitable to give better returns for the amount of risk taken. It's computed by deducting the risk-free return, outlined as an Indian Government Bond, from the fund's returns and then dividing by the beta of returns.

Formula-[(return from the fund-risk free rate of return)/Beta] (Measures the excess return earned per unit of systematic risk that is beta.)

6.5.5 Alpha

It indicates how the fund generated additional returns compared to a standard. Let's say if a fund A benchmarks its returns with Nifty 50 returns, alpha equal to 1.0 indicates the fund has beaten the nifty returns by 1%, so the higher the alpha, the better.

Formula - Portfolio return-[risk free rate+ portfolio beta* (market return-risk free rate)](Measures abnormal return of a security or portfolio of securities over the theoretical expected return.) (Fisher & Ronald, 1995).

6.5.6 Expense Ratio

The expense ratio is defined as the annual fee that an investor is charged for the management of his or her funds. Annual fund operating charges, basically known as the expense ratio, are the percentage of assets payable to the fund manager (i.e., AMC) as the conservation fee.

7. Results and Discussions

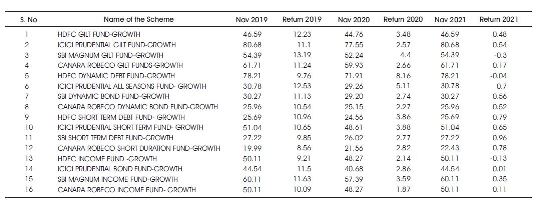

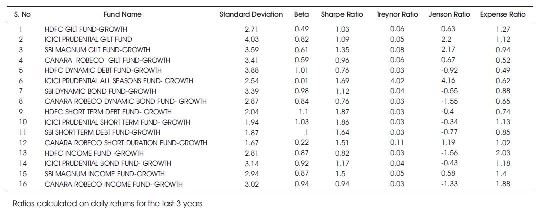

Table 1 and Table 2 show the comparative NAV (Net Asset Value) for the selected debt mutual fund schemes. It can be seen that the returns are very volatile for all the 16 sample schemes during the period of three years. The Canara Robeco short-duration fund has the lowest standard deviation of 1.67%, and the most risky is the ICICI prudential gilt fund, with a standard deviation of 4.03%.

Table 1. Debt Fund

Table 2. Risk Ratio (Debt Fund)

The ICICI Prudential Short Term Fund has the highest beta of 1.03 compared to other funds. It indicates the sensitivity of a scheme's return in relation to the market return. Because the beta is more than 1, the scheme responds aggressively to the market volatility and hence it becomes risky to invest in such a fund. Further, it is clear that HDFC gilt fund, ICICI prudential gilt fund, SBI magnum gilt fund, Canara Robaco gilt fund, ICICI prudential all season fund, SBI dynamic bond fund, Canara Robeco dynamic bond fund, Canara Robeco short term duration fund, HDFC income fund, ICICI prudential bond fund, SBI magnum income fund, Canara Robeco income funds have betas of less than 1, which indicates that they are safe against some macroeconomic risk that affects the rest of the investment portfolio adversely (Bhalla, 2008).

The analysis of the Sharpe ratio revealed that HDFC Short Term Debt Fund has performed with the highest Sharpe Ratio of 1.87. It indicates that this scheme is better at dealing with the total risk attached to the fund as compared to its competitors. HDFC dynamic debt fund and Canara Robeco dynamic bond fund has lowest sharpe ratios among all the debt schemes with 0.76 sharpe ratio.

The higher Treynor Ratio is a good performance indicator. It is revealed from Table 2 that from among all the funds ICICI Prudential All Seasons fund has performed better as it has the highest Treynor Ratio of 4.02. Most of the other funds have underperformed lowest Treynor ratio.

Jenson alpha of 7 mutual fund schemes out of 16 sample schemes have come out with positive Jensen's values, which indicate superior stock selectivity of their fund managers assuming their respective level of risk.

Positive alpha (α) indicates good performance whereas negative alpha (α) indicates poor performance of the funds. ICICI Prudential All Seasons fund has performed best with the first rank among all the schemes with Jensen Ratio of 4.16 and ICICI Prudential Short Term Debt fund ranks last with-0.34 Jensen's Ratio.

HDFC Income fund has the highest expense ratio of 2.03. HDFC Dynamic Debt fund has the lowest expense ratio of 0.49.

The private companies' Debt Mutual fund schemes have found to be the better investment for the investors as compared to the public companies’ Debt mutual fund schemes as they are found to be performing better. (Debasish, 2009).

Conclusion

In the present scenario in India, mutual funds are one of the smart investment sources accessible to small investors with a low risk of investment. This study anatomized the 16 Debt Mutual fund schemes. All the sample schemes carry further risk as assimilated to their returns, despite the economics low down. Financial years 2019 and 2020 have given appreciative returns as analogized to the negative returns in the year 2021. Most of the growth funds have outperformed the market according to the Sharpe and Treynor performance measures. According to the Jensen performance measure, the fund managers of both public and private companies have begun to have superior stock selectivity. The private companies' mutual fund schemes have been found to be the better investment for investors as analogous to the public companies' mutual fund schemes as they are found to be performing better.