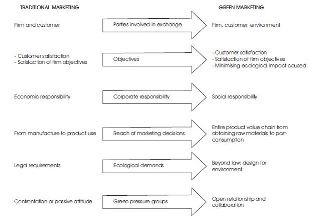

Figure 1. Difference between Traditional Marketing and Sustainable Marketing ( Punitha & Rasdi, 2013)

Patagonia has been exploiting the toolbox of green marketing by focusing persistently on the environmental and social aspects of their work. In the following section, a few pre-pandemic marketing initiatives are discussed to underline the firm's effective positioning and pivot to the green marketing model.

3.2 Pre-Pandemic Sustainability Marketing Campaigns

Patagonia's mission statement was revised in the spring of 2019, just before COVID-19 plunged the world into a pandemic, from "Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis" to "We're in business to save our home planet.” The old philosophy was the "how," how the company would implement measures to deal with the environmental crisis. The new philosophy is all about the "why". The new statement means that each staff member is to think about the "how" and the means themselves on a holistic basis (Funazaki, 2019).

The following are the examples of specific "how", implemented before the pandemic.

3.2.1 Transparency

Being a sustainable company requires continual monitoring and evaluation. Therefore, Patagonia monitors all processes, including every step of the manufacturing process, to minimize environmental and social impact. This data is analyzed and solutions are developed and applied.

These assessments include a proprietary tool called the Eco Index, developed in collaboration with the Outdoor Industry Association (OIA) and its affiliates and the European Outdoor Group (EOG). The Eco Index is a product-level tool designed to help companies benchmark and measure their environmental footprint, identify areas for improvement, and make informed sourcing and product lifecycle decisions (Outdoor Industry Eco Index Pilot Program Officially Launched, 2010).

3.2.2 “Worn Wear” - Recycling, Repair, & Reuse

To minimize the negative impact of the products, Patagonia is using 87% recycled materials this season and is working to increase the ratio up to 100%. The raw materials come from both post-consumer materials, such as used clothes, plastic bottles, and used fishnets, and pre-consumer materials generated in factories during the manufacturing process.

Patagonia's “NetPlus” line is a collection of fully traceable, recycled marine plastic fabrics, 100% recycled from used fishing nets collected from fishing communities in South America in collaboration with Bureo. To date, more than 400 tons of fishing nets have been collected, helping to alleviate the problems associated with ocean plastic.

The program, called Worn Wear, provides an easy way to repair and recycle Patagonia products. It includes a repair guidebook that consumers can follow themselves and the sale of used, repaired items. The company claims that extending the life of a garment by two years can reduce carbon emissions, water use, and waste footprint by as much as 82% (Worn Wear - Used Patagonia Clothing & Gear).

The "Don't Buy This Jacket" campaign, which became a topic on Black Friday 2011, was also an appeal for pledging to Common Threads Initiatives, which focus on reducing the environmental impact of over-consumption and promote reducing, repairing, and reusing as opposed to buying a new jacket (The Success of Patagonia's Marketing Strategy, 2020).

3.2.3 “The Climate Crisis” - Energy, Carbon Emissions & Carbon Sequestration

In the spring of 2019, Patagonia announced a new goal called "The Climate Crisis." Patagonia has achieved 100% renewable energy for its headquarters, offices, retail stores, and distribution centers in the United States and 76% worldwide (Climate Crisis - Patagonia, n.d.). However, these do not include its supply chain. Patagonia is aiming to become fully carbon neutral by 2025, including its supply chain.

Besides switching to renewable energy, the company is supporting carbon sequestration by investing in natural carbon solutions. In addition, they recognize the importance of forest conservation and work to procure raw materials by following strict FSC (Forest Stewardship Council) standards for biodiversity, worker safety, and the rights of local and indigenous communities.

3.2.4 Donations

3.2.4.1 “1% for the Planet”

Since 1985, Patagonia has pledged to use 1% of its sales to protect and restore the natural environment, donating more than $140 million in cash and in-kind contributions to grassroots environmental organizations working in their respective communities in the U.S. and abroad. 1% for the Planet, founded in 2002 by Yvon Chouinard, founder of Patagonia, and Craig Matthews, owner of Blue-Ribbon Flies, is an alliance of companies that understand the need to protect the natural environment. Companies in this alliance donate 1% of their annual sales and understand that "business profits and losses are directly related to the health of the global environment” (1% for the Planet - Patagonia, n.d.) and are concerned about their industries' social and environmental impacts.

3.2.4.2 “100% for the Planet in 2016”

On Black Friday 2016, the company launched a campaign to donate all of its sales, 100%, to grassroots environmental groups working in local communities to protect the air, water, and soil for future generations. As a result, sales during the campaign period were five times higher than expected, amounting to $10 million. The fact that the sales were five times higher than expected means that five times as many people sympathized and agreed with the ad. In addition, the advertisement was spread by various media, and its publicity effect can be said to be even greater than that (Nakamura, 2017).

3.2.4.3 The Right Way to Spend Money

In 2018, Patagonia donated $10 million which was received from President Trump's 2017 tax cuts to groups working to protect the environment and find solutions to the climate crisis (Miller, 2021).

The above are just a few examples of what they have actually done to make Patagonia a pioneer in sustainability and a leader in the field, keeping their fundamental mission that uses business as the tool to drive environmental responsibility.

3.3 Sustainability Marketing and Green washing

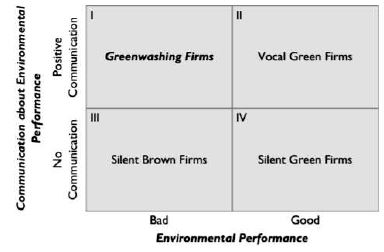

Business organizations advertise to their consumers sustainable options at every instance of the purchase process. However, it is important for consumers to always be aware of whether the products are eco-friendly or not. Green washing is a method where business organizations exaggerate or mislead their claims to consumers to encourage them to purchase their products (Halverson, 2018). The term "green washing" was first coined in 1986 by Jay Westervelt in an essay on the hotel industry, where the practice of reusing towels by hotel customers was coined as an environmental concern by hotel management rather than a cost reduction strategy ( Kraev, 2015)). Figure 2 shows companies based on their environmental performance and their communication on environmental performance. Green washers are classified as bad at environmental performance and good at positive communication.

.

Figure 2. Classification of Firms Based on Environment Performance and Communication ((Delmas & Burbano, 2011).

According to Delmas & Burbano, (2011), the key drivers for business organizations to opt for green washing are,

- Competitors and consumers expectation to exhibit improvement in eco-friendly practices.

- Management practicing less ethical practices and motivated to increase profits..

- In some cases, the marketing teams advertise company as green before it meets the required requirements.

- To appraise the performance of selected schemes using risk adjusted performance measures namely Sharpe, Treynor and Jenson's Alpha ratios.

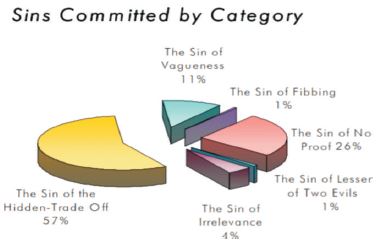

In 2007, based on companies' environmental false or misleading claims, TerraChoice identified six sins of green washing, which are sins of no proof, sins of no irrelevance, sins of hidden trade-off, sins of vagueness, sins of lesser than two evils, and sins of fibbing (TerraChoice Environmental Marketing, 2007). The research outcome in (TerraChoice Environmental Marketing, 2007) identified that the sin of the hidden trade-off was committed by most of the companies, as shown in Figure 3. In this case, the product is claimed to be "green" based on a single or narrow eco-friendly attribute. For example, the promotion of paper products based on recycled content without highlighting non-substantiable manufacturing methods. Patagonia, with all its initiatives and campaigns placing their environmental and social ambitions on a metaphorical pedestal can may classified as a vocal green firm, although Patagonia is not a flawless enterprise it has shown to play a serious and dedicated role in positively impacting the industry.

For businesses, sustainable branding has become a key concept to include environmental, economic, and social factors into business operations (Dobe, 2020). At the same time, it is challenging for businesses to confirm that their operations are 100% green (Lein, 2018). However, there are different ways for the products to be sustainable. For example, the ingredients can be environment friendly, minimizing carbon emissions using renewable energies and providing employees fair wage and safety working environment (Lein, 2018). The fashion brands that are popular among young people, such as H&M, were found to be "green washing. In 2019, H&M introduced "conscious" clothing, representing its own way of being green. H&M claimed that its manufactured clothes were made of "organic" cotton and recycled polyester. However, it was found to be a false marketing strategy in order to appear to be eco-friendly. The trade regulatory organizations only provide loose guidelines for greenwashing, which makes it unclear to determine whether a company is misleading or not (Vogt, 2020). As part of the earlier identified criticism about the outdoor fashion seller neglecting animals' well-being, Patagonia was identified for its inhumane treatment of birds by global animal welfare organization Four Paws. To improve such practices, Patagonia is now working hand-in-hand with Four Paws (Vogt, 2020). To some extent, Patagonia may have become the "lesser of two evils" as identified as a minority group in the chart, and while their own CEO admits that Patagonia has an ecological footprint that negatively affects our planet, having all companies operate like Patagonia compared to the rest of the industry's global players would potentially be a step in the right direction for the entire fashion and textile sector. This is also reflected in the company's external assessment of its impact.

3.4 External Evaluation of Patagonia's Commitments

Patagonia is not a publicly traded company, but it still manages to be as transparent as possible in an industry that is riddled with non-transparency and green washing. For starters, Patagonia's cotton is third party certified by the Global Organic Textile Standard, some of its fabrics are Blue sign certified, and part of its supply chain is certified by the FLA Workplace Code of Conduct and Fair Trade USA (Seventh Queen, 2021).

Patagonia's most notable third-party certification is its B Corporation certification, which it first attained in 2011. To attain and retain this certification, the non-profit B Lab assesses the overall impact of the applicant company on its stakeholders - workers, customers, the community, and the environment. This assessment involves third-party validation, public transparency, and legal accountability (B Corporation, n.d.). B Corps have built-in requirements and mechanisms that must be followed. The set standards must be met in social and environmental performance. For example, Certified B Corporations must submit their B Impact Report transparent on bcorporation.net and also amend their legal governing documents to require their board of directors to balance profit and purpose (B Corporation, n.d.). The B-Corp certification takes a lot of time, resources, and a big commitment to continually pass all third-party random audits, stay transparent, and abide by all requirements each year, including the publication of an annual benefits report.

Patagonia is also part of the Sustainable Apparel Coalition (Wolf, 2022). "This Coalition develops the Higg Index, a suite of tools that standardises value chain sustainability measurements for all industry participants. These tools measure environmental and social labour impacts across the value chain. With this data, the industry can identify hotspots, continuously improve sustainability performance, and achieve the environmental and social transparency consumers are demanding (Razvi, n.d.). Patagonia scored 60 percent on the Fashion Transparency Index 2020, an index that reviews and ranks 250 of the world's largest fashion brands and retailers according to what information they disclose about their social and environmental policies, practices, and impacts in their operations and supply chain (Fashion Revolution, 2020), leading the list of fashion companies but still having potential to grow. Arguably, Patagonia still has been under fire for its transparency with concerns related its animal welfare policies and practices, which are acknowledged as more comprehensive than other companies' but are still called to be in "on the way" to becoming sufficiently pro-animal welfare ( PETA, 2018; Wolfe, 2020).

4. COVID-19 and the (Outdoor) Fashion Industry

4.1 COVID-19 and the (Outdoor) Fashion Industry

COVID-19 had and continues to have a multitude of positive and negative effects on the supply, demand, production, and operations of the outdoor retailer industry. As the global pandemic pushed people outdoors, outdoor retailers saw some of their products skyrocket and fly off the shelves, while some of their product lines decreased in sales to almost nothing. According to a McKinsey and World Federation Sporting Goods Industry report, "a gain in outdoor enthusiasts can be tied directly to that timeframe, as a spike in outdoor app downloads was seen across April, May, June, and July 2020." Those included apps about biking, hiking, walking, and other outdoor activities ( Salpini, 2021). Hiking boots, bikes or biking gear, camping equipment, or kayaks were a few of the products that retailers had a difficult time keeping in stock due to demand. For Fjällräven, a Swedish company specialising in outdoor equipment, "some categories saw double- and triple-digit growth as long-time users and newcomers stocked up on gear for local trips outside" ( Salpini, 2021). This is backed by an October 2020 Harris Poll indicating that close to “70 percent of Americans wanted to spend time outdoors, an almost 20 percent increase over what the firm has tracked for the past ten years” ( Salpini, 2021).

As stated, not all activity categories fared well. Team and travel sports categories suffered dramatically. Foot Locker experienced this in its Foot Locker brand in addition to its Eastbay brand, which focuses on high school athletes. Since schools turned to virtual learning and sports and activities were cancelled, Foot Locker Vice President of Marketing Jason Brown explained further that "the high school athlete this past year didn't necessarily buy baseball cleats or soccer cleats how they would have the year prior." ( Salpini, 2021

4.2 Impact on Consumer Demographics

With a push toward the outdoors, retailers experienced an increase in new customers. These new customers, also referred to as "new entrants," have carried the industry along. Retailers have viewed this as an opportunity to groom new customers into loyal customers as they get more interested in their new hobbies. Along with the push outdoors from COVID-19, retailers are hanging onto the hope that this fuel will be "buoyed further by people committing to living healthier lifestyles after seeing the outsized impact COVID-19 has on people with pre-existing conditions" (Salpini, 2021)

Demand relating to the location of where customers were purchasing outdoor gear also became skewed as people relocated, moved around, or even stayed put throughout COVID-19. Fjällräven's outdoor destination locations (Vail, Colorado, and Park City, Utah) thrived throughout the pandemic, while some of their urban locations (Downtown Seattle, Washington) saw close to zero traffic due to a lack of cruise line tourism in the area (Salpini, 2021).

Although retailers were already seeing the trend of ecommerce growing in every sector, the pandemic exploded this trend by forcing non-essential retailers all over the globe to temporarily close brick and mortar stores, leaving online as the only option to shop for periods of time. This pushed retailers to increase their online presence and fine-tune their websites to better serve shoppers' needs. E-commerce has worked so well for some retailers that they have permanently closed some locations. On one of the United States' most notable shopping and commercial avenues, the Magnificent Mile, in Chicago, Illinois, has seen many store closures that are concerning to city planners. Some of these closures include a Macy's flagship store, a three-story Gap flagship store, Disney, Express, Forever 21, Top Shop, and Uniglo (Miller, 2021). Additionally, New York's famed Fifth Avenue shopping district had 32 storefronts empty as of February 2021.

4.3 Impact on the Supply Chain

With demand decreasing in some areas, increasing in others, and a heap of unexpected store closures, forecasting demand and where that demand is coming from was a major headache for retailers and their supply chains. Susanne Connor, soft goods buyer at Lost River Outfitters in Ketchum, clarified, "We thought it was going to be difficult last year (2020), but there are way more challenges this year (2021)."The supply chain has come unraveled, and I don't know when it's going to go away" ( Moore, 2021). The manufacturing process takes about a year from the time a buyer places an order to the delivery of that item to a store. An additional forecasting hurdle for outdoor retailers is whether people will need to restock on gear for next year. In another instance, Sturtevant has been having issues "across the board, from apparel to bike racks to helmets" ( Moore, 2021). With unforeseeable demand, raw material shortages, manufacturing delays, and shipping delays, forecasting for the supply chain of goods has been a "Hail Mary" for retailers trying to plan for the future.

4.4 Patagonia's COVID-19 Response

Patagonia responded to COVID-19 aggressively from the start to protect its workers and customers. On March 13th, 2020, Patagonia became one of the first North American retailers to close its stores (39 brick and mortar) and its ecommerce website temporarily ( Martin, 2020). This temporary closure did not include its production facilities but did extend to disabling online orders until it could ensure the safety of its warehouse team. The online store was closed for about one month before accepting online orders on April 9, 2020. Before they reopened their online store, Patagonia overhauled its distribution center in Reno, Nevada, to include COVID-19 safety protocols (Maheshwari, 2020). Almost half of Patagonia's business comes from distribution through local outdoor shops near outdoor havens and national retail chains like REI and Nordstrom (Maheshwari, 2020)). With Patagonia's own stores seeing sales decline and its other disruption outlets being hit hard, Patagonia's North American sales dropped 50 percent (Maheshwari, 2020). Patagonia executives have taken pay cuts to account for lost sales, and staff has been furloughed for at least 90 days. Holding true to its values, Patagonia kept furloughed employees' health benefits and said it would honor planned paid leave (Maheshwari, 2020). Patagonia has been experimenting with many different ways to get through the pandemic safely, below are some of the ways they are making things safer (Maheshwari, 2020).

- new mobile checkout device that avoids lines at registers and shopping by appointment.

- Employees wore gloves and face coverings and the facilities were disinfected regularly.

- Allowing employees in facilities to have 30-feet of space.

- Eliminating touches on products as they go through processing and shipping.

- Employees are screened by a thermal temperature scanner as they arrive at work.

- The cafe that once served organic food is temporarily closed, and employees have been asked to bring their lunch in individual coolers, so that they do not congregate at refrigerators.

4.5 Post-Pandemic Initiatives

Next to the reactive initiatives affecting the own business, Patagonia has not stopped during the last one-and-a-half years to use its voice and brand to create a change beyond their “business”, addressing issues related to COVID-19 as well as well as other environmental and societal issues, stressing that these problems have not gone away despite the world's attention foremost being given to the virus. The following are examples of a few post-COVID-19 initiatives the company has struck up.

4.5.1 Patagonia Provisions and Regenerative Agriculture

The recent pandemic has caused a significant lifestyle change around the world. As it continued to strain the global supply chain, more and more people recognized the importance of local produce and the farmers who grow it.

Based on the founder Yvon Chouinard's belief, “the requirements for a prosperous business and prosperous people are the same,” the company has been running Patagonia Provisions, a division dedicated to food, for nearly a decade before COVID-19. Still, once again, they are promoting the practice of regenerative organic farming. The method can produce larger crops while building healthy soils, drawing out and storing more greenhouse gases ( Chouinard, 2020).

4.5.1 Patagonia Provisions and Regenerative Agriculture

The recent pandemic has caused a significant lifestyle change around the world. As it continued to strain the global supply chain, more and more people recognized the importance of local produce and the farmers who grow it. Based on the founder Yvon Chouinard's belief, “the requirements for a prosperous business and prosperous people are the same,” the company has been running Patagonia Provisions, a division dedicated to food, for nearly a decade before COVID-19. Still, once again, they are promoting the practice of regenerative organic farming. The method can produce larger crops while building healthy soils, drawing out and storing more greenhouse gases ( Chouinard, 2020).

4.5.2 Letter to President Biden

In June 2021, the new CEO of Patagonia, Ryan Gellert, sent a letter to President Biden. In it, the CEO talked about the specific positive effects of removing dams across the U.S., including the impact on ecosystems, coastlines, and communities. The report describes and proposes specific positive effects of removing dams across the U.S., including ecological effects, shoreline effects, and economic effects on local communities, Dam Removal, Hydropower and Infrastructure Spending: A Letter to President Biden, ( Patagoina, 2021).

4.5.3 Climate Activism School in Japan

Patagonia Japan held a "Climate Activism School" for high school and university students from across Japan. Through online classroom lectures and dialogues, followed by fieldwork, the program aims to help students envision the future, collaborate with stakeholders in each theme, and put their creativity into practice as leaders of society while focusing on the reality of environmental problems such as climate change and loss of ecosystems that the existing economic and social systems have created. The program enables participants to envision the future, collaborate with stakeholders in each theme, and put their creativity into practice as social leaders. The program is also part of Patagonia's long-running Tools for Grassroots Activists Conference, designed to help environmentalists succeed.

The goal is to create new value and a society where the fragmented environment and people are reconnected (Patagonia, 2020). Finally, in 2022, Patagonia owner Yvon Chouinard, made a surprise announcement stating that “Earth is now our only shareholder. If we have any hope of a thriving planet, much less a business, it is going to take all of us doing what we can with the resources, we have. This is what we can do” ( Chouinard, 2020 (Trafecante, 2022).