Figure 1. Key Variables in Constructs of Sourcing Decision

Cinnamon is one of the most powerful spices on earth and scientist has ranked it as wonder spice for its medicinal values and properties. Key producers are Indonesia, China, Vietnam, and Sri Lanka and key importers are Mexico, USA, India, and Bangladesh. India is a net-importer of Cinnamon from countries, such as Indonesia, Vietnam, and Sri Lanka as domestic supplies are too small to meet the growing demands of domestic consumption and export demand of value added spices, wherein cinnamon is mixed with other spices. This paper aims to understand the existing import regime of cinnamon in India including tariff and non-tariff issues, duty preference regime under various negotiated Free Trade Agreement, issues of certificate of origin, compliance costs, and cost-effective suppliers.

Cinnamon is one of the most powerful spices on earth and scientists had ranked it as wonder spice for its medicinal values and properties (Raghavan, 2000). Cinnamon has been used medicinally around the world for thousands of years and it was one of the main traded spices by merchants in the imperial times when merchants from Europe used to visit markets of Asia for trade and commerce. Jaffrey (1995) briefs that cinnamon is a popular spice in many cultures of Asia and Indians has a great liking for cinnamon. Ancient texts speak a lot about the health benefits of cinnamon and modern research collaborates it that there are widespread health benefits of Cinnamon, including its distinctly sweet, warming taste, and ease of use in culinary recipes. There are two varieties of cinnamon, first being 'cassia' (Cinnamomum aromaticum) and second is “true cinnamon” (Cinnamomum verum or Ceylon cinnamon). There is more production of cassia which is produced in South East Asia, primarily in countries, such as Indonesia, China, and Vietnam as researched by Triệu and Isaak (1997). Bradu and Sobti (1988) have documented that cinnamon produced in India is also of the cassia variety and is stronger and more intense in flavor. Cinnamon produced in Sri Lanka is of highest quality as it releases a more delicate aroma and is priced much higher than cassia cinnamon. Mexico and United States are leading importers of true cinnamon produced in Sri Lanka. Cinnamon is a favorite household for Asian family and also has become popular in western cultures in the last one century. Key producers are Indonesia, China, Vietnam, and Sri Lanka and key importers are Mexico, USA, India, and Bangladesh. In fact, such was the trade volumes of cinnamon and at one point of time it was traded as currency for exchanging goods at maritime ports of Indo- Pacific region. Cinnamon is extracted from the inner bark of a small evergreen tree. Bark is peeled from the tree and it is laid in the sun to dry, where it curls up into rolls known as cinnamon sticks. Cinnamon is mixed in various spices in the powder form. Gulati (1982) had documented that cinnamon oil has several medicinal uses.

There have been several studies on cinnamon, which explain the medicinal properties and health benefits of use of cinnamon. A study by Joseph Nordqvist, published in Medical News Today, entitled as “What are the health benefits of cinnamon?” briefs us about the medical benefits of use of cinnamon. It suggests that taking cinnamon as a supplement can have effects on health and disease. It concludes that with increasing awareness, people are using cinnamon as a supplement to treat problems with the digestive system, diabetes, loss of appetite, and other conditions. National Center for Complementary and Integrative Health (NCCIH) of United States recommends that some people use cinnamon as a dietary supplement for gastrointestinal problems, loss of appetite, and diabetes, among other conditions. It has also been used in traditional medicine for bronchitis. A study commissioned by National Center for Biotechnology Information, U.S. National Library of Medicine entitled, “Cinnamon: A Multifaceted Medicinal Plant” conducted by Pasupuleti Visweswara Rao and Siew Hua Gan details comprehensively the health benefits of cinnamon wherein it mentioned that antioxidant compounds present in cinnamon play a vital role in human life, acting as health-protecting agents.

Unites States Agency for International Development commissioned a study entitled, “Feasibility Study of Cinnamon Processing in Seychelles” aims at promoting and developing both pre and post-harvest eco-system for Cinnamon trade in Seychelles. The study was done by Dr. Brian Lawrence and Dr. Michael Farbman. It was a comprehensive study scanning prospects of and potential of producing and consuming markets covering all aspects of pre-processed and value-added cinnamon products. A study by Srilal de Silva (2017) entitled, “Cinnamon Authority vital to promote value-added exports” suggest the measures that Sri Lankan Cinnamon authority has to take to promote the valueadded exports and realize precious foreign exchange. A study by University of Mississippi scientists explain that “True Cinnamon” is as good as gold in its medicinal usage, which can spell boom for Lanka's cinnamon industry. Out of these studies, USAID study was comprehensive in dealing with trade aspects of cinnamon. There is no specific study dealing with sourcing of cinnamon in India in globalized era. This study attempts to address the issues of mapping cost effective sourcing of cinnamon for growing needs of Indian market. In this context, the research objective of the study is “to map the demand side capabilities of key suppliers both as producers and exporter and demand side capacities of Indian markets and look out at cost effective supplier of cinnamon by appraising issues, such as unit prices, tariff issues, non-tariff issues, quality compliance, and ability as reliable supplier for meeting the growing needs of Indian market”.

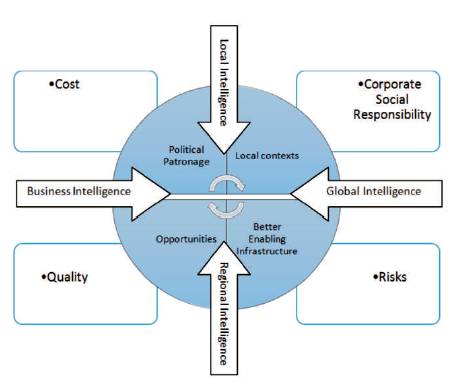

With increased globalization of economic activities, there is greater attention on cost-cutting by understanding the global value chain, clustering of economic activities to low cost centers, technological improvements in transportation and logistics, and increased role of information technology in flow of goods and services from point of production to point of consumption as documented by Porter (1985) in his famous work entitled, “Competitive Advantage: Creating and Sustaining Superior Performance”. Monczka and Trent (1991), while elaborating the role of sourcing in an era of globalization, writes that waves of globalization will eliminate the myths surrounding the global sourcing operations and there is greater integration of economic activities among nations today. Sourcing of both goods and services is considered an appropriate option by policymakers for cost cutting, business expansion, and diversification. Increased purchasing operations from across the countries has compelled firms to design and develop Global Sourcing Framework (GSF) that incorporates the business concerns of any firm into a logical management structure. Exhibit 1 as under details the eight dimensions of global sourcing framework that guide to firm to source the goods from another country (Figure 1).

Figure 1. Key Variables in Constructs of Sourcing Decision

Low cost pricing is a prime reason for sourcing of goods along with assurance of better quality of goods from an overseas supplier. In fact, it is the quality assurance and cost-cutting, which are two main driving forces for emergence of manufacturing activities in China and South-East Asia and that of services to India and Philippines as documented by Weiand Balasubramanyam (2015). Firms want to reduce the level of business risks in centralized manufacturing for their global operations and as a result, may prefer to hedge risks by shifting some of the business operations to another country so as to ensure the reliable supply chain operations for their business operations across the world. Corporate social responsibility is another reason for sourcing for example; many American firms are sourcing from least developed countries as they get tax breaks for generating additional business opportunities for Africans. Africa Growth Opportunity Act of United States is one such example. In addition to that, the firms foresee greater opportunities in sourcing in long run, address political noise, handle local context, and enabling infrastructure are some of the other enables of global sourcing.

Sourcing strategy of any firm revolve around that who can supply the goods in cost effective, quality complied, and in a reliable manner. One needs to understand the production as well as export capabilities of leading suppliers of any goods or services. Accordingly, production and export-wise, the capabilities of various leading suppliers are assessed as under:

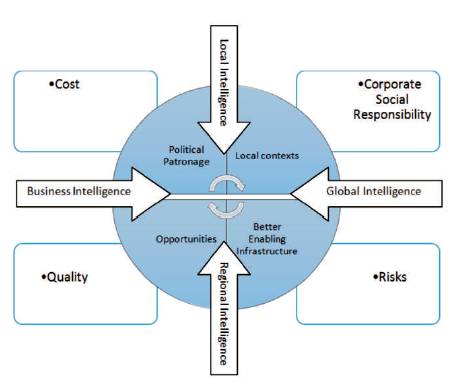

Table 1. World's Top Cinnamon Producing Countries

World total production was around 219 thousand tons in 2016. Cinnamon production is on rise and has witnessed an increasing trend in world production from 2007-2016. Some of the key reasons for increasing production of cinnamon are increasing awareness for medical properties of cinnamon, diversification of diet, increasing love for spices among consumers, especially in European countries, mixing in spices for culinary recipes, and growth of bakery products. This general positive trend was largely conditioned by a robust expansion of the harvested area and a slight contraction of the yield figures. Indonesia (42%) is the leading producer and produces over 98,000 tons of cinnamon every year, which may have market value to around $100 million. As Indonesia has large number of volcanoes, a lot of agricultural production of cinnamon takes places on slopes of such volcanoes. Mount Kerinci in Sumatra is famous for production and high yield of cinnamon, where the cinnamon tree flourishes, providing high quality of cinnamon such as high oil content. China is the second largest producer of cinnamon, where mainly cassia cinnamon is produced, which is more-stronger, intense, and hotter flavor than Ceylon variety. Chinese cassia has a sweeter flavor compared to Indonesian cassia. Production of cinnamon in China takes place in the provinces of Guangdong, Guanxi, Yunnan, and Fujian, which all are on eastern part of China.

Vietnam is the third largest producers, where mainly the Saigon cinnamon is produced which is similar to that of China's cassia. There is strong domestic demand for cinnamon in Vietnam, however Vietnam is also leading and reliable supplier of Cinnamon, especially to India where 78% imports of cinnamon comes from Vietnam. The key areas of production of cinnamon in Vietnam are around the central highland regions, especially Quang Ngai Province. Cinnamon spice is an important ingredient in the kitchen of Vietnamese and is widely used in the making of noodle soup, known as pho in local language. A fourth largest producer is Sri Lanka which boasts of the best quality of cinnamon in the world, wherein the main production areas are located in coastal belt from Kaluthara to Mathara Sri Lanka's Cinnamon Ratnapura and Ambalangoda are also known for quality produce of cinnamon in Sri Lanka. With increasing interest for other crops due to high economic returns, the acreage of cinnamon plantations in Sri Lanka is on decline in recent years. India is not a significant producer of cinnamon, however is important importer and consumer of cinnamon. Cinnamon is one of the important elements of various spice recipes. Thomas (2009) documents that India's share in world production is less than 2% and is around 5-5.5 thousand tons only, which comes mainly from the state of Kerala.

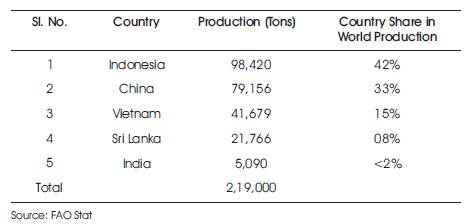

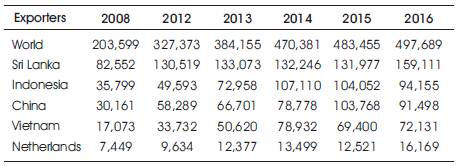

Accordingly to 'World Markets in the Spice Trade 2000- 2004', the trade of cinnamon has witnessed a continuous increase in world market. Total export values of cinnamon in world economy were mere 203.59 million USD in 2008, which has year on year increase and were 497.68 million USD in 2016. Sri Lanka is the largest exporter of cinnamon as it produces the finest quality of true cinnamon. Exports from Sri Lanka were mere 82.55 million USD, which has increased to 159.11 million USD in the year 2016 which is lower than world total export rates. In the period 2012- 2016, world exports of cinnamon have increased by 12%, wherein the export growth of Sri Lanka has been mere 4%. Vietnam has registered the highest growth rates of 26%, followed by Indonesia (18%) and China (14%). The second largest producer of Cinnamon is Indonesia, which has mere 35.79 million USD of exports in 2008. Indonesia export of cinnamon has touched the magic figure of over 100 million USD in 2014 and 2015, however exports have witnessed a declining trend in 2016 and were 94.15 million USD. Table 2 as under provides the details of leading suppliers of Cinnamon to world market.

Table 2. Leading Suppliers of Cinnamon to World Market from 2008-2016 (000' USD)

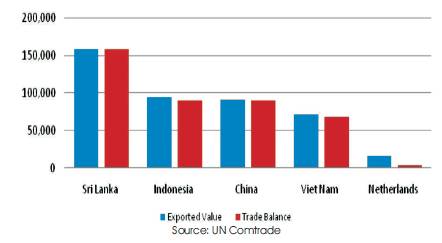

Iskandar et al. (2012) documents that Indonesia, even after being the largest producer of cinnamon; is the second largest exporter of cinnamon as the quality of South East Asian countries cinnamon attract lower price in world market in comparison to that of Sri Lanka. China has trebled its exports of cinnamon from mere 30 million USD to 91.49 million USD and is very close to Indonesia in terms of market share. Indonesia market share is 18.9% and china is close third with 18.4% market share. Sri Lanka occupies the prime position in cinnamon exports with market share of 32% although it contributes mere 8% of world production. Vietnam is fourth largest exporter of cinnamon, where exports have grown from 17.07 million USD to 72.13 million USD with market share of 14.5% of tworld exports. Netherland is shown as 5th largest exporter of cinnamon, but it has no production. Netherland, being a gateway port for European countries imports lots of cinnamon, which is subsequently shipped to neighboring countries. One need to carefully comprehend trade data as it may sometimes provide misleading results as in this case of Netherland. Accordingly, Figure 2 provides further insights in export values and trade balance of top five exporters, wherein it is clear that Netherland imports cinnamon for the purpose of exports to neighboring countries. Alternatively, Netherland exported cinnamon of 16 million USD, however its favorable trade balance is mere 4 million USD indicating that cinnamon is routed through gateway port of Rotterdam for duty free markets of European Union and Russia. Figure 2 supplements the discussion on export values and trade balances of key suppliers of cinnamon.

Figure 2. Export Values and Trade Balance of Key Suppliers (000' USD)

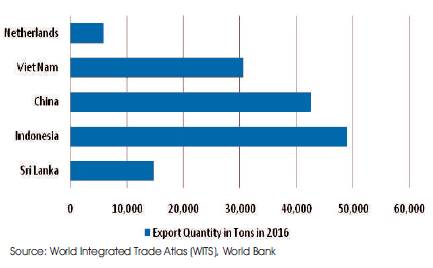

In the period 2012-16, the world export of cinnamon by quantity grew by 6%, where the Vietnam's export of cinnamon has grown by 13%, China and Netherland by 9%, Indonesia by 4% and Sri Lanka has grown negatively by 5%. By quantity, Sri Lanka has exported mere 14,693 tons of cinnamon, however the respective volumes in tons for Indonesia (48,900), China (42,414), Vietnam (30,510), and Netherlands (5,755). Figure 3 as under provides the details of leading exporters of Cinnamon by quantity.

Figure 3. Export Quantity in Tons in 2016

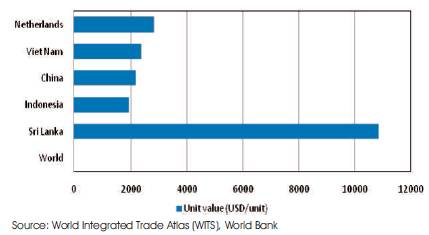

The export success of Sri Lanka as largest exporter of cinnamon can be attributed to unique quality of true cinnamon it produces, which gets the best prices in international markets. Figure 4 provides the information on average export prices of different suppliers. Average export price of Sri Lanka's cinnamon is five times to that of other exporters such as Indonesia, Vietnam, and China. Sri Lanka exported cinnamon at the average export prices of 10,829 USD, where other exporters can merely realize the export prices (per ton) of Indonesia (1925 USD), China (2157 USD), Vietnam (2364 USD), and Netherland (2810 USD). It is again clear from the data that Netherlands imports cinnamon and exports it to neighboring countries by selling at premium, making an annual profit of around 4 million USD from trade of cinnamon annually.

Figure 4. Unit Value (USD/ Unit)

An analysis of export dependence and export concentration among importing countries provides interesting results. Figures as under indicates that among the top five exporters, China and Netherland have least export dependence as it has low concentration among importing countries. Indonesia, Sri Lanka, and Vietnam has relatively high export dependence and export concentration, where Vietnam has the highest export concentration of 0.35 as its exports are mainly destined to one country, India. For any economy which is highly dependent on exports to one country with high export concentration, there is always possibility of increased volatility in both export earnings and economic growth as any economic shocks of importing country will have direct impact on its export thus making it extremely vulnerable. In this case, Vietnam has high concentration of exports to India, which is around 78% of its total exports, and it may be prone to significant fluctuations in export earnings, should there be decline in imports of India due to any of market forces, such as increased domestic production, higher tariffs, introduction of non-tariff measures, etc. Figures 5 as under provides that export concentration of top five exporters in the importing countries.

India is 3rd largest importer of cinnamon in the world representing 11.1% of world imports. The leading importer is United States which imports it mainly from Indonesia accounts around 57% to its total imports followed by Sri Lanka (26%) and Vietnam (14%), respectively. Mexico is the second largest importer of cinnamon and its consumers has high preference for high quality cinnamon. Mexico imports around 96% of its cinnamon from Sri Lanka only. Mexican has special love for Ceylon cinnamon originating from Sri Lanka which is due to its colonial past when Ceylon cinnamon was introduced by Mexican by Spanish merchants. Traditional Mexican culinary dishes are usually prepared by using Ceylon cinnamon and with increasing immigration of Mexican in U.S.A., the imports of United States are also growing for Ceylon cinnamon. The use of Cinnamon is increasing in North America due to increasing awareness among consumers that it provides relief from a range of health issues, including diabetes, improved metabolism, controlled blood pressure, and weight loss.

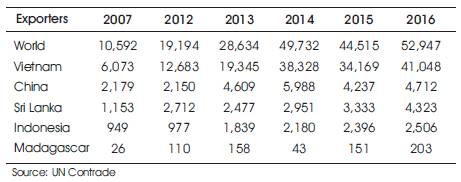

India is an attractive market for supply of cinnamon, however it has indicated a preference for the cheaper variety of cinnamon unlike expensive varieties preferred by Mexico and USA. India import cassia cinnamon mainly from Vietnam totaling around 41.08 million USD, which is 78% of its total import bill of 52.94 million USD. China is second largest supplier of cinnamon to India, totaling import bill of 4.71 million USD which is around 9% of India's total import bills. Sri Lanka is 3rd largest supplier followed by Indonesia and Madagascar. Import bill for high quality Ceylon cinnamon was 4.32 million USD in 2016 and that of Indonesia was 2.50 million USD. Supplies from Madagascar are negligible and are mere 2 Lakh dollars in 2016. Food regulator in India has notified that there are potential health hazards by the use of strong cassia cinnamon and with introduction of restrictions on the consumption of cassia cinnamon, it is expected that there may be change in import demand in near future. It is expected that Indian consumers may eventually shift towards to Ceylon cinnamon considering potential negative impact on their health, by use of cassia cinnamon. Table 3 as under provides the details of India's imports from world along with top five suppliers.

Table 3. Key Suppliers of Cinnamon to India

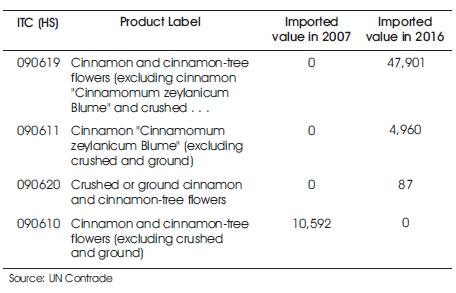

Sourcing of cinnamon in India has witnessed a metamorphic change in last ten years. Import bills were 10.59 million USD, which has increased more almost 5 times to 52.94 million USD in 2016. Imports from Vietnam has witnessed a great shift from mere 6 million USD to 41 million USD thus increasing share of Vietnam imports from mere 60% to around 78%. In terms of specific types of cinnamon imports, import demand in India has witnessed a great change. Of the total imports, around 80% constitute cinnamon in form of tree flowers (HS 090619) in 2016. Table 4 as under provides the details of different varieties of cinnamon in India, which are sources of domestic consumption.

Table 4. Product-wise Import of Cinnamon in India

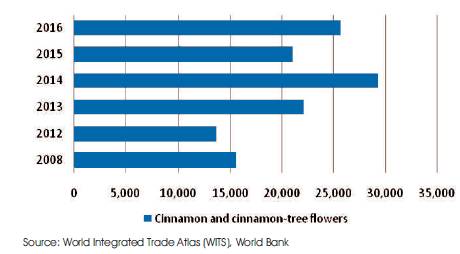

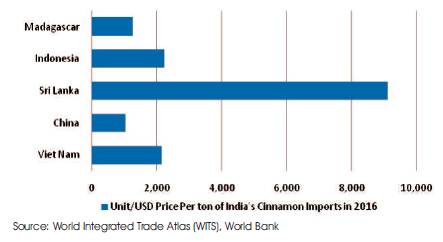

Sourcing strategy for any import is governed by factors, such as price attractive, quality of goods, reliable suppliers, and duty preference, low-level of non-tariff barriers, logistics advantages, and attractive trade terms offered by supplier, cultural affinity and exchanges. A larger import volume requires analysis why Indian importers have resorted to Vietnam for supplies of cinnamon to such great extent. Figure 6 provides the details of quantity imported year on year by India. It offers deeper insights of price per unit (per ton) for imports of cinnamon in India from various suppliers. Sourcing of cinnamon has been the most attractive from China, however due to even number of health advisories issued against Chinese cassia, Indian importers has preferred to source it from other countries such as Vietnam and Indonesia which are almost same in price attractiveness for an Indian importer. India imports Ceylon cinnamon as well which is priced much higher as compared to cassia cinnamon. Figure 7 supplements this discussion on Unit Price per Ton of import of cinnamon in India in 2016.

Figure 6. Cinnamon and Cinnamon-tree Flowers

Figure 7. Unit/USD Price Per Ton of India's Cinnamon Imports in 2016

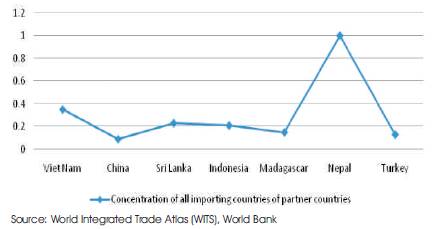

Sourcing strategy of any country is dependent on issues of concentration of exporters in country imports. Figure 8 as under provides estimates of the import dependence of India and details that India has high import dependence on Nepal and Vietnam (Figure 8). As Nepal does not produce Cinnamon, data seems little deceptive in the sense that some consignments must to destined to India via Nepal either as actual imports or re-imports. Among top 5 suppliers, India has high import concentration from Vietnam, which means it has high import dependence thus exposing it to potential vulnerabilities in case of crop failure in Vietnam and other economic, political, and trade challenges.

Figure 8. India's Import Dependence- Concentration of Key Suppliers

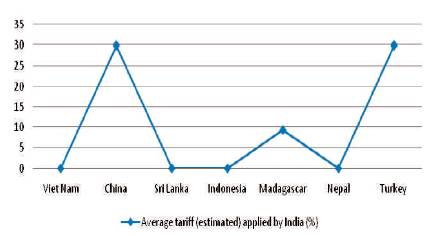

India has signed several free trade agreements and suppliers from countries, such as Vietnam, Indonesia, Sri Lanka, and Nepal enjoy zero duty regimes for their exports to India. Most Favored Nation duty (MFN) is 30%, which is applied to export originating from China and Turkey. Since India has offered a Duty-Free Tariff Preference (DFTP) to Least Developed countries, the applied tariff on exports originating from Madagascar is mere 10%. Figure 9 as under provides the details of tariff imposed by India on various countries on sourcing of cinnamon (Figure 9).

Figure 9. Average Tariff (Estimated) applied by India (%)

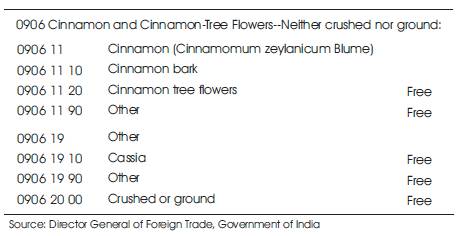

Sourcing of goods and services are subject to applicable rules and regulations of country of import. Accordingly; one needs to scan the import policy and associated regulations of a country. Import policy of any country is aimed at regulation and development of imports in an orderly manner. Import Policy in India is framed by Director General of Foreign Trade. It is prescribed in Schedule 1 of ITC (HS) nomenclature. Import regime of both HSN 0906 is provided herewith for decision making whether imports are allowed and what additional authorization/ licenses are required. Table 5 as under provides the prevailing import regime of cinnamon in India.

Table 5. Foreign Trade Regime (Schedule 1- Import Policy) of ITC (HS) Heading 0906 Cinnamon and Cinnamon Tree Flowers

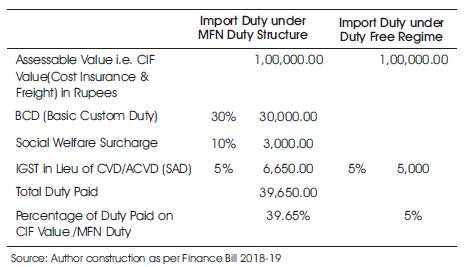

Sourcing construct lists costing of goods to be a key indicator for sourcing and import of cinnamon is no exception as its imports into India may attract custom duties as prescribed in different statutes and legislations. India's duty structure is layered at various levels even after post GST scenario and involve duties and, cesses such as Basic Duty of Customs (BCD), Integrated Goods and Services Tax (IGST), and primary and secondary education cess. Screenshot as under details the applicable custom duty on cinnamon imports in India under MFN regime (Figure 10).

As India has free trade agreement with ASEAN1 , applicable rate of duty to imports originating from Vietnam and Indonesia is zero. For Nepal and Sri Lanka, duty is basic duty of customs will be zero under South Asian Free Trade Agreement (SAFTA) and India- Sri Lanka Free Trade Agreement. However, an importer is duty-bound to pay Integrated Goods and Services Tax, which is 5% for cinnamon for the financial year 2018-192. Table 6 as under provides the information on tariff preference available to cheaper imports of cinnamon in India under various trade agreements, India has signed.

Table 7. Sample duty Calculation of CIF Value of 1 Lakh Dollar Import of Cinnamon

An analysis of applicable custom compliance requirement indicates that sourcing of cinnamon in India is subject to regulations of Food Safety and Standards Authority of India and Plant Quarantine Regulations of India. Screenshot as under indicates the even number of compliance requirements of Food Safety and Plant Quarantine, applicable to Cinnamon imports in India (Figure 11).

Assuming if the C.I.F. Value of 'cinnamon' (0906) is of 1 lakh U.S.D. (1,00,000 USD), the landed price cost estimation (Table 17) of imported cinnamon will be as below.

It can be concluded that in import and sourcing of cinnamon, quality is the most important decision. As there are reports of toxic cinnamon originating from China, an importer has to be extra-cautious in sourcing such kind of cinnamon as it may be rejected by Indian customs or may fail the stipulated quality control tests as stipulated by Food Safety and Standards Authority of India and Plant Quarantine Council of India. An importer should also check all other food safety standards mandated by Food Safety and Standards Authority of India. Imports become cheaper when originating from Vietnam, Indonesia, and Sri Lanka as India has Free Trade Agreement with these countries. It is required for an importer to get certificate of origin issued by nominated agency so as to claim the duty preference under applicable FTA/ RTA with a partner country. Indian importer should leverage Certificate of Origin so as to claim the duty preference thus making their final products cheaper and attractive to final consumers. Since, supplies from Vietnam are most cost effective, importer should be encouraged to source the cinnamon from Vietnam followed by Indonesia and Sri Lanka only as import prices for cinnamon originating from these countries cost least to an Indian importer. Existing policy regime for imports indicate that imports of cinnamon is free hence no additional licenses and authorizations are required except those required under FSSAI/ PQCI. In order to reduce the import concentration from Vietnam only, efforts should be made to diversify the import basket considering other important factors of sourcing such as cost and quality of goods.

1 Association of South East Asian Nations (ASEAN), India has FTA with Asean since 1st Jan 2012.

2 Vide Finance Bill 2018-19