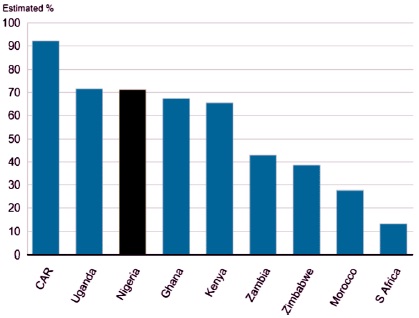

Figure 1. Revenue Gap in African Countries

The innovation and advancement of Information Technology (IT) makes electronic payment (e-payment) a common part of the global economy. In 21st century, many advanced nations are collecting their revenues using online platforms. In Nigeria, the Central Bank of Nigeria (CBN) has been promoting a 'cash-less policy' to foster development and adopt Nigeria's vision of a digital economy. This paper designs and implements a USSD based cashless revenue collection system using a mobile phone as a database that holds the information needed to conduct transactions and effect payments. The user's data is stored in a digital wallet on the user's mobile phone, which is digitally processed by the revenue collector. Java Programming Language is used for both the desktop and mobile application. Apache Tomcat server was the web server and MySQL was the database. Africa's Talking USSD simulator was used to simulate mobile service providers. The prototype was tested to evaluate its feasibility and usability. The evaluation of the system shows that the prototype implementation can support the collection of revenue from the informal sector of the economy to enhance the efficiency of the revenue collection process and block revenue leakages.

Nigeria as a nation is facing an economic crisis as a result of fluctuations in oil prices and the weak value of the country's currency (Naira) in the international global economic market. Thus, experts in the field of economics and finances have begun to look for a solution that will assist the government at all levels in Nigeria to derive revenue outside oil in order to finance her budgets and also meet her obligatory responsibilities and functions. The dwindling fortunes from oil revenue to the government in the recent years have resulted into calls for more revenue generation outside oil, especially, taxing the informal sector for revenue and economic reasons (Prichard, 2010). Revenue collection is a major source of fund to governments. Governments in both developed and developing world depends on internal revenue to some extent (Olaoye et al., 2009). In the same vein, it is one of the main sources of income for governments at all levels in Nigeria (Ojong et al., 2016). Ngotho and Kerongo (2014) state that collection of revenue is important for government anywhere in the world to acquire assets which are not liable to debt and the government uses them to provide basic human needs and social amenities.

The informal sector is a part of the economic unit that is primarily made up of self-employed individuals, small and micro-enterprises and other forms of economic activities. The income generated by the operators in the sector, in many cases, are not officially captured into the tax net of the states or nations. The informal sector forms a greater percentage of tax defaulters thereby increasing cases of tax evasions, leading to leakages in government revenue (Udoh, 2015). The informal sector (comprising of small, micro and medium scale enterprise, traders and artisans) constitutes a significant portion of the Nigerian economy. However, Nigeria's tax to GDP is quite low and remains unchanged despite the effort of the tax and revenue collection agencies to improve collection. Going by the size of the informal sector in the Nigeria economy, tax to GDP ratio will not have meaningful improvement until this large and untapped section of the economy is effectively subjected to tax and revenue payment (CISLAC, 2016).

Nigeria has a large informal economy, which operates largely outside the formal tax or revenue collection system. The informal economy comprises of economic activities that take place outside of government regulations, and these sectors are neither taxed nor represented in a country's GDP (CISLAC, 2016). The informal sector in Nigeria is approximated to be at 65% and consists of activities that range from agricultural production to mining and quarrying, small-scale building and construction and machine-shop manufacturing (CISLAC, 2016).

Despite these statistics, the contribution from this sector to the national revenue in the form of tax is minimal. This is largely due to the cash-based nature of most transactions and revenue payment in Nigeria and the absence of necessary technology with relevant revenue authorities. Thus, it becomes difficult to assess their levels of tax liability and track compliance with tax regulations. The noncapture of the informal sectors in the tax net of revenue income, create revenue leakage, economic loss and increases the tax gap within the Nigerian tax system (Smith, 2016). The Nigeria informal sector generates high turnovers and enormous levels of taxable items, but they avoid tax because of the absence of effective revenue collection system that builds them into the tax net. Many countries are still struggling to collect revenue from these sectors (Smith, 2016).

According to the World Bank and the Nigerian government report for the year 2018, Nigeria's economically active population is 65 million but only 19 million Nigerians paid tax into federal or state coffers. This implies that less than 30% of the population pay tax or revenue. In addition, the UN report in 2018 reveals that Nigeria's estimated revenue gap was one of the largest in Africa, as shown in Figure 1.

Figure 1. Revenue Gap in African Countries

Thus, access to informal sectors in Nigeria for effective revenue collection has always been a major concern. Economic experts and policy makers have been at the forefront urging government at all levels to adopt an innovative approach that is affordable, accessible and easy for the low-income earners in the informal sector (Munyoro & Matinde, 2016). The challenge is that Nigeria has a large significant informal economy. The digital platform for cashless payment has relatively penetrated within the formal economy; the reverse is the case for the informal economy. Most of the existing payment platforms are not designed to meet the needs of an informal economy, thus, there is an open question on how to get these sectors to transit from cash to digital platforms (Hamilton, 2018), for effective revenue collection and generation by the governments.

Like many developing nations, Nigeria does not have an efficient revenue collection system leaving a high proportion of revenue uncollected as a result of leakages and corruption. The efficiency and effectiveness of revenue collection depend on the medium of collection and could be enhanced through the use of Information and Communications Technology (ICT) as a driver, as is currently the practice in developed nations.

USSD, a popular acronym that stands for Unstructured Supplementary Service Data, is currently used as a communications technology to deliver mobile financial services to low-income earners in the informal sector. Nigeria is witnessing the fastest growing telecommunication market in the world and the huge penetration of mobile phones (ITU, 2017; United Nations, 2016, Research ICT Africa (RIA), 2017). The progressive development of mobile phone usage in Nigeria has prompted the development and adoption of USSD by mobile operators to automate interactive functional processes (Babakano et al., 2020). USSD is basic and is available in all mobile operators; it is an easy technology that even a layman can use without training.

Existing payment platforms that connect users with service providers through the internet still exclude the vast majority of the people in the informal sector. Short Message Service (SMS) has security and user experience shortcomings compared to USSD (Hanouch, 2015). More than 60% of Nigerians have access to mobile phones, it, therefore, makes it easy for the low-income earners in the informal sector to use USSD for easy revenue payment, because it eases the penetration of revenue collection among the low-income earner in the informal sector. Therefore, this paper proposes a USSD based Cashless Revenue Collection System targeting the informal sector of the economy. The emphasis is on motorists, as a specific case of an informal sector. The aim is to address the problem of revenue leakages, corrupt practices and increase revenue generation to the government.

Izhar et al. (2011), presented an electronic payment gateway which they claim is used to enhance the security feature of the existing payment gateway. In their proposed payment gateway architecture, only authentic customers can buy products from the merchant's site whose account balance is sufficient to buy the required product. The system works by first checking if the customer is an authorized one or not, before the transaction can takes place. Though this system might have sufficient security measures, its implementation in real life is not feasible. The need of the proposed system to authenticate all the potential customers or users in advance is not efficient.

Ukpere et al. (2012), implemented a mobile money system that allow individuals to make financial transactions using mobile phones in Nigeria. They use short messages services (SMS) and unstructured supplementary service data (USSD) for the implementation of mobile money. The system was modeled using Django and Python as the programming language, MySQL was used as database and Apache hypertext transfer protocol serves as the Web server.

The prototype implementation is user-friendly with good usability. However, this system excludes the uneducated and illiterate people have trouble using this system. Therefore, the system needs to have a combined bank and agent-based implementation to cater to all kind of people.

Etuh et al. (2017), designed a secure online electronic transaction system with biometric integration as a security measure and authentication mechanism for a secured transaction over the network in an E-market of a cashless society. They modelled an online store scenario as a market plaza, where goods and services are displayed for buyers to access according to their choice. The development adopts the use of open-source software solutions and uses a 3-tier architecture using PHP scripting language and Java to design the front-end, Apache HTTP, as the Web server and MySQL was used to implement the database.

Akobundu et al. (2015), presents the development of a mobile payment system to implement a cashless economy using Nigeria as a case study. The proposed mobile payment system is a service system where the consumer sends a payment request via SMS text message to a customized code. The system evaluates the request with regards to financial regulations and either accepts the request and carries out the financial transaction or rejects the request by sending an SMS back to the consumer who initiated the request. The system was designed using VB.Net programming language to implement the front end and MySQL was used to implement the database.

Rane et al. (2017), proposed a cashless payment using near-field communication technology to transfer money digitally from the payer's bank to the payee's bank. The system aims to eliminate the need for physical cash and serves all types of payment and identity needs. The information provided by the user(s) is/are sent to the bank server to complete the transactions, and generate a secure payment system. A capacitive fingerprint sensor was harnessed to increase the security of the card. The SMS sending module will require the details of the payer to transmit it to the cloud via GSM.

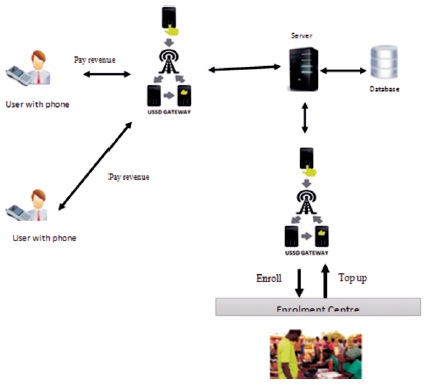

An object-oriented analysis approach was adopted to organize requirements around objects, where behaviours and states are integrated into real-world objects that the revenue collection system interacts with. Java Programming Language was used for both the desktop and mobile application. Apache tomcat server served as a web server and MySQL was the database. Africas talking USSD simulator was used to simulate mobile service providers. An e-wallet scenario was developed to model a digital storage where the user's information is stored. A potential user will have to create a digital wallet account where virtual money and other details are stored in order to pay revenue or top-up e-wallet. This e-wallet is therefore available for the user to make a transfer of payment or top-up using designated USSD code. The architecture of the proposed system is shown in Figure 2.

Figure 2. The Architecture of the System

As shown in Figure 2, the users make use of their mobile device with e-wallet to effect revenue payment or top-up their e-wallet account using USSD gateway. The USSD gateway in this research provides the necessary infrastructure for wireless communication service. The enrolment centre is where users get their e-wallet and enrollment. The architecture is designed to run on two platforms, namely; desktop and mobile version.

The user uses his mobile device to make revenue payment over a USSD network. The request includes the details of the user and specified amount to be paid as revenue to the government. All this information are stored in the user's digital wallet, in which the point of payment is processed digitally.

The intended user of the system (the state or local government authority), may contract a revenue collection company as a task force to manage the system. The task force may hire Agents (Payment point officer, Admin and Checkpoint officer) to effectively manage the payment terminal, validate and top-up user's digital wallet as the case may be. The task forces are equipped with a desktop version of the system to manage the digital wallet for enrolling user, reporting and visualization using the executive digital dashboard of the system.

The use case diagram, Entity-Relational Diagram (ERD) and activity diagram are shown and discussed in this section.

A use case diagram pictorially represents functionality provided by the system. The goal of the use case diagram is to aid the development teams to visualize the function of the system and the relationship between the users. The system use case diagram is shown in Figure 3.

The revenue collection system involves four main users. These include an admin, payment point officer, checkpoint officer and a user (motorist).

Entity-Relational Diagram shows the proposed system with the entities, their attributes and the relationship that exists between the entities. The ERD describes how the data is modelled. The ERD of the revenue collection system is shown in Figure 4.

The class diagram is Unified Modeling Language used to describe the structure of a system by showing the system's classes, the attributes and the relationships among objects. UML diagram is used to map directly with objectoriented languages. The class diagram for the system is shown in Figure 5.

The implementation of the prototype was performed by implementing MySQL database where user details and the administrator's login details are stored. The communication was implemented using Africas talking ussd to simulate mobile service providers. The proposed revenue management system comprises of both desktop and mobile version. The desktop version will be used by the task force or the revenue management agency to perform the following operations; getting realtime revenue report using the system's digital dashboard, register user, create the checkpoint officers, create an enrollment point and top-up user's digital wallet among others. The mobile version will be used by the user(s) (motorists) to perform either of the following operations: revenue payment, check balance, and top-up the digital wallet. The login interface to the desktop version of the developed system is shown in Figure 6.

Figure 6. Sign in Page

A successful sign in will take the user to an input environment designed to manage revenue collection processes and services, as shown in Figure 7. In addition, the service management platform supports graphical analysis using the dashboard option for the executive summary.

Figure 8 shows the payment point created at various designation with their various officer's name which manages the system. The admin can view, edit or create a new payment point as the need arises.

As stated earlier, every potential user will have to be registered into the system by creating a digital wallet account where virtual money and other details are stored to pay revenue or top-up e-wallet. Figure 9 shows the number of motorists registered and the amount associated with them by those responsible for managing revenue collection from the service management platform.

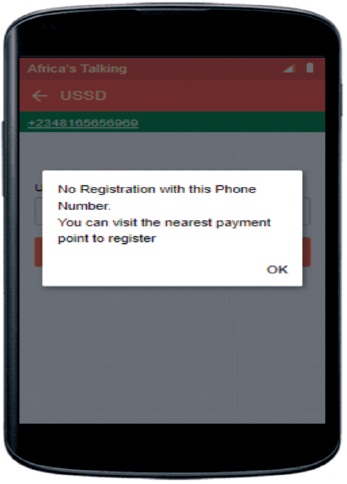

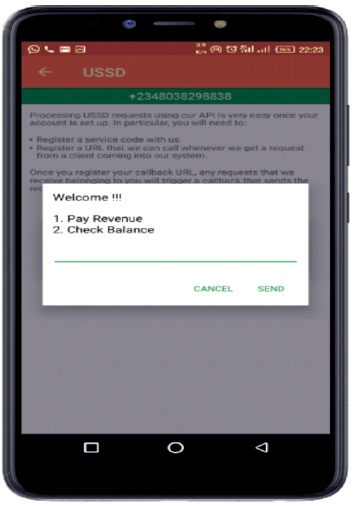

The mobile version of the system contained the user's ewallet and will be accessed from the user's mobile phone, by sending *222# command to the USSD gateway service provider. A non-registered motorist will get the response as shown in Figure 10. However, if the mobile number is registered, the list of options that appear is shown in Figure 11.

Figure 10. Response to Non-registered Mobile

Figure 11. Response to Registered Mobile

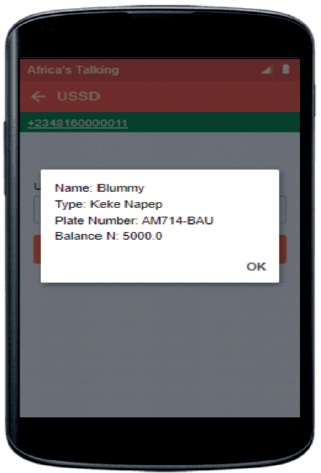

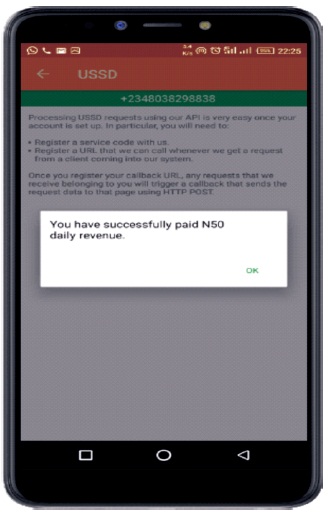

If the user selects option 2, to check balance, the response to checking balance by the user is as shown in Figure 12. However, if option 1 is chosen by the user, the response is shown in Figure 13.

Figure 12. Balance and Detail of the User

Figure 13. Successful Payment Acknowledgement Displayed on a Mobile Device

The daily revenue payment is assumed to be fixed, therefore all the user needs to do is select the appropriate code number to effect daily revenue payment. The system works like normal conventional payment terminals, except that, this is simulated in a virtual environment.

Essentially, the aim of the proposed system is to create some level of transparency in the revenue collection process. Therefore, the desktop version of the system supports graphical analysis using the dashboard to display the summary of all the revenue generated.

As shown in Figure 14, the system report is based on the number of registered motorists, daily, monthly and yearly revenue collected. With this feature, it will be relatively easy for the government to check revenue payment and know when and where to increase its generation.

Revenue collection, which is a major source of fund to the government has been a major challenge, especially from the Informal sector of the economic unit, which is primarily made up of self-employed individuals, small and micro enterprises. These challenges are primarily of tax evasions and corruption leading to leakages in government revenue, which can partly be blamed on the manual process involved in the payment of revenue by cash, that physically payers in the tax office should have.

With the current advocacy for cashless policy and the current trend for a digital economy in Nigeria, revenue collection of all forms, especially at the state and local government levels, need to be carried out digitally and remotely to avoid leakages. This demand for cashless policy and digital economy has necessitated the need for a payment system that is suitable to meet the needs of the low-income earners in the informal sector of the economy. This is essentially the goal of this paper using motorist as a specific target.

We implemented a prototype of USSD based revenue collection system where a user (targeting the low-income earners in the informal sector of the Nigeria economy) could create a digital wallet account where virtual money and other details would be stored in order to pay revenue or top-up e-wallet. The system is designed to make revenue collection and payment centralized, which reduces corruption in the payment process. The evaluation of the designed prototype indicated the potential of the system to make revenue collection from the low-income earners seamless, thereby increasing revenue generation to the state and local governments. This system will go a long way in securing revenue collection from low-income earners, thereby increasing revenue for state and local governments. However, the current work cannot issue a receipt as a proof of payment. In future, this research is to extend the ability of the mobile version to issue out an electronic receipt to the user(s) that can be digitally verified by the task force through a contactless mobile communication.