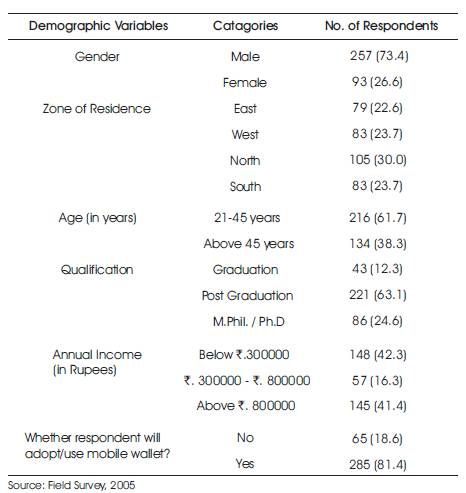

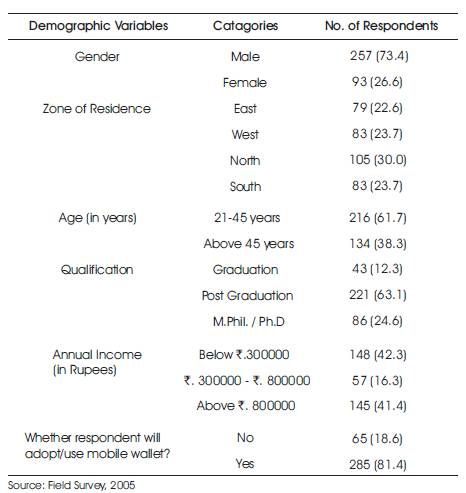

Table 1. Classification of Respondents on the Basis of Demographic Factors

There has been a rapid rise in the growth of mobile technology throughout the world. In Indian perspective, it provides benefits to both customers and service providers. First to the customer (demand) side, it represents an opportunity for financial inclusion among a population that is underserved by traditional banking services. On the service provider (supply) side, it opens up possibilities for financial institutions to deliver a great diversity of services at low cost to a large customer base of the poorest sections of society and people living in remote areas. This paper identifies the active factors that influence people’s intention to use mobile wallet in India. Data was collected from a sample of 350 people from all four zones in India i.e., east, west, north, and south. The data was collected through a well structured questionnaire, by asking open ended and close ended questions regarding their attitude towards mobile wallet and their intention about its adoption/use. For analyzing and interpreting data in the present study, basic statistical tools and logistical regression analysis was used with the help of SPSS 16.0 version. Keeping in mind the previous studies, six factors (i.e., perceived quality of service, perceived risk, perceived usefulness, perceived cost, perceived ease of use, and trust) which drive customers’ intention to use mobile wallet have been chosen. The effectiveness of these extracted factors have been examined and observed that only one significant factor i.e., perceived usefulness is the factor which actively influence future intention to adopt/use mobile wallet. Further the study exhibited that perceived usefulness positively influence the intention to use/adopt mobile wallet. This model has the overall predictability of classifying 85.1% cases correctly and exhibited that 96.5% people are classified for adopting/using mobile wallet services whereas 35.4% people for not having intention to adopt/use it in future.

Smartphones have become an inseparable part of people's life and is a convenient tool for making digitalized payments. With expanding infiltration of portable cell phones, digital wallets have been anticipated to bring the next rational stride in transit to a cashless society (Apanasevic, 2013). Like the rest of the world, India is also witnessing a rapid adoption of digital payments. In fiscal year 2012-13 and 2014-15, mobile wallet (a form of digital wallet) transactions grew by 180 per cent, compared to 80 per cent growth respectively, in mobile banking transactions (Anand, 2015). According to a July 2016 report by Google and the Boston Consulting Group (BCG), 78% of all consumer payments in 2015 were made in cash down from 89% in 2010 and 92% in 2005. The digital payments industry in India is a huge opportunity that is waiting to be tapped. The Google-Boston Consulting Group report predicts that the industry can touch US $ 500 billion by 2020, contributing 15% to India's GDP (Gross Domestic Product). Significantly, India is today in a sweet spot where customers want the convenience of digital payments, policymakers are seeking greater financial inclusion and higher transparency. With all the pieces in place, demonetization provides India a unique opportunity to leapfrog into a brave new digital world. However, till date relatively less number of individuals have been utilizing mobile wallet, as compared to mobile phone users. The fundamental obstacle is the attitude of individuals to adjust to a yet another innovation. In a nation such as India where larger part of consumers still favours Cash-on-Delivery, it is difficult to fasten the pace of process of innovation diffusion such as mobile wallets. So in the present time, there is a need to re-examine the effectiveness of the factors which drives customer intention to adopt/use mobile wallet. This will help Government, banks, and mobile wallet service providers to formulate effective policies in order to ensure adoption/usage of mobile wallet by large number of people in India.

In order to curb black money out of Indian market, Government of India demonetized rupees 500 and 1000 th denomination notes on November 8 2016, which comprised of approximately 86 percent of total value of currency issued by reserve bank of India (Central bank). The government has demonetized high-value notes and has not abolished cash as a currency. As a result, there has been scarcity of currency notes in the Indian market. People in India are facing problems due to this scarcity. Yasuoka, H. (2010) reports that the decrease by 0.04% in the circulation of money announced by the Bank of Japan in 2006, the first time since 1971, can be attributed in part to the increased usage of electronic money. Government of India has been making concrete efforts to motivate people of India to adopt/use digital methods of making financial transactions. So it is essential to study the active factors which drive people’s intention to adopt/ use mobile wallet. The results of the study will be helpful to Govt. of India and commercial banks in framing effective policies so that more focus is put on those factors which result in adoption/continuous usage of the digital method of payment. In the past, a number of researches have been conducted to determine the factors affecting adoption of mobile wallet. But with passage of time, the effectiveness of those determined factors may have reduced. So it is essential to re-examine the effectiveness of these factors. After deriving the results of the present study, Government of India, Indian banks and mobile wallet vendors may make necessary changes in policies so that people accept mobile digital payment method.

Further the need has also been felt to study the intensity of impact made by the determined active factors on the intention of people to adopt/use the method of digital payment.

The world witnessed a rapid growth in e-commerce in the recent years. Widespread use of mobile devices in the ecommerce has a role in this expansion. Associated with growth of trading volume and the introduction of new devices, new products emerge. One of such latest product is mobile wallet. There is a need, therefore, to uncover the factors that actively affect customer willingness to adopt/use mobile wallet. So, in order to study the active factors which drive customer intention to adopt/use mobile wallet, following objectives have been framed:

A well-structured literature review is characterized by a logical flow of ideas, current and relevant references with consistent, appropriate referencing style, proper flow of terminology and an unbiased and comprehensive view of the previous research on the topic. This part of the study comprises the views of other researches.

Jaradat, M. I. R. M. & Faqih, K. M. (2014) concluded that although perceived usefulness was considered to be the most convincing predictor of digital payment solutions, self-efficacy too plays a major role in adoption of digital payment solution as consumers with higher degree of selfefficacy were more inclined towards the use of digital wallet, as their comfort level with technology use was high.

Padashetty, S. & Kishore, K. S. (2013) critically examined the theoretical aspects of electronic commerce to understand the substructure of behavior towards intention in using digital wallet. The literature review specifies the consumer behavior towards the adoption of digital wallets by taking into consideration various factors motivating adoption of technology. Various factors have come into play which affect the adoption of digital wallets as a payment medium, such as trust, expressiveness and perceived ease of use, playing a crucial role in facilitating adoption of digital payment solutions.

Liu, S., et al. (2012) concluded that security perception plays a significant role in adoption of mobile wallets. Perceived security and privacy defines the extent to which consumers assume that digital wallet payment method is safe and secure. Perceived usefulness motivates users via enhancement in their self-innovative capabilities. Factors like authentication, confidentiality, integrity of data were identified to have a positive effect on users’ trust in digital payment methods. They further concluded that digital wallet payments bring extra convenience to shoppers by offering flexible payment additions and accelerating exchanges.

Rai, N., et al., (2012) discovered that safety and security of payment as compared to traditional methods, act as one of the driving forces for adoption of mobile wallet.

Mbogo, M., (2010) studied the various factors that contribute to success with the use of mobile payments within micro businesses in Kenya. He inferred that convenience of the money transfer technology plus its accessibility, cost, support and security factors are related to behavioral intention to use the mobile payment ser vices. He further concluded that perceived convenience, perceived ease of accessibility, and perceived support had positive relationship with the intention to use mobile payment services.

Shin (2009) examined mobile wallet adoption by using the UTAUT model (Unified Theory of Acceptance and Use of Technology) and proposed four additional constructs, i.e., security, trust, social influence, and self-efficacy. He confirmed that familiar factors such as perceived usefulness and ease of use are key determinants toward consumer acceptance. He further concluded that perceived security and trust are key determinants in customer intention to accept mobile wallets, which in turn determines user behavior. The research results also suggested that security and trust are enhanced by social influence.

Chen (2008) examined the determinants that affect consumer intention to use mobile payments (mpayments). He concluded that consumer acceptance was determined by four factors: perceived use, perceived ease of use, perceived risk, and compatibility.

Pousttchi and Wiede mann (2007) evaluated key factors that influences customer’s intention to use mobile payments and found that subjective security was not a primary driver of mobile payment acceptance. They found that perceived confidentiality of payment details and perceived trustworthiness were strongly correlated. Four key variables, i.e., performance expectancy, effort expectancy, social influence, and facilitating conditions were found which directly affect consumer intention and usage behavior.

Lin and Wang (2006) examined the factors that contributed to customer loyalty in mobile commerce. They concluded that perceived value and trust were found to be directly related to customer satisfaction and customer loyalty. Customer satisfaction was also suggested to positively affect customer loyalty. In addition to it, habit was proposed to determine customer loyalty. They also found that customer loyalty was directly affected by perceived value, trust, habit, and customer satisfaction.

Lee (2005) investigated the impact of perceptions of interactivity on customer trust and transactions in mobile commerce and concluded that trust plays an important role in determining consumer transaction intentions.

Lu, Yao, and Yu (2005) suggested that behavioral sciences and individual psychology are strong determinants of adoption of mobile technology. They suggested that while perceived usefulness and perceived ease of use are strong variables in consumer willingness to adopt mobile technology, variables such as personal innovativeness and social influence must also be taken into consideration in determining consumer acceptance.

Cheong, Park, and Hwang (2004) concluded that perceived facilitating conditions were directly related to perceived usefulness and intention to use. However, increased cost and attractiveness of alternatives were negatively related and facilitating condition was in fact found to be a significant contributor of perceived usefulness and intention to use. Consumers that have little loyalty to credit card companies would possibly be more ready to switch to mobile payment services.

Dahlberg, T. & Mallat, N., (2002) concluded that security and privacy factors were the major concerns for the consumers, which affect the adoption of digital payment solutions.

Davis, F.D., (1989) inferred that future technology acceptance research must explain, how other variables affect usefulness, ease of use and user acceptance. Therefore, perceived ease of use and perceived usefulness may not fully explain behavioral intentions towards the use of mobile banking. He emphasized on a search for additional factors that can better predict the acceptance of mobile banking.

After reviewing the related literature, six factors, i.e., perceived quality of service, perceived risk, perceived usefulness, perceived cost, perceived ease of use, and trust, have been extracted which influence the decision of customers regarding adoption/use of mobile wallet. Effectiveness of these factors in adoption/usage process has been re-examined. In addition to it, the intensity of impact made by these factors on the adoption/usage intention of customers has also been measured.

The research design is the conceptual structure within which the research is conducted; it constitutes the blueprint for the collection, measurement, and analyses of data (C.R. Kothari, 2004). In this study, confirmatory research design and a quantitative research approach was adopted. Initially data was collected at pilot level to check the designed questionnaire's ability to attain the objectives of the study. Later some changes were made in questionnaire so that objective of the study is achieved. The questionnaire has two sections. First section consist of questions related to characteristics of respondents whereas second section consist of questions exploring the attitude of consumers towards mobile wallet. A number of close ended questions were incorporated in the questionnaire. In order to make sample representative of the population, data has been collected from ten states of India. Online survey was conducted all over India. The link of the questionnaire was shared on LinkedIn, Facebook, and WhatsApp. The link was also e-mailed to various potential respondents from all over India. Responses were recorded by 350 respondents, all being consumers. Later, responses were divided into four zones, i.e., east, west, north, and south. East zone included responses from West Bengal, Bihar, and Jharkhand. West zone consisted of Rajasthan and Gujarat. North zone included responses from Himachal Pradesh, Haryana and Punjab, and South zone included Bangalore and Hyderabad. Both primary and secondary data has been used in the present study. Data from sellers/retailers of goods and services has not been collected in the present study. The detail of sample design has been explained further. In order to collect the information, the respondents were selected by applying purposive sampling method.

Table 1 presents the demographic characteristics of 350 respondents. 73.4 percent of the respondents are males and remaining 26.6 percent respondents are females. Data was collected from all four zones of India: 22.57 percent from East zone, 23.71 percent from West zone, 30.0 percent from North zone, and 23.71 percent respondents from South zone recorded their responses and were included in the present study. Table 1 shows that all respondents are adults with 61.7 percent of respondents in the age group of 21-45 years, whereas 38.3 percent are above the age of 45 years. Majority of the respondents, i.e., 63.1 percent respondents are postgraduates, followed by 24.6 percent respondents who held M.Phil./Ph.D. There are 12.4 percent respondents who are graduates. Further, 42.3 percent respondents earn income up to ` 3,00,000 annually, while the annual income of 41.4 percent respondents is above ` 8,00,000. The annual income of 16.3 percent respondents falls between ` 3,00,000 to ` 8,00,000. In addition to it, 81.4 percent respondents use/will adopt mobile wallet service while only 18.6 percent respondents do not use/will not adopt this digital mode of payment.

Table 1. Classification of Respondents on the Basis of Demographic Factors

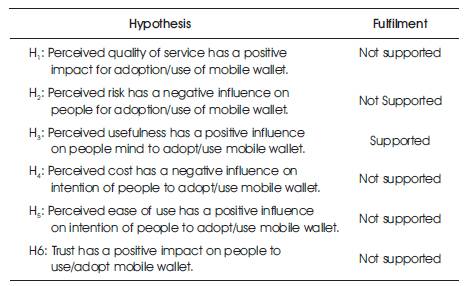

Keeping in mind the different factors which have emerged from the literature reviewed, following hypothesis have been developed in the present study and are tested in an empirical manner in order to see if they are effective in the mobile wallet adoption/usage or not.

H : Perceived quality of service has a positive impact 1 for adoption/use of mobile wallet.

H : Perceived risk has a negative influence on people 2 for adoption/use of mobile wallet.

H : Perceived usefulness has a positive influence on 3 people’s mind to adopt/use mobile wallet.

H : Perceived cost has a negative influence on 4 intention of people to adopt/use mobile wallet.

H : Perceived ease of use has a positive influence on 5 intention of people to adopt/use mobile wallet.

H : Trust has a positive impact on people to use/adopt 6 mobile wallet.

An effort has been made to identify the active factors which drive people to adopt/use mobile wallet. The logistical regression model has been used to explain the intention of people for adopting/using mobile wallet. Dependent variable has been dichotomous (Yes/No) in nature corresponding to relation with the perception of people towards various variables driving people to subscribe/use mobile wallet.

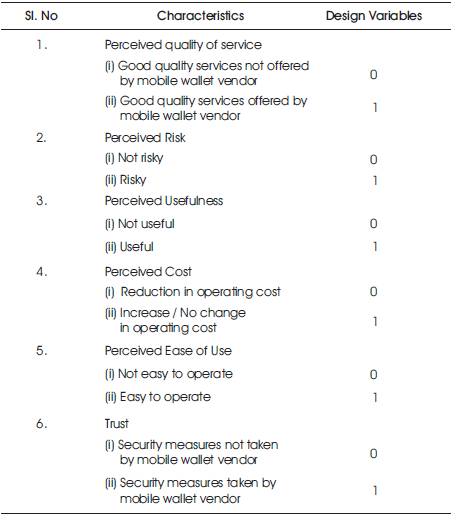

The design and codes given to independent variables has been given in Table 2.

Table 2. Design Variables in the Logistical Regression Analysis

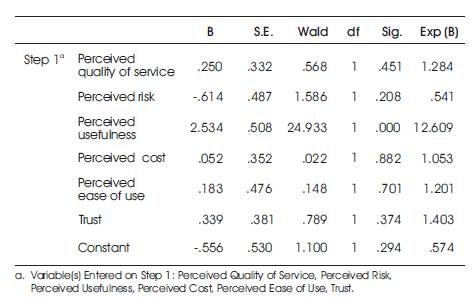

The Wald statistics has been used to test the significance of the regression coefficient and is shown in Table 3. Out of the six selected variables, there are five variables, i.e., perceived risk, perceived quality of service, perceived cost, perceived ease of use, and trust with no significant coefficient (p>0.05). Therefore, these variables are not active determinant factors for adoption/use of mobile wallet. There is only one factor 'perceived usefulness' which is determined as active determinant in mobile wallet adoption/usage. The intensity of effectiveness on mobile wallet adoption/use process has been explained further.

Table 3. Variables in the Equation

As the variable’s 'perceived usefulness' increase by one unit, the possibility of mobile wallet adoption increase by 2.534 times.

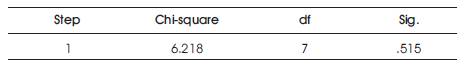

After verifying the significance of regression coefficients, the goodness of fit test to the model has been conducted with the help of Hosmer-Lemeshow test which is given in Table 4. The Hosmer-Lemeshow statistics is 6.218 with p value of 0.515, which is greater than 0.05. The probability for the chi-square distribution with 7 degrees of freedom which shows that model has a goodness of fit with observed data. H-L statistics has a significance of 0.515 which means that it is statistically significant.

Table 4. Hosmer and Lemeshow Test

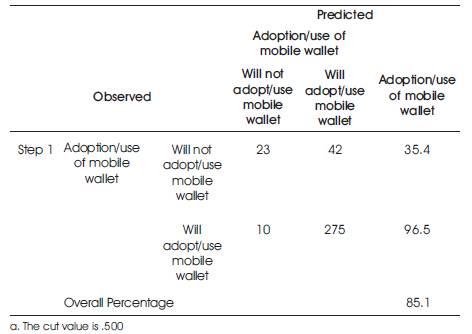

Analysis of model has a good predictive capacity with 85.1 percent of classified cases correctly (rate of correct classification) for a cut-off value of 0.50 as shown in Table 5. Here, 96.5 percent have been correctly classified for adopting/using mobile wallet and 35.4 percent have been classified for not having intention to adopt/use mobile wallet.

Table 5. Classification Tablea

The developed hypothesis has been tested and given in Table 6. The results of logistical regression supports null hypothesis that only perceived usefulness (H ) has positive 3 influence on intention of customers to use mobile wallet.

Table 6. Test Results for Developed Hypothesis

It has been observed that out of six extracted factors considered in the present study, only one factor i.e., Perceived Usefulness has been found active in influencing intention of customers to use mobile wallet. Further it has been observed that perceived usefulness has been positively influencing the adoption intention of customers. However, Perceived ease of use, Perceived Risk, Trust, Perceived quality of service, and Perceived cost have not been influencing the intention of customers to adopt mobile wallet. The developed model has the overall capability of classifying 85.1% cases correctly and exhibited that 96.5% customers will adopt mobile wallet service whereas 35.4% customers would not use it in future.

India, like the rest of the world, is witnessing a rapid increase in the adoption of digital payments and Government of India, banks, and mobile wallet vendors are making every effort to make mobile wallet a success. In the present study, it has been observed that out of the considered six factors extracted from previous studies, only one factor i.e., Perceived usefulness has been putting an impact on adoption intention of customers to adopt mobile wallet. Further, it has been concluded that Perceived usefulness has been positively affecting intention of customers to adopt mobile wallet. So efforts must be made to encourage customers to use this service in this era of cashless economy. Special promotional drives should be made to motivate such customers. Special seminars should be organized by the Government, banks, and other mobile wallet service providers to publicize the benefits of using digital method of making payments. Government through their machinery should advertise the benefits of digital economy. This will increase the confidence of people on this digital method of performing financial transactions. Banks as well as Government should advertise the multifarious usefulness of using mobile wallet by launching special schemes and providing printed manual of its usefulness.

Adoption of mobile wallet in India is still at infancy. So in order to make it a success, Government of India and other stakeholders are making efforts to encourage its customers to use mobile wallet. In the present study, efforts were made to check the effectiveness of the factors that has been explored in the previous studies.

Only one significant factor i.e., perceived usefulness has been identified, that dynamically influence the future intention of customers to adopt mobile wallet. Further, it has also been observed that perceived usefulness positively influence the intention to adopt mobile wallet. As usefulness of mobile wallet perceived by customers is positively related to mobile wallet adoption, banks and other stakeholders should publicize the multifarious benefits of the digital method of payment to a large extent, which would result into increase in subscription of mobile wallet service.

Many limitations were faced while conducting this study in India. Firstly, the data was collected from only ten states of India which was finally divided in four zones. Further the data has not been collected from rural areas, so the analysis of results may not represent the perception of consumers of India as a whole. Secondly, lack of money was also a constraint faced during the study. If the data was collected at a large scale from every state and from both urban and rural area, the expenses of conducting research study would have been also high. Therefore, with the limited financial resources, the study was conducted. Thirdly, the data was collected from sample size of only 350 respondents, which is relatively small. Hence, queries about accuracy of results could be raised.

The scope of further research is that, a more comprehensive study could be conducted to examine the factors influencing the consumers’ intention to adopt mobile wallet in developing nations. The data could be collected from a number of developing nations. Accordingly, conclusion could be drawn which would help any developing nation in framing suitable policies and strategies by the Government and other stakeholders, which would ensure success of mobile wallet service.

The study will be a benefit to the Government, Banks, and mobile wallet service providers. The information will be helpful to researchers, bankers, policy makers, and the Government, as the development of mobile wallet will help the growth of digital and cashless Indian economy.